Break the Chains

of Student Loans

Follow these five steps to a future of freedom.

First things first—we’re huge fans of college! But the fact is, college isn’t for everyone or every career. So, don’t put this decision on autopilot. The traditional college route isn’t the only path to success.

The key to this decision is first knowing what job or career you want. It’s not an easy question—most adults are still looking for the answer! In this video, Ken Coleman, America’s Career Coach, helps high school juniors and seniors understand how their talents and passions connect to their mission—and ultimately, their dream career.

Additional Resources

A lot of students make their biggest mistake when they choose which college to attend—but you can make it your wisest move! Your new definition of “dream school” is the school you can attend without student loans. Here’s how to choose your dream school:

1. Have the talk. Find out how much your parents can (or can’t) help with college costs—without taking on debt.

2. List your potential schools. Ask yourself: Why am I drawn to these schools? Plan campus visits to narrow down your list.

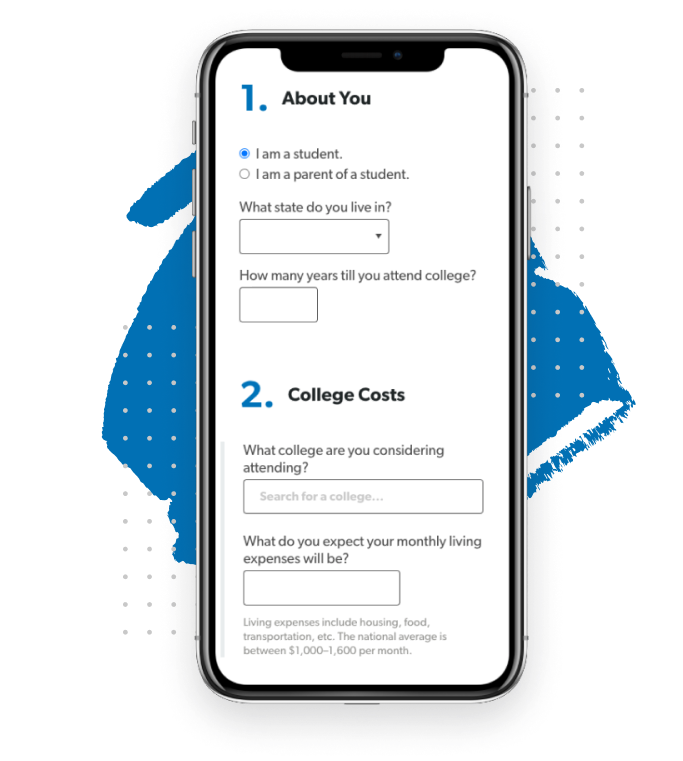

3. Research and compare costs with our College Cost Calculator.

4. Choose your school. Make a big deal of it! Let your friends and family know where you’re going and that you’re going without student loans.

5. Work your plan. If there’s a gap between how much you have saved and how much you’ll need, set savings goals and work toward them. Make applying for scholarships your part-time job. Look at all your options—like community college or even a gap year.

Additional Resources

Financial aid isn’t just for those with financial need, super high GPAs or crazy athletic talent. Find out what you qualify for with The Free Application for Federal Student Aid (or FAFSA). This is the key to getting federal financial aid, and it can also qualify you for aid from your state and your college. But heads up: In addition to qualifying you for scholarships and grants (free money!), the FAFSA will also qualify you for student loans (no way!). So, read your award letter carefully so you don’t accept a student loan by mistake.

Additional Resources

What if people were practically begging to give you money for college? They are! Billions of dollars in scholarships go unused every year because students make the mistake of believing they won’t qualify. Start your search by filling out the FAFSA. Then talk with your guidance counselor and your school’s financial aid office and search online for even more options.

Most applications require essays—and topics range from why you chose your specific major to your thoughts on distracted driving. Apply for scholarships every week because every dollar you earn in scholarships is a dollar you don’t have to pay for college!

To avoid student loans for all four years, you might need to get a little weird (that’s a good thing!) In addition to filling out the FAFSA and applying for scholarships every year, consider these smart moves:

1. Work during college. If you work 20 hours or so a week, you’ll bring in a good income and still have plenty of time to study and socialize! And instead of wasting away your whole summer vacation, stack cash big time with a full-time job.

2. Go to community college. Save big by getting your general requirements at a community college, then transfer to a four-year school for your major classes.

3. Live at home. Living at home can save you an average of $11,450 for on-campus housing or $10,780 for off-campus housing.1

4. Skip meal plans. Brown-bag it and make meals at home or in your dorm.