Key Takeaways

- The U.S. government collects taxes from taxpayers to finance a range of public services and the institutions that provide those services.

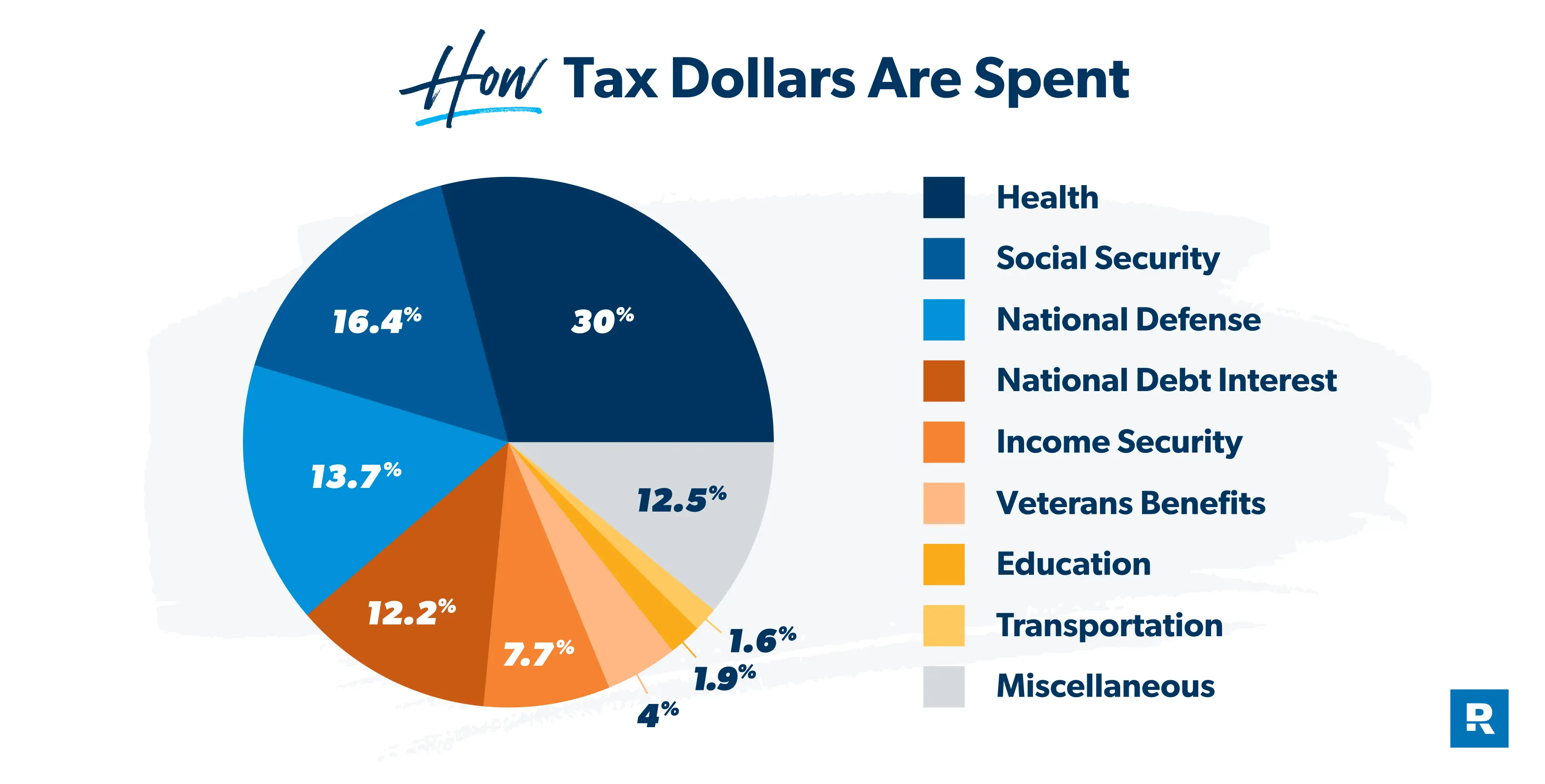

- The five largest budget items in the federal budget usually include: Health, Social Security, national defense, interest on the national debt, and income security programs.

- In most years, the federal government operates in a budget deficit—meaning it spends more than it makes. As a result, the government ends up borrowing money to make up the difference and increases the national debt in the process.

- While you may have little control over how the government spends your taxes, you can prepare yourself for tax season and take advantage of ways to lower your tax bill.

Fun fact for all you numbers nerds out there: The IRS collected around $5.1 trillion in gross federal taxes in 2024.1

Get expert money advice to reach your money goals faster!

That’s trillion—with a T! Take a minute. Remember to breathe and pick your jaw up off the ground.

Recovered? Good. If you’re like most folks, when you see a number like that, you can't help but wonder, What exactly is the government doing with my tax dollars, anyway?

That’s a great question . . . and while you may not have much skin in the game with how Uncle Sam divvies up your tax dollars, you should know where they’re being spent.

What Do Your Federal Taxes Pay For?

If you’re like most people, you’re probably wondering where all that money is going. The federal government collects taxes to finance a range of public services and the institutions that provide those services.

What does that look like in the real world? Let’s talk about all the different ways the government spends your tax dollars.

1. Health

There’s no way around the fact that health care is expensive—especially for folks in their retirement years or who are struggling to get by. That’s where Medicare and Medicaid come in.

Medicare is a taxpayer-funded federal health insurance program that provides coverage for several groups of people, but mainly folks over age 65. American workers help fund Medicare through a 1.45% payroll tax on all of their earnings and an additional 0.9% tax on earned income over $200,000 ($250,000 for married couples).2,3

Medicaid is another government-sponsored insurance program that provides health coverage for low-income adults, children, pregnant women, the elderly, and people with disabilities.4 The federal government splits the cost of Medicaid with state governments, and the states get the better deal. Generally, Uncle Sam pays somewhere between the 50–80% of their Medicaid costs.5

On top of that, more of your tax dollars help fund government health agencies like the Centers for Disease Control (CDC), Food and Drug Administration (FDA), National Institute of Health (NIH), and other general health initiatives. These agencies research diseases and new drug therapies, oversee food safety, and fund medical research.

Altogether, the U.S. government spent a whopping $2.6 trillion (30%) on health as part of its 2025 budget.6

2. Social Security

Social Security was created to provide income for retired workers over the age of 65 and is designed to supplement your income when you retire or become disabled. If you were to die before you become eligible, your dependents would receive benefits.7

Nearly 69 million Americans will receive Social Security benefits in 2025.8 Beneficiaries include retired workers, surviving children and spouses of deceased workers, and disabled workers. Social Security accounts for $1.4 trillion (16.4%) of the government’s budget.9

Social Security accounts for a large chunk of what the government calls mandatory spending that Congress is required to pay for. Mandatory spending includes entitlements like Social Security, Medicare, Medicaid, and some Veterans Affairs benefits and services. They’re called entitlements because the government takes money out of your paycheck to fund them, so you’re entitled to these benefits once you meet certain conditions.

Social Security taxes and benefits are tied to inflation, which means they go up as your cost of living goes up. But even with those adjustments, those monthly payments from the government aren’t enough for most people to live on. So if you’re banking on Social Security to fund your retirement dreams, you’re going to want to rethink that plan!

That’s why it’s so important to save at least 15% of your income for retirement. If you have questions about saving for retirement, contact a SmartVestor Pro and start making a plan.

3. National Defense

Your taxes also help pay for national defense and security-related programs. In 2025, the U.S. spent $1.2 trillion on defense, which makes up about 13.7% of the government budget.10

Defense spending, which funds the Department of Defense and the cost of international military programs, usually accounts for about half of all discretionary spending.

You see, Congress dukes it out every year over who gets how much money when they debate spending bills. In other words, these programs are subject to Congress’ discretion, meaning they can decide to increase or decrease funding for certain programs as they see fit.

4. Interest on Government Debt

Let’s just say Uncle Sam isn’t exactly working the Baby Steps (that might be the understatement of the century).

The U.S. government is currently more than $38 trillion in debt—and counting—with a chunk of your tax dollars going toward paying the interest on that debt.11 How did they rack up that much debt? Well, Uncle Sam isn’t swiping a supersized credit card to pay for stuff. Instead, he borrows money by issuing bonds.

The interest on the national debt, which must be paid by the federal government each year, changes based on two factors—the size of the debt itself and rising and falling interest rates. And since both the national debt and the interest rates on that debt are expected to increase over the next decade, so will the size of our nation’s interest payments—which means more of our taxpayer dollars will be used to make those payments.12

About $1 trillion (about 12.2% of the 2025 national government’s budget) went toward paying interest on our national debt.13 Seriously, D.C.? At this rate, Uncle Sam will never get to do his debt-free scream!

5. Income Security

Accounting for nearly 7.7% (or $655.7 billion) of the 2025 federal budget, income security programs provide cash and other government assistance to folks in need, especially those who are unemployed or earning a low income.14

Some examples of the economic security measures that fall into this portion of the budget include unemployment compensation, housing assistance, and retirement and disability insurance (not counting Social Security), as well as food and nutrition programs like the Supplemental Nutrition Assistance Program (SNAP) and National School Lunch Program.

6. Veterans Benefits

Thankfully, your income taxes also help cover benefits for our veterans, including disability compensation, burial benefits, pensions, education, job training and rehabilitation, insurance, and housing programs.15 The government also funds the operation of Veterans Administration (VA) medical facilities and clinics. That’s the least we can do to say thank you to our vets.

While some veterans benefits are part of the government’s mandatory spending, almost half of the VA budget comes from discretionary funds set aside by Congress.16 The government spent about $337.2 billion (4%) on these veterans benefits in 2025.17

7. Education

Pell Grants, work study programs, student aid, and elementary and secondary education initiatives are all funded through your income taxes. The government spent $164.3 billion (1.9%) on educating America’s bright young minds as part of its 2025 federal budget.18

These funds mainly go through the Department of Education and cover everything from paying teachers’ salaries to funding grants to pay for college. Unfortunately, this also includes funding for federal student loans. Or even student loan forgiveness (because somebody has to pay for it). Womp womp.

8. Transportation

This pays for infrastructure like roads and bridges, air traffic control, and the Department of Transportation. We have to get around in our planes, trains and automobiles somehow! For 2025, the U.S. government spent $134.4 billion (1.6%) to help keep Americans on the move.19

9. Miscellaneous

There are plenty of other government functions and programs that your tax dollars help fund. And here are a few other ways the government uses your tax money:

- Agriculture: Funding for the U.S. Department of Agriculture (USDA), which provides leadership on food, agriculture, natural resources, rural development, nutrition, and other related issues.

- Justice: This covers federal law enforcement activities across multiple government agencies, as well as funding for courts, judges and federal prisons.

- General government: This funding pays for the daily operations of several federal government agencies, including the IRS and Treasury departments.

- Natural resources and environment: Things like pollution control, conservation and land management, and overseeing the nation’s water resources fall into this bucket.

- International affairs: This covers humanitarian assistance, financial programs, and security assistance for our friends around the world.

- Community and regional development: Disaster relief and community development are covered under this category.

What Is the 2025 Federal Budget?

Every year, taxpayers hand over a chunk of income to Uncle Sam. Then the government uses those taxes to fund the upcoming fiscal year’s budget and keep some important federal programs afloat.

The federal government plans to spend roughly $8.5 trillion during the 2025 fiscal year.20 And—you guessed it—most of that money comes straight from the American taxpayers.

As we mentioned above, the 2025 fiscal year budget is $8.5 trillion. Still trying to wrap your brain around a number that big? How’s this:

- A line of 1 trillion dollar bills laid end to end would be longer than the distance from the Earth to the sun.

- If you stacked one trillion dollar bills on top of each other, the pile would reach over 67,000 miles high—that’s about a third of the way to the Moon.

- If you spent $1 trillion at a rate of $20 per second, it would take you 1,585 years to spend it all.

Yet our federal government will spend more than eight times that amount in one year. And there’s no sign that their budget will ever start decreasing. Sheesh!

And you might be wondering, If the government is collecting less in taxes than it plans to spend every year . . . then where is the rest of the money coming from?

In addition to taxes, the government raises revenue in a few other ways—like customs duties, leasing land and buildings owned by the government, selling natural resources, and payments made to federal agencies.

But even then, the government usually ends up operating under a budget deficit (meaning it spends more than it takes in). In 2025, the U.S. spent $1.78 trillion more than it took in.21 In fact, the last time the U.S. had a balanced budget was 2001.

So what does the government do to make up the difference? It borrows money by selling U.S. Treasury bonds and other debt instruments—and goes deeper and deeper into debt in the process. Maybe it’s time to finally get Washington on the debt snowball . . .

When Does the Federal Budget Go Into Effect?

The U.S. Constitution gives Congress the authority to create a federal budget each year, so they get to decide how much money the government can spend over the course of the upcoming fiscal year.

A fiscal year is a 12-month period used by a business or government to keep track of accounting and budgeting. The federal government’s fiscal year runs from October 1 of one year through September 30 of the next. That means the 2026 fiscal year runs from October 1, 2025, to September 30, 2026.22

When they get together to crank out a budget, Congress has to negotiate and decide who gets what when it comes to discretionary spending (things like military spending, transportation and education), and also provide the funds necessary to meet its mandatory spending obligations (this mostly includes entitlement programs like Social Security and Medicare).

Once Congress agrees on a budget and passes it, the budget then goes to the president’s desk for final approval.

Getting a budget passed by Congress and signed by the president is a long and complicated process. That’s why Congress starts planning the new budget a full year before it goes into effect. You could say it’s like trying to get your Orlando family vacation plans passed and approved by all your spouse’s Disney-obsessed relatives. It’s messy, but at least EPCOT has some killer finger-food options.

Next Steps

- Let’s face it—you may have little control over how the government spends your taxes, but there are a few things you can control, like how prepared you are for tax season. The more prepared you are, the less stressful filing your taxes will be.

- If you have a complex tax situation, you can connect with a RamseyTrusted® tax professional who can help you file your taxes and give you peace of mind.

- If your tax situation is simple enough that you can file your taxes with a tax prep software like Ramsey SmartTax, we can help you take the stress out of tax season.