Key Takeaways

- Adjusted gross income (AGI) is your total income from all sources—like employment, real estate, investments and Social Security—minus specific deductions like retirement contributions, Health Savings Account (HSA) contributions, student loan interest and alimony payments.

- The IRS uses your AGI to determine your taxable income and your eligibility for tax credits and deductions, such as the earned income tax credit (EITC). A lower AGI can increase your chances of qualifying for more tax benefits.

- To calculate your AGI, start with your gross income, then subtract any allowable adjustments.

Let’s face it: Some of us procrastinate filing taxes because we’re afraid of how much we owe the IRS. Others put off filing because they feel uncomfortable dealing with Uncle Sam and all that paperwork.

We get it. Taxes aren’t fun (understatement of the year), and they can be super overwhelming.

But the good news is they don’t have to be!

As with anything else in life, when it comes to taxes, knowledge is power. The more you know, the more confident you’ll be when it comes to filing. Knowing what your adjusted gross income is and how it affects your taxes is a great place to start if you’re considering using online tax software for the first time or just want to understand the whole taxes thing better.

So, let’s discuss the details and help you build confidence when it comes to filing. You can do this!

What Is Adjusted Gross Income (AGI)?

We’ll start with the basics. Adjusted gross income (AGI) is the amount of income you earn from your employment and other sources (like real estate, investments and social security) minus certain deductions, such as contributions to your retirement accounts and Health Savings Account (HSA), student loan interest, and alimony payments.

Sounds complicated, but stick with us.

Your AGI is important because the IRS uses it to determine your taxable income, which is the amount of income Uncle Sam uses to calculate how much tax you owe each year.

It also determines your eligibility for many tax credits and tax deductions. The earned income tax credit (EITC), for example, is based on your AGI.1 The higher your AGI, the less likely you are to qualify.

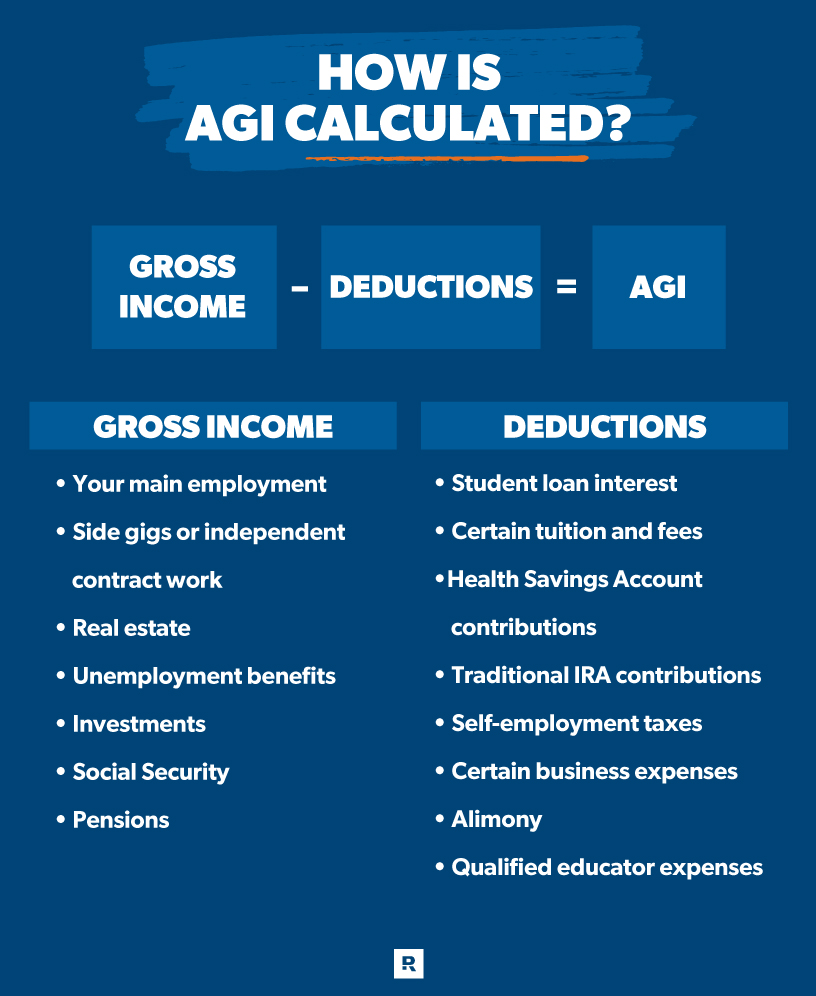

How Is Adjusted Gross Income (AGI) Calculated?

Adjusted gross income is simply your gross income (your total income from all sources before any deductions or taxes) minus certain payments that help lower your taxable income, like student loan interest payments and retirement account contributions.

So, the formula for calculating your AGI starts with calculating your gross income. This includes income from:

- Your main employment

- Any side gigs or independent contract work

- Investments

- Real Estate

- Unemployment Benefits

- Social Security

- Pensions

Once you know your gross income, you’ll subtract certain payments and expenses to find your AGI. These payments and expenses are called adjustments to income, and they directly lower your taxable income. The more adjustments you have to report, the lower your AGI will be, and a lower AGI could help you qualify for more tax credits and tax deductions.

Here are some of the more common ones you might subtract from your gross income to get your AGI:2

- Student loan interest

- Tuition and other education expenses

- Health Savings Account (HSA) contributions

- Traditional IRA contributions

- Some business expenses (like health insurance premiums, retirement plan contributions, and half of the self-employment tax)

- Moving expenses for members of the armed forces

- Alimony paid before 2018

- Educator expenses

Whew! That’s a lot of figures to keep track of. Thankfully, if you’re filing your taxes online, your tax software will calculate your AGI for you before you choose to take the standard deduction or itemized deductions. If you use a tax pro, they’ll also calculate this figure for you.

Where Is AGI on a Tax Return?

Finding AGI on your tax return is easy. It’s on your Form 1040 (line 11, to be exact).3 This is the same form where you’ll report your gross income to Uncle Sam, claim any tax credits and deductions you qualify for, and calculate your tax bill or refund.

AGI vs. Gross Income vs. Taxable Income

Income, gross income, adjusted gross income, taxable income . . . Is it just us or can all these tax terms be really confusing? Yeah, it’s not just us. Let’s look at the differences between your AGI, gross income and taxable income:4,5

- Gross income: This is all your income before any taxes or deductions are subtracted from it. This includes income from employment (salary and wages), investments, real estate, social security, pensions, and capital gains. You report your gross income on Form 1040 and it will help you calculate your AGI and taxable income.

- Adjusted gross income (AGI): As we mentioned above, your AGI is your gross income minus certain deductions, including student loan interest, deductible contributions to your retirement accounts or a Health Savings Account (HSA), educator expenses, moving expenses for military personnel, and half of your self-employment taxes, to name a few. This is the number you’ll report on line 11 of your Form 1040.

- Taxable income: Your taxable income is the portion of your income that is . . . drum roll, please . . . taxable! To calculate your taxable income, start with your AGI, then subtract either the standard deduction or your itemized deduction amount (depending on which deduction you choose), and any qualified business income deductions you have. Ta-da! You’ve arrived at your taxable income, and you’ll report this number on—you guessed it—Form 1040 (on line 15, to be exact).

What Is Your Modified Adjusted Gross Income (MAGI)?

Many tax calculations use your taxable income or AGI, but some call for your MAGI, or modified adjusted gross income.

Don’t settle for tax software with hidden fees or agendas. Use one that’s on your side—Ramsey SmartTax.

Modified adjusted? Sounds a bit complicated, but in reality it’s not. So, what is MAGI? In the simplest terms, it’s your adjusted gross income plus a few deductions (like student loan interest or tuition and fees) added back in. That’s the modified part!

In most cases, your MAGI will be identical or only slightly different from your adjusted gross income. The IRS mostly uses your MAGI to figure out if you qualify for certain tax benefits and government programs. For example, if you’re itemizing so you can take certain deductions, you may have to calculate your MAGI.

Several tax credits and deductions have thresholds that use your MAGI instead of your gross income, and MAGIs above those thresholds mean those credit or deduction amounts start to phase out or disappear.

MAGI is also used to determine whether you’re eligible to contribute to a Roth IRA. If your MAGI is below the limits set by Uncle Sam, you can make contributions, but the actual amount you can contribute is also determined by your MAGI. And if your MAGI exceeds Uncle Sam’s limits, your contributions are phased out.6

File Your Taxes With Confidence

If you still have questions about how your AGI will affect your taxes, reach out to a RamseyTrusted tax pro in your area to walk you through your tax situation and answer your questions. Get ready to walk into the next season feeling like a tax boss. Find your tax pro today!

Feel like your taxes are simple enough to do yourself with tax software? Ramsey SmartTax makes it easy to take control of your taxes and file your tax return in a matter of minutes. You won’t be surprised by hidden fees, and you won’t have to make sense of confusing tax jargon—what you see is what you get!