Key Takeaways

- Many Americans are worried about the economy, with nearly half struggling to pay bills and many drowning in debt.

- There are six key economic indicators that can give us a clue for what’s in store in 2025: the stock market, the housing market, interest rates and inflation, the unemployment rate, consumer confidence and gross domestic product (GDP).

- The stock market had a surprisingly strong year in 2024, but things might slow down in 2025 because of lingering concerns about inflation and tensions around the world.

- In the housing market, the number of houses available for potential home buyers remains low, but mortgage rates might drop a bit in 2025. Still, finding an affordable home will be a challenge for many potential home buyers.

- While the stock market is always somewhat unpredictable, focusing on things within your control—like monthly budgeting and consistently investing for retirement—can help lower your financial stress.

- The best thing to do with your investments is to keep things simple. Here’s how: Once you’re debt-free and have a fully funded emergency fund, invest 15% of your gross income for retirement in good growth stock mutual funds in tax-advantaged retirement accounts.

As we kick off the new year, a lot of folks seem to be on edge about the economy and their own personal finances.

According to Ramsey Solutions’ State of Personal Finance study, the vast majority of Americans (78%) are worried about the economy, and almost half (49%) said they’ve had trouble paying their bills. Meanwhile, many individuals and families have fallen deeper into debt since the summer. In fact, 34% of Americans are now carrying more than $10,000 of consumer debt.

How about you? How are you feeling about your own financial situation and the economy as a whole? Maybe you’re a little queasy about what’s ahead—or maybe you’re more optimistic than the rest.

Whatever camp you find yourself in, it’s important to remember what you can and can’t control. For example, you can’t control what happens to the economy, but you can control how much you invest and how consistently you invest—no matter what’s happening on Wall Street.

How Much Can You Save for Retirement in 2025?

According to The National Study of Millionaires, the path to becoming a millionaire runs through your 401(k). That’s where 8 in 10 millionaires built their wealth. And thanks to adjustments for inflation, you’ll be able to save a little more in your workplace retirement accounts this year.

- The IRS is raising the annual contribution limit for employer-sponsored retirement plans to $23,500. This includes folks who contribute to a 401(k), a 403(b), most 457 plans and the federal government’s Thrift Savings Plan.1

- If you’re nearing retirement and need to catch up on your savings, you can also put an extra $7,500 into your plan if you’re age 50 or older. And there’s a fun new wrinkle for 2025: If you’re 60–63 years old, you have an even higher catch-up contribution limit of $11,250.2

What about the annual limit for IRAs? You can save up to $7,000 in your IRA accounts in 2025—and that goes for Roth and traditional IRAs. If you’re age 50 or older, the catch-up contribution remains at $1,000, so you can put up to $8,000 into an IRA in 2025 if you’ve fallen behind on your retirement savings.3

One last thing before we move on: You’ll be able to save a little bit more in your Health Savings Account (HSA) if you have one. For 2025, individuals can save up to $4,300, while families can put $8,550 into their HSAs.4 It’s a nice bump, so take advantage if you can!

What Are Economic Indicators?

Economic indicators are just statistics and trends that give us insight into how the economy is doing and where it might be headed. That’s the short and sweet of it. Think of these economic indicators as thermometers that help us keep an eye on the temperature of the overall economy.

Market chaos, inflation, your future—work with a pro to navigate this stuff.

Here are six of the major economic indicators to watch in 2025:

- Stock Market

- Housing Market

- Interest Rates and Inflation

- Unemployment Rate

- Consumer Confidence

- Gross Domestic Product

Let’s take a look at these indicators and find out what they could mean for you and your money.

1. Stock Market

The stock market is kind of like your local supermarket. But instead of buying bread and milk, you’re buying and selling stocks (which are basically small pieces of ownership in a company).

The S&P 500 index, which measures the performance of 500 of the largest companies whose stocks trade on the New York Stock Exchange and Nasdaq, is considered the most accurate measure of the stock market as a whole. When this index increases, the economy is usually doing well. Still with us?

You know we’re always telling people the stock market is like a roller coaster—full of ups and downs that can make your head spin. Let’s take a quick look back at what happened with the stock market—and what we can expect moving forward.

The stock market reached new heights in 2024.

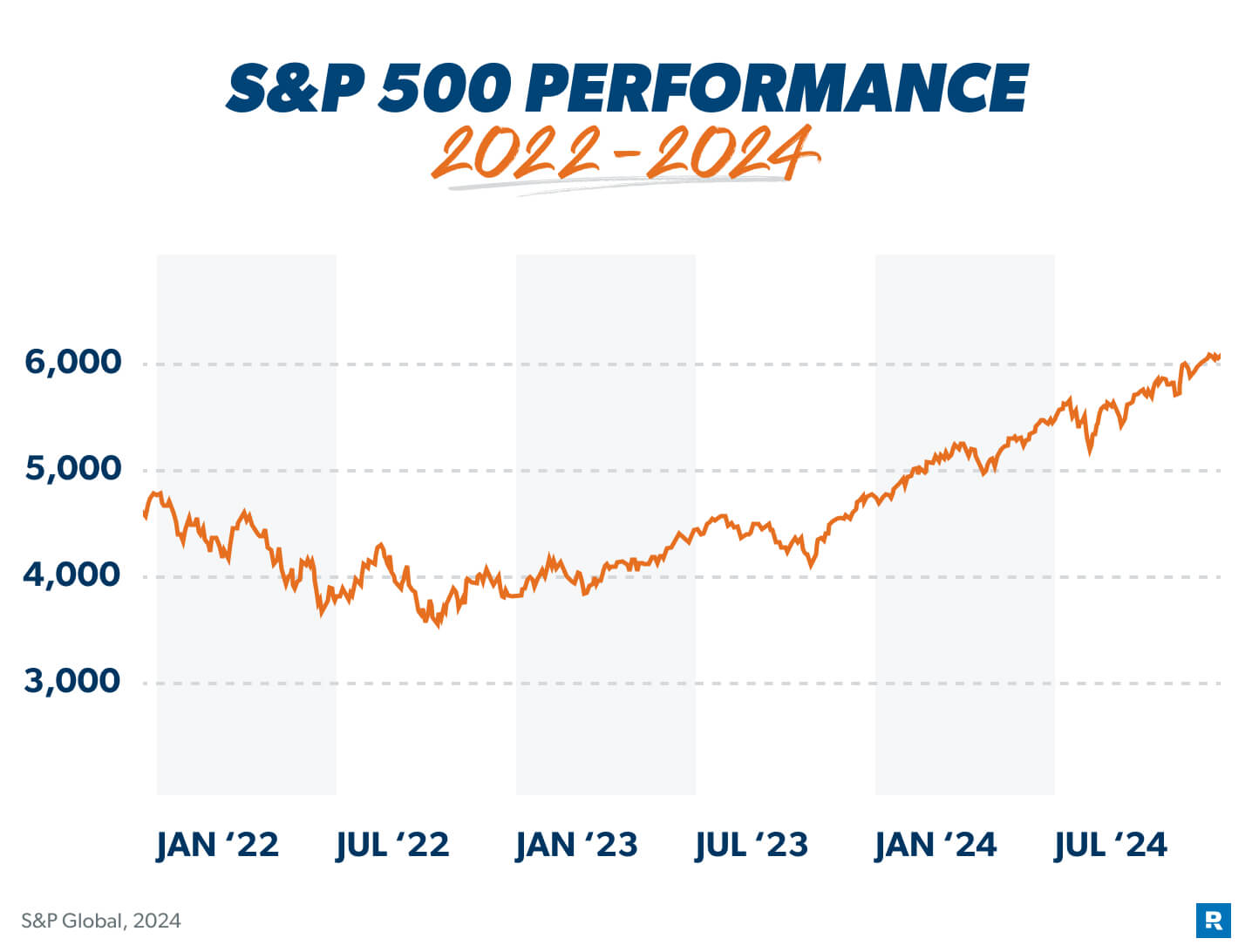

After a rough year for the stock market (and probably your retirement accounts) in 2022, the market bounced back in 2023 and made up for all the losses from that terrible, horrible, no good, very bad year.

As for 2024? Well, it’s safe to say that the stock market’s performance pretty much blew most experts’ predictions out of the water. As the year wrapped up, the S&P 500 was up roughly 25% and hit record highs throughout the year. This was due in large part to huge gains by major technology companies like Amazon, Apple and Meta.5

Interest rate cuts (more on that later), low unemployment, cooling inflation, and investor optimism that the U.S. would avoid a recession also played a role in the stock market’s stellar performance.

There are reasons for cautious optimism in 2025.

Will the stock market continue its upward trend? It appears likely that we’re headed for a third straight year of stock market gains, but there probably won’t be another double-digit percentage increase. Investors and market analysts are showing cautious optimism as we enter 2025.6

On the positive side, the U.S. economy is expected to continue to grow. Improvements and breakthroughs in technology should help boost profits for companies in many different industries, including health care and energy.

But some experts warn that many U.S. stocks could see “corrections” this year, which means they could experience a 10–20% drop in value. There are also concerns about inflation flaring back up, interest rates rising again, and ongoing tensions with Russia, China and North Korea—all of which could pour cold water on a hot economy.

But remember: Investing is a marathon, not a sprint. No matter what the stock market is doing, stay focused on the long term, avoid making decisions out of fear, and keep saving for retirement (as long as you’re out of debt and have a fully funded emergency fund in place).

The stock market might rise or fall over the course of the year, but it has a long history of trending upward. The historical average annual rate of return for the stock market according to the S&P 500 is 10–12%.7 So stay focused and keep putting money in your 401(k) and your Roth IRA—and do not cash them out “just in case.”

Make an Investment Plan With a Pro

SmartVestor shows you up to five investing professionals in your area for free. No commitments, no hidden fees.

Ramsey Solutions is a paid, non-client promoter of participating pros.

2. Housing Market

So, now that we’ve taken a look at what’s happening with the stock market, what’s in store for the housing market? Here are a few trends you should be aware of as we move into a new year:

A housing market crash is not on the horizon.

Whether you’re worried about or hoping for a drop in home prices in 2025, you can probably put those hopes and fears to rest. It doesn’t look like prices will go down drastically anytime soon. Home prices are actually expected to grow modestly in 2025.8

Simply put, low housing inventory (which refers to the number of houses for sale) leads to higher home prices. It’s all about supply and demand, which is a big reason why buying a home has gotten so expensive—and why it looks like it’s going to stay that way in 2025.

Housing inventory will likely stay low in 2025.

The real estate market has been dealing with low housing inventory for several years now. That means there haven’t been enough homes for sale to meet buyer demand.

When it comes to housing inventory for 2025, there’s some hope on the horizon for home buyers. Inventory is increasing, but it’s still nowhere close to pre-COVID levels (so don’t hold your breath for a major price adjustment).9 Still, this is a positive sign because it means the market is slowly getting healthier overall.

Mortgage rates should stay level in 2025.

After several years of rising mortgage rates, things will likely settle down in 2025. Mortgage rates will probably remain somewhere between 6–7% for 30-year mortgages, but we could still see a small, gradual decline in mortgage rates throughout the year.10

And let’s not forget that mortgage rates have already started to fall from some recent highs. The typical rate for a 30-year fixed-rate mortgage, for example, dropped from 7.79% in October 2023 to 7.04% in January 2025. The rate for 15-year mortgages fell from 7.03% to 6.27% during the same time frame.11

Even though we may be a long way from rates returning to the 2–3% range we saw at the end of 2021, home buyers can find some comfort watching rates start to trend downward instead of upward.

So whether you’re buying a home or selling one in 2025, it might be time to reset your expectations. For sellers, it’s still a seller’s market—that means you can expect to sell your home pretty quickly and for close to your asking price, as long as your asking price is fair.

What if you’re planning to buy? Our advice is simple: Be patient. You’ll have a few more options than in years past and a little less competition (probably). Sure, prices are still high, but the feeding frenzy has died down. If you have to take out a mortgage, a conventional 15-year fixed-rate mortgage is the only way to go. That’s because it’ll save you tens of thousands of dollars in interest over the life of your loan.

Whether you’re buying or selling a home, get in touch with one of our RamseyTrusted® real estate pros. They know your housing market like the back of their hand and can help you buy or sell your home—even in an unpredictable market!

3. Interest Rates and Inflation

Okay, hang with us here. The Federal Reserve (aka the Fed) is the U.S. central bank in charge of the nation’s policies on money. The Fed has two main goals: grow the economy at a sustainable rate and keep inflation under control.

The Fed has several ways to achieve its goals, but one of its main tools is raising and lowering interest rates. Now, the Fed doesn’t tell commercial banks what interest rates to charge on loans, but they do influence the banks’ rates by setting the federal funds rate. The federal funds rate is the interest rate banks charge each other for overnight loans, and it influences most other interest rates.

Lowering interest rates can give the economy a boost because it makes people and businesses more likely to borrow and spend money. But if too many dollars are chasing too few goods, prices rise—and that’s called inflation.

Raising interest rates can slow inflation down because it encourages people to spend less and save more. But if rates are too high, they can choke economic growth. When interest rates are high, businesses tend to spend less, and this can also lead to higher unemployment. So, the Fed tries to find a balance that’s just right.

With inflation hitting a 40-year high in 2022—impacting everything from how much we spent for a gallon of gas to the cost of a dozen eggs—the Fed repeatedly raised interest rates throughout 2022 and 2023 to try to cool things down.12

As inflation rates finally started to come down, the Fed took a cautious approach and held rates steady for most of 2024 before lowering them toward the end of the year to try to support economic growth.

Inflation dropped to 2.9% by the end of 2024 (from a high of 9.1% in June 2022), but it still remains above the Fed’s 2% target rate.13 Inflation is expected to average around 2.4% in 2025, which suggests that inflation will continue to be a factor for consumers in the new year.14 The Fed now anticipates only modest interest rate cuts this year as they try to combat inflation that just won’t go away.

According to The State of Personal Finance study, 64% of Americans said they’re either “extremely” or “very concerned” about inflation as they struggle to pay their bills and worry about rising costs. If that’s you, here are some smart ways to deal with it:

- Adjust your budget. This means you might have to cut back on some things in order to pay for necessities. Look for ways to save money by using coupons, buying generic brands, or carpooling.

- Look for ways to boost your income. A side hustle is a great way to earn extra income for bills or your debt snowball. If you’re stuck in a dead-end job, face your fear of the unknown and start looking for a new job.

- Keep investing for retirement. The best way to protect your nest egg from rising prices is to make sure your investments are growing faster than inflation. That’s why we recommend you invest in good growth stock mutual funds in your retirement accounts.

No matter how high or low interest rates are, borrowing money for things like a car loan or a home equity loan is always a bad idea. We want interest to work for you, not against you. Debt isn’t your friend. It takes your time and money, and it gives you headaches and heartaches in return.

4. Unemployment Rate

This next one is easy. Each month, the unemployment rate tells us how many people got (or lost) a job. It’s one of the clearest ways to see which way the economy is moving. Rising unemployment is scary—that means fewer people are working, which weakens the economy. Lower unemployment means more people are finding work and the economy is getting stronger . . . which is what we all want.

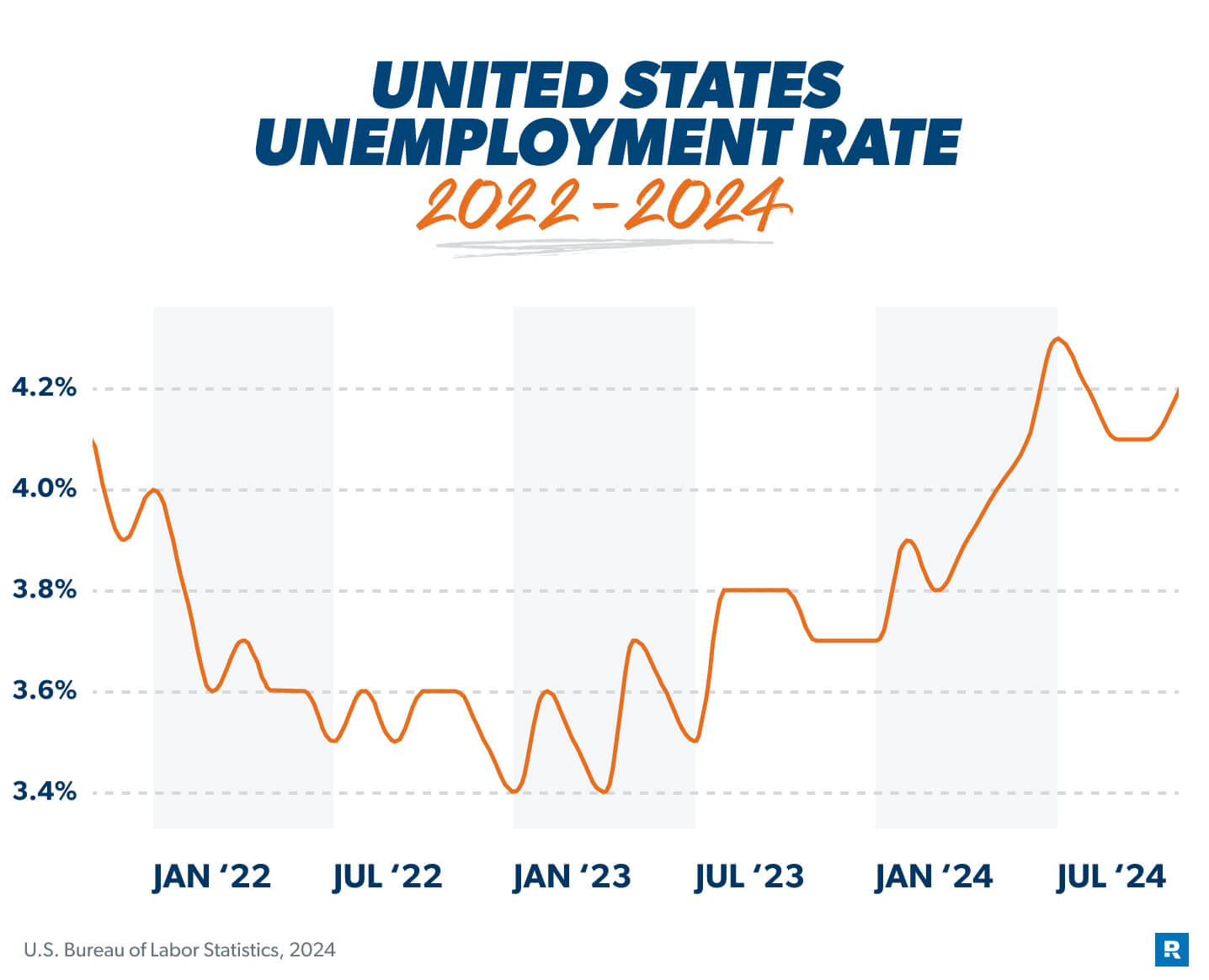

After the unemployment rate started to tick upward in 2023 and during the first half of 2024, the labor market bounced back and was more stable during the back half of the year. According to the U.S. Bureau of Labor Statistics, the unemployment rate held steady for most of the year and stood at 4.1% in December 2024.15

While the unemployment rate remained relatively stable in 2024, we might see a small uptick in 2025 (some analysts think the number might rise to 4.4%).16 The good news is that continued economic growth is likely to lead to more new jobs, keeping the labor market healthy in the coming year.

While the unemployment rate remained relatively stable in 2024, we might see a small uptick in 2025 (some analysts think the number might rise to 4.4%).16 The good news is that continued economic growth is likely to lead to more new jobs, keeping the labor market healthy in the coming year.

So, what does all that mean for your investments? Well, if job growth slows down, that means less growth for companies . . . which could hurt your investments in the short term. But don’t panic—this kind of thing happens from time to time. Work with your financial advisor to see if you need to make any adjustments to your portfolio or if you should just ride it out for the long haul.

5. Consumer Confidence

You can usually tell when someone feels confident. They walk with their head held high, and they have a swagger in their step. They also tend to spend more and save less! Well, that last part is what the Consumer Confidence Index says, at least.

The Consumer Confidence Index is a survey done by an organization called The Conference Board. The index measures how everyday Americans feel about the economy. When people are confident, they typically spend more money. When their confidence is low, they don’t.

Consumer confidence was up and down throughout 2024, which reflected Americans’ shifting sentiments. With worries about inflation still on everyone’s minds, consumer confidence is expected to continue to shift downward in 2025.17

In the face of rising prices, many Americans are turning to credit cards and buy now, pay later plans or dipping into their savings accounts to keep up their spending. In fact, Americans have accumulated more than $1.17 trillion in credit card debt.18

With more Americans adding to their debt and savings rates slipping to some of their lowest levels in years, millions of families could be in trouble down the road.19 That’s why it’s more important than ever to get on a budget, stay away from debt, and keep saving and investing for the future to outpace inflation.

6. Gross Domestic Product

In a nutshell, gross domestic product (GDP) is the value of all goods and services produced in a country during a specific time period. The GDP of the United States is a huge number: about $27 trillion a year!19 GDP growth is a key measure of the health of a country’s economy.

When GDP growth is negative for two consecutive quarters, that usually means a country is experiencing a recession. But the U.S. economy grew throughout 2024, supported by strong consumer activity and increased investments across different sectors of the stock market.20

The Federal Reserve Bank of St. Louis predicts GDP growth will slow in 2025 but stay positive and end the year somewhere around 2.1%.21 Despite higher interest rates threatening to slow the economy down, the American economy has continued to thrive thanks to strong consumer spending and improvements in productivity.

Here’s the Bottom Line

Whew! That was a lot of stuff to work through. The reason we took time to unpack all of this is because it’s the kind of thing you’ll hear about on the news or from your buddy at the gym. The difference is, we’re not going to tell you to do anything different with your investments because of what’s happening in the world.

The best thing to do with your investments is to keep things simple. Here’s how: Once you’ve paid off all debt (except the house) and saved 3–6 months of expenses in a fully funded emergency fund, invest 15% of your gross income for retirement. Put that money in good growth stock mutual funds in tax-advantaged retirement accounts.

And then just keep doing that. Over and over again. The key to building wealth is consistency. That’s the thread that ties millionaires together.

No matter what the stock market is doing, millionaires keep working hard and putting money away. They don’t get distracted. They don’t put their hard-earned money in a flashy investing trend they don’t fully understand. They don’t panic every time the stock market has a bad day.

And one day, they look up and see their nest egg has hit the seven-figure mark. Now that’s what winning looks like. And there’s no reason that can’t be you someday.

Next Steps

- Ready to learn the ins and outs of investing? Ramsey’s Complete Guide to Investing will show you how to grow your wealth and leave a legacy for those you care about.

- The most important factor for retirement success is your savings rate—how much you’re saving for retirement. Our Retirement Calculator can help you figure out whether or not you’re saving enough.

- If you’re ready to start investing, our SmartVestor program will connect you with investment professionals in your area who can help you create a plan to save and invest for retirement.

This article provides general guidelines about investing topics. Your situation may be unique. To discuss a plan for your situation, connect with a SmartVestor Pro. Ramsey Solutions is a paid, non-client promoter of participating Pros.