Key Takeaways

- Your tax withholding is the amount of money held back from each paycheck to help pay your income taxes throughout the year.

- If you withhold too much, you’ll end up with a huge tax refund. On the flip side, withholding too little will lead to a massive tax bill. Since the goal is to avoid a big bill or a big refund, you need to adjust your withholding to get your tax bill as close to $0 as possible.

- To find out where you stand, you’ll need to figure out how much you‘re currently withholding, estimate how much you’ll owe in taxes based on your taxable income, and then subtract how much you owe from how much you’re withholding.

- If you need to adjust your withholding, you can fill out a new W-4 form and submit it to your employer. It’s a good idea to meet with an HR representative or your tax pro before making any adjustments.

Think that hefty tax refund you got last year was a big ol' bonus? Think again.

If you got a big, fat refund check, that just means you’ve been loaning the government too much of your hard-earned cash with each paycheck. Uncle Sam is simply returning money that was yours to begin with—that’s why it’s called a refund! It’s not a gift, and it’s definitely not free money.

Here at Ramsey, we want to make taxes easier to understand. So, whether you’re thinking, Oh my gosh, how much should I withhold for taxes this year? or you want to know how to calculate tax withholding in the first place, this is the article you’ve been searching for.

And answering these questions is easier than you think. It all starts with taking a closer look at your tax withholding.

What Is Tax Withholding?

Okay, first things first: Your tax withholding is the amount of money held back from each paycheck to help pay your income taxes throughout the year. Your employer then takes that money and sends it to the IRS. That’s right—you’ve been paying your income taxes all year long thanks to tax withholding.

Just think of your withholding on each paycheck like an estimate. You’re trying to send roughly what you think you’ll owe in taxes to the IRS based on your income and other factors (like tax deductions and tax credits).

When you file your annual tax return during tax season, the IRS will let you know how you did. If you withheld too much, you’ll get that money back as a tax refund. But if you didn’t withhold enough, you’ll get a tax bill for whatever you still owe Uncle Sam.

That’s why it’s important to get your withholding dialed in. You want to get your tax return as close to $0 as possible so you don’t get a big tax bill or a tax refund.

When Do You Need to Adjust Your Tax Withholding?

Good question! Here are some signs you might need to adjust your withholding:

1. You get a huge tax refund from the IRS every year.

IRS data shows that the average tax refund for the 2024 tax season was $2,869.1 Twenty-eight Benjamin Franklins sitting around with nothing to do all year sounds wasteful, right? But let’s take a look at what that means for your everyday life.

Don’t settle for tax software with hidden fees or agendas. Use one that’s on your side—Ramsey SmartTax.

If you were paid twice a month and got your withholding just right, that means you could’ve had an extra $120 in every paycheck last year. And just think of what you could do with an extra $240 each month! Those Benjamin Franklins could be working for you instead.

2. You receive a large tax bill every year.

Or maybe you have the opposite problem: You’re getting hit with massive tax bills, and you’re sick and tired of sending the IRS a big check every April. If that’s you, we feel your pain. Getting on the same page with the IRS is no easy task . . . especially since the tax code has thousands of pages.2

If you’re looking at a tax bill that’s several hundred or even thousands of dollars, you’ll want to adjust your withholdings so you avoid the stress of figuring out how you’re going to pay that bill by Tax Day (not to mention the failure-to-pay penalty if you can’t pay your taxes on time).

3. You went through a major life change recently.

Having more money in your pocket isn’t the only reason to make adjustments to your tax withholding. If you had a major life change over the past year that might impact how much you owe in taxes, you should review your tax withholding and make any necessary adjustments.

Here are some major life events that might warrant a fresh look at your tax withholding:

- You got married.

- You bought a house.

- You had a baby.

- You left a job and/or started a new one.

How to Calculate and Adjust Your Tax Withholding

So, exactly how do you fine-tune your withholding so you don’t owe Uncle Sam a bunch of money or get a big refund? Good question!

Let’s break it down into a step-by-step process. We are talking about taxes, after all, so details matter.

And to keep things simple, we’ll focus on the federal stuff in this article. But keep in mind that most states have an income tax too, which means they have their own forms and rules. Just make sure you do your homework.

Step 1: Total Up Your Tax Withholding

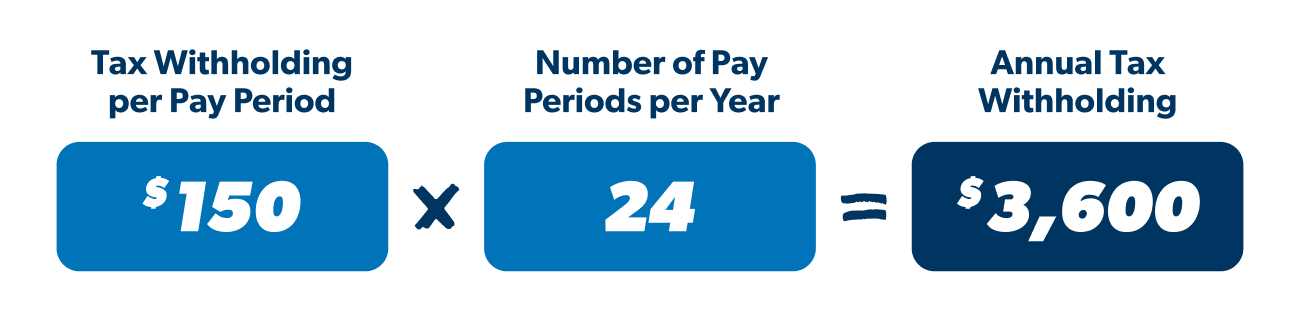

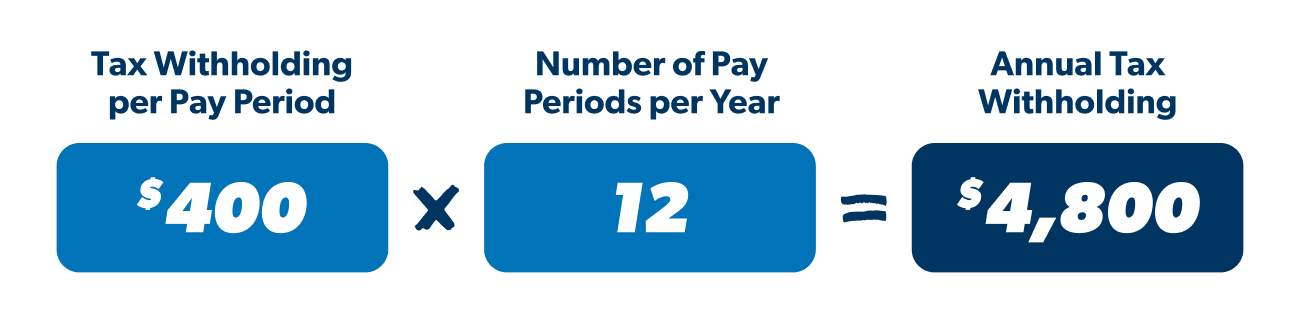

Okay, now we’re going to total up your tax withholding. First, take a look at the amount of federal income tax that’s withheld on each check (you can find this on your paycheck stub or digital payroll statement).

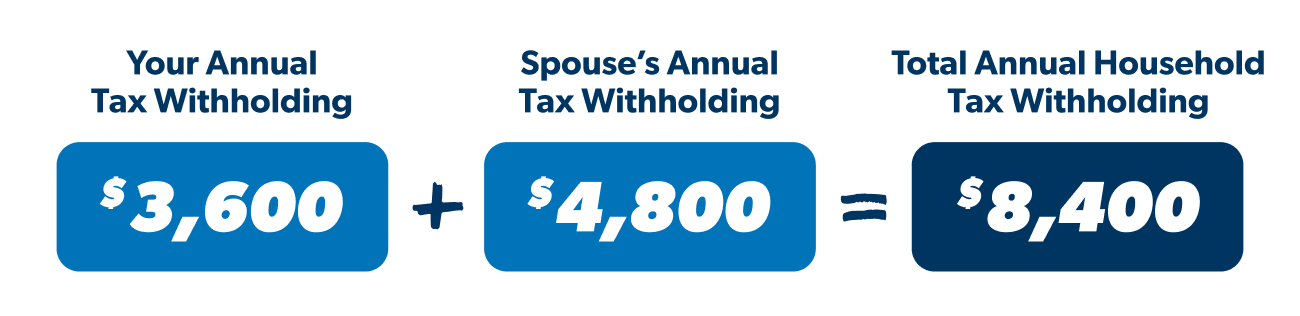

Let’s say you have $150 withheld each pay period and get paid twice a month. That would be $3,600 in taxes withheld each year.

If you’re single, this is pretty easy. If you’re married filing jointly and both of you work, calculate your spouse’s tax withholding too. In this example, we’ll assume your spouse has $400 withheld each pay period and receives a monthly paycheck.

Then add the two together to get your total household tax withholding.

And if you’re self-employed, here’s a fun little tax-time reminder: Federal taxes aren’t automatically deducted from self-employment income, so it’s on you to set aside a portion of your income for taxes (and to pay estimated taxes to the IRS every quarter, if necessary).

If you have a side hustle or do freelance work, it’s especially important to factor that income into your tax equation to make sure you don’t end up with a big tax bill at the end of the year.

Step 2: Verify Your Taxable Income

Okay, knowing your withholding is great, but that’s just one part of the equation. Next, you need to figure out what your taxable income is (basically, the amount of your income that’ll be used to determine how much you’ll owe in taxes this year).

To get your taxable income for the year, you’ll add up all the money you made this year (everything from your salary and freelance income to interest and unemployment benefits) to get your gross income.

Then you’ll subtract any adjustments to income and any tax deductions from your gross income to get your taxable income. Let’s break each of those down real quick.

Adjustments to Income

Adjustments to income include things like payments on student loan interest, contributions to traditional 401(k)s or traditional IRAs, or money you’ve socked away in a Health Savings Account (HSA). Those adjustments reduce your taxable income.

Tax Deductions

For tax year 2024, the standard deduction for single filers is $14,600 (or $29,200 if you’re married filing jointly).3 For most taxpayers, it makes sense to take the standard deduction. One, it’s easier than itemizing, and two, it’s usually a better deal. (If you’re a homeowner or have a situation where you can deduct qualifying medical expenses or charitable donations, you’ll want to at least check to see if you can get a bigger deduction by itemizing.)

Step 3: Estimate How Much You’ll Owe

Now you can finally estimate how much you’ll owe in taxes for the year (what the nerds in Tax World would call your tax liability).

If you’re married filing jointly, for example, and your taxable income together is $81,500 for the 2024 tax year, that puts you in the 12% tax bracket. But you won’t actually pay 12% on all of your income because here in the U.S., we have a progressive tax system. Here’s how it breaks down:

- You’ll pay 10% on your first $23,200, which is $2,320.

- You’ll pay 12% on your next $58,300 ($81,500 - $23,200), which is $6,996.

- So $2,320 + $6,996 = $9,316. This is your tax liability.

But wait . . . we’re not done just yet! Before you move on to the next step, you need to subtract from your tax bill any tax credits you qualify for.

You see, tax credits directly reduce the taxes you owe (or increase your refund) dollar for dollar. Your individual situation will determine what tax credits you may qualify for (such as the child tax credit, the earned income tax credit and more). It’s totally worth it to check for every single possibility here—it could save you a lot of money.

Step 4: Subtract the Difference

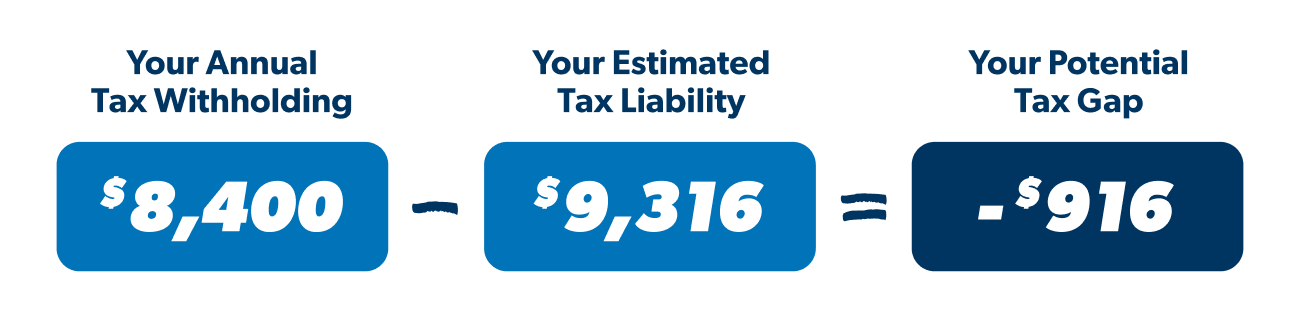

Once you have an idea of how much you owe the IRS, it’s time to compare that amount to your total withholding. Take your annual tax withholding and subtract your estimated total tax liability.

If your tax liability is greater than your withholding, you have a tax gap (you underpaid your taxes), which means you’ll have to pay when you file your tax return. But what happens if your liability is less than your withholding? That means the government owes you money and you’ll get it back as a tax refund.

As we’ve mentioned before, neither situation is ideal because it’s your money. And the best place for your money is in your own bank account where it can be working hard for you—not sitting idle in a cold, drafty government account.

The good news is, you can fix it before tax time rolls around by adjusting your tax withholding any time of year to help you get as close as possible to breaking even on your taxes.

Let’s continue our example from above, where we assumed you and your spouse only had $8,400 withheld throughout the year. With an estimated tax liability of $9,316, that means you still owe $916 in taxes for the year.

Step 5: Adjust Your Tax Withholding

If you run the numbers and find out you’ve withheld too much or too little, it’s best to adjust your tax withholding as soon as you can.

To adjust your withholding, you’ll need to file a new W-4 and submit it to your employer. If you’ve been at your job for a while and you’ve been getting big refunds or tax bills for years, filling out a new W-4 could help you solve that problem.

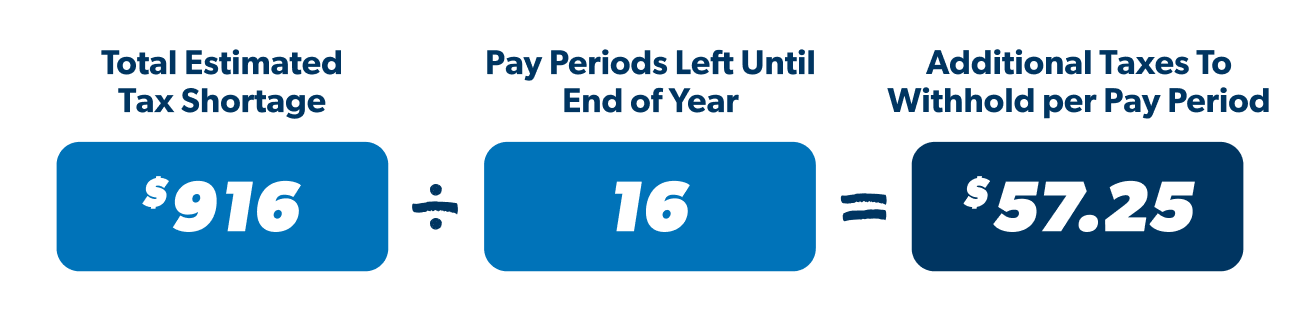

If you haven’t been holding enough from your paychecks, you can specify additional withholding on your W-4 by entering the extra amount you want withheld from each paycheck.

Simply divide your estimated tax shortage by the number of pay periods you have left before the end of the year to get your number. Here’s a sample calculation based on the tax gap example above:

What if you want less money withheld from your paycheck? On your W-4 form, you can increase the number of dependents in Step 3 (you should only do this if you’re eligible to claim these dependents—your pets don’t count) or add to your expected deductions in Step 4(b).

Either way, adjusting your withholding can be tricky and not something you want to figure out on your own. It’s probably a good idea to set up a meeting with your tax pro or someone in your company’s HR department who can make sure you get your withholding just right.

Do Taxes the Right Way

This may be the understatement of a lifetime, but income taxes can be complicated. If you get stuck along the way or don’t feel comfortable with your numbers, ask a RamseyTrusted® tax pro for help. They’re experts when it comes to taxes.

They can make sense of your personal tax situation and help you make adjustments where needed so you can look forward to next year’s tax season with a lot less stress.

If you’re ready to file your taxes online on your own (because you’re just that awesome), check out Ramsey SmartTax. It’s tax software that’s both easy to navigate and affordable, so you can file your return with confidence.

Federal Classic Includes:

-

All major income types and federal forms

-

Prepare, print and e-file

-

Phone and email support

-

1 year of audit assistance

Federal Premium Includes:

Everything in Federal Classic plus:

-

Live chat

-

Priority phone and email help

-

Free financial coaching session

-

3 years of audit assistance

-

1 month of ID theft protection