Want to know what will derail your budget quicker than almost anything? Unexpected expenses. Want to know how to keep that from happening? Plan ahead!

Maybe you’re thinking, Okay but how? How can I get ahead of something I didn’t see coming? Keep reading to see how you can stay in control and on top of your money—even when it comes to unexpected expenses.

Unexpected Expenses or Overlooked Expenses?

First let’s be super clear about what we’re really dealing with here. Because sometimes “unexpected” expenses are actually just “overlooked” ones.

Here’s what we mean by that: If you’ve got a quarterly pest control bill, well, you know that’s coming four times a year. When the bill pops up and you didn’t budget for it that month, that’s not unexpected. That’s overlooked.

Now, don’t beat yourself up over it. Making mistakes with your budget is one of the ways you learn to be a better budgeter.

Also, we’ve got good news. Whether the expense is unexpected or overlooked—you can still be prepared. Yup! And these tips will show you how.

1. Have monthly budget meetings.

Get yourself an accountability partner (that’s your spouse if you’re married), and start having monthly budget meetings. This’ll help in two ways.

First, budgeting can be hard. But it’s easier when you realize you don’t have to go it alone. An accountability partner doesn’t just call you out when you’re about to go off course—they walk with you along the way!

Second, that extra pair of eyes is so helpful, especially when you’re trying to sort through expenses that keep falling through the cracks—which is part of what you’ll do in your monthly budget meetings.

2. List your possible overlooked expenses.

Open your online bank account or EveryDollar budget and look for past expenses that surprised you. List them out and jot down the expense, month due and cost.

If you’re feeling stuck, look at the examples below that often slip past us, sorted by budget category.

Groceries: Holidays, celebrations and parties can mean higher food costs.

Home: Think about maintenance and upkeep, quarterly bills, months with higher electric bills (cooling in summer and heating in winter), property taxes, pest control, furniture replacement, moving costs and appliance repair.

Cars: Be ready for routine car maintenance and repairs, tires, oil changes, car tags and maybe toll fees.

Kids: They’re always growing and needing new clothes—plus think about field trips, school supplies and extracurricular activities.

Health: This might mean copayments for doctor’s visits, medicine and prescriptions, new glasses or contacts, braces, the birth of a new baby, or maternity leave. If you’ve got an HSA, don’t forget to use it for any of these costs you can!

Seasonal: Budget in the right month for things like landscaping, spring break, summer vacations, holiday travel, Halloween costumes and candy, and everything Christmas.

Memberships and subscriptions: When do your annual memberships and subscriptions renew? Do you have any club dues? Budget. For. Them.

Gifts: Presents should be about joy—in giving and getting. But let’s be honest: It’s stressful if you forget to budget ahead for gifts for weddings, birthdays, holidays, baby showers and all the other reasons you might need a present.

Okay, here’s another important callout too: You should never ever ever feel pressure to over-give. Ever. This should always be about what you can afford and about the person receiving your gift! You don’t have to spend a lot to show you care a lot.

Are you prepared for life’s emergencies? Learn how to get there with Financial Peace University.

Random: Will you need to replace any phones or computers? Does your pup have an annual vet visit? Is your kid about to join band in the fall and need a slightly used alto saxophone? Should you stock up on ear plugs? (They’ll sound less like a stressed-out goose in a few months. Don’t worry.)

Really think ahead and try to make your list as ready for each month as it can be!

3. Build overlooked expenses into your budget.

Once you’ve got your list, it’s time to turn the “overlooked” expenses into budget lines! You’ve got three ways to handle this—and really, you should use a power combo of all three.

Set up a miscellaneous line in your budget.

If you can budget $50 or more into a miscellaneous line, it will save you so many headaches. Because no matter how much we plan ahead, things still get forgotten, or surprises still pop up—like if your kid makes a new best friend and gets invited to their rainbow narwhal-themed birthday party last minute. Just move money from that miscellaneous line to buy a gift, and you’re covered. No sweat.

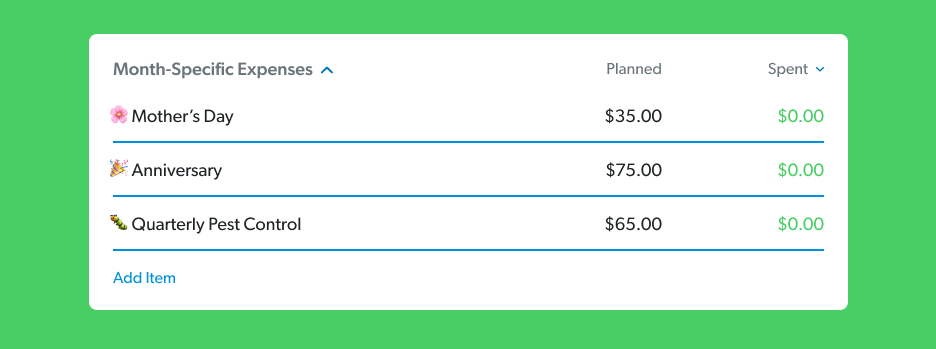

Create a month-specific budget category.

Keep this category in your budget every month. You can just change out the lines that go under it as you need to.

By the way, the budget category is kind of like a file folder, and the lines are like the files that go in it. Or the categories are like your kid’s dresser drawers, and the lines are the neatly folded clothes inside each one. Okay, that last one is wishful thinking for most parents, but you get the idea.

This method is excellent for covering the smaller (or even medium-sized) expenses you listed out earlier. Plan for every month to have couple hundred dollars in this category. Adjust your budget lines during your monthly budget meeting. And if you don’t end up needing that money one month, throw it at your current Baby Step!

Set up a sinking fund.

If the expense is too much to cover in one month, your best bet is to set up a sinking fund. What’s that? Well, a sinking fund is a way to save up a big amount of money over time by breaking it into smaller monthly bites.

Like Christmas. If you spend around $1,200, that means you can stick $100 into a sinking fund every month, starting in January. Then you’ll be cash-ready for the most wonderful time of year!

Or your summer getaway. If you plan to spend $1,000 in June and start saving for your vacation in February, you’ll sock $200 away a month until you’ve got your feet in the sand and a good book in hand.

You can even use a sinking fund for those less glamorous overlooked expenses, like car maintenance. If those tires are starting to wear thin, get saving for new ones! Because a tire blowout is an unexpected expense, but replacing old tires is something you can plan ahead for.

Quick callout: Put your sinking fund money in a safe spot with easy access. A checking account or a savings account with check-writing privileges will do the trick.

And if you use EveryDollar, you can easily create sinking funds for all your savings goals. It’s a great way to keep everything sorted and watch your progress. Every single month!

4. Build an emergency fund for unexpected expenses.

Our research shows only about half of Americans (49%) have $1,000 or more in savings. And one-third of Americans (34%) have no savings at all. This is not okay, people! Financial stress is a legit problem, and worrying if the next unexpected expense will push you over the edge is no way to live.

But there’s hope. You can be budget-ready, even for those truly unexpected expenses, like an accident or a layoff.

How? With an emergency fund!

An emergency fund is money set aside for—you guessed it—emergencies. Start with a starter emergency fund of $1,000. From there, once you’re debt-free, move on to a fully funded emergency fund of 3–6 months of your current expenses.

There’s nothing like the peace of mind you’ll gain from having this money safely tucked away for when you need it. Trust. Us.

What to Do When an Unexpected Expense Hits

First of all, don’t freak out! You’ve planned for this:

- You’re having those budget meetings to plan ahead.

- Your miscellaneous line is in place for small surprises.

- You’ve got your month-specific budget category armed and ready.

- You have sinking funds set up for bigger expenses.

- Your emergency fund is prepped for true unexpected expenses.

Now, when that unexpected expense pops up (because that still happens), ask yourself if it’s time to:

- Use the miscellaneous line,

- Cut spending somewhere else to cover the unexpected expense, or

- Move money from the emergency fund.

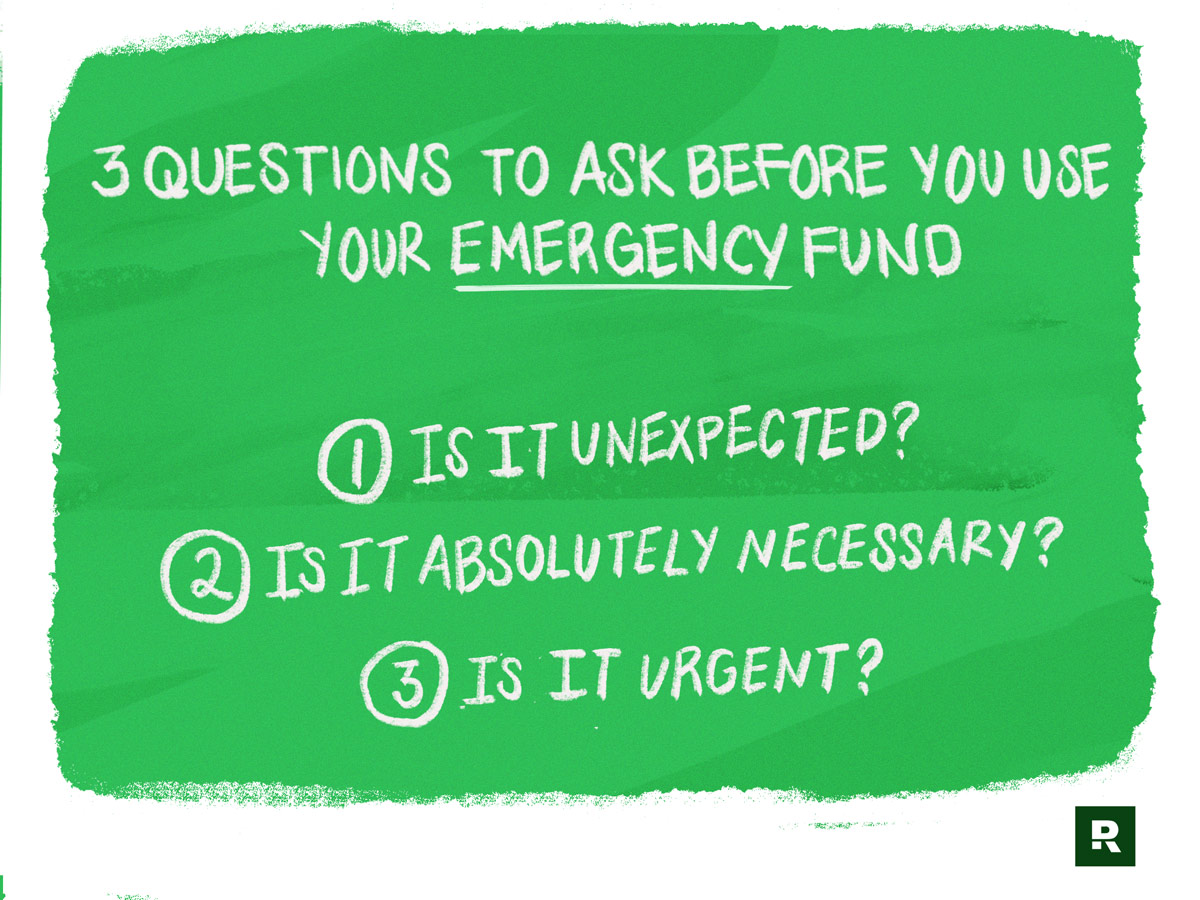

Before you touch that emergency fund—try those first two options. And ask yourself these questions:

- Is it unexpected? (Overlooked doesn’t count here.)

- Is it absolutely necessary?

- Is it urgent?

For example: Needing to repair the furnace in the middle of winter is unexpected, urgent and absolutely necessary, but wanting to redo an ugly-but-functional bathroom is not. Start a sinking fund for the bathroom and use your emergency fund for the furnace.

This All Helps You Prepare for Unexpected Expenses

Real quick, if don’t already use EveryDollar, you should check it out! This app will help you handle your monthly budget and set up those sinking funds for big expenses. You can try it for free. Like . . . today.

That’s it! That’s how you stop feeling like you’re running out of money because of constant surprise bills. That’s how you stay prepared.

From getting real with yourself about overlooked expenses to setting up special savings for unexpected expenses—now you know how to plan for the unplanned!