Key Takeaways

- Parents can benefit from tax credits like the child tax credit, child and dependent care credit and adoption credit, which can all help lower their tax bills and offset the costs of raising children.

- For the 2024 tax year, the child tax credit allows eligible parents to claim a $2,000 credit per child under age 17, with income limits set at $200,000 for individuals and $400,000 for married couples.1,2

- Single parents might consider switching their filing status to head of household. This offers a higher standard deduction and lower tax rates.

- Tax breaks like the American opportunity tax credit and various tax-advantaged savings plans (529 plans and ESAs) can help parents and students manage the many expenses of higher education.

Children are a blessing. Even when they test you (looking at you, teenagers and “threenagers”), you wouldn’t trade them for anything.

You know what else kids are? Expensive. From buying thousands of diapers to saving for college, it all adds up. And fast. Even Uncle Sam knows how expensive raising kids can be. That’s why parents are eligible for a slew of tax breaks.

Let’s take a closer look at each of them and how they can save you some money this tax season.

1. Child Tax Credit

For the 2024 tax year (filed in 2025), the child tax credit is $2,000 per child under the age of 17—with an income limit of $400,000 for married couples and $200,000 for individuals.3,4

Here’s how the tax credit works. Let’s say you have a family of four: Mom and Dad and their two kids, Kenny and Jenny. Together, Mom and Dad bring home $100,000, and they plan to take the standard deduction.

They would get the standard deduction of $29,200, which would make their adjusted gross income $70,800 ($100,000 - $29,200 = $70,800).5

Based on fancy tax bracket math, they owe for the year about $8,032 in taxes.6 But the $4,000 child tax credit ($2,000 apiece for Kenny and Jenny) chops their tax bill almost in half—now they only owe $4,032.

Pretty sweet, right?

2. Child and Dependent Care Credit

Did you pay someone to care for your child so you could work or look for a job? You could qualify for the child and dependent care credit! This credit can help you claim 20–35% (depending on your taxable income) of some of your childcare costs—up to $3,000 for one child (under the age of 13) or up to $6,000 for two or more.7 Okay, that’s a lot of numbers—let’s break it down.

Let’s say you have one kid and last year you spent $3,500 on childcare with a taxable income of $50,000. Based on your income, you’d be eligible to claim 20% of the first $3,000 of those costs, leaving you with a pretty nice $600 tax credit. That’s more than just chump change!

Qualifying childcare expenses include more than just day care. Don’t forget about nanny services, after-school care and summer day camps. Just make sure you have the name, address and taxpayer identification number for each care provider you’ve used.

3. Adoption Credit and Exclusions

If you adopted a child this year, congratulations on your new addition! Not only did your family grow, there’s also a good chance you’re eligible for the adoption credit.

For 2024, this credit covers up to $16,810 of your expenses per adopted child.8 According to the IRS, qualified adoption expenses include:

- Adoption fees

- Court costs and attorney fees

- Traveling expenses

- Other costs directly related to your adoption

If the credit is larger than your tax bill, you may not get the whole amount back this year. But you can use the remainder on your future tax bills for up to five years.

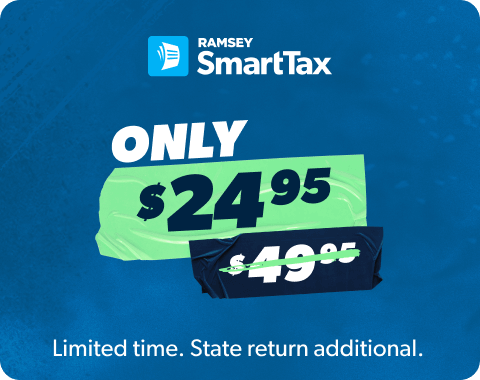

Don’t settle for tax software with hidden fees or agendas. Use one that’s on your side—Ramsey SmartTax.

Also, if your employer provides adoption assistance, you can exclude that amount from your income, also up to $16,810. Here’s the thing though—you can’t claim the credit and the exclusion for the same expenses. You can, however, combine both the exclusion and the credit.9

Here’s how this works. You spend $10,000 on adoption expenses to bring home your beautiful new bundle of joy. Your employer has a really great adoption assistance program and kicks in $4,000. You exclude the $4,000 from your income, but you can’t claim the credit for it. Now, you subtract $4,000 from the overall $10,000 that you would have used on the tax credit, leaving you a $6,000 adoption credit ($10,000 - $4,000 = $6,000). And don’t forget to add the child tax credit and any childcare expenses now that you’re a parent!

Remember, there’s an income limit for the adoption credit and the exclusion. If you make less than $252,150, you’re eligible for the full amount. You qualify for a reduced amount between $252,151 and $292,150, and it’s eliminated completely at $292,151 and up.10

4. Single Parent Filing As Head of Household

If you’re a single parent, in most cases you can file as head of household. Not only could that lower your tax rate, it also allows you to take a higher standard deduction. For example, if you file as head of household for 2024, your standard deduction will be $21,900, compared to just $14,600 for a single person.11 That’s a whopping $7,300 difference!

But remember that you can only file as head of household as a single parent if you meet the following three requirements. First, you must be single, legally separated or considered unmarried on the last day of the tax year. Second, you need to have a child or other qualifying dependent who lived with you for at least half the year. And finally, you must have paid for more than half of the household costs for your home—that includes utilities, food and the rent or mortgage.

5. American Opportunity Tax Credit

Got kids in college? Help them stay out of student loan debt and catch a break on your taxes with the American opportunity tax credit (AOTC). The credit applies to any qualified education expenses, like:

- Tuition

- School fees

- Required textbooks

The credit covers 100% of education expenses up to $2,000 and 25% of the next $2,000 after that. For all you math majors out there, that means you could get a maximum credit of $2,500. There is an income limit of $80,000 for those filing single and $160,000 for married couples, and above that it starts to phase out. Once you make more than $90,000 filing single or $180,000 as joint filers, you can’t claim the credit.12

6. Tax-Advantaged College Savings

While we’re talking college, did you know there are certain types of college savings programs that are tax-exempt? That’s right, you can save for your kids’ college tax-free with an Education Savings Account (ESA) or a 529 plan!

But before you start saving up that college fund, we recommend you do the following:

- Make sure you’re out of debt (except for the mortgage).

- Have an emergency fund of 3–6 months of expenses.

- Contribute 15% of your income toward retirement savings.

If you’re ready to take the first step toward saving for your kids’ education, get in touch with an investment professional to get started.

Don’t Miss Out on Tax Savings

We’ll say it again: Raising kids isn’t cheap! But tax breaks can help lighten the load (like, a lot). So, be kind to yourself, and make sure you’re taking advantage of every credit and deduction you can—whether you file yourself or work with a pro.

Next Steps

- Want to dive deeper into the child tax credit? Here’s everything you need to know about claiming it.

- Still have questions on what to claim? A RamseyTrusted® tax pro can help you navigate the child tax credit, other family tax breaks, and pretty much everything else tax related.

- Are you the DIY type? E-file your taxes online with Ramsey SmartTax for easy access to all federal forms from the start. It’ll guide you step by step to claim every credit you’re eligible for.

Federal Classic Includes:

- All major income types and federal forms

- Prepare, print and e-file

- Phone and email support

- 1 year of audit assistance

Federal Premium Includes:

Everything in Federal Classic plus:

- Live chat

- Priority phone and email help

- Free financial coaching session

- 3 years of audit assistance

- 1 month of ID theft protection