How to Budget for Big Expenses That Happen Only a Few Times a Year

5 Min Read | Jul 11, 2023

Big expenses that come around just a few times a year have a funny way of slipping under the radar and becoming a big money problem. There’s nothing worse than an unplanned expense putting a dent in your perfectly prepped budget. (Okay, there are worse things, but you know what we mean.)

Here’s the deal: If you aren’t looking ahead, it’s easy to forget what’s coming. But the good news is that budgeting for those month-specific or irregular big expenses isn’t hard. At all. Just use these five tips and you’ll be ready when they happen.

1. Revisit your past.

Before you make a budget, it’s a good idea to see what you spent money on last year. Don’t worry! You won’t need a time machine to tackle this job. Checking out your bank statements (or clicking back to previous months in your free EveryDollar budgeting app) will do just fine.

Look for any expenses that fall outside of your monthly routine, then write down the amount and date due. Your list might look something like this:

|

Irregular Expense |

Amount |

Date(s) Due |

|

Car insurance premium |

$850 |

January 1 |

|

Tag renewal fees (2 vehicles) |

$35 |

March 31, September 30 |

|

HOA dues |

$200 |

January 15, April 15, July 15, October 15 |

|

Family dental cleanings |

$120 |

June 10, December 10 |

|

Annual vet checkup |

$150 |

April 18 |

|

Quarterly pest control |

$75 |

February 5, May 5, August 5, November 5 |

2. Flash forward to the future.

Now that you’ve made a list of all your irregular expenses, it’s time to get them into your budget. That way they don’t show up uninvited down the road.

You’ve got two ways to handle this:

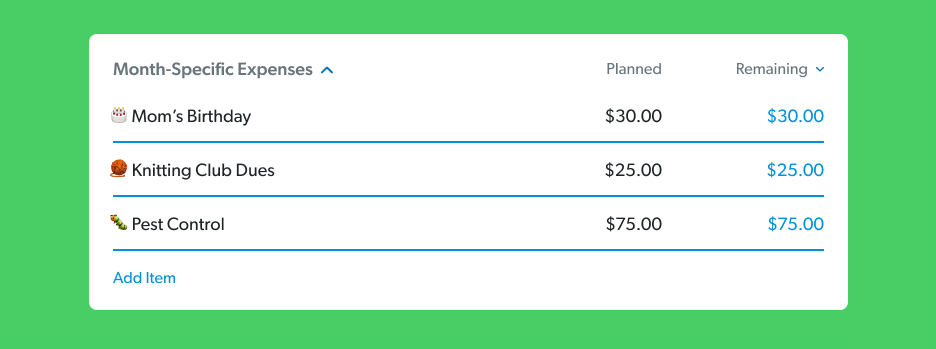

Create a month-specific budget category.

Every month, put all your special expenses in a month-specific budget category. Give a line to birthdays, insurance, dues, quarterly home expenses and other bills—whatever you need to cover that month. (This is really easy with EveryDollar. You can copy the previous month over, then make the tweaks you need.)

The next month, you keep the month-specific budget category, but change out the amount so it matches what’s coming that month.

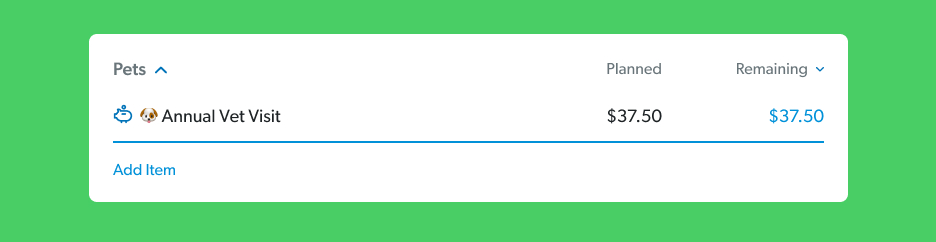

Create sinking funds for big expenses.

Another option is to create a sinking fund for each irregular expense. A sinking fund is an easy way to break down the cost of big expenses into smaller month-sized bites.

For example, let’s say you know Scruffy needs to see the vet every April, and that visit costs $150. Starting in January, you have four months to save up for the expense. Put away $37.50 a month so you’ve got the cash to cover your pup’s bill.

Also, you can do a mix of both of these methods if you like. Maybe you create sinking funds for the really big irregular expenses, and you use a month-specific budget category for the less expensive expenses. (Try saying that five times fast.)

3. Create a miscellaneous line.

No matter how hard you prep that budget, surprises happen. Or you might forget an expense. That’s okay. It happens to us all! But how can you cover it without dipping into your emergency fund? Just add a miscellaneous line to your monthly budget. It’s that easy!

It doesn’t matter how much you set aside. Even $50 a month can do the trick. If an overlooked expense pops up, that’s $50 you don’t have to subtract from other budget categories. If you end up not using it, throw it at your current Baby Step, and you’ll be $50 closer to your money goal!

Every savings goal starts with a budget. Create yours today with EveryDollar.

If the surprise is quite the big expense and costs more than your miscellaneous line, try moving things around in other budget categories to make up for it. If you can’t, this could be a good time to use your emergency fund.

4. Give yourself grace.

So, does all this new knowledge mean you’ll never overlook another expense again? Probably not. We’re all human, and mistakes come with the territory.

Also, please know it usually takes new budgeters about three months to get the hang of this. That’s okay. Give yourself grace through the process, and don’t give up. Budgeting is totally worth it! It puts you in the driver’s seat with your money—so you’re telling every single dollar where to go, instead of wondering where it went.

You can do this!

5. Make a new budget each month.

Remember, budgeting isn’t a one-and-done activity. You’ve got to make a new budget every month. And the best time to do that? Before the next month even begins.

Why?

Well, as you can see, it’s super important to get ahead of things when you’re budgeting. When you get your budget ready early, you’ll do a way better job of making sure everything’s covered (including these irregular big expenses).

And when everything’s covered, you can move forward instead of feeling constantly stuck or surprised by what’s happening to your money.

So, make a budget, every month, before the month begins. That’s the first step to solving your money problems—big and small—and starting an amazing money future! (It’s you. You’re the solution. It’s you!)

Speaking of Way Better . . .

Budgeting gets that way when you use our free budgeting app, EveryDollar. Just saying.

Download EveryDollar