Raise your hand if you love doing your taxes! Anyone? Anyone at all?

We get it, filing taxes is nobody’s idea of a good time. Some folks would rather get an IRS tattoo or name their kid “Taxes” than sit down to fill out their tax returns.1 (Do you want your kid to get bullied in school? Because that’s how you get your kid bullied in school.)

And look, thinking about taxes isn’t our idea of a good time either, but ignorance is not bliss when it comes to this stuff. In fact, it could cost you big time when Tax Day finally does roll around. So, let’s get our education on.

Here are the five biggest tax myths and misconceptions we hear all the time. Yup—we’re picking up our Ramsey-powered hammer of truth and busting up these falsehoods for good.

Myth #1: A tax refund is a reason to celebrate. It’s free money!

Let’s channel our inner Dwight Schrute and say, “False.”

Get expert money advice to reach your money goals faster!

A tax refund is not a reason to celebrate, because it’s not free money. Contrary to popular belief, Santa Claus doesn’t live in Washington, D.C. If he did, we doubt he’d work at the Internal Revenue Service.

Here’s the truth: You’re getting a refund because you basically loaned the government too much money every time you got paid (an interest-free loan, we might add—not a courtesy shared when you owe them). The government is simply sending your money back where it belongs—your wallet.

That’s why it’s called a refund, folks. Get the picture?

You see, your employer takes money out of each paycheck before it hits your bank account to pay your “fair share” in taxes to Uncle Sam. That’s called tax withholding.

So, let’s say you got the average tax refund, which is typically around $3,000.2 That means throughout the year you overpaid the federal government by three grand. That’s not free money—it should have been yours the whole time!

If you get paid every other week, like most Americans, then you could’ve had an extra $115 per paycheck. That’s money you could’ve used to:

- Pay off debt

- Build up your savings/emergency fund

- Invest for the future

- Put in a snazzy hot tub

Instead, that money went to the government and just sat there, earning you no interest. No savings. And definitely no hot tub. Jokes aside, we know you’re smart enough to put that money to better use throughout the year. It’s not a bonus.

Plus, if you’re on a solid budget, you know how amazing an additional $115 per paycheck might feel when it comes to supporting your daily needs—like paying the rent or mortgage, keeping the lights on, and filling up your car’s gas tank. Heck, for some that might even mean a full week of groceries.

The goal is to get your tax bill as close to $0 as possible. So if you’re getting a huge tax refund or tax bill every year, it’s time to adjust your tax withholding.

Myth #2: It’s bad to be in a higher tax bracket.

This is a really terrible myth. It makes people afraid to earn more money because they don’t want to pay more in taxes. Yes, if you keep making more money, you’ll eventually get bumped into a higher tax bracket. But being in a higher tax bracket doesn’t mean you’ll bring home less money.

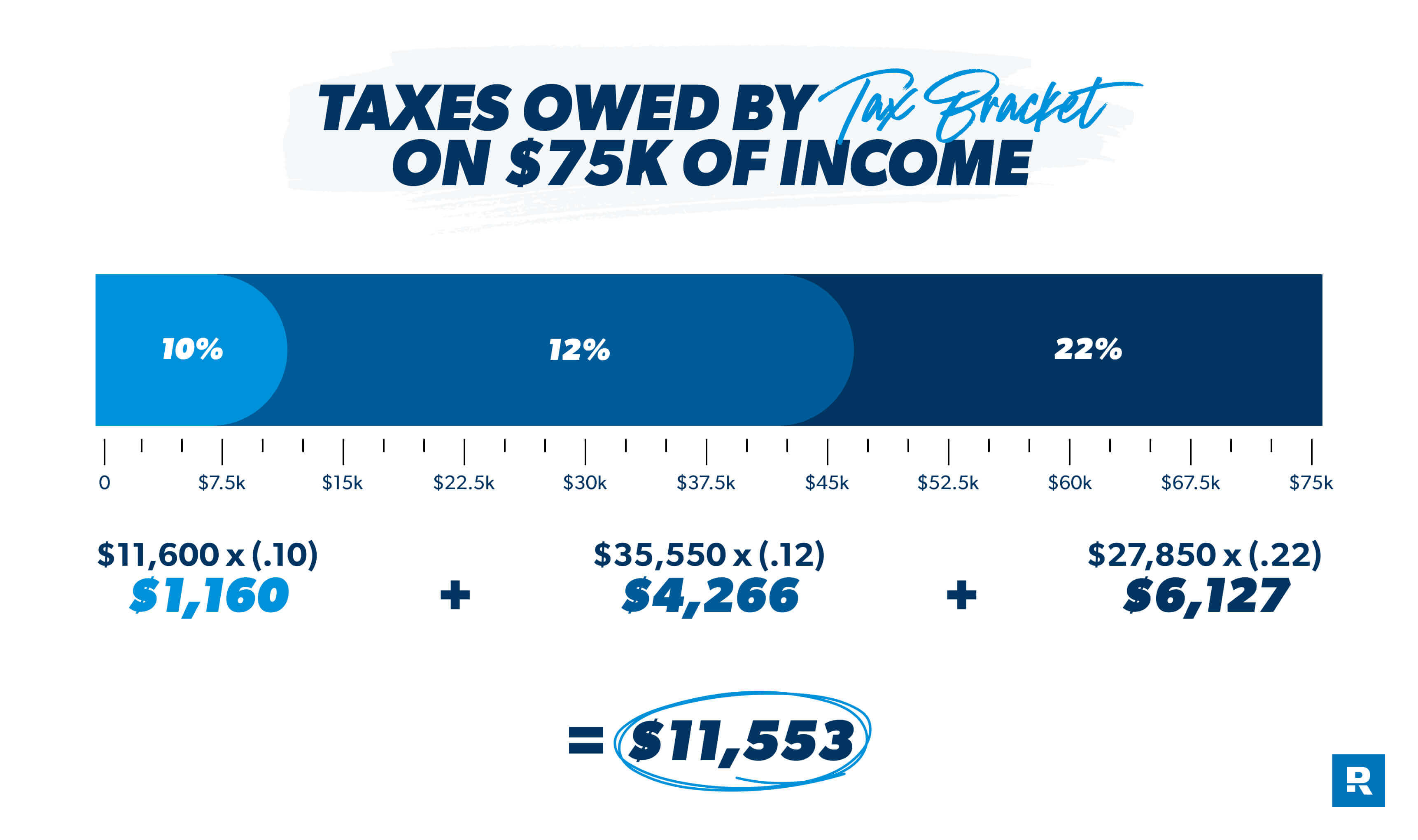

Let’s say you’re single and made $75,000 in 2024. This puts you comfortably in the 22% tax bracket. Does that mean all your income will be taxed at 22%?

No, sirree!

You see, U.S. income tax rates are marginal, which means they’re not real butter . . . no, wait, that’s margarine. Our bad. Marginal means that certain portions of your income are taxed at different rates. Basically, part of your income will be taxed at 10%, another part at 12%, then 22% and so on—depending on how high your income is.

So, going back to the $75,000 scenario, here’s what you would actually owe:

Now, this is a simplified example that doesn’t take deductions and credits into account, but you get the idea. If all your income was taxed at 22%, your tax bill would have been a whopping $16,500—about $5,000 more. But because tax rates are marginal, your real tax rate (or effective tax rate) in this scenario is actually about 15% ($11,553 divided by $75,000). Not bad.

Here’s the bottom line: Making more money is always a good thing. Don’t turn down the opportunity to raise your income because you’re afraid of ending up in a higher tax bracket. That’s just crazy talk!

Myth #3: Keeping debt around is good for the tax deduction.

How can we say this clearly . . . no! This is a bad idea 100% of the time. If you heard this advice from some TikTok or YouTube expert, smash that unsubscribe button. If your tax pro is telling you this, it’s time to get a new one. Staying in debt for the tax deduction is just straight-up bad advice.

Let’s back up for just a moment. A tax deduction is an expense that lowers your taxable income, which helps lower your tax bill. These write-offs include things like mortgage interest, student loan interest or loan interest for a business vehicle.

But listen, spending a dollar just to save a quarter on taxes is not smart. It’s the opposite of smart. You don’t have to be a math nerd to figure that out.

Let’s say you’re the “average” American with a 30-year mortgage, a student loan and an auto loan for a used car that you use only for business. That means you might find yourself paying this much in interest in a typical year:

Add these three figures together and you get about $18,156 in interest payments. If you’re in the 22% tax bracket and claim all those interest payments as tax deductions, that’ll save you around $3,994 on your tax bill.

In other words, you’re spending $1 just so you can save $0.22. On what planet does that make sense? Not this one!

Don’t overthink this, folks. Pay off your debts as fast as you can using the debt snowball method and enjoy the peace that comes with having no more monthly payments. Not only will you avoid sending hundreds of dollars to some bank or loan provider each month, but you’ll also be able to put that money toward your financial goals. That’s worth way more than a small discount on your tax bill.

Myth #4: Pay by Tax Day or don’t pay at all.

Closing your eyes, clicking your heels together three times, and hoping the IRS magically forgets you exist is not a smart tax strategy.

Ignoring your tax bill is just about the worst thing you can do because the IRS will start charging interest and penalties immediately (even if you filed for an extension). Believe us when we tell you that no one can screw up your life more than the IRS.

If you can’t pay your tax bill by the deadline for whatever reason, don’t panic—you have options. Here’s what you need to do:

Step 1: File your tax return by the regular deadline.

If you owe money to the IRS, you might think it’s best to wait to file your taxes. Huge mistake. The penalty for not filing a return or filing late can be up to 10 times as much as the penalty for not paying on time.8

If you need more time to file, then go ahead and apply for a tax extension. It won’t give you more time to pay (your taxes are still due on Tax Day), but at least you’ll avoid those pesky late-filing penalties.

Step 2: Pay as much as you can by the tax deadline.

Even if you can’t pay the entire tax bill, send the IRS what you can. The more you pay by the deadline, the less you’ll owe in penalties and interest. And if you file your tax return early, that gives you time to sell some stuff or take on a side hustle to pay off as much of that tax bill as you can by Tax Day.

Step 3: Set up a payment plan with the IRS.

If you have an outstanding tax balance after Tax Day, go to the IRS’s website and apply for a payment plan.

You can set up either a short-term payment plan (where you’ll pay off your tax debt in 120 days or less for amounts less than $100,000) or a long-term payment plan (where you’ll make monthly payments for up to 72 months on amounts less than $50,000).9,10

The good news is, you can complete the application and set up a payment plan online—no waiting in line in some depressing office building or being put on hold by some soulless operator.

Myth #5: You’re not smart enough to do your own taxes.

If you get nothing else from this, we want you to know: You is smart, you is kind . . . and you can do your own taxes. Well, most of the time. Tax software has come a long way over the past few years, making the process of filing taxes a whole lot easier for millions of Americans with simple tax situations.

If you’re trying to decide whether to file on your own or with a tax pro, let’s walk through when each option might make sense.

You’re probably better off filing on your own if your taxes are simple (you have just one or two sources of income and plan to take the standard deduction), you had few major life changes, and you feel comfortable doing it yourself.

On the other hand, if you have a more complicated tax situation, then you might want to get help from a pro. If you own a business, went through major life changes (got married, bought a house, or had a baby, for example), have lots of investments outside of your retirement accounts, or just want to save some time this tax season, you’d probably fall into this camp.

Next Steps

- Get prepared for tax season with our free tax resources, including our tax prep checklists for personal or self-employment income and the Beginner’s Guide to Taxes.

- If you feel a little in over your head this tax season, ask a RamseyTrusted tax pro for help. They can make sense of your tax situation and help you file your taxes so that you can have peace of mind.

- If you’re ready to file your taxes online, check out Ramsey SmartTax. It’s tax software that’s easy to navigate and affordable so you can file your return with confidence.