Key Takeaways

- If your tax withholding is off, you took on a side hustle, or you went through some major life changes in the past year, that might affect your tax situation in ways that lead to a bigger tax bill.

- Other factors that might lead to higher-than-expected taxes include qualifying for fewer tax deductions, moving into a higher tax bracket, or owing capital gains taxes on the sale of certain investments or real estate.

- Getting a better handle on what you’ll owe in taxes, adjusting your tax withholding, and making quarterly tax payments could help you avoid getting blindsided by your tax bill next year.

- If you’re looking for ways to lower your tax bill or make adjustments that will help take the sting out of tax season, get in touch with a tax professional who can make sense of your situation.

Getting to the end of your taxes and realizing you owe money to the IRS is one of the worst feelings in the world. Right up there with seeing blue lights flashing in your rearview mirror or hearing your parents say, “We’re canceling Netflix. You can’t share our account anymore.”

Get expert money advice to reach your money goals faster!

Your heart sinks, and the first questions that pop into your head are: Why do I owe taxes this year? Didn’t a bunch of taxes already come out of my paycheck?

Well, let’s take a look at some common reasons why you might owe so much in taxes. And good news: I’ll show you how you can avoid having that sinking feeling ever again.

Why Do I Owe Taxes This Year?

Having to pay the IRS on Tax Day can be a real gear grinder. And it’s even more painful if you were expecting to get a tax refund.

But at the end of the day, a tax bill boils down to simple math: You owe more taxes than you paid throughout the year. That usually means you didn’t have enough money withheld from your paycheck to cover taxes. Bummer.

But figuring out exactly why you ended up owing Uncle Sam money is a little more complicated. Here are six reasons why you might owe taxes.

1. Your tax withholding is off.

If you got a new job this year, your employer probably had you fill out a bunch of paperwork in between handshakes and bathroom breaks. You almost certainly filled out a W-4, which is a tax form that determines how much money your employer will withhold from your paycheck for taxes.

To help your employer get a more accurate idea of just how much to withhold each paycheck, you report the following on the W-4:1

- Your filing status: Single, head of household, married filing jointly, married filing separately or qualified widow(er)

- Multiple jobs or working spouses: If you (or your spouse if you’re married filing jointly) have more than one job

- Dependents and other credits: If you have any children or other dependents who qualify for the child tax credit (more details on this credit below) or other tax credits for dependents

- Other adjustments you want to make: If you have other forms of taxable income (not from a job) you want to withhold taxes for or if you want more money withheld from your paycheck for additional taxes

If you report those details correctly on your W-4 as soon as you start a new job, your tax withholding should be pretty accurate, and you probably won’t have a huge tax bill waiting for you when tax season rolls around. But the longer you work at a job, the more likely you are to get raises or have some other life events (more on those in a minute) that’ll change your tax situation.

Now, you don’t have to fill out a new W-4 form every year, but it’s always a good idea to do a paycheck checkup once in a while just to make sure your employer isn’t withholding too much (or too little) on payday. When you have too much withheld from your paycheck, you’ll end up getting a big tax refund. Which sounds great . . . until you realize it means you’ve been overpaying your taxes and giving the IRS an interest-free loan. You’re smarter than that!

2. You owe taxes on self-employment income.

So, you joined the wild world of DoorDashing on weekends to earn some extra cash? Well, the lingering smell of kung pao chicken isn’t the only thing that’ll hang around from your side hustle. Whether you’re driving for Uber or picking up freelance photography jobs, you’re going to have a tax bill. And when you work for yourself, the IRS considers you a self-employed independent contractor.

Having a side hustle can jack up your tax situation because you don’t have an employer withholding taxes from your paycheck. It’s all on you to pay your taxes. A good rule of thumb is to set aside 25–30% of every paycheck for taxes. And in addition to your regular taxes, you’ll be on the hook for the self-employment tax. This 15.3% tax is made up of the employee and employer portions of the Social Security and Medicare taxes.2

Not having taxes withheld from your paycheck on a regular basis means you could rack up a pretty big tax bill by the end of the year. Because of this, the IRS requires contractors who expect to owe more than $1,000 in taxes to pay quarterly taxes (also known as estimated tax payments). This means you have to estimate your income and tax liability and send a tax payment to the IRS every few months.

If you don’t make estimated payments and end up with a tax bill over $1,000 at the end of the year, the IRS will hit you with fees and penalties for underpaying your taxes.3 Big yikes.

3. You went through some life changes.

As the great philosopher Ferris Bueller once said, “Life moves pretty fast.” Seriously fast. People get married. They change careers. They have babies. And before you know it, the kid who used to rub spaghetti in her hair is off to college. All these life changes can affect your tax situation—for better or worse.

A big change that can really raise your tax bill is when your kids start to grow up. For example, once your kids are 17 years old or older, you can’t claim the child tax credit. (You can still claim them as dependents and claim other tax credits on your tax return, though.)

And if one of those life changes included losing a job and getting unemployment benefits, keep in mind that those benefits are taxable.

4. You qualify for fewer tax deductions.

Tax deductions lower your taxable income, which means a lower tax bill. Deductions should be music to your ears (basically Now That’s What I Call Music!: IRS Edition). Nearly 90% of taxpayers use the standard deduction instead of itemizing deductions.4

But if you’re one of the folks who still itemizes your deductions, your tax bill could be a little bigger this year. That’s because some of your deductible expenses might be lower than last year—or you didn’t have those expenses at all.

For instance, student loan interest, mortgage interest and some medical costs are all tax-deductible expenses.5 But if you paid off your student loans or your mortgage this year (which is an awesome thing, by the way), you won’t have any interest payments to claim on your tax return (again, that’s a good thing!).

And if you had to pay thousands of dollars in medical expenses last year but had fewer medical bills this year, then you’ll have fewer expenses to claim on this year’s tax return.

5. You’re in a higher tax bracket.

Hey, getting a pay bump and making extra money is sweet. But a raise could put you in a higher tax bracket. Tax brackets are income ranges taxed at specific rates.

So, for the 2024 tax year, if you’re single and your taxable income falls somewhere between $47,151 and $100,525, that means you’re in the 22% tax bracket. But let’s say you’ve been crushing it at work and you get a raise. Your income goes up to $110,000, which now puts you in the 24% tax bracket.6 If you don’t adjust your tax withholding, you could end up with a bigger tax bill at the end of the year.

Getting a bigger paycheck also excludes you from the earned income tax credit (EITC), a tax credit that could give you $632–7,830 back on your tax return (depending on your income and how many children you have). To receive the EITC, your adjusted gross income (AGI) has to be below a certain amount. For example, a married couple with three kids can claim the EITC if their AGI is $66,819 or less. For a single person with no kids, it has to be $18,591 or less.7

6. You owe capital gains taxes.

If you bought and sold investments for a profit or loss—and that can include anything from cryptocurrency and single stocks to exchange-traded funds (ETFs) and real estate—you’ll have to report those gains (or losses) on your tax return. And guess what? The IRS has a special tax for investors called the capital gains tax. Short-term capital gains (on assets owned less than a year) are taxed at your regular income tax rate. Long-term capital gains (on assets you’ve owned longer than a year) are taxed at a lower rate.

Not only do cryptocurrency, single stocks or any other flavor-of-the-month trendy investments spark huge tax headaches—they’re also not the way to build wealth. Most people who do that end up getting burned. That’s why the best way to get rich quick is to get rich slow. That means following the 7 Baby Steps and waiting until Baby Step 4 to invest 15% of your income in good growth stock mutual funds. Plus, you’ll get to take advantage of retirement accounts like your 401(k) and Roth IRAs that give you tax advantages—not tax hassles.

What to Do if You Owe Taxes

A tax bill sucks, but don’t feel like it’s the end of the world. You’re not going to prison over a tax bill! (That punishment is reserved for Real Housewives cast members who evade taxes.) The IRS doesn’t file criminal charges on honest people who filed their taxes but just can’t afford to pay. You have plenty of options.

If you can’t pay your taxes, you still need to file your tax return so you don’t get hit by failure-to-file penalties, which are a lot higher than the penalties for not paying your bill on time. Next, start working to pay your bill a little bit at a time. Bills are due by Tax Day (for the 2024 tax year, it’s April 15, 2025), so once that day passes, you’ll start owing interest in addition to the balance you owe.

If you don’t think you’ll be able to pay off your tax bill by Tax Day, you should apply on the IRS website for a payment plan. And guess what? You can set up the plan online without having to call the IRS and wait on hold for hours. But if IRS on-hold music is your jam, then make a call to Uncle Sam: 1-800-829-1040. Those clever folks at the IRS decided to put 1040 in their phone number as a tip of the hat to Form 1040. Hey, nerds can have fun too!

The IRS offers a short-term payment plan (120 days or less) for bills that are less than $100,000. Long-term monthly plans are available for balances less than $50,000.8 Long-term plans require a small set-up fee, but the fee could be waived depending on your income.9

And one last thing: If you’re working the Baby Steps and still trying to get out of debt, make sure your tax debt goes straight to the top of your debt snowball—even if it’s not your smallest debt. Believe me when I tell you that you want to get the IRS out of your life as quickly as possible.

How Do You Avoid Owing Taxes Next Year?

You’ll do just about anything not to have the feeling of owing taxes at the end of the year, right? Well, the great news is, fixing your taxes isn’t as difficult as you might think. You just need to do a little bit of math and fill out a new W-4.

Refigure Your Tax Liability

Okay, so here’s the math part. You need to calculate your tax withholding. This is kind of a two-step process. First, find out how much is withheld from your paycheck for federal taxes—just income tax. Ignore Social Security and Medicare taxes. You can find this info on your W-2 or on a paystub. If you’re using a tax total from a paystub, you’ll need to multiply that number by the number of pay periods per year to get your total tax withholding.

For example, let’s say you’re single and make $50,000 a year. You get paid twice a month (24 times per year), and your income tax withholding is $150 per check. That means your total withholding is $3,600.

Next, you’ll need to figure out roughly how much you’ll owe in taxes—that’s your tax liability—based on how much you make and what tax bracket you’re in. If you don’t think your income will change much this year—and you just filed your taxes and have your tax return on hand—you can use what you paid in taxes last year as a reference point.

Then, just take your tax liability and subtract your withholding to see how much you underpaid your taxes by. Once again, if you just filled out your taxes and owed money to the IRS, you should know that number without having to do any math.

Let’s go back to our example. Say your tax liability (what you owe) is $4,300. If you subtract your $3,600 withholding from your $4,300 liability, that means you underpaid your taxes by $700.

Adjust Your Withholding

Once you know how much you underpaid your taxes for the year, you need to adjust your tax withholding to make sure enough taxes come out of your paycheck each pay period. Simply divide your estimated tax shortage by the number of pay periods you have left before the end of the year to get your number.

Going back to our example, if you divide $700 by the number of pay periods left in the year—we’ll say that’s 18 pay periods—you’ll need to have an additional $39 withheld from each paycheck.

Then, you’ll need to fill out a new W-4 tax form with your employer and enter the additional amount you want to have withheld from each paycheck. (You do that on line 4c.) Easy peasy.

Make Quarterly Tax Payments

If self-employment income or money from a side hustle is the main reason you owe taxes, you have two options. Earlier, we talked about the first option: making quarterly tax payments. But estimating and paying quarterly taxes can get pretty complicated. If you have another job with payroll withholding, you can increase your withholding from that paycheck to cover the income from your side hustle. That’s your simplest option. And anytime you can simplify your tax situation, do it!

Work With a Tax Pro

If you find yourself in a tax mess, a RamseyTrusted® tax pro can help you straighten out your tax situation. These tax experts know their stuff and are vetted by the Ramsey Solutions team, which is why you can count on them to get the job done.

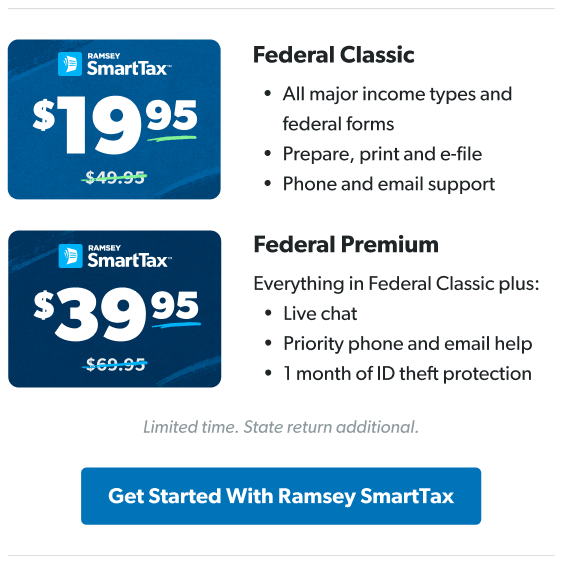

If you’re confident you can handle your taxes on your own and just want easy-to-use tax software, check out Ramsey SmartTax.