Key Takeaways

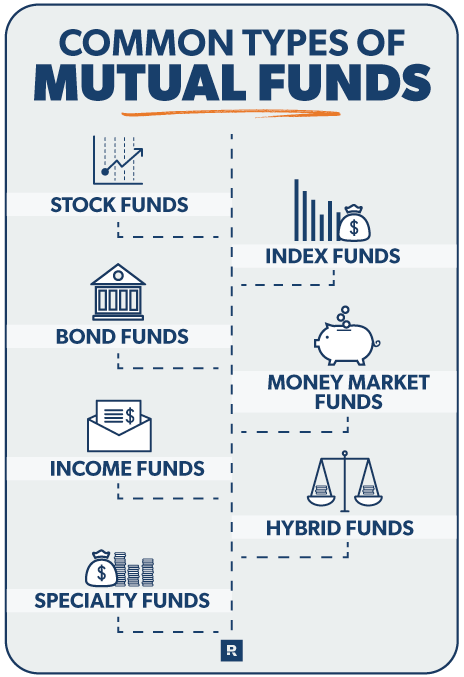

- There are several types of mutual funds based on what they’re invested in—including stock, bond, index or even hybrid mutual funds.

- The best way to invest in mutual funds is to have these four types of mutual funds in your investment portfolio: growth and income (large cap), growth (medium cap), aggressive growth (small cap), and international. This will help spread your risk and create a stable, diverse portfolio.

- The goal of investing is to build wealth, and growth stock mutual funds often grow at a faster rate than other types of mutual funds while also diversifying your portfolio.

Whenever you make a big purchase, it’s important to buy high quality. The same goes for anything you invest your money in for wealth building. With mutual funds, there are good options and there are duds. That’s why when you’re getting ready to invest, you don’t want to just grab any old mutual fund off the shelf!

Market chaos, inflation, your future—work with a pro to navigate this stuff.

To pick the right mutual funds for your investments, you need to first understand the main types of mutual funds you can choose from. Let’s start by talking about the most common types of mutual funds:

How are they different? And which funds should you include in your investing portfolio to help you hit your retirement goals? Let’s break them all down, one by one, so you can make the best choice for your financial future.

1. Stock Funds

Stock funds—also called equity funds—are made up of (you guessed it) stocks, which are publicly traded shares of a company. If you own stock in a company, you own a tiny piece of that company. When you invest in a stock mutual fund, you own a tiny piece of all the companies that mutual fund invests in.

Of all the types of mutual funds, stock funds are usually the most volatile, but they also carry the greatest potential for growth and a higher rate of return over the long haul. That’s because each mutual fund has a team of professional managers in charge of picking and choosing what stocks to include inside these funds, with the goal of bringing in better returns than the market or other similar funds.

As you learn how to invest in mutual funds, we always recommend focusing specifically on growth stock mutual funds. These funds grow at a faster rate than the rest of the market. Historically, the average annual rate of return of the stock market is between 10–12%.1 But if you invest in the right mutual funds, you can collectively beat the stock market over time.

Growth stock mutual funds are often categorized by their cap size—or in other words, how much the companies they invest in are worth. Here’s how it breaks down:

- Small-cap funds: companies valued below $2 billion

- Medium-cap funds: companies valued between $2–10 billion

- Large-cap funds: companies valued at more than $10 billion

One of the most basic principles of investing is to diversify—spread out your dollars into different types of funds so you don’t have all your eggs in one basket.

That’s why we recommend splitting your investments evenly (25% each) between four types of stock mutual funds: growth and income, growth, aggressive growth, and international. That way, you’re not relying too much on one particular fund to perform well.

Here’s a quick overview of the right mix of mutual funds you should invest in:

Growth and Income Funds (Large Cap)

These are the calmest of the growth stock mutual fund types. Their goal is to provide slow and steady growth by investing in large cap companies that rise and fall much more slowly than smaller companies.

Growth Funds (Medium Cap)

These funds invest in medium-cap companies, which creates moderate growth and volatility. They sit right in between small-cap and large-cap funds.

Aggressive Growth Funds (Small Cap)

These are also called emerging market funds or small-cap funds. These “wild child” funds can make big gains and losses in a short amount of time. Aggressive funds often invest in lots of startups with the potential for rapid growth.

International Funds

These are growth stock mutual funds made up of companies from around the world, and they vary by cap size depending on the fund. International funds help you further diversify your money by investing outside of American companies and into companies like BMW, Mercedes and LG.

Ramsey’s Complete Guide to Investing

Whether you’re a total beginner or experienced investor, this free guide will teach you what you need to know to invest with confidence.

2. Index Funds

Index funds are a type of mutual fund with a simple goal of mirroring a stock market index or a particular area of the market. Unlike other stock mutual funds that are actively managed (which means professional managers choose what stocks go inside the fund), index funds only invest in stocks, bonds or other types of investments that are included in a particular index. That’s called passive management—copy, paste, repeat!

As an example, let’s take a look at one of the most popular indexes: the S&P 500. The S&P 500 measures the performance of the stock market by tracking the stock prices of the top 500 American companies. So if you invest in an S&P 500 index fund, you’re essentially buying bits and pieces of the companies that are listed on that index.

Some investors claim index funds are more profitable in the long run because you won’t pay management fees. But there are plenty of professionally managed mutual funds that outperform index funds consistently enough to make up for the additional fees. Plus, you’ll always benefit from working with an investment professional who’s keeping an eye on your portfolio for you.

Here's A Tip

Exchange-traded funds (ETFs) are basically a cross between mutual funds and stocks. They usually mirror a market index (like the S&P 500) and can be bought and sold throughout the day like single stocks. Learn more about how they compare to mutual funds.

3. Bond Funds

With bond funds, investors put their money into either government or corporate bonds. Instead of buying stock (or equity) in the company, you’re lending the company your money with the expectation that you’ll be repaid. While the returns from growth stock mutual funds bounce all over the place, bond funds have a steady rate of return, which is why they’re sometimes called fixed-income funds.

This might seem like a safe and dependable investment, but let’s take a step back and remember that the goal of investing is to build wealth. Long-term government bonds have a history of yielding between 5–6%.2 But this just barely outpaces inflation, which averages between 3–4% each year.3 Even though bonds feel less risky than stock funds, you run the risk of not building enough wealth if you don’t grow your money!

4. Money Market Funds

Money market mutual funds invest in short-term debt securities, which basically means money loaned to governments, banks and companies that’s supposed to be paid back to investors in less than a year.

Most of the time, these are even worse than bond funds for building wealth! Some money market funds only yield a 3% average rate of return, so your money might even lose value over time if inflation rises above 3%! Think of a money market mutual fund as a bouncer for your money. It watches over it and keeps it safe, but it’s so afraid of risk that it doesn’t leave much room for growth.

When choosing mutual funds, avoid money market funds. Money market funds are like a forced savings plan, but similar to bonds, they’re not a great investment tool. Here’s the deal: You can’t afford to not take some risk when it comes to growing your money.

5. Income Funds

Income mutual funds are interested in stocks that pay regular dividends. An investor who wants an income fund probably isn’t worried about how much a stock’s price rises or falls. They’re more concerned with consistently getting a small cut of the earnings from the companies inside that fund throughout the year.

6. Hybrid Funds

Hybrid mutual funds automatically diversify your investments by spreading out your investing dollars between stocks (equity) and bonds (debt). There are two main types of hybrid funds to choose from: balanced funds and target-date funds.

Balanced Funds

With balanced funds, the ratio between stocks and bonds is set and doesn’t change. For example, you’ll commonly see the fixed ratio of 60% equity (stocks) and 40% debt (bonds). If you invested $1,000 in a balanced fund with that ratio, $600 would be used to buy stocks and the other $400 to buy bonds inside that fund.

The goal of a balanced fund is to help investors enjoy some of the growth that comes with investing in stocks while creating a steady income stream with bonds.

The problem with balanced funds is that their performance is usually weighed down by the lower-performing bonds inside the portfolio, robbing you of potential long-term returns on stock mutual fund investing.

Target-Date Funds

Target-date funds are one of the most common types of balanced funds. They’re based on the asset allocation approach to retirement planning.

Here’s how it works: You assume (and you know what happens when we assume . . . ) that you’ll retire at a certain age, say 65. You invest aggressively in growth stock mutual funds when you’re young, but as you age, the fund automatically shifts your investments to money markets and bonds in order to decrease volatility and risk.

If you’re not careful, your target-date fund might be so conservative that inflation starts to kick your butt as you age. We recommend keeping growth stock mutual funds in your portfolio, even after you retire. Your money can still grow!

7. Specialty Funds

The list of mutual funds can go on and on, but we're going to touch on a few of the most common types of funds here and tie up some loose ends.

Sector Funds

Sector funds are invested in stocks within a particular sector of the economy. If you wanted to pour your money into technology, for example, you might invest in a sector fund that focuses on buying stocks from companies like Apple, Google and similar tech companies.

Socially Responsible Funds

Some mutual funds are created to especially reflect the ethical or moral views of the investor. Also known as impact investing, they might invest in companies dedicated to a certain cause or based on environmental, social and governance (ESG) criteria—such as gender equality or carbon emissions. They also might be deemed “ethical” by excluding products like tobacco. Each fund will yield a different return, but some are much lower than traditional mutual funds.

Commodity Funds

Commodity funds invest in precious metals like gold and silver, raw materials and natural resources like oil and natural gas, and agricultural goods like corn and wheat. But despite everything those late-night infomercials might try to tell you, there are major problems with commodities. They’re always going up and down, with prices based more on fear and greed than anything else, and they bring in poor returns over time. Don’t get caught up in the commodities craze!

The Best Way to Invest in Mutual Funds

It takes a lot of research and understanding to get a handle on mutual funds, but it’s worth your time! Mutual funds are a great investing tool. If you choose the right ones, you’ll be able to build wealth, retire with dignity, and be a blessing—not a burden—to your loved ones and community by having plenty to share.

You can buy growth stock mutual funds from any broker, but the best place to start is with your retirement plan at work, like a 401(k). Retirement savings accounts have a tax advantage, and often they also have an employer match—code for free money!

One of the limitations of a 401(k) and most employer-sponsored retirement plans is that you usually only have a handful of mutual fund options to choose from. So once you’ve invested up to the match—or if you don’t have access to a 401(k)—your next step is to open a Roth IRA with help from an investment professional.

A Roth IRA gives you two awesome benefits. First, you have the freedom to buy any mutual fund you want to add to your portfolio—and there are thousands of funds out there to choose from. And second, you get some sweet tax advantages—like tax-free growth and tax-free withdrawals in retirement—which help your investing dollars stretch even further. It’s a no-brainer!

Work With an Investment Pro

Whether you still have questions about the different types of mutual funds or you’re ready to get started, the best way to make your investment decisions is to work with an investment professional. Save yourself time and a whole lot of confusion by getting a professional to help!

Next Steps

- Our investment calculator can help you figure out whether you’re saving enough for retirement—and show you how investing just a little more each month can make a huge difference.

- To get an in-depth look at everything you need to know about investing—from the basics of mutual funds to powerful tax-saving strategies—check out our free Ramsey’s Complete Guide to Investing.

- If you have questions about mutual funds or need help choosing investments for your portfolio, it always helps to talk with an investment professional. The SmartVestor program can connect you with a financial advisor who can help you create a personalized plan for your retirement goals.

This article provides general guidelines about investing topics. Your situation may be unique. To discuss a plan for your situation, connect with a SmartVestor Pro. Ramsey Solutions is a paid, non-client promoter of participating Pros.