Being self-employed has its advantages: You can set your own hours! You can work from home! You can be your own boss! But being self-employed also has its disadvantages: You can set your own hours . . . You can work from home . . . You can be your own boss . . . See what we did there?

The fact is, with great freedom comes great responsibility. And part of that responsibility is paying taxes on the income you earn. If you’re self-employed or have a freelance gig, you’ll probably receive a tax form each year called a 1099-NEC (the NEC stands for nonemployee compensation).

Get expert money advice to reach your money goals faster!

A 1099-NEC form lists how much money you earned as an independent contractor so you can pay taxes on that income. If you worked for multiple companies throughout the year, you’ll likely receive multiple 1099-NECs. If this all sounds like news to you, that’s OK. The 1099-NEC form has only been around for about five years. Before the IRS launched it in 2020, self-employed folks and freelancers received 1099-MISC forms from their clients.

Now the last thing you want to do is hand those 1099-NECs to your payroll department (aka your desk drawer) and forget about them. You’ll need them when you file your income taxes, because even nonemployees have to pay taxes.

So let’s walk through what you need to know about the 1099-NEC.

What Is Nonemployee Compensation?

Nonemployee compensation (also called self-employment income) is just what it sounds like. It’s money a company pays someone who is not an employee for work they’ve done. Pretty simple, right? These nonemployees are called independent contractors or sometimes freelancers. The IRS has a bunch of rules for determining if someone is an employee or an independent contractor, but the general rule is that you’re an independent contractor if a company assigns you work but does not direct or control how you do it.1

When you hear contractor, you might be picturing a burly guy wearing old jeans, a tool belt and a yellow hard hat while he hammers nails. But that’s not the type of contractor we’re talking about. An independent contractor could be a college student building company websites in his parents’ basement or the Uber driver who picks you up at the airport.

These days, many independent contractors work in what’s known as the gig economy. Gig sounds like we’re talking about computers—megabyte, gigabyte, terabyte, oh my!—but think of it in rock-band lingo: “Dude, we got a gig at The Roxy.” So a gig is basically a short-term job.

According to the IRS, the gig economy is “activity where people earn income providing on-demand work, services or goods. Often, it’s through a digital platform like an app or website.”2

Rideshare companies like Uber and Lyft, food delivery companies like DoorDash and Grubhub, and grocery delivery companies like InstaCart are all part of the gig economy.

Why Did I Get a 1099-NEC?

When you work as an independent contractor, the company cuts you a check for the work you did. They typically don’t deduct payroll taxes or health care and other premiums from your check like they would for an employee. Those big checks might have you thinking, Woo-hoo! This money is all mine!

Nope. The 1099-NEC helps make sure Uncle Sam gets his cut. And if you’re self-employed, you have to pay your taxes yourself. In January you’ll receive a 1099-NEC that lists how much money a company paid you during the prior year. A 1099-NEC is similar to a W-2 that companies send out to their employees, and the information is reported to the IRS. Like we mentioned above, if you did freelance work for multiple companies, you could receive several 1099-NECs.

The IRS requires companies to issue a 1099-NEC by January 31 to any contractor who was paid more than $600.3 If that January 31 deadline comes and goes and you still haven’t gotten your 1099-NEC, you should reach out to that company or client to get that straightened out.

How Much Taxes Do I Owe on a 1099-NEC?

Your tax bill all depends on how much money you earned in a given year. So let’s look at a quick example. Say George Shakespeare wrote freelance articles for an online magazine until his fingers were bleeding, and at the end of the year, the magazine sent him a 1099-NEC that said he earned $60,000. Without any deductions, George would owe about $8,000 in taxes.

When he files his income taxes, George could take the standard deduction and claim additional deductions for his home office, utilities, travel and plenty of other costs related to being self-employed. All that could cause his tax bill to be a lot lower.

But wait! There’s more. At a normal full-time job, your Social Security and Medicare taxes are taken out of your paychecks automatically—and your employer covers half of those taxes. But as a freelancer, you’re considered both an employee and an employer, so you’ll have to pay a 15.3% self-employment tax.4 That could be an additional $9,180 in taxes for poor old George.

But wait! There’s even more. If George doesn’t live in a state with no state income tax, he will be on the hook for even more taxes. Depending on what city he lives in, he also might have to pay local taxes. Federal law requires you to file quarterly taxes if you expect to owe more than $1,000 at the end of the year, so George’s situation is even more complicated.

We say all that to let you know to plan ahead. We recommend saving 25–30% of every freelance check to cover your taxes.

What’s the Difference Between a 1099-MISC and a 1099-NEC?

Well, the quick answer is not much. It’s really just a name change. Prior to the 2020 tax year, companies were required to issue 1099-MISC forms to independent contractors. The 1099-MISC included a box for nonemployee compensation as well as boxes for rents, royalties, fishing boat proceeds, crop insurance proceeds and several other types of income. In 2020, the IRS decided to break out nonemployee compensation into its own form—and the 1099-NEC was born.

Why Did I Receive a 1099-K?

The 1099-MISC and 1099-NEC are the most common types of 1099s, but the IRS has about 20 different types. Another one you might see when it comes to the gig economy is the 1099-K.

The 1099-K reports gross revenue received from credit cards and third party payment processors, like PayPal.5 Revenue is your total sales and is higher than your net income (revenue minus expenses). If you drive for a rideshare program like Uber or even sell your crafty creations on Etsy, you’ll receive a 1099-K if your revenue is above $20,000.

Do I Need to File a 1099-NEC?

If you’re working as an independent contractor, you don’t need to file a 1099-NEC with the IRS, but you will need the form to report your income when it comes time to file your taxes. The company that sends you a 1099-NEC will also send that info to the IRS at the end of the year. In some cases, you might not receive a 1099-NEC, but whether you received one or not, you still have to report your earnings. So keep detailed records of your expenses as well as your earnings.

File Your Taxes With Confidence

Working as an independent contractor adds another level of difficulty to preparing your taxes, especially if you have to file quarterly or receive multiple 1099-NECs. If thinking about all that paperwork keeps you up at night, a qualified tax pro can help. A RamseyTrusted tax pro can help make your tax burden not so much of a . . . well, burden.

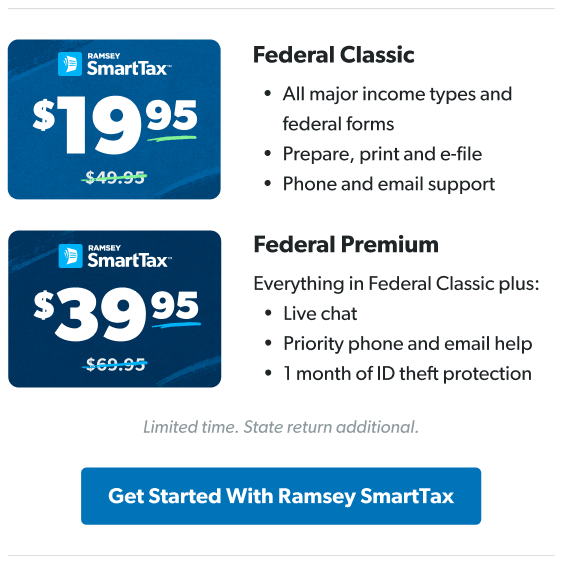

Maybe your taxes are simple enough to handle on your own. Great! Say hello to Ramsey SmartTax—the tax software designed with you in mind! With Ramsey SmartTax, you’ll always know right up front how much you owe when you e-file your taxes. No hidden fees, no gimmicks, no games.

Check out Ramsey SmartTax today!