The pandemic may be officially over, but the price you’re paying for groceries and fuel is an irritating reminder that we’re still seeing the effects of COVID-19 play out in the economy.

And it’s not just your wallet that’s feeling the pressure. It’s the weird job market we’re seeing in 2023. Did you know Americans applied for unemployment insurance in record numbers during the pandemic?1 Maybe you were one of them, turning to unemployment benefits to help you weather the storm. And now that the COVID clouds have cleared, hopefully you’ve returned to a job you love or taken a leap of faith and started that small business you’ve been dreaming about!

But if you were unemployed at some point this year or if you’re still searching for work and collected unemployment over the last several months, you might be wondering if you’ll have to pay taxes on those unemployment benefits you received. Don’t worry! We’ve got the answers that will help you figure it all out.

Let’s start with the basics about unemployment benefits.

Who Is Eligible to Receive Unemployment Benefits?

Each state sets its own guidelines to determine who’s eligible to receive unemployment benefits. But in most states, you’ll qualify if you become unemployed through “no fault of your own.”2

So if your job was cut in a round of layoffs or you resigned because of unsafe working conditions, you should have no problem applying for and receiving unemployment benefits. But if you just quit, you might be out of luck.

Some states also say you must have worked a certain amount of time at your last job or received a minimum amount of earnings from your previous employer to qualify for benefits. It all depends on where you live.

Do I Have to Pay Federal Taxes on Unemployment Benefits?

So the short answer is yes. For the 2023 tax year, unemployment benefits are taxable.

The government views unemployment benefits as part of your income, so those benefits are reported to the IRS and added on top of any other taxable income you file. You can expect a 1099-G form (the “G” stands for “certain government payments”) showing the amount of unemployment benefits you received for the tax year. You’ll report that on your income tax return.

You may have heard that unemployment isn’t taxed, and that was briefly true . . . for folks receiving unemployment in 2020. Well, sort of. They weren’t taxed on the first $10,200.3

Congress passed the American Rescue Plan of 2021 with a goal of giving people who’d lost their jobs due to COVID layoffs a much-needed tax break in 2020. But the worst of COVID ended (hurray!) and so did the American Rescue Plan’s tax break on unemployment benefits (boo!).

Do I Have to Pay State Income Taxes on Unemployment?

So we’ve talked about federal taxes on unemployment. What about state taxes?

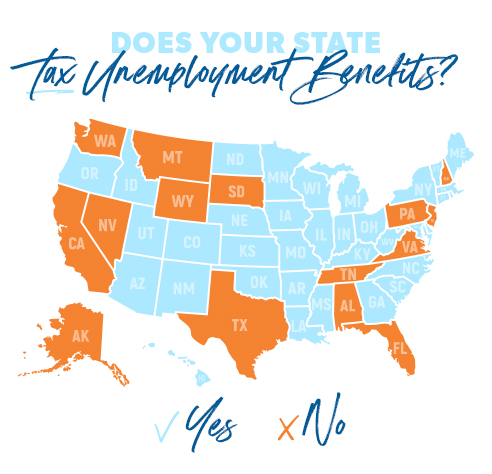

Your unemployment benefits are also subject to state income taxes unless you work in a state with no income tax or a state that doesn’t tax unemployment benefits at all.

Here’s a state-by-state breakdown of states that do and don’t tax unemployment benefits:

You’ll want to check your state’s unemployment office to find out more information about how your unemployment benefits will be taxed and whether you’re eligible for those benefits.

How Do I Pay Taxes on My Unemployment Benefits?

Now that you know your unemployment benefits are taxed, let’s look at your options for paying those taxes! Here are some options to consider:

- Withhold your taxes from your unemployment benefits. If you chose to have 10% of each unemployment check withheld (you can’t withhold more or less) to help cover federal income taxes when you signed up for unemployment benefits, you might not have to do anything else.4 It’s a simple solution to avoid a shock when tax season rolls around. Nice!

- Wait until tax season. If you’re currently unemployed, we understand how tight cash is until you land a job, but our advice is to pay taxes on income as you go rather than wait till tax season to pay all at once. When it comes to paying taxes, procrastination is not your friend. Waiting to pay your income taxes—on income that includes your unemployment benefits—won’t make your life easier when Uncle Sam demands his share during tax season.

What if I Can’t Pay My Taxes?

Making every dollar count until you find a new job isn’t exactly a walk in the park. If you’re unable to pay your taxes (including taxes on your unemployment benefits) this year, don’t panic. Everything’s going to be okay.

Don’t settle for tax software with hidden fees or agendas. Use one that’s on your side—Ramsey SmartTax.

Just remember, the worst thing you can do in this situation is ignore the problem by not filing a tax return or trying to hide from the IRS. That’ll just rack up more fees and penalties. And keep your chin up—you have some options here.

First of all, file your tax return—even if you can’t pay a dime by the deadline. That way you won’t get hit with a penalty for not filing. If there’s anything you can pay by the deadline, that’s awesome. Do it.

Next, keep paying as much as you can and contact the IRS about setting up a payment plan. If you’re waiting to start a new job in the next few weeks and can pay your taxes pretty soon, the IRS offers a short-term payment plan with a payment period of 120 days or less (total amount owed has to be $100,000 or less).5

If you’re uncertain about your job prospects and can’t pay your total tax amount that quickly, you could go with a long-term payment plan with a payment period longer than 120 days, as long as you owe less than $50,000.6

For those of you working the Baby Steps, you’ll add that tax payment to your debt snowball plan. But don’t get discouraged. Just focus on knocking out what you owe the IRS first (no one wants the tax man on their back!). Then you can get back to plowing through your debts, smallest to largest.

File Your Taxes With Confidence

We're here to help shoulder that burden with you. If you’re stressing about how unemployment benefits affect your taxes—do you pay, do you not pay, how much do you pay, how do you pay?—you can always reach out to a tax advisor for help.

Nothing takes the stress out of Tax Day like having a tax advisor in your corner who eats, sleeps and breathes all this tax stuff on a daily basis. So if you still have questions about the taxes on your unemployment benefits, get in touch with one of our RamseyTrusted tax pros!

Would you rather file your taxes on your own? We’ve got you covered there too. Ramsey SmartTax makes filing your taxes feel like a walk in the park!

File your taxes with Ramsey SmartTax today!

Federal Classic Includes:

-

All major income types and federal forms

-

Prepare, print and e-file

-

Phone and email support

-

1 year of audit assistance

Federal Premium Includes:

Everything in Federal Classic plus:

- Live chat

- Priority phone and email help

- Free financial coaching session

- 3 years of audit assistance

- 1 month of ID theft protection