How to File Your Taxes With Ramsey SmartTax

9 Min Read | Dec 19, 2024

Every year it’s the same story at tax time. Everywhere you turn, you see ads for “free” tax filing software that sound like a great deal. So you sign up. . . but then, when you’re halfway through filling out your forms, you find out each one is an additional charge. What gives?

Listen, you don’t have to put up with that nonsense this year. That’s because there is a tax software out there that’s actually honest about how much it costs and will show you how to file your taxes online the right way—and it’s called Ramsey SmartTax.

Powered by TaxSlayer, Ramsey SmartTax is easy to use and gives you access to all the federal forms and deductions you need to file (without any upcharges). And with no hidden fees, you could save up to 70% when you switch to Ramsey SmartTax from another tax filing software.

Here’s a step-by-step look at how Ramsey SmartTax can help you file your taxes with confidence and put tax season in the rearview mirror.

Step 1: Choose your tax filing plan.

Once you create your account, Ramsey SmartTax gives you two easy options to file your taxes online: Federal Classic or Federal Premium. Let’s walk you through each of those options.

Federal Classic ($49.95)

Federal Classic is a great plan if you know what you're doing and have a simple return but maybe need a little nudge to help you get going and some guidance to keep things moving.

With Federal Classic, all your deductions and credits are included, and you can easily prepare, print and e-file your tax return with the IRS.

Federal Premium ($69.95)

For just $20 more, Federal Premium includes everything that comes with Federal Classic plus priority-level support for any questions you might have along the way. Here’s what you get with Federal Premium:

- Audit assistance for three full years

- Live chat to get answers fast

- Priority email and phone support

Do you need to file a state return too? Ramsey SmartTax has you covered! The cost to file a state return is $44.95, whether you choose Federal Classic or Federal Premium.

And if you change your mind, that’s okay! If you file with Federal Classic and realize halfway through that you might want priority support or the peace of mind that comes with audit assistance, you can upgrade to Federal Premium at any time.

Step 2: Tell us about yourself and your tax situation.

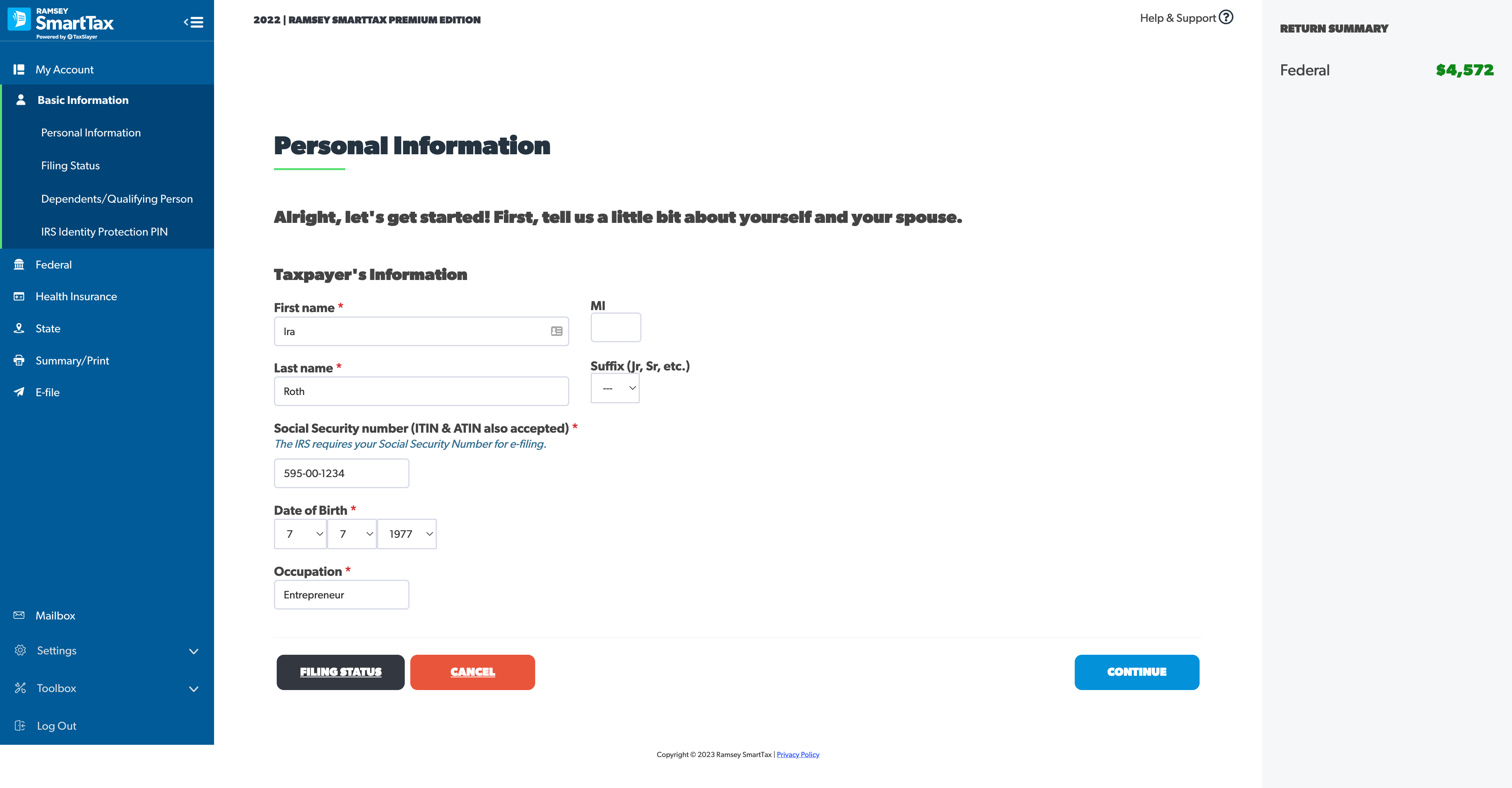

Now it’s time to get to know you a little bit! Ramsey SmartTax makes this step really simple. All you have to do is upload your tax return from last year (like a PDF from another tax software) and voila—your personal info will be auto-filled into Ramsey SmartTax.

You could also manually fill out your personal information if you'd like to go that route. In order to file your taxes, you’ll need to have the following information at the ready:

- Taxpayer name

- Social Security number

- Date of birth

- Occupation

- Address

Then Ramsey SmartTax will ask you if certain situations apply to you, like whether you were affected by a natural disaster this year or if you can be claimed as a dependent on someone else’s tax return.

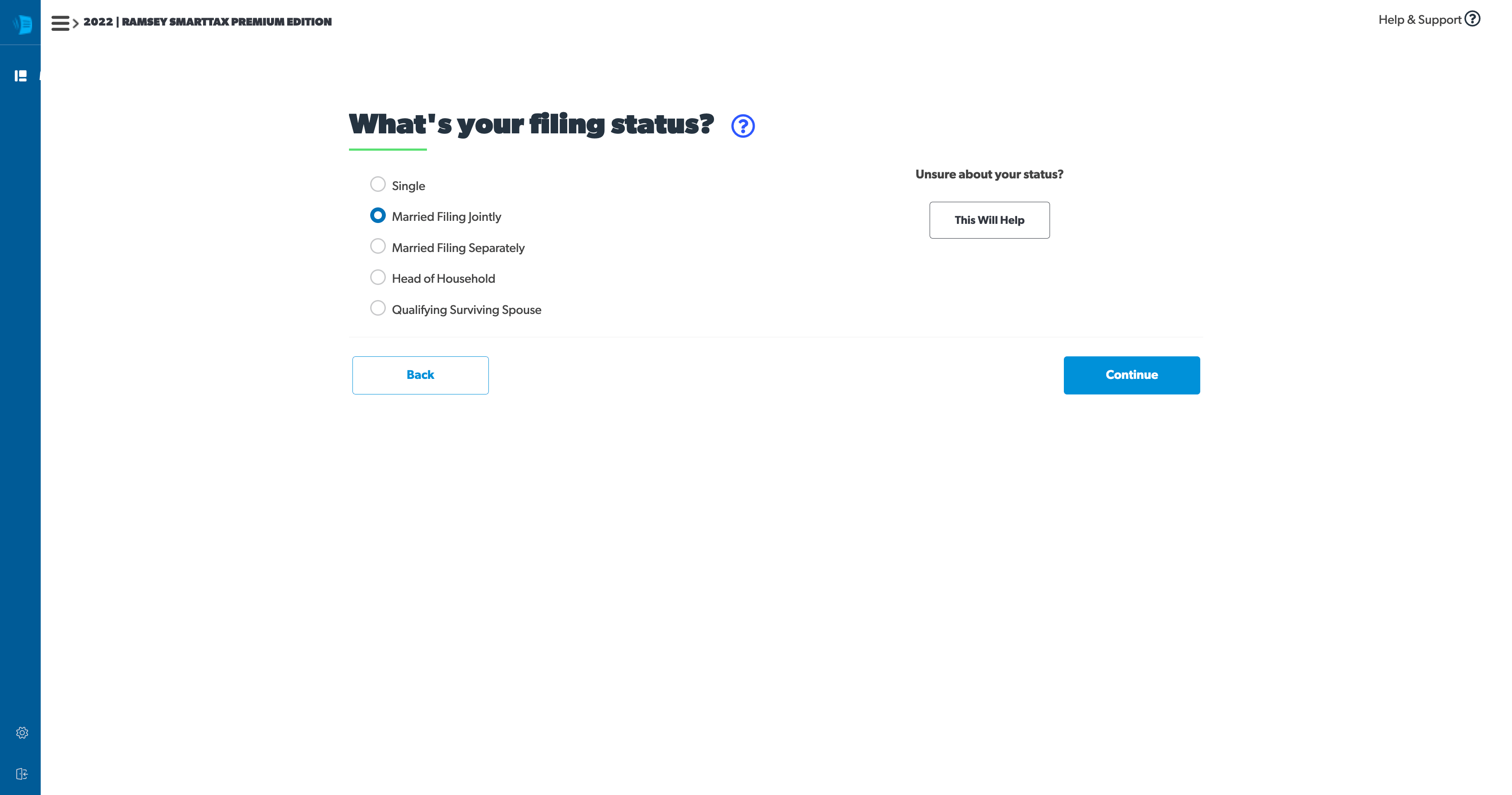

After that, Ramsey SmartTax will ask you a series of questions to better understand your tax situation, like what your filing status is and if you plan to claim any dependents (such as your kids or relatives who live with you and rely on you for support) on your return.

Step 3: Fill out your tax return.

Once your basic info is covered, it’s time to get into the nitty-gritty of your tax filing journey!

Don’t settle for tax software with hidden fees or agendas. Use one that’s on your side—Ramsey SmartTax.

Ramsey SmartTax will walk you through all the tax forms you need to complete in order to file your tax returns and pay your taxes (if you end up owing anything).

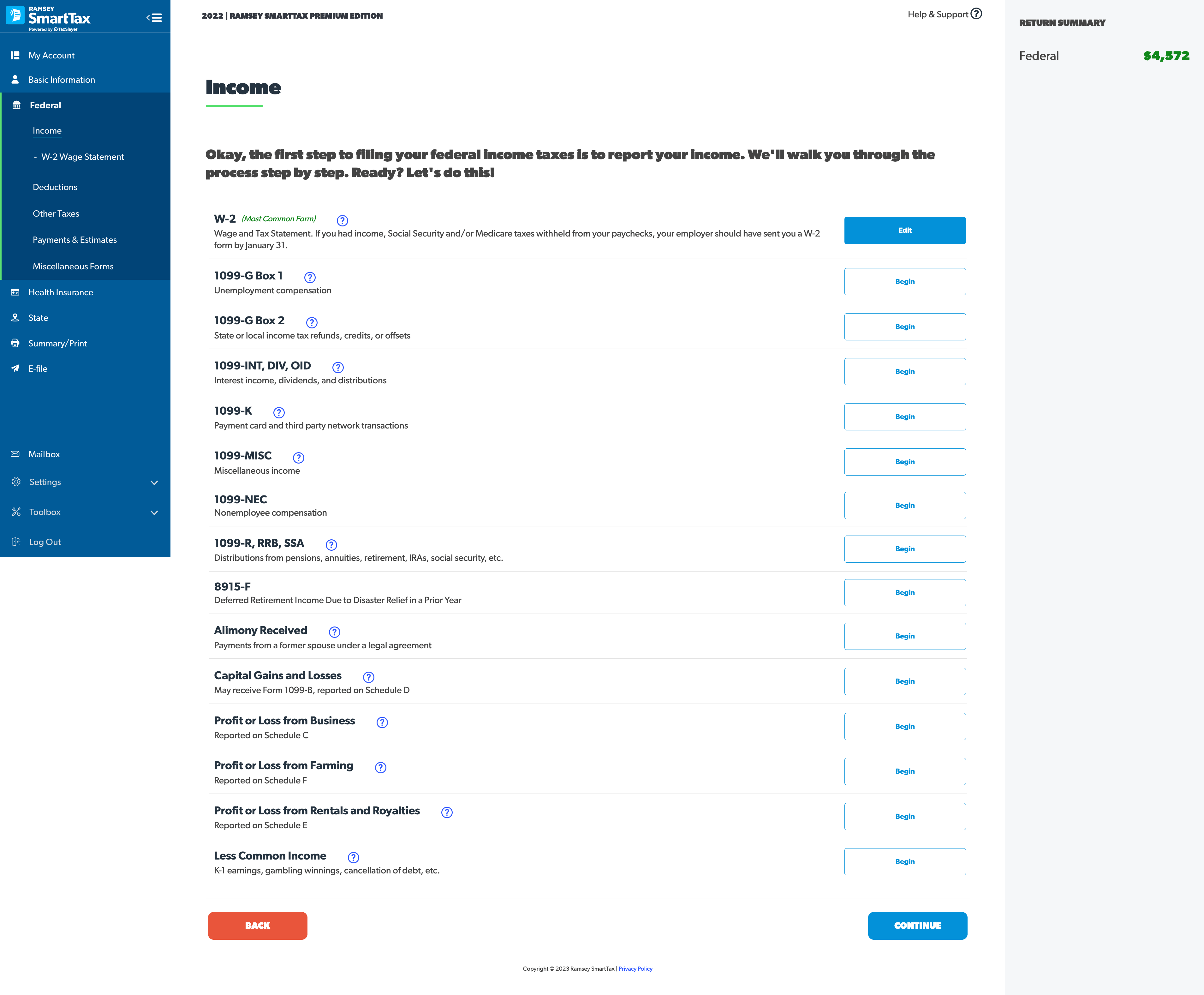

Income

First, Ramsey SmartTax will ask you about the money you earned for 2024. From the salary you received from a full-time job to the interest you made from a high-yield online savings account and everything in between.

Here are some of the types of income you’ll need to report to file your taxes:

- Wages and salary (W-2)

- Unemployment compensation (1099-G, Box 1)

- State or local tax refunds (1099-G, Box 2)

- Interest and dividend income (1099-INT, 1099-DIV)

- Retirement account distributions (1099-R)

- Payment card and third-party transactions (1099-K)

- Capital gains and losses (1099-B, reported on Schedule D)

- Social Security benefits (1099-SSA)

- Miscellaneous income (1099-MISC)

- Nonemployee compensation (1099-NEC)

- Profit or loss from business (reported on Schedule C)

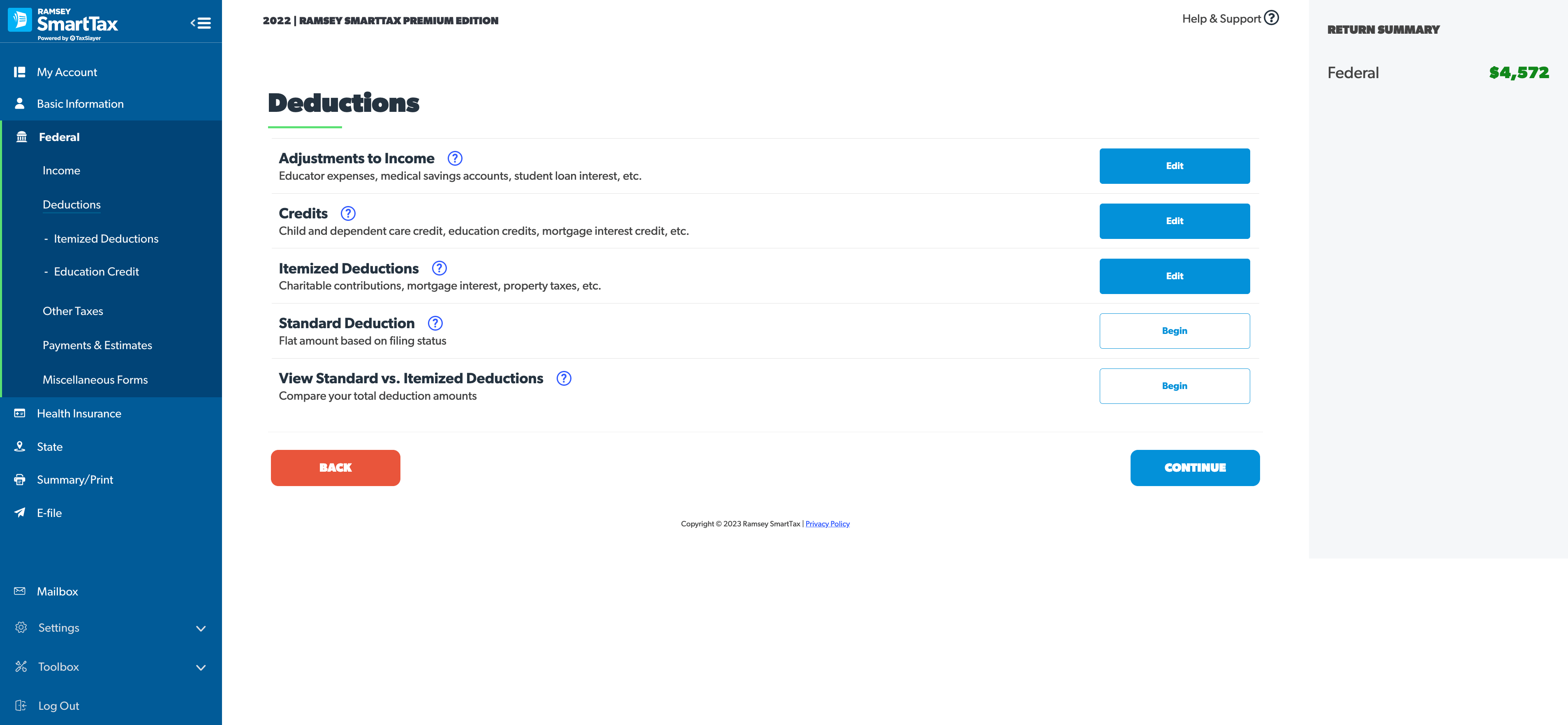

Deductions

Now that you have all your income reported, Ramsey SmartTax will help you find ways to lower your tax bill through tax deductions and tax credits. The software will walk you through each of the following sections:

- Adjustments to Income: These are certain expenses—such as educator expenses, student loan interest payments, and contributions to a Health Savings Account—that can directly reduce your total taxable income. These items are not included as itemized deductions and can be entered independently.

- Tax Credits: The awesome thing about tax credits is that they reduce the actual amount of tax you owe, dollar for dollar. Some common examples are the child and dependent care credit, education credits, and mortgage interest credit.

- Itemized vs. Standard Deduction: Ramsey SmartTax will help you find out whether you should itemize your deductions or take the standard deduction. Both options will lower your taxable income, but you’ll want to take the option that lowers it the most. The cool thing about Ramsey SmartTax is that it will automatically use the deduction that benefits you most on your tax return.

Other Taxes

Once that’s done, Ramsey SmartTax will help you figure out if you owe any other federal taxes beyond the regular income tax.

Here are some examples that might apply:

- Additional tax (or “penalty”) for early withdrawals from 401(k)s and other retirement accounts.

- Alternative minimum tax (AMT)

- Net investment income tax (NIIT)

- Self-employment tax

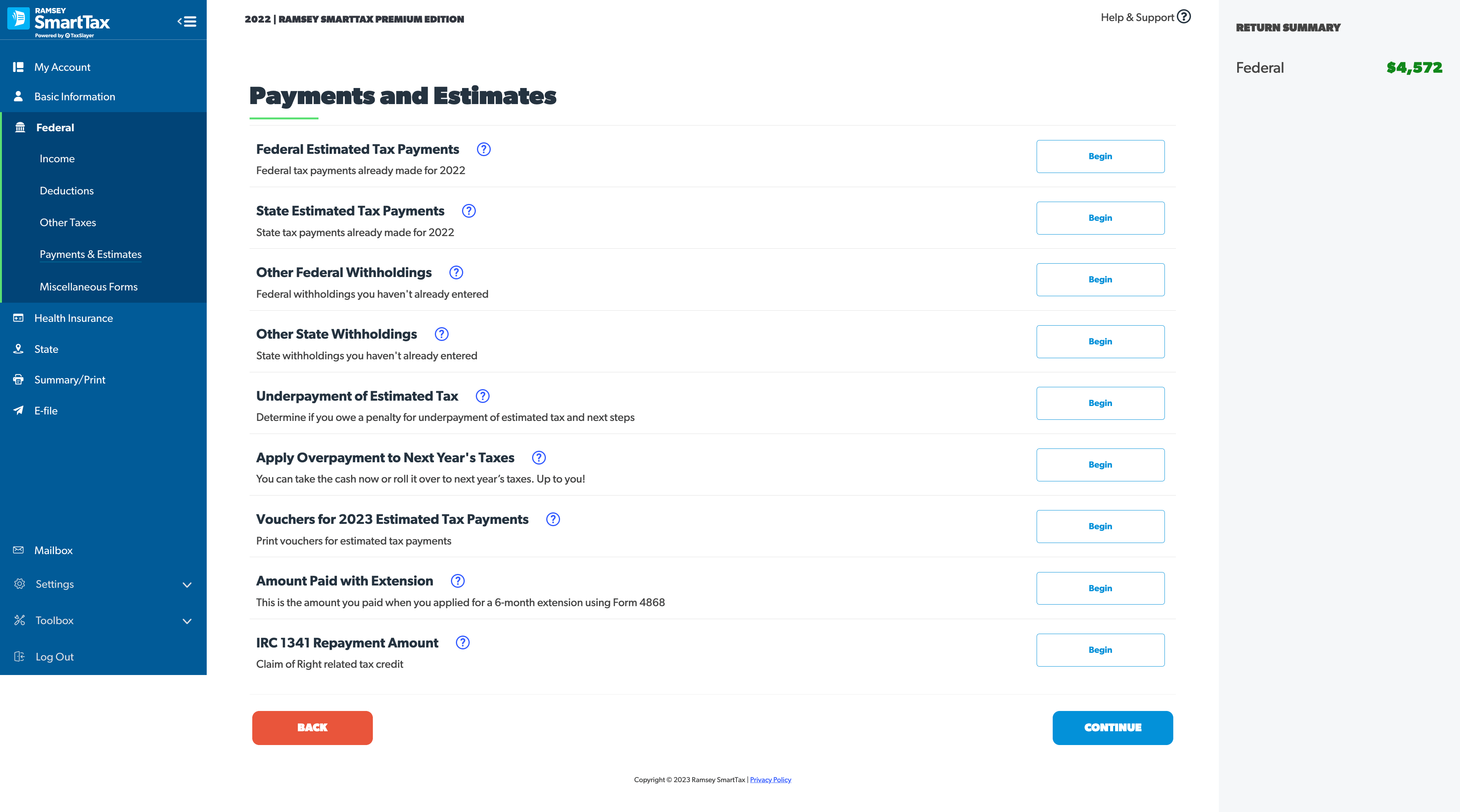

Payments and Estimates

Are you self-employed? Then you might have to make estimated tax payments throughout the year. The general rule is this: If you expect to owe at least $1,000 in tax for the current tax year, you’ll need to make quarterly estimated tax payments.

This section is where you’ll report any estimated taxes you already paid on the self-employed income you made in 2024. If you didn’t—and you owe more than $1,000 in taxes on that income—then you might owe a penalty for not making those estimated tax payments throughout the year.

Don't worry, Ramsey SmartTax will help you figure all that out.

Miscellaneous Forms

When it comes to tax forms, you want to make sure you have all your bases covered—and so does Ramsey SmartTax!

Chances are you won’t have to worry about any of the forms in this section. But if you need to file a tax filing extension with Form 4868 (so you avoid paying the penalty for filing late) or if you’re claiming a refund for a deceased taxpayer who isn’t your spouse (you’ll need Form 1310 for that), this is the section where you’ll get that taken care of.

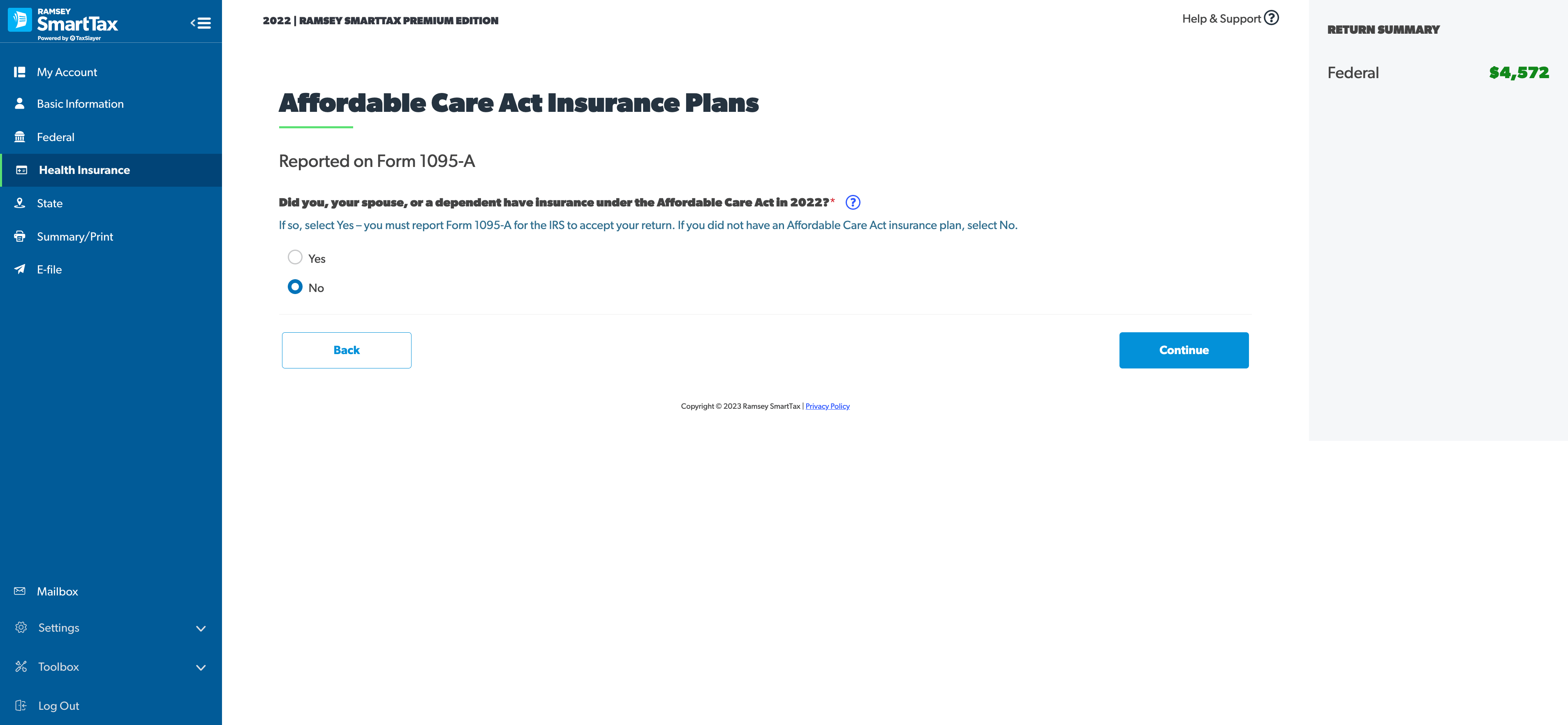

Health Insurance

Did you (or your spouse or one of your dependents) have health insurance under the Affordable Care Act? If you did, you need to report Form 1095-A. Unfortunately, if you don't report it, the IRS won’t accept your return (womp, womp).

If you didn’t have an Affordable Care Act insurance plan (maybe because you get health insurance through work), then just select “No” and keep it moving!

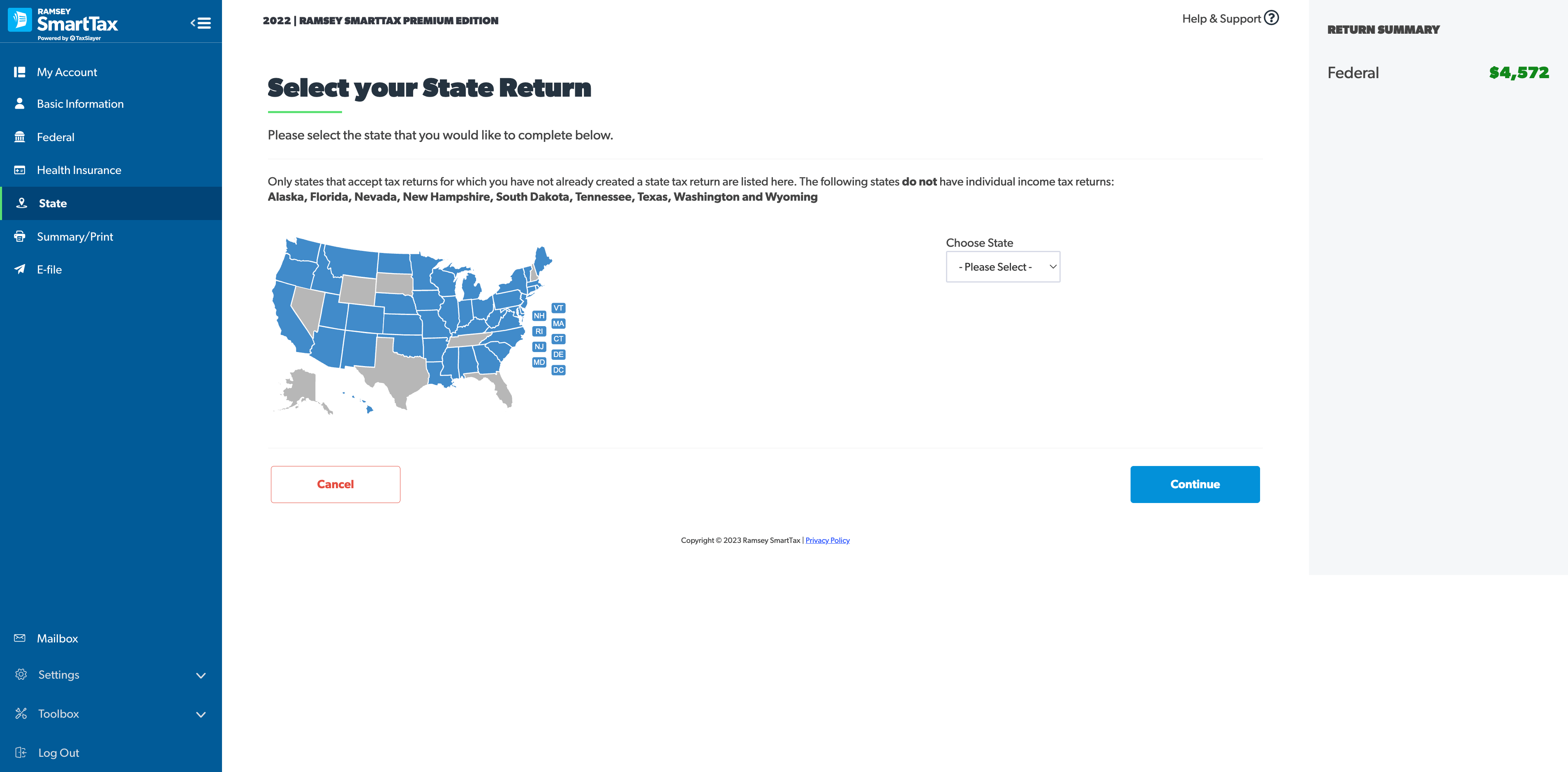

State Returns

Now that Uncle Sam is taken care of, it’s time to turn your attention to your home state’s income taxes. The good news is, this should be quick, since Ramsey SmartTax will transfer all the information from your federal return to your state return automatically.

All you have to do is put in some state-specific information and let Ramsey SmartTax see if there are tax breaks available for you in your state. Keep in mind that filing state returns are $44.95 each.

Now, if you’re one of the fortunate souls who live in one of the nine states that doesn’t have a state income tax, you can just skip this section and move right on ahead toward the final step of the tax filing process!

Step 4: E-file your tax return.

We’re almost done, y’all! Now that we’ve gone through the hard part of getting all your income reported, credits and deductions claimed, and everything in between, it’s time to bring it all home.

Summary and Print

Before you send your return over to the IRS, make sure you take a few minutes to review everything on the Tax Return Summary page. This page will show you all the following information:

- Total Income

- Adjusted Gross Income

- Tax and Credits

- Total Tax

- Payments

- Amount You Owe

You can also view a version of the return that will be sent to the IRS and print a copy for your own records.

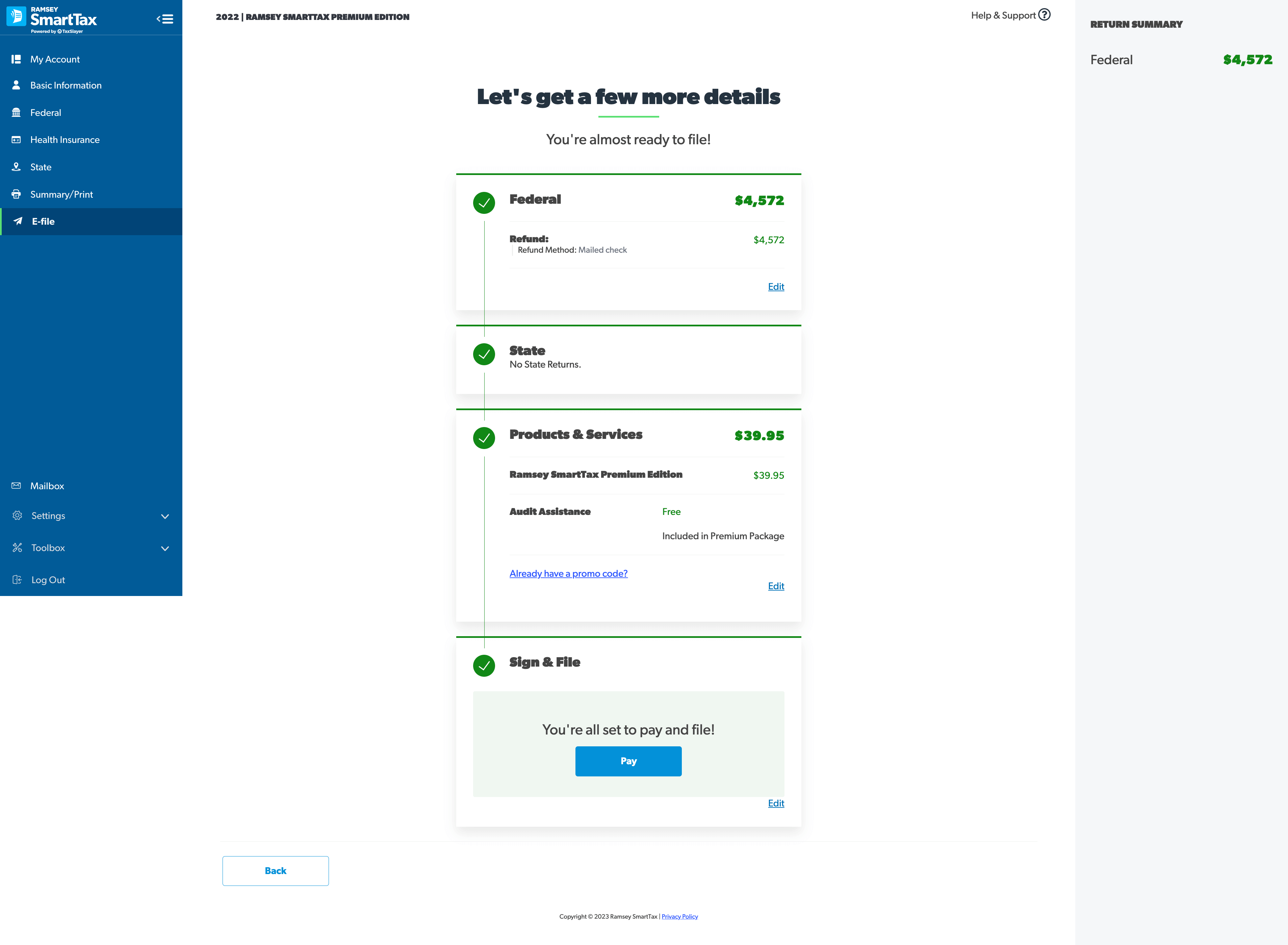

File and Pay

Woo-hoo! You’ve made it to the finish line! At this point, Ramsey SmartTax will let you know if there’s anything that’s missing or needs to be fixed on your return before you e-file your return with the IRS.

If everything looks good, you’ll see what you owe in taxes (or the amount of your refund) on your federal and state returns, and how much you owe for filing with the Federal Classic or Federal Premium version of Ramsey SmartTax.

All you have to do now is file your return and pay what you owe!

File Your Taxes With Confidence

Ready to file your taxes? Don’t put it off! If you have all of your tax forms and information on hand, there’s no reason to wait. The sooner you file, the sooner you get back to enjoying the things you actually want to do this spring.

Think you'll owe taxes, but you're not quite ready to pay? No problem! You can still file and then schedule your tax payment to be withdrawn from your account at a later date. That's one of the many benefits of filing early.

Federal Classic Includes:

- All major income types and federal forms

- Prepare, print and e-file

- Phone and email support

- 1 year of audit assistance

Federal Premium Includes:

Everything in Federal Classic plus:

- Live chat

- Priority phone and email help

- Free financial coaching session

- 3 years of audit assistance

- 1 month of ID theft protection