Key Takeaways

- Taxable income is the portion of your earnings subject to federal income tax after deductions are applied.

- Common sources of taxable income include wages, salaries, bonuses, commissions, interest, dividends, rental income and business earnings.

- Some types of income, such as life insurance payouts and child support, are not taxed.

- Taxable income is calculated by subtracting deductions, like the standard deduction or itemized deductions, from gross income.

Did you know a portion of your income is tax-free? That’s right. Hands off, Uncle Sam!

Get expert money advice to reach your money goals faster!

We’ll get to why some income is tax-free (cough, cough—tax deductions), but the rest of your pay is known as taxable income because it’s . . . well, taxable.

Knowing how much of your income is taxable and how it’s going to be taxed is important because it’ll help you understand what you’ll owe on Tax Day (April 18 this year).

So, how do you know what income is taxable and what isn’t? And how exactly do you calculate your taxable income? Let’s dig a little deeper and find out.

What Earnings Count As Taxable Income?

What do getting your paycheck, bartering and winning the lottery have in common?

They all come with taxable income.

What? Yep. The truth is, the IRS taxes a lot of stuff, not just your salary or hourly wages—like most folks assume. If your income falls under any of the categories below, you have to report it on your federal tax return.

Income you earn: Whether you worked for someone or you were self-employed, your earned income is always taxable. This includes wages, salaries, commission, freelance earnings, holiday bonuses and tips.

Winnings: After years of dreaming, you finally heard the announcer say, “Come on down. You’re the next contestant on The Price Is Right!” And when you won a new washer and dryer, you jumped up and down like a kid waiting in line for ice cream. Then you got the bad news: You have to pay taxes on that. Yep. It’s true. You must report anything you win from gambling or betting—even prizes you win on a game show or in a contest.

Money or property you gain: So, maybe you didn’t work for a portion of your income. Maybe you earned money from your investments or you own a rental property. Is that income taxable? Yes. In particular, the IRS considers all of the following to be taxable income:

- Canceled or forgiven debt

- Profits from the sale of stock or other investments

- Interest or dividends from investments

- Proceeds from the sale of real estate

- Rents

- Royalties from copyrights and patents

- Stock options

- Unemployment compensation

- Union strike benefits

- Gains from virtual currency (like Bitcoin)1

A few of these types of income are considered capital gains. This includes money you earn from the sale of an asset such as a share of stock or a piece of real estate. Capital gains are divided into short term (assets held less than a year) and long term (assets held for more than a year). Short-term capital gains are added to your taxable income and taxed at the same rate as your income, but long-term capital gains are separate and taxed at a capital gains rate, which is typically lower than the rate of your income tax bracket.

Real estate sales also have their own set of rules. For example, let’s say you sell the house you’ve lived in as your primary residence. As long as you’ve lived there full time for two of the previous five years, you don’t pay any taxes on your profit up to $250,000 (or $500,000 for a married couple)1. Now, if you bought a house, fixed it up, and flipped it three months later for a profit, your profit is considered taxable income.

Exchanges or bartered services: This one surprises people. Let’s say you’re a mechanic and your best friend—a carpenter—builds a deck on your house. In exchange, you fix the transmission on his truck. According to the IRS, both of you must declare the value of the other’s service as income.

Fringes: A fringe is a benefit your company gives to you. It can be anything from a paid gym membership to a Christmas bonus. Like prize winnings, you will be taxed on fringes.

What Doesn’t Count As Taxable Income?

Yeah, we know what you’re thinking. That’s a lot of taxable income. But believe it or not, the IRS doesn’t tax everything. Generally, here’s what the IRS usually considers nontaxable income:

- Accident and personal injury rewards

- Cash rebates

- Child support

- Alimony

- Federal income tax refund (duh!)

- Foster care payments

- Inheritances and money gifts (up to a certain amount)

- Life insurance payouts

- Scholarships or fellowship grants

- Veterans benefits

- Welfare benefits2

One quick warning before we move on. Some of these can be taxable under certain circumstances.

For example, let’s say you win a scholarship and you use it for tuition. Well, in that case, you wouldn’t have to worry about taxes. But if you use that money for room and board or you don’t use that money for school at all and you buy a car instead, it would be taxable.

Our rule of thumb for deciding what’s nontaxable: Don’t guess. If there’s uncertainty, contact a tax professional who can look at the type of income and your particular situation.

How Do Tax Deductions Affect Your Taxable Income?

Earlier, we told you a portion of your income isn’t taxed. Well, let’s get down to it. You can reduce your taxable income. How?

With tax deductions.

What Is a Tax Deduction?

Tax deductions reduce your taxable income which, in turn, reduces your tax bill. For example, let’s say Tom earns $62,000 in 2023 as a teacher. He takes the standard deduction, so he can subtract $13,850 from his annual income.3 That means the IRS can only tax $48,150 of his income.

Wait. Standard deduction?

Right, if you’re not sure about deductions, we can back up a minute. When it comes to filing taxes, you can take a standard deduction ($13,850 for single filers in 2023 or $27,700 for married couples filing jointly). Or you can itemize deductions from a list made by the IRS that includes things like charitable giving, mortgage interest and property taxes.

The thing to remember here is this: You can’t do both. You can take the standard deduction or you can itemize. So how do you choose? Pick the one that saves you more money! If you’re not sure which one to choose, definitely contact a tax pro.

How Can I Lower My Taxable Income?

If taxpayers were puppies, this is when their tails would start wagging. Lower my taxable income? Yes! Finally. We’re at the part when we talk about how you can save money on your taxes.

1. Take advantage of tax deductions.

Yes, itemizing is a pain, and the standard deduction usually cuts your tax bill the most. But if it means saving more money, take the extra time (and aspirin) it takes to itemize.

2. Use adjustments to income if you can.

Adjustments to income are the tax filer’s secret weapon. They work like itemized deductions and the more you qualify for, the more you can take off your taxable income. But here’s the thing: They’re not itemized deductions. That means even if you take the standard deduction, you can still use them.

Okay, so how do you know if you qualify for adjustments to income? You do if you answer yes to any of these questions:

- Did you pay student loan interest?

- Did you make contributions to a traditional HSA or IRA?

- Did you receive income from self-employment?

- Did you teach K–12?

- Did you pay a penalty for withdrawing from a savings account?

You can find more adjustments to income on the IRS website. If you qualify for any of these adjustments, you’ll need to fill out Schedule 1 on Form 1040 to subtract those amounts from your taxable income.

3. Contribute more to a traditional 401(k).

You don’t pay taxes on money you invest in a traditional 401(k). For example, let’s say you make $53,000 and you invested $3,000 in your 401(k) at work. Standard deductions and itemizing aside, you can take $3,000 off your taxable income to make it $50,000.

So, if your employer gives you the option to invest in a traditional 401(k), feel free to contribute to your 401(k) at least up to the employer match (if offered). In 2023, you can put up to $22,500 in your 401(k)—and if you’re 50 or older, you can contribute an extra $7,500.4

Now, we want to be clear on something: We don’t want you to invest just to reduce your taxable income. You should wait to invest for retirement until you’ve finished Baby Step 1 (save $1,000 for a started emergency fund), Baby Step 2 (pay off all debt using the debt snowball), and Baby Step 3 (save 3–6 months of expenses in a fully funded emergency fund).

Saving for retirement starts at Baby Step 4. Yes, it’s great that contributing to a traditional 401(k) can help reduce your tax bill. And if you have one, go for it. But there are other investing options out there—like a Roth IRA—that can help you grow your actual investment tax-free. So, once you meet the employer match in your 401(k), start investing in a Roth IRA.

What Tax Bracket Is My Income In?

Okay, once you’ve calculated your taxable income, the next step is to determine your tax bracket. Think of tax brackets as an income range that corresponds to a tax rate. If that sounds like a mouthful, here’s what the 2023 tax brackets look like.

2023 Federal Income Tax Brackets and Tax Rates

|

Tax Rate |

Single Filer |

Married, Filing Jointly |

Married, Filing Separately |

Head of Household |

|

10% |

$0–11,000 |

$0–22,000 |

$0–11,000 |

$0–15,700 |

|

12% |

$11,000–44,725 |

$22,000–89,450 |

$11,000–44,725 |

$15,700–59,850 |

|

22% |

$44,725–95,375 |

$89,450–190,750 |

$44,725–95,375 |

$59,850–95,350 |

|

24% |

$95,375–182,100 |

$190,750–364,200 |

$95,375–182,100 |

$95,350–182,100 |

|

32% |

$182,100–231,250 |

$364,200–462,500 |

$182,100–231,250 |

$182,100–231,250 |

|

35% |

$231,250–578,125 |

$462,500–693,750 |

$231,250–346,875 |

$231,250–578,100 |

|

37% |

Over $578,125 |

Over $693,750 |

Over $346,875 |

Over $578,1005 |

And for 2024, those tax brackets will remain the same, but tax rates will be adjusted for inflation:

2024 Federal Income Tax Brackets and Tax Rates

|

Tax Rate |

Single Filer |

Married, Filing Jointly |

Married, Filing Separately |

Head of Household |

|

10% |

$0–11,600 |

$0–23,200 |

$0–11,600 |

$0–16,550 |

|

12% |

$11,600–47,150 |

$23,200–94,300 |

$11,600–47,150 |

$16,550–63,100 |

|

22% |

$47,150–100,525 |

$94,300–201,050 |

$47,150–100,525 |

$63,100–100,500 |

|

24% |

$100,525–191,950 |

$201,050–383,900 |

$100,525–191,950 |

$100,500–191,950 |

|

32% |

$191,950–243,725 |

$383,900–487,450 |

$191,950–243,725 |

$191,950–243,700 |

|

35% |

$243,725–609,350 |

$487,450–731,200 |

$243,725–365,600 |

$243,700–609,350 |

|

37% |

Over $609,350 |

Over $731,200 |

Over $365,600 |

Over $609,3506 |

The U.S. tax system is progressive (are you having flashbacks to your U.S. government class yet?). That means the higher your taxable income, the more taxes you pay.

But here’s the thing, folks: You don’t just fall into one income range (unless your income is in the first range, then you do). Your income is spread across them.

For example, let’s say you’re single and after taking the standard deduction ($13,850), you have a taxable income of $60,000 in 2023. Here’s what that would look like:

First tax bracket: $11,000 x 10% = $1,100

Second tax bracket: $33,725 x 12% = $4,047

Third tax bracket: $15,275 x 22% = $3,361

Total income tax: $8,508

And that’s the magic of the American tax system!

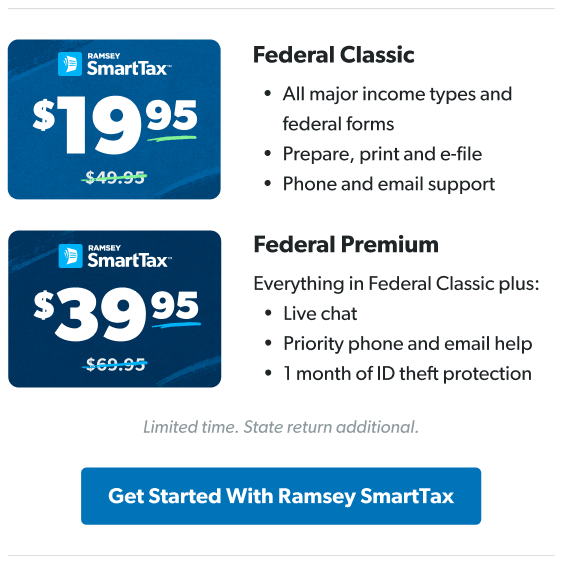

File Your Taxes With Confidence

Tax brackets, taxable income, deductions . . . If your head is spinning right now, don’t worry. There’s hope. If you need budget-friendly tax software to file your taxes on your own, Ramsey SmartTax is the no-nonsense tax software you can trust. It will even teach you and educate you along the way, so you feel empowered to do your own taxes with confidence.

File your taxes with Ramsey SmartTax!

If your taxes are a little more complicated and you feel like you need a tax pro, check out our RamseyTrusted program. A RamseyTrusted tax pro can guide you through all the forms and schedules.