Tax Advisors in Kansas You Can Trust

State Income Tax: 3.1% - 5.7%

Household Income: $50K - $70K

How Are RamseyTrusted® Tax Pros Different?

-

RamseyTrusted tax pros are Certified Public Accountants (CPAs) or Enrolled Agents (EAs) who know Kansas taxes like the backs of their hands.

-

They aren’t part-timers who swoop in to help just during tax season. They’re around to serve all year with taxes, bookkeeping and more.

-

They’ve got the heart of a teacher and are mentored by our coaches to ensure they uphold our high standards of customer service.

Kansas

Tax Filers

Household Income

$50K - $70K

Median State Tax Bill

$4,100

Median State Tax Refund

$2,800

Excellent Service From Pros Who Serve Your Area

Whether you get connected to a local RamseyTrusted pro or our national partner, you’ll have someone who’s experienced in handling taxes for Kansas. They have the heart of a teacher and can walk you through everything you need to know about your taxes.

Ways a Tax Pro Can Help You All Year Long

You work hard at your business, and you can think of RamseyTrusted tax pros as an extension of it. Local pros and national partners can help you navigate Kansas taxes, but they don’t just stop there. They get to know the ins and outs of your business and can provide year-round support for bookkeeping, payroll and more—so you can focus more on serving your customers.

Working With a Tax Pro Is a Partnership

For 20 years, we’ve been matching people with tax pros who serve with excellence. By partnering with a RamseyTrusted tax advisor, you can build a trusting relationship with a pro who is ready to teach and serve you and your business.

Ask your advisor questions—even after tax season.

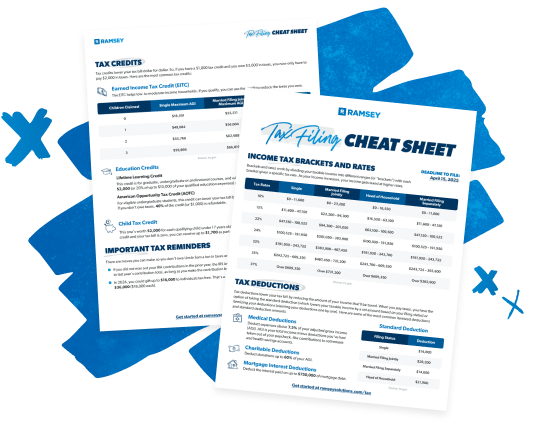

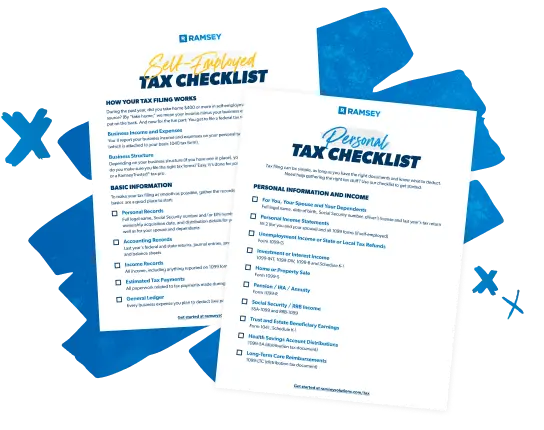

Get your documents organized with our free Tax Prep Checklists.

Check in with your pro throughout the year to continue building trust.

Research tax code changes to make sure all bases are covered.

Prepare your taxes and get them ready for filing.

Provide tax insight and advice for your personal and small business needs.

How Much Does It Cost to Hire a Tax Pro?

Typical personal tax preparation costs can range anywhere from $300 to $600 or more. The cost for small-business taxes can vary too. And there are several factors that determine what tax filing costs.

It’s good practice to have an up-front conversation with your tax pro about what they charge for their services. And good news—it doesn’t cost you anything to connect with a pro and get the conversation started.

“As a small business owner, I really appreciate my RamseyTrusted tax pro’s approach of financial stewardship and valuing me as a partner I can trust rather than just a business transaction.”

Free Tax Resources

-

Tax Filing Cheat Sheet

See tax rates, important dates, deductions and more.

-

Beginner’s Guide to Taxes

Make sense of it all with this comprehensive guide.

-

Tax Prep Checklists

Use them to get organized for tax filing.

Common Questions . . . and Answers

-

How is a RamseyTrusted tax pro vetted and what do they do?

-

A RamseyTrusted tax pro is a tax advisor who’s been vetted by the Ramsey team. They can work with you to file your taxes and can provide other tax-related services for you, your family and small business throughout the year. To earn the right to be called RamseyTrusted, tax pros must be a Certified Public Accountant (CPA) or an Enrolled Agent (EA) and have a minimum of two years full-time experience.

A CPA is a professional who takes care of all the detailed and essential math tasks that go with running a business. They can assist with bookkeeping, payroll administration, and preparing financial documents like tax returns and profit-and-loss statements. They can also provide financial planning for individuals, families and small businesses. CPAs are licensed by states.

EAs focus more narrowly on taxes and tax issues for individuals, businesses and private entities. An EA has knowledge in tax-related subjects—like income, estate, gift, payroll and retirement taxes. They're licensed by the federal government. -

Can I get more than one option for a tax pro?

-

Once you’ve submitted the form, we’ll connect you with one RamseyTrusted tax pro. It’s a great idea to ask them questions when you first get connected to see how the pro can help with your situation. If you decide this pro’s not the best fit for you, please reach out to our Customer Success Team so they can work on connecting you with a new pro. They’ll get back to you within one to two business days.

-

Why is my tax pro so far away? Is there anyone closer to me?

-

It’s probably because there isn’t a RamseyTrusted pro available in your area right now. If that’s the case, you’re matched with our national tax partner who’s uniquely qualified to serve the tax needs of all 50 states. And they’ve passed our vetting standards with flying colors, meaning they provide top-notch service and have the heart of a teacher.

-

What is the process of working with a national tax partner versus a local tax pro?

-

All RamseyTrusted tax pros work to make the process as seamless as possible. Your initial meeting is a great time to discuss your preferences and find out more about what you can expect.

Local pros generally make themselves available to meet in person, but if talking over the phone or a video call works better for you, just ask if that’s an option.

When working with our national tax partner, you can upload and view your documents through their secure portal. You can conveniently talk with them over the phone—and connect through video calls to go over your tax return or other important topics. They’ll also email you throughout the process to keep you up to date.

-

Should I use tax software to file myself or do I need a tax pro?

-

If you have personal or self-employed income and feel confident using tax software, you can easily file online with Ramsey SmartTax. If you have more complicated taxes, don’t want to take the time to do your own taxes, or want expert advice, then a RamseyTrusted tax advisor is for you.

Learn About Taxes and Working With Tax Pros

Our articles cover self-employed taxes, small-business taxes and more.

Tax Season 2025: What You Need to Know

You may not be looking forward to tax season 2025, but filing your taxes doesn't have to be difficult. Here's everything you need to know to get started!

How to Calculate Taxes for Your Business

Calculating taxes for your small business can be tough, especially when you’re trying to grow it at the same time. But don’t worry. We’ll show you how to calculate your taxes as simply as we can.

How to Find the Right CPA for Your Small Business

Running a small business is awesome, but there could come a time when you need some help with the books. Like from a CPA, but where do you find one? And what should you ask them when you do find one?

Your state has a progressive income tax. This just means that as you earn more money, you pay a larger percentage in taxes. When a range of income is taxed at a specific rate, it’s also known as a tax bracket.