Every year, taxpayers hand over a chunk of income to Uncle Sam. Then the government uses those taxes to fund the upcoming fiscal year’s budget and keep some important federal programs afloat. In fact, the federal government plans to spend $7.6 trillion in the 2023 fiscal year.1 And—you guessed it—most of that $7.6 trillion comes straight from the American taxpayers.

If you’re like most people, you’ve probably wondered where all that money is going. So let’s talk about the federal budget and all the different ways the government spends federal taxes.

What Is the 2023 Federal Budget?

As we mentioned above, the 2023 fiscal year budget is $7.6 trillion. Still trying to wrap your brain around a number that big? How’s this:2

- A line of 1 trillion dollar bills laid end to end would be longer than the distance from the Earth to the sun.

- A carpet of 1 trillion dollar bills would cover nearly 4,000 square miles—an area twice the size of the state of Delaware.

- If you spent $1 trillion at a rate of $20 per second, it would take you 1,585 years to spend it all.

Yet our federal government will spend over seven times that amount in one year. And there’s no sign that their budget will ever start decreasing. Sheesh!

When Does the 2023 Budget Go Into Effect?

Every year, Congress works on a federal budget for the next fiscal year. A fiscal year is a 12-month period used by a business or government to keep track of accounting and budgeting.

The federal government’s fiscal year runs from October 1 of one year through September 30 of the next. Got it? Good. That means the 2023 fiscal year is from October 1, 2022, to September 30, 2023. Getting a budget passed by Congress and signed by the president is a long and complicated process. That’s why Congress starts planning the new budget a full year before it goes into effect. In fact, you could say it’s like trying to get your Orlando family vacation plans passed and approved by all your spouse’s Disney-obsessed relatives. It’s messy, but at least EPCOT has some killer finger-food options.

How Does the Government Spend My Taxes?

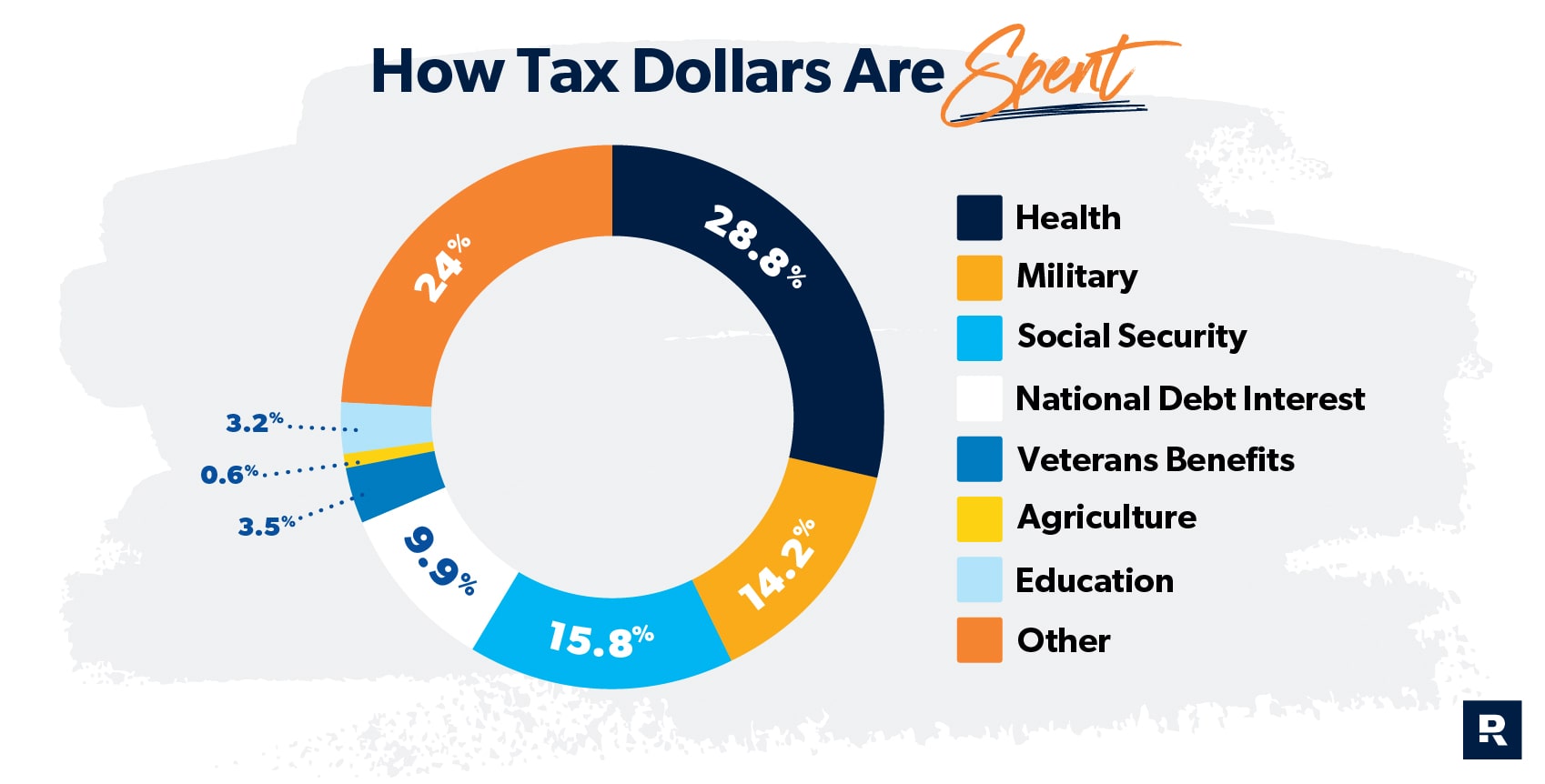

If there’s one thing the government isn’t afraid of, it’s spending money. Can we get an amen? Here's a breakdown of how the government spends your tax dollars:

Let's zoom in on seven ways Uncle Sam spends your taxes:

Health Programs

Your taxes go to fund health programs like Medicaid, Medicare, Children’s Health Insurance Program, and general health initiatives. Together these programs account for around 29% of the 2023 federal budget.3

Military

Your taxes also help pay for national defense and security-related programs. Funds in this category, which make up about 14% of the 2023 budget, support the Department of Defense and the cost of international military programs.4

Social Security

Nearly 67 million Americans will receive Social Security benefits in 2023.5 Beneficiaries include retired workers, surviving children and spouses of deceased workers, and disabled workers. Social Security makes up around 16% of the government’s 2023 budget.6

Interest on the National Debt

It’s no secret that the government isn’t gazelle intense about paying off its debt. The national debt is $32.9 trillion, and the federal government relies on your taxes to make interest payments on the money it’s borrowed.7 But only around 10% of the 2023 national government’s budget goes toward paying interest on our national debt.8 Seriously, D.C.? At this rate, Uncle Sam will never get to do his debt-free scream!

Veteran Benefits

Thankfully, your income taxes also help cover our U.S. veterans’ pensions, medical care, education programs and disability payments, which is the least we can do to say thank you to our vets. The government also funds the operation of VA medical facilities and clinics.

Food and Agricultural Benefits

This category includes assistance programs like the Supplemental Nutrition Assistance Program, the Federal Crop Insurance Corporation, and the National School Lunch Program. (Remember that school cafeteria pizza? You either loved it or hated it. Either way, it’s hard to forget!)

Education Programs

Pell Grants, work study programs, student aid, and elementary and secondary education initiatives are all funded through your income taxes.

Taxes don’t have to overwhelm you. See what’s best for your situation—and services you can trust.

And here are a few other ways the government uses your tax money:

- Unemployment and labor programs like Temporary Assistance for Needy Families (TANF), plus retirement and disability benefits for federal employees

- Government expenses like U.S. Customs and Border Protection and operating the federal prison system

- Housing assistance and community development programs

Don’t Overpay Your Taxes

While your tax money is essential to keep our government running, that’s no reason to pay more taxes than you have to. In 2021, an estimated 16 million people overpaid taxes by an average of about $1,200 because of a change in how unemployment benefits are taxed.9 We’re talking millions of dollars in overpaid taxes!

That’s money that rightfully belongs in taxpayers’ pockets, but they leave it all for Uncle Sam without batting an eye. That money could be bulking up your emergency fund or helping you with a 20% down payment on your next house.

Get Help From a Pro

A tax professional can help you make sure you’re not paying more taxes than you should this year. They can also review tax returns from past years for any money you overpaid the IRS.

If you’re looking for a tax expert in your area, RamseyTrusted tax pros have years of experience and can help you file your taxes with confidence. Find a tax pro today!

If your taxes are pretty straightforward and you want an easy-to-use tax software that can give you some peace of mind, check out Ramsey SmartTax. No hidden fees, no advertisements, no games. That’s how it should be!