Time flies when you're having fun. Before you know it, another year has passed and—bam!—it’s time to file your taxes again. If thoughts of tax season have you feeling like a deer in headlights and scrambling to figure out dependents and tax credits—take a deep breath. We’ve got the 411 when it comes to claiming dependents and filing your taxes with confidence!

First, let’s walk through who qualifies as a dependent, who can claim a dependent, and what tax credits might be available to you.

What Is a Tax Dependent?

A tax dependent is a person other than you and your spouse who relies on you financially and qualifies for certain tax deductions and credits on your tax return.

Think children, elderly parents or other family members who rely on you for food, housing, medical expenses or clothing. The rules for qualifying as a dependent can be messy, but we’ll guide you through the murky areas.

Who Qualifies as a Dependent?

A person must fall into one of two IRS categories to be considered a dependent: a qualifying child or a qualifying relative.

Sure, that doesn't sound all that complicated—there are only two options! But the key word to keep in mind here is qualifying.

Let’s take a closer look.

Claiming a Qualifying Child

Children can certainly have an impact on your taxes. To claim a child as your dependent, they must meet the following qualifications:1

- Relationship: They can be your daughter, son, stepchild, adopted child, foster child or grandchild; or they can be your brother, sister, half-brother, half-sister, stepbrother, stepsister, or a descendant of any of them (aka your niece or nephew).

- Age: They must be under the age of 19 by the end of the tax year and also be younger than you. If they are a student, they must be under the age of 24. Anyone who has a permanent disability, regardless of age, also qualifies.

- Citizenship: They must be a U.S. citizen, a U.S. resident alien, a U.S. national, or a resident of Canada or Mexico.

- Residence: They must live with you for more than half the year.

- Income: Their annual income can’t be more than half of what it costs you to support them.

- Tax status: They can't also file a joint return for the year. What this means is that you would not be able to claim someone who is married and filing a joint tax return. For example, let’s say you have a recently married, college-aged child. If they file a joint tax return with their spouse, you can’t claim them as a dependent—even if you supported them for most of the year.

Claiming a Qualifying Relative

Figuring out if your relative qualifies as a dependent can be tricky. For one thing, they don’t even have to be a relative (more on that below). Let’s look at the key requirements so you can get the tax breaks you deserve:2

- Relationship and residence: They don’t have to be a relative—but if they aren’t, they do have to live with you for the entire year. If they’re a relative, they don’t have to live with you.

- Age: They can be any age—your great-grandfather can be your dependent.

- Citizenship: They must be a U.S. citizen, a U.S. resident alien, a U.S. national, or a resident of Canada or Mexico.

- Support: You have to provide more than half of their total support for that year.

- Income: Their gross income (total income before any taxes or deductions) for the year must be less than $4,400.

- Tax status: They can’t already be claimed as a dependent on another taxpayer's return.

Claiming Disabled Children or Adults as Dependents

The IRS doesn’t offer any specific credits for disabled dependents. Any disabled children or adults you’re financially supporting must meet the same qualifications we listed above. But if your child is permanently and totally disabled, you can claim them as dependents no matter their age.

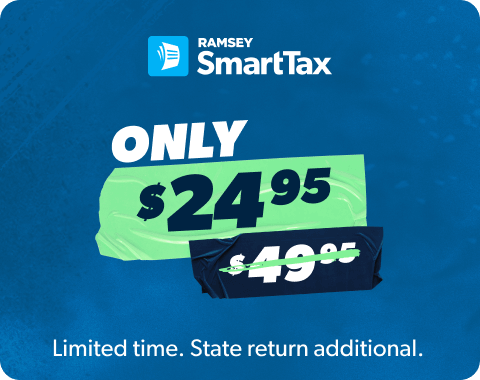

Don’t settle for tax software with hidden fees or agendas. Use one that’s on your side—Ramsey SmartTax.

Of course, there are some exceptions and special circumstances for dependents, so the best way to make sure all your bases are covered is to connect with a tax pro to help you wade through the details.

How Do I Claim Someone as a Dependent?

Okay, now that you've got some clarity around who qualifies as a dependent—how do you actually do it?

Claiming a dependent on your tax return is actually pretty simple. If you’re using tax software, it’ll ask you if you have any dependents and then have you plug in a few details about them. If you’re going old school, then on the first page of your return (aka form 1040), you’ll just enter each name, their personal information, and their relationship to you, then check which dependent category they fall under. Then you’ll calculate the child tax credit on the second page, if applicable.

Deductions and Credits Available When Claiming Dependents

Now for the good stuff—saving money on your taxes! Here are some of the deductions and credits you might qualify for with children or dependents.

- Earned income tax credit: This refundable credit helps give a break to low- to moderate-income families and workers. To qualify, you must have worked and earned an income under $59,187 and have an investment income below $10,300 in the 2022 tax year.

Also, you don’t have to have children to qualify for this credit, but kiddos will mean a larger refund.3

- Child tax credit: If you do claim a qualifying child as a dependent (and meet the other specifications), you may be able to claim a child tax credit. The maximum amount of credit that you'd be eligible for is $2,000 per qualifying child thanks to the 2017 Tax Reform Bill.

The income threshold where the child tax credit begins to phase out has also increased from $110,000 to $400,000 for married couples filing jointly. This means even more families with children under the age of 17 qualify for the larger credit.4 Heck yeah!

- Credit for other dependents: If you claim a qualifying relative—someone who is not your child—you would qualify for a nonrefundable tax credit with the same income thresholds as the Child Tax Credit.5

- Adoption credit: If you adopted a child this year, you’re amazing and deserve every tax break in the world. Thankfully, there’s a good chance you’re qualified for the adoption credit. This credit covers up to $14,890 of your expenses per adopted child. These expenses can include adoption fees, court costs and attorney fees, travel expenses, and any other costs directly related to the adoption.6 (Friendly reminder to keep good records and receipts, folks!)

Like most tax credits, the IRS has placed an income limit for the adoption credit. If you make less than $223,410, you’re eligible for the full amount. You qualify for a reduced amount between $223,410 and $263,410, and it’s eliminated completely at $263,410 and up.7

- Child and dependent care credit: Paying for childcare is no joke! We know it’s painful, and Uncle Sam offers a credit to try to offset some of those jaw-dropping costs. If you have to pay for childcare, the care of elderly parents, or care for dependents unable to care for themselves, you might qualify for the Child and Dependent Care Credit.

For 2022, it’s 20% to 35% (depending on your taxable income) of up to $3,000 for one qualifying dependent and $6,000 for two qualifying dependents.8 As always, the IRS likes to keep things simple, right? Here’s an example of what it would look like: If you dish out $5,000 for childcare for your toddler, you can claim $3,000 of that—but only 20% of $3,000 (because you make more than $43,000). So, you would get a $600 nonrefundable deduction ($3,000 x 0.2).

Qualifying childcare expenses include more than just day care. Don’t forget about nanny services, after-school care and summer day camps! Just make sure you have the name, address and taxpayer identification number for each care provider you’ve used.

- American opportunity tax credit (AOTC): Let’s face it. The costs of sending Junior to college aren’t getting any cheaper. This credit covers 100% of education expenses up to $2,000 and 25% of the next $2,000 after that—$2,500 total! This includes expenses like tuition, school fees and textbooks.

For the AOTC, there is an income limit of $160,000 for married couples, and above that it starts to phase out. You can’t claim the credit once you make more than $180,000.9

When Should I Stop Claiming My Child as a Dependent?

All good things eventually come to an end and claiming your child as a dependent is no different. Children no longer qualify if they turn 19 before the end of the tax year. But if they’re a full-time student, you can claim them as a dependent until they turn 24.10

As we mentioned above, if your child is permanently and totally disabled, you can claim them at any age.

When Does My Child Have to File Taxes?

So your teenager started their first real job, saving up for that first beater car. Ah, the memories! Duct tape and leaky sunroofs. Or maybe that savings account that grandpa set up has been earnings some serious interest.

Whether it was earned income or interest from a savings account (unearned income, according to Uncle Sam), if you’re claiming a minor as a dependent, they may still have to file their own taxes.

Minor children—assuming they are single, under 65 (duh), and not blind—will need to file a return if one of these is true:11

- Their earned income only is more than $12,950

- Their unearned income only is more than $1,150

- Their gross income (earned and unearned income combined) is more than whichever of these totals is bigger: either $1,150 or their earned income plus $400. Yeah, we can’t make sense of that either. That’s why we’re going to break it down for you…

So let’s say your kid has $800 of earned income and $300 of unearned income. That’s $1,100, which is obviously less than $1,150, so they passed that first part, but they’re not out of the woods yet.

Now let’s add their earned income ($800) and $400 (which is so random—but it’s the IRS, so sure). That’s $1,200 total. So, they don’t need to file because their gross income ($1,100) is less than $1,200. Isn’t tax season the best?

File Your Taxes With Confidence

We know taxes can be tricky and confusing, especially when it comes to claiming dependents and figuring out tax credits. But don’t worry—you don't have to tackle this on your own!

If you have a relatively simple return and want to try filing on your own, go for it! For an easy and straightforward online solution, check out RamseySmartTax.

If you’re not comfortable flying solo and want more help, our RamseyTrusted tax pros are ready to help guide you through the tough parts of your tax return so you can file with confidence.

Federal Classic Includes:

- All major income types and federal forms

- Prepare, print and e-file

- Phone and email support

- 1 year of audit assistance

Federal Premium Includes:

Everything in Federal Classic plus:

- Live chat

- Priority phone and email help

- Free financial coaching session

- 3 years of audit assistance

- 1 month of ID theft protection