What Is the Self-Employment Tax and How Do You Calculate It?

10 Min Read | Mar 27, 2025

Listen to this article

Key Takeaways

- The self-employment tax is a tax on people who work for themselves—like independent contractors and small-business owners—and it funds Social Security and Medicare.

- It applies to anyone earning $400 or more in self-employment income.

- For 2024, the self-employment tax rate is 15.3%.

- You can calculate how much you’ll owe by multiplying your net earnings by 92.35%, then multiplying that amount by the 15.3% tax rate.

- It’s important to understand how to calculate and pay self-employment tax so you can budget ahead and avoid surprises at tax time.

To outsiders, being self-employed might look like fun. Woo-hoo! I’m my own boss. I set my own hours! But the truth is, working for yourself isn’t all fun and games. And that’s especially true during tax time when Uncle Sam hits you with the self-employment tax. Yes, the IRS has a tax just for you. Makes you feel all warm and fuzzy inside, right? Wrong!

It's very important you know the ins and outs of the self-employment tax so you can file your taxes right, reduce your tax bill, and avoid any expensive surprises at tax season. So buckle in—this stuff gets confusing. But don’t sweat it! We’ll take things one step at a time.

What Is Self-Employment Tax?

The self-employment tax is a tax on people who work for themselves—like independent contractors and small-business owners—and it funds Social Security and Medicare. Normally, your employer pays half of this tax and automatically withholds the other half out of your paycheck. But self-employed folks are stuck paying the whole thing themselves.

Self-Employment Tax Rate for 2023–2024

The self-employment tax rate for 2023–2024 is 15.3% of your net earnings. It’s made up of 12.4% for Social Security and 2.9% for Medicare.1 These taxes are often called the FICA tax, which stands for Federal Insurance Contributions Act. (You’ve probably seen FICA as a line item on a paystub at some point and wondered, Who the heck is FICA and why are they taking my money?)

Okay, so how much is the self-employment tax? Here’s what you’re paying and why:

Everyone who works has to pay FICA taxes on their wages. But the difference between being self-employed and being employed by a company is that employers are required to foot the bill for half (7.65%) of FICA.

If you’re self-employed, the federal government thinks of you as both employer and employee—so you’re stuck paying the full 15.3%. Ouch! It’s kind of like going out to get some tacos with a friend and when it’s time to split the check, they’re like, “Oh man, I can’t find my wallet.” Pretty frustrating, right?

And the self-employment tax is in addition to any other federal, state or local taxes you’re required to pay based on your income. So, what it really boils down to is that being self-employed will cost you about 7.65% in additional taxes.

But don’t freak out yet. There are some deductions that will lower your tax bill slightly. First, let’s walk through calculating the self-employment tax.

How to Calculate the Self-Employment Tax

If you’re your own boss and your boss isn’t great at math, calculating your self-employment tax can be tricky. Fair warning: Self-employed folks have to wade through more tax forms than an average tax filer. Yes, lots and lots of forms, especially if you’ve worked for multiple clients. Let’s walk through it step-by-step:

Step 1: Gather your tax forms.

It’s best to have all your forms organized and on hand when it’s time to figure out your self-employment tax. This includes Form 1040, any 1099-NEC or 1099-K tax forms you received doing work as a contractor, and any receipts from business expenses. Having these ready to go will save a ton of time (and stress).

Step 2: Fill out Schedule C.

Next, take a look at Form 1040. You want to find and fill out the Schedule C section. This is where you’ll add any income from being self-employed listed on your 1099 tax forms.

Step 3: Deduct your business expenses.

Then, you’ll deduct expenses to figure out your net income. We’ll get into this more in a bit, but deductions can help lower your net income, which will lower your tax bill. So hang on to those receipts!

Step 4: Calculate self-employment tax on Schedule SE.

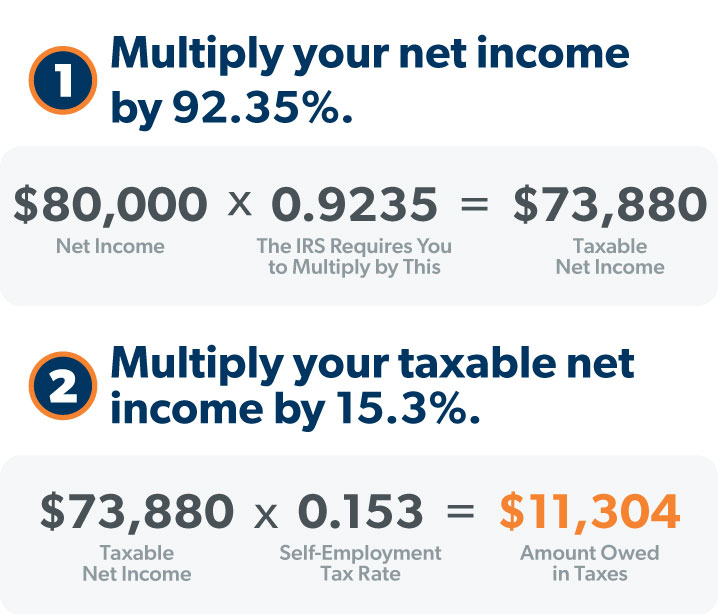

Next, to calculate your self-employment tax, look for Schedule SE (SE stands for self-employment). Do you have your calculator ready? First, multiply your net income by 92.35% (0.9235). This is your taxable income. Then, multiply your taxable income by 15.3% (0.153). The result is how much you owe for the self-employment tax.

Got small business tax questions? RamseyTrusted tax pros are an extension of your business.

Did you misplace your 1099-NEC or 1099-K tax forms? Not the end of the world! Just get in touch with your client and have them send you a copy. They should have it in their records.

Okay, is your head spinning yet? Don’t worry. We’ll look at a real-life example in just a minute. Before that, let’s look at who has to pay the self-employment tax.

Who Has to Pay the Self-Employment Tax?

We already know if you earn all your income from being self-employed, you have to pay the self-employment tax. You also have to pay it if you work a regular job and earn more than $400 a year from a side hustle, gig, freelance work—whatever you want to call it.2

Do you have to pay the self-employment tax on the money you earn driving for a rideshare company? Yep. Mowing yards? Yep. Selling your handmade friendship bracelets on Etsy? For sure. Any amount over $400 is subject to the self-employment tax. And in a strange piece of tax code, any amount over $108 earned while contracting for a church is taxed.3

But as your income increases, you do get some relief on the 12.4% Social Security portion of the self-employment tax. For the 2023 tax year, the maximum amount of income subject to Social Security is $160,200 (it increased from $147,000 in 2022).4 And this limit can be reached through a combination of what you earn from your regular job, which would already have Social Security taxes taken out, and your side job.

But if your self-employed income exceeds $200,000 as a single filer or $250,000 as married filing jointly, the IRS will charge you an additional 0.9% in Medicare taxes.5

When and How to Pay the Self-Employment Tax

Okay, let’s get to everyone’s favorite part (cue eye roll): Paying your taxes. Here’s what you need to know about paying the self-employment tax.

Getting a Social Security Number (SSN)

If you don’t have a Social Security Number, you can get one by filling out and submitting Form SS-5. You can find this form online, by calling 800-772-1213, or by heading to your local Social Security office.6

Getting an Individual Taxpayer Identification Number (ITIN)

If you’re a nonresident or a resident alien working in the United States and you don’t qualify for an SSN, the IRS will issue you an ITIN. You can apply for an ITIN through form W-7, Application for IRS Individual Taxpayer Identification Number.7

Make Estimated Tax Payments (Quarterly Taxes)

If you hate paperwork—which means you’re human—there’s some more not-so-great news. If you’re self-employed and expect to owe more than $1,000 in taxes when you file your tax return, the IRS requires you to pay estimated taxes (also called quarterly taxes).8

This means you’ll have to estimate your income and the amount of taxes you expect to owe, and then make four tax payments throughout the year. Quarterly taxes are typically due April 15, June 15, September 15 and January 15. Put those dates on your calendar because you can get penalized for late payments.

To figure out your estimated taxes, you’ll need to fill out a 1040-ES form.9 The IRS accepts just about any kind of payment: cash, check, or online with a bank account or debit card. Unfortunately, they don’t accept Monopoly money or trades for baseball cards. (Nice try, though.)

Do you only have a small side hustle alongside your regular job? You might not have to file quarterly taxes. Here are a couple options to look into:

Lump With Your Regular Tax Return

If your side hustle doesn’t really move the needle on your income, you can lump your self-employment taxes into your regular tax return. But it doesn’t take a ton of income to accumulate more than $1,000 in taxes. So if you’re making more than about $5,000 on the side, you might have to look at filing quarterly taxes.

Adjust Your Tax Withholdings

Another simpler option is to adjust your tax withholding at your regular job to have extra taxes taken out of your paycheck to cover the taxes from your extra income. To do this, you’ll need to fill out a new W-4 form and send it to the folks in your company’s payroll department.

Example of the Self-Employment Tax

Let’s look at an example to see how it all works. Meet our good friend, Bob.

Bob runs a fishing lure business, and he reported a net income of $80,000 on Schedule C. To figure out the amount of his net income that’s taxable, he’ll multiply $80,000 x 92.35%, which equals $73,880. (It’s complicated, but if you really want to know the reason why Bob only has to pay taxes on 92.35% of his income, it’s because the IRS allows self-employed people to deduct the 7.65% portion of FICA an employer would normally pay.)

So Bob’s taxable net income is $73,880. Multiply that by the 15.3% self-employment tax rate, and you get about $11,304. And that’s how much he owes. That’s a pretty big chunk of change. And remember: This is in addition to any other federal, state or local income taxes he might owe.

Though when figuring out his additional taxes, he will be able to take advantage of the standard deduction or itemized deductions to reduce his taxable income—bringing down that tax bill a bit.

And Bob is also going to mark his calendar and pay quarterly taxes. This way, Bob can avoid any additional IRS late penalties. Bob does not like paying extra. Be like Bob.

Tax Deductions for Self-Employment

The Schedule C IRS form lists a bunch of expenses you can deduct from your income if you’re self-employed. Remember, deductions lower your net income, and that means your self-employment tax will be lower. That means deductions are a good thing. Some of the most common deductions are:

- Advertising and marketing

- Office supplies

- Computer equipment and software

- Travel and business meals

- Home office

- Utilities

Make sure to keep receipts and invoices for all these expenses in a central location. And no, your wallet stuffed with coupons, cash and cards is not the place for them. Having detailed records will make tax time much easier and protect you if the IRS ever audits you.

Find a Quality Tax Professional

Let’s face it: Taxes are complicated. And being self-employed makes them even more complicated. If your head is swimming thinking about 1099s and Schedule Cs, a tax professional can guide you through the mountains of paperwork.

They’ll also make sure you’re taking the right deductions to lower your tax bill. And they can even set up your quarterly taxes to avoid any late penalties from the IRS. This stuff isn’t easy, and sometimes you just need a little help. To find a tax pro near you, try our RamseyTrusted program.

Find a tax professional who serves your area today!

If you’re confident you can handle your own taxes and just want easy-to-use tax software (without the big sticker price), check out Ramsey SmartTax—we make filing your taxes easy and affordable.