What Is an Individual Retirement Account (IRA)?

14 Min Read | Mar 27, 2025

Key Takeaways

- An IRA (Individual Retirement Account) is a tax-advantaged savings account designed to help you invest for retirement.

- There are two main types: traditional IRAs, which are funded with pre-tax dollars and have taxed withdrawals, and Roth IRAs, which are funded with after-tax contributions and offer tax-free withdrawals in retirement.

- IRAs offer tax-advantaged growth through lots of investing options, and they provide flexibility in choosing how and where to invest.

There are a couple things you need to know about how millionaires build their wealth.

First, the vast majority of millionaires (80%) invested in their 401(k) to build their wealth, according to The National Study of Millionaires. But they didn’t stop there. Three out of four millionaires also invested outside their workplace retirement plan—which means IRAs likely played a key role in helping most of them reach millionaire status.

But what exactly is an IRA? And why is it one of the most powerful ways you can save for retirement? There’s a lot of ground to cover, so let’s dive right in!

What Is an Individual Retirement Account (IRA)?

An individual retirement account (IRA) is a tax-favored savings account that lets you invest for retirement with some special tax advantages—either a tax deduction now with tax-deferred growth, or tax-free growth and withdrawals in retirement.

Remember an IRA isn’t an investment itself—it’s the account that holds your investments and determines how they’re taxed by the government. Think of your IRA as a sweater that protects your investments from the elements—the elements, in this case, being Uncle Sam’s cold, harsh taxes.

How Do IRAs Work?

You can open an IRA through a bank, brokerage firm, or with help from a financial advisor. Then you add money to your account (called contributions) to be invested in a wide range of different investments—from simple savings at a bank (bad idea) to mutual funds and exchange-traded funds (ETFs). And since IRAs aren’t limited to the small menu of options offered by your 401(k) plan administrator, you have more control over what investments go inside your IRA.

Investing with an IRA is like having a fast pass at your favorite theme park because you get to skip the tax line in several ways. You can change your investments inside your IRA without paying taxes. Plus, you either won’t owe any taxes until you take your money out in retirement (traditional IRA), or you won’t owe taxes at all (Roth IRA) so long as you wait until age 59 1/2!

And since an IRA is meant to help you save for retirement, don’t even think about taking your money out early. If you take money out before you’re age 59 1/2, you’ll get hit by a 10% early withdrawal penalty (on top of whatever taxes you owe).1 Plus, you’ll miss out on the tax-deferred or tax-free growth of that money—and you’ll end up way behind on your retirement savings goals.

Who Can Invest In an IRA?

The key phrase to answer that question is earned income, which includes your salary, freelance earnings and holiday bonuses. Anyone with a pulse and an earned income (including children and teenagers) can open up an IRA and contribute to one. Plus, stay-at-home spouses can open up a spousal IRA to save for retirement as well.2

What Is the IRA Contribution Limit?

Unfortunately, the government puts a cap on how much money you can put in these tax-friendly accounts. That limit usually changes every year based on inflation.

How much will you need for retirement? Find out with this free tool!

For 2024, the total contribution limit for all IRAs is $7,000—that limit applies to both Roth and traditional accounts. If you’re over 50 years old and behind on your retirement savings, you can invest $8,000 (that extra thousand bucks is called a catch-up contribution).3

Types of IRAs

We’ve already talked about how individuals can open a traditional IRA or Roth IRA to help them save for retirement outside of their workplace plan. But small-business owners and freelancers can also set up a SEP IRA or SIMPLE IRA to help themselves and their employees save for retirement.

Let’s cover all the nuts and bolts of those IRAs (plus a few others) one by one:

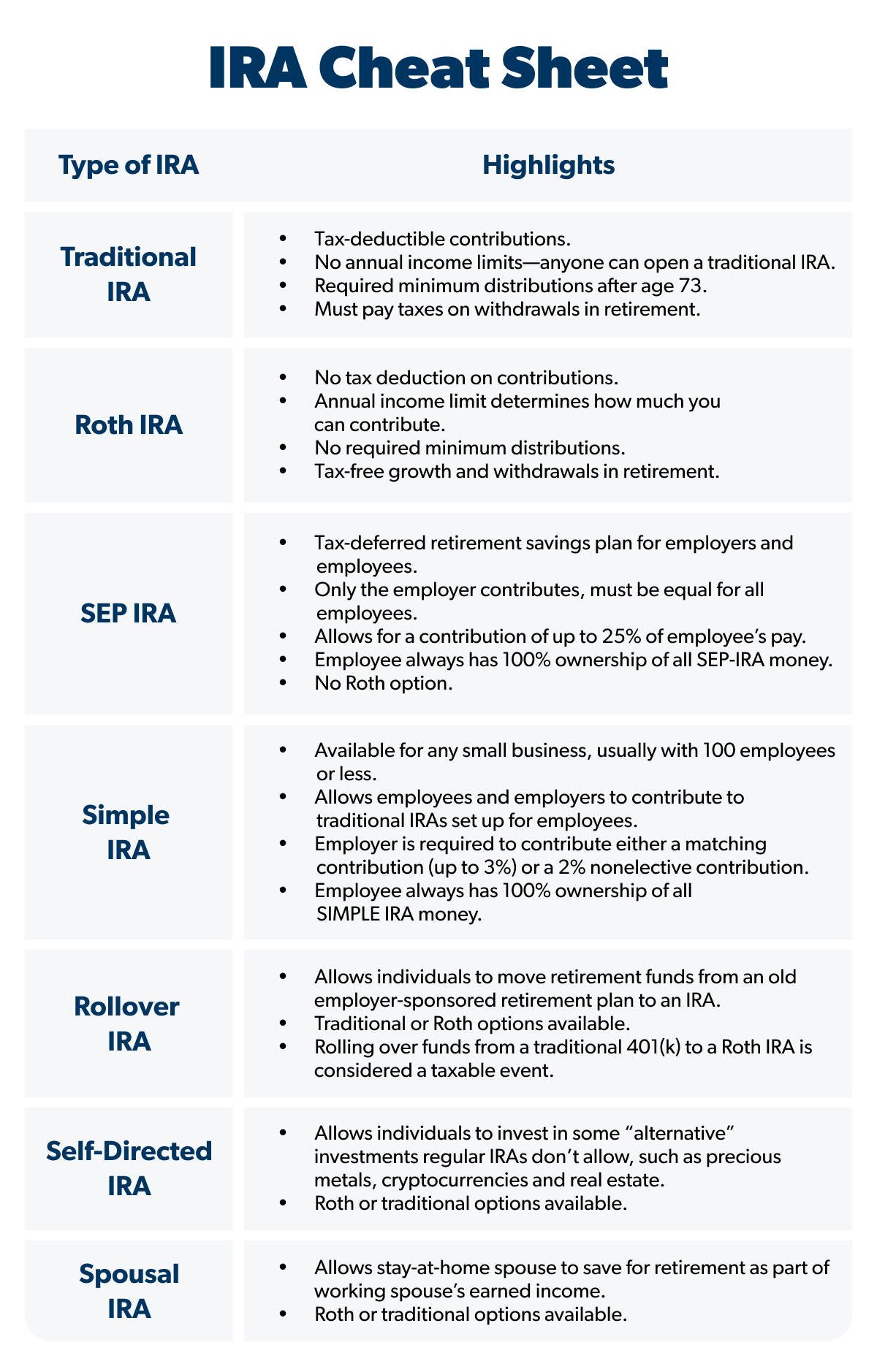

Traditional IRA

Traditional IRAs are funded with pretax dollars, which just means you can lower your tax bill this year by writing off your contributions as a tax deduction. But since you’re not paying taxes on the money you put into your traditional IRA this year, you’ll have to pay taxes on that money and its growth when you take the money out in retirement (that’s what tax-deferred growth means).

Traditional IRAs have no income limits. That means anyone and everyone with taxable income can open a traditional IRA and contribute the maximum amount.4

But with a traditional IRA, you have to start making annual withdrawals (called required minimum distributions or RMDs) after your 73rd birthday.5 Why? One word: taxes. You still owe taxes on the money sitting in a traditional IRA, and Uncle Sam wants his cut eventually.

Roth IRA

With a Roth IRA, you’ve already paid taxes on the money you put into the account (that’s what after-tax contributions means). The great thing about that is, now you can watch your money grow tax-free and enjoy tax-free withdrawals in retirement.

If your annual household income is above a certain amount, you can’t open or contribute to a Roth IRA (or you might only get to invest a reduced amount). For Roth IRAs, you can contribute up to the maximum amount as long as your gross income is less than a certain amount (for 2024, it’s $146,000 for single filers and $230,000 for married couples filing jointly).6

Another great thing about Roth IRAs is, you can leave the money in your Roth IRA for as long as you’d like—no RMDs. That means more time for your money to grow!

If your income is too high to contribute to a Roth IRA directly, there’s a perfectly legal work-around called a backdoor Roth IRA. First, you invest in a pretax traditional IRA and then roll that account into a Roth IRA.

Keep Boosting Your Investing Know-How

Every two weeks, the Ramsey Investing Newsletter will send you practical insights, easy-to-use resources, and the latest investing news. All explained in plain English.

SEP IRA

SEP IRA is short for simplified employee pension plan, and it lets the self-employed and business owners create tax-deferred retirement savings plans for themselves and their employees.

But SEP IRAs only allow the employer to contribute to the plans—after all, these plans have pension right in the name. The great thing about SEP IRAs is, they’re easy to set up and operate with low administrative costs. They also offer flexibility for employers, who can adjust their annual contributions if money is tight in a down year.

These don’t work well if you have long-term employees, though, because you have to contribute the same percentage to their account that you put in yours.

SIMPLE IRA

Another option for small-business owners is the SIMPLE IRA, which stands for savings incentive match plan for employees. SIMPLE IRAs are start-up retirement savings plans for small businesses with up to 100 employees.

Like the SEP IRAs, SIMPLE IRA plans are easier to set up and simpler to run than most other workplace plans and offer tax-deferred growth (there’s no Roth option). But there’s a key difference: SIMPLE IRAs allow both employers and employees to contribute and share the responsibility of saving for retirement.

The employer either has to match up to 3% to employee accounts or contribute 2% to every employee’s plan (whether the employees are adding their own money or not).7 But the administrative fees for SIMPLE IRAs are much less for the employer than they are with a normal 401(k).

Rollover IRA

If you leave your job, you can always roll over the balance from your 401(k) (or another employer-sponsored retirement plan) into a rollover IRA. That way, you can have your investments all in one place instead of leaving behind a trail of orphaned 401(k)s from the jobs you left over the years.

So, what type of rollover IRA should you move your money to? It all depends on the type of 401(k) you’re rolling over. If you have a traditional 401(k), for example, you’ll probably want to roll those funds into a traditional IRA to avoid getting hit with a tax bill.

But if you have enough cash on hand to pay the taxes for a Roth conversion—which means rolling over traditional 401(k) funds into a Roth IRA—it’s an option worth talking over with your financial advisor and a tax pro. We don’t recommend doing this unless you’ve paid off your house first.

Self-Directed IRA

A self-directed IRA (SDIRA) is very similar to a traditional or Roth IRA, except these accounts let you invest in some “alternative” investments regular IRAs often don’t. With a self-directed IRA, you can invest in things like precious metals (gold and silver), cryptocurrencies, real estate, and even energy and natural resources (like mineral rights, if you happen to build your house on top of a bunch of oil).

2But here’s the thing about self-directed IRAs: You probably don’t need one. Most of the investments you’d need a self-directed IRA for are super risky and worth steering clear of. After all, do you really want to bet your retirement future on something as unpredictable as Dogecoin?

Spousal IRA

Stay-at-home spouses can save for retirement with an IRA too through a spousal IRA. For example, if one spouse works full time while the other is home taking care of the kids, the stay-at-home parent can still have an IRA in their name as part of the working spouse’s earned income.8

Why You Should Invest in an IRA

We love IRAs (especially Roth IRAs) for retirement investing. Not only do they offer tax advantages for your retirement savings that are simply too good to pass up, but they also come with benefits that make them ideal for just about anyone who wants to invest for the future.

- You get tax-free or tax-deferred growth. With a traditional IRA, you get a tax break now. With a Roth IRA, you get a tax break later. Either way, you win!

- You have more investing options. When you invest with an IRA, you can pick and choose from thousands of different mutual funds. The more options you have, the more likely you are to find great funds to include in your investing portfolio.

- They’re not tied to your employer. Unlike a workplace retirement plan, you can open a Roth IRA at any time. And no matter what your employment situation is, it doesn’t affect your IRA at all. There’s no need to roll over any funds or worry about keeping track of a dozen 401(k)s from old jobs.

- They’re accessible and easy to set up. Like we mentioned, anyone with an earned income can take advantage of an IRA, and there’s no age limit for opening or contributing to an IRA. Plus, it can take as little as a few minutes to set up your account.

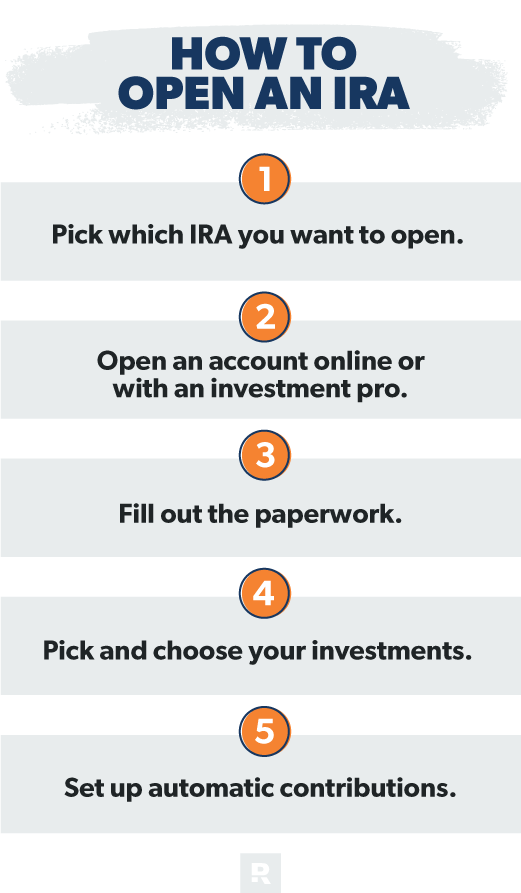

How to Open an IRA

Getting your IRA up and running doesn’t take a lot of time or a bunch of paperwork. In fact, it’s almost as easy as opening up a checking or savings account at your bank. Here’s what you have to do:

1. Pick which IRA you want to open.

Traditional or Roth? The choice is up to you, but we recommend a Roth IRA every day of the week (and twice on Sunday) if you meet the income limit requirement and you’re eligible to contribute to one. Tax-free growth and tax-free withdrawals, remember?

2. Open an account online or with an investment pro.

If you’re the do-it-yourself type, you can go the online route and set up your IRA on your own with a brokerage firm. But we think saving for retirement is too important to do on your own—which is why we recommend opening an IRA with help from an investment professional.

With an investment pro in your corner, you have someone who can help you identify funds to add to your investing portfolio and advise you through the ups and downs of the stock market.

3. Fill out the paperwork.

Nobody likes paperwork (if you do, you should probably talk to someone about that), but it has to be done. Make sure you’ve got the following information ready to go when it’s time to fill out the forms:

- Your driver’s license or other government-issued form of photo ID

- Your Social Security number

- Your bank’s routing number and your checking or savings account number

- Your employer’s name and address (optional)

4. Pick and choose your investments.

This is the most difficult—and also the most important—step to opening an IRA. You’ve got so many options to choose from, but you want to be careful not to invest in things that are extremely risky (single stocks) or too conservative (bonds).

That’s why we recommend investing in a mix of mutual funds. They’re made up of stocks from dozens—or sometimes even hundreds—of different companies, lowering your risk while still giving your investment dollars a chance to grow.

You should specifically spread your investments evenly between four types of mutual funds: growth and income, growth, aggressive growth, and international. That’s what investing nerds call diversification. After all, the last thing you want to do is put all your eggs in one basket because, at some point, you’ll probably end up with egg on your face. Yuck.

5. Set up automatic contributions.

More than anything, successful investors make a habit of investing consistently month after month. And the good news is, you can do that by automating your investing right from the get-go. You can set up payroll deductions, automatic bank withdrawals or direct deposits to fund your IRA so you’ll never miss a single month.

Is It Better to Have a 401(k) or IRA?

You might be thinking, What about my 401(k)? Should I invest with an IRA instead of my workplace plan? No! When we’re talking about 401(k)s and IRAs, it’s not an either-or scenario—it’s both-and!

Your 401(k) offers some advantages your IRA doesn’t—like an employer match and higher contribution limits. When you take advantage of that and your IRA to save for retirement, you’re setting yourself up to become a Baby Steps Millionaire and retire with dignity.

Here’s the plan: Once you’re out of debt (everything except the house) and have a fully funded emergency fund, you should invest 15% of your gross income for retirement.

But where do you start? Just remember this simple rule: Match beats Roth beats traditional. Here’s how your 401(k) and IRA can work together to help you save for retirement:

1. Take the match.

If your employer offers you a match on your 401(k) contributions, start there and invest up to the match. That’s free money, and you don’t say no to free money.

Do you have a Roth 401(k) and like your investment options? Fantastic! You can invest your whole 15% there and you’re done. If not, that’s where your Roth IRA comes into play.

2. Max out your Roth IRA.

If you have a traditional 401(k)—or if you’re not super happy with the investments offered through your company’s plan—then you can move on to the Roth IRA and invest there.

Remember, you can only put up to $7,000 (or $8,000 if you’re 50 or older) into your IRA in 2024. So, it’s very possible you could invest up to the match at work, max out your IRA, and still not hit 15%. In that case . . .

3. Go back to your 401(k).

Here’s your last step! All you have to do is go back to your 401(k) and increase your contributions until you reach 15%. You won’t get a match on that money, but at least your investment dollars can grow tax-deferred or tax-free, depending on what type of 401(k) you have.

Work With an Investment Pro

If you’re ready to take the next step toward a secure retirement future, then it’s time to meet with an investment professional. A good investment professional can answer any questions you might have about IRAs and help you create a strategy for your retirement savings.

Make an Investment Plan With a Pro

SmartVestor shows you up to five investing professionals in your area for free. No commitments, no hidden fees.

This article provides general guidelines about investing topics. Your situation may be unique. To discuss a plan for your situation, connect with a SmartVestor Pro. Ramsey Solutions is a paid, non-client promoter of participating Pros.