To split, or not to split? That is the question many large companies face when their stock becomes so expensive that the average investor can no longer afford even a single share of their stock.

The potential solution to that problem is what’s called a stock split. A stock split happens when a company decides to split up all of its existing shares into multiple new shares in order to lower the price of each share of the company’s stock.

Stock splits basically make buying a company’s stock more affordable for the average investor while making it easier for existing shareholders to buy and sell the shares they already own (or “more liquid” in investing jargon).

How Does a Stock Split Work?

Imagine for a second that there are two piping hot apple pies sitting right in front of you. One of those delicious pies is sliced into four pieces while the other is cut up into eight slices.

Would you rather have two slices of pie from the pie that was cut into eight pieces, or one slice of pie from the pie that was cut into four pieces? The answer is . . . it doesn’t really matter! You’d be getting the same amount of pie either way, no matter how you slice it.

So what happens when a stock split happens? Almost the same thing! It creates more shares for investors to invest in and each of those shares is available for a lower price, but it’s important to remember that a stock split does not change the total value of the company’s stock (what investing experts call market capitalization, or “market cap”).

It doesn’t matter if you slice those pies into four slices, eight slices or even a hundred slices—the amount of pie available is still the same. So if a company is worth $100 million before a stock split, it will still be worth $100 million afterward. At the end of the day, it’s a neutral move!

The most common types of stock splits are 2-for-1 and 3-for-1 stock splits. What does that mean? Basically, a 2-for-1 split doubles the number of shares a company has by dividing each individual share into two new shares. And that means a 3-for-1 split (you guessed it) triples the number of shares a company has by turning each share into three new ones.

So, for example, if you owned 10 shares of a stock that’s worth $100 per share and that company decided to do a 2-for-1 split, you would now have 20 shares that are worth $50 per share after the split.

What’s an Example of a Stock Split?

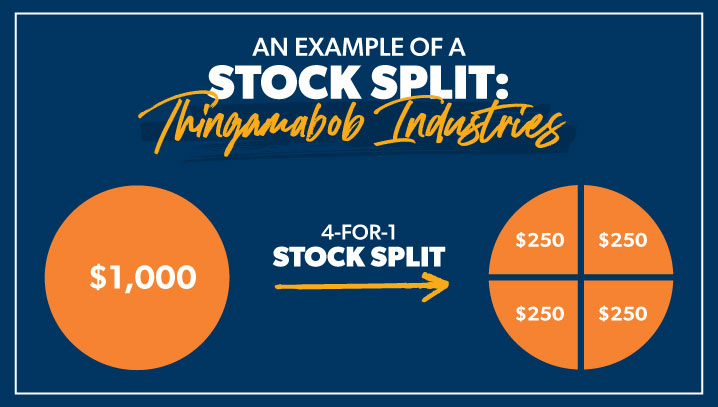

Let’s say there’s a company called Thingamabob Industries that currently has 10,000 shares available for investors to buy and sell out in the stock market. Over the past few years, Thingamabob has become a very successful company that many people want to invest in, but the price of the company’s stock has skyrocketed to $1,000 per share.

That price is just too high for most everyday investors, who will probably look elsewhere for more affordable stocks to invest in. Meanwhile, those really high share prices also make it a little more difficult for folks who already own Thingamabob stock to find buyers if they wanted to sell.

So the board of directors at Thingamabob get together and decide to do a stock split. In this case, they want to split every single existing share into four new shares (this is called a 4-for-1 split).

Market chaos, inflation, your future—work with a pro to navigate this stuff.

After the stock split, there are now 40,000 shares available to be bought and sold on the stock market (four times more than there were before), and each share is worth $250 per share. The total value of all the shares combined stays the same, but the price of each individual share is now lower.

After the stock split, there are now 40,000 shares available to be bought and sold on the stock market (four times more than there were before), and each share is worth $250 per share. The total value of all the shares combined stays the same, but the price of each individual share is now lower.

Again, the total value of the company doesn’t change at all because of the stock split. Thingamabob Industries was worth $10 million before the split and was still worth $10 million after it was done. But it might make buying the company’s stock more appealing to more investors. The idea is that the Average Joe investor is more likely to buy four shares for $250 each than one share for $1,000. It’s mostly psychological!

And what if you owned five shares of Thingamabob stock before the stock split? At $1,000 per share, the total value of your shares is $5,000. After the 4-for-1 stock split, you would own 20 shares of the company’s stock worth $250 each . . . and the total value of what you own remains exactly the same at $5,000. The only thing that changed is you now have more shares with a lower price tag per share.

Reasons for a Company to Do a Stock Split

So if a stock split doesn’t really do anything to increase the value of a company . . . that begs the question: Why? What’s the point of doing a stock split? Here are the three main reasons why a company might consider a stock split.

1. Makes it easier for average investors to afford their company’s stock.

The more expensive a company’s stock is, the longer it might take the Average Joe to save up enough to invest in the company. The hefty price tag might even drive those Joes away altogether. If a company wants more investors to be able to invest in their company, a stock split can help do just that.

2. Makes it easier for shareholders to trade their stocks.

The more expensive a stock is, the longer it can take for someone to sell their shares of that stock. That’s because it could be harder to find someone willing to buy stock that’s worth $500, $1,000 or even more per share. If a company splits their stock, it could make it easier for shareholders to find buyers.

3. Makes it easier for investors to buy company stock options.

Stock splits could also make it easier for investors who want to buy options in the company’s stock. As a refresher, a stock option gives an investor the right to buy or sell a stock at a certain price or date (they don’t have to buy or sell, but they have the option to do so . . . that’s why it’s called an option). They could also sell the option itself to someone else—this is called options trading.

Options are sold in blocks of 100 shares, so if a company’s stock is worth hundreds of dollars per share, it could cost someone thousands of dollars just to buy a company’s option . . . which can be a very risky move.

But listen, we’re going to be straight with you—messing with options is a dangerous game and you should probably avoid it like Blockbuster stock. There’s a lot of money on the line, and if a stock’s price goes the wrong way, an option can become worthless. Steer clear!

What Is a Reverse Stock Split?

Yup, reverse stock splits are a thing! A reverse stock split is exactly what it sounds like: Instead of splitting one share into many shares, a reverse stock split takes many shares and combines them into a single share. So in a 10-for-1 reverse split, 100 shares worth $1 each would now be 10 shares worth $10 each.

Since many stock exchanges will “delist” stocks once they fall beneath a certain price, companies with really low stock prices might try to do a reverse stock split to increase the price of their stock and prevent their stock from getting kicked off the exchange.

Should I Invest in a Company Going Through a Stock Split?

Should a company going through a stock split cause you to come running and invest in it? Not really. Stock splits don’t really change anything—they’re just slicing their pie of shares into smaller pieces. It doesn’t mean the company is guaranteed to continue growing or not.

Sure, stock splits might grab some headlines and cause people to take another look at a company’s stock that might have been too expensive to invest in before. But they don’t guarantee that a stock is going to grow in the long term.

And stock split or no stock split, investing in single stocks is still a risky way to invest. Instead of betting your financial future on the success of a handful of company stocks, you need to make sure your investment portfolio is diversified—that just means you’re spreading your investment risk by investing in many different company stocks instead of just a select few.

That’s where growth stock mutual funds come in. When you buy shares of a mutual fund, you are buying bits and pieces of ownership in dozens or even hundreds of different companies. That gives you instant diversification!

We also recommend going a step further and investing in four types of mutual funds: growth, growth and income, aggressive growth, and international. That way, you’re invested in a wide variety of companies from across all sectors of the economy.

Work With a Financial Advisor

Coming up with an investment plan that will help you save for retirement and build wealth is too important to figure out on your own. That’s why we want to make it easy to connect with a financial advisor through our SmartVestor program.

Not only will a good financial advisor take the time to teach you all about investing, but they can also help you set up a plan to save and invest confidently for the future.

Make an Investment Plan With a Pro

SmartVestor shows you up to five investing professionals in your area for free. No commitments, no hidden fees.

This article provides general guidelines about investing topics. Your situation may be unique. To discuss a plan for your situation, connect with a SmartVestor Pro. Ramsey Solutions is a paid, non-client promoter of participating Pros.