Key Takeaways

- A sinking fund is a strategic way to save money by setting aside a little bit each month for a specific expense down the road.

- Sinking funds work great for expenses you can’t or don’t want to pay for in a single month’s budget, such as new tires, Christmas gifts, vet bills, wedding expenses, vacations, home remodels and concert tickets.

- Sinking funds are different from emergency funds—while a sinking fund is for known, upcoming expenses, an emergency fund is for unexpected, urgent and necessary expenses.

- To create a sinking fund, determine the total amount you need, set a timeline, and divide the total amount by the number of months until the expense to determine how much to save each month.

I love sinking funds. What are sinking funds? They’re the perfect way to save up for any large expense.

Whether you’re planning a trip to Disney World or buying a new couch or even a new car—sinking funds help you pay cash for all of it and avoid the post-purchase regret.

So, let’s dive in to how sinking funds work and how to create one so you can get a head start on your savings goals!

What Is a Sinking Fund?

A sinking fund is a strategic way to save money by setting aside a little bit of money each month.

Here’s how sinking funds work: Every month, you’ll save a certain amount of money for a specific purpose to use at a later date. That way, you’re saving up small amounts over time, instead of having to come up with a big chunk of money all at once.

Sinking funds work great for things you can’t or don’t want to pay for in a single month’s budget, like:

- New tires for your car

- Christmas gifts

- Vet bills

- Wedding expenses

- Plane tickets

- Birthday parties

- School books and supplies

- Clothes for a special occasion

- Vacations

- Home remodels

- Concert tickets

You can create a sinking fund for any financial goal, dream or expense you have!

Sinking Fund vs. Savings Account

Sinking funds and savings accounts go hand in hand, but they’re not the same thing. A savings account is where you save your money. And a sinking fund is how you save your money.

If you’re trying to save for a new car, next year’s vacation, your anniversary gifts, your kid’s dance camp, and your Christmas presents all in the same savings account, that’s a lot to keep track of. Sooner or later, the lines will start to blur.

So, instead of just throwing money into your savings account, you can create multiple sinking funds for specific purposes. That way, you’ll know exactly when you hit your savings goals and how much you have to spend in each category.

Sinking Fund vs. Emergency Fund

A sinking fund is also different from an emergency fund. Very different.

A sinking fund is for those expenses you know are coming and can plan ahead for—like your kid’s soccer season or the bridesmaid dress you need for your friend’s wedding.

An emergency fund, on the other hand, is for unexpected expenses. For example, the air conditioner goes out, you get a flat tire, or one of your kids chips a tooth.

You have no way of knowing if these things are coming or when they’ll happen. But because you do know life happens, you need to have the money set aside and ready to use. Your emergency fund is your safety net between you and life.

So, a sinking fund is for the known, and an emergency fund is for the unknown.

Every savings goal starts with a budget. Create yours today with EveryDollar.

And while you may be tempted to dip into your emergency fund when the rug you really want is on sale or you’re trying to snag floor tickets to a concert, that’s not what it’s for. Only use your emergency fund for actual emergencies. And use sinking funds for everything else.

Benefits of Sinking Funds

No matter what your money tendencies are—whether you’re a spender or a saver, a nerd or a free spirit—everyone can benefit from a sinking fund.

Want to take your family of four to the beach for a week? There goes $1,500. Need a new roof? That’ll be $6,000. Then there’s your kids’ summer camps, the washing machine you need to replace soon, and that adult-sized scooter your husband just has to have. (Just my husband? Oh, okay. Cool.)

And instead of putting everything on a credit card and making payments for months, you can actually save up and pay for things in cash—even the big stuff. No sweat!

A sinking fund helps you:

- Save for anything and everything. Get as specific as you like to make sure you cover every need and want on your list.

- Plan for big, extravagant fun. This makes my spender heart so happy. Upgrade your kitchen, take the trip of your dreams, invest in your hobbies, or give generously. Make room for fun by telling your money what to do, month after month.

- Ditch large-purchase guilt. Decide up front (with your spouse, if you have one) what you’re saving for and how much money you’d like to set aside. When it comes time to spend, you can do it without worry or regret—and most importantly, without going into debt.

- Prepare for those inevitable expenses. When you see those tires are wearing thin, start saving for new ones. If you know the house you just bought has an old roof, start saving for a new one. These aren’t emergencies yet, and if you start saving up now, they never will be!

Saving strategically means fun purchases will actually be fun, and frustrating expenses won’t be a big deal.

How to Create a Sinking Fund

Now that you know what sinking funds are, how they work, and why they’ll help you, here’s how to create one in four easy steps.

Step 1: Decide what you’re saving up for.

An Alaskan cruise, a down payment on a house, Christmas presents, or a wedding reception. Whatever you’re saving for, you want to start planning for it now—so it doesn’t sneak up on you and make you broke.

Step 2: Decide where you’re going to store your sinking fund.

You can choose to open a separate savings account for your sinking fund. Just make sure the account doesn’t have a minimum balance to maintain (like a money market account). You don’t want monthly fees to chip away at your savings.

And if you use my favorite budgeting tool, EveryDollar, you don’t need a separate savings account at all. EveryDollar will designate that money for you in your budget so you always know exactly how much is in that fund. (More on this in Step 4.)

Step 3: Decide how much you need to save.

To figure out how much to save, take the total amount you want to spend and divide it by the number of months or weeks you have left until you need to make the purchase.

If you want to spend $1,000 on Christmas and it’s September, you only have about three months to save. That means you’ll need a line item in your budget reminding you to stash away about $330 every month until December.

Step 4: Set up your sinking fund in the budget.

A sinking fund will only work if it’s in your monthly budget. So, whether you budget with a spreadsheet, in an app, or with a pencil and paper, put your sinking fund line item in the budget!

Here’s exactly how to create a sinking fund in the EveryDollar budgeting app:

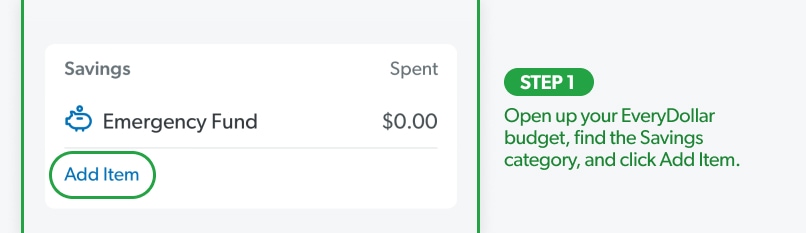

Open up your EveryDollar budget, find the Savings category, and click Add Item.

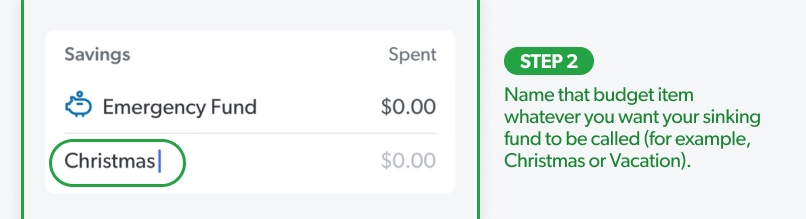

Then, name that budget item whatever you want your sinking fund to be called (for example, Christmas or Vacation).

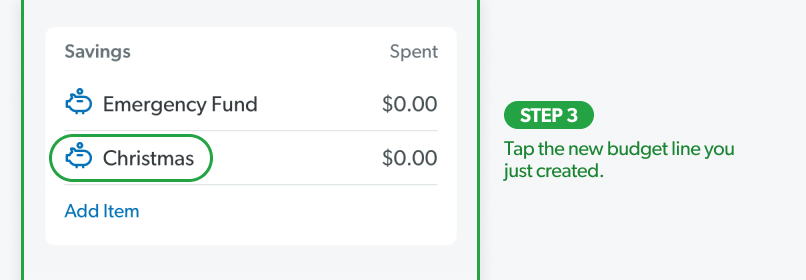

Next, tap the new budget line you just created.

Next, tap the new budget line you just created.

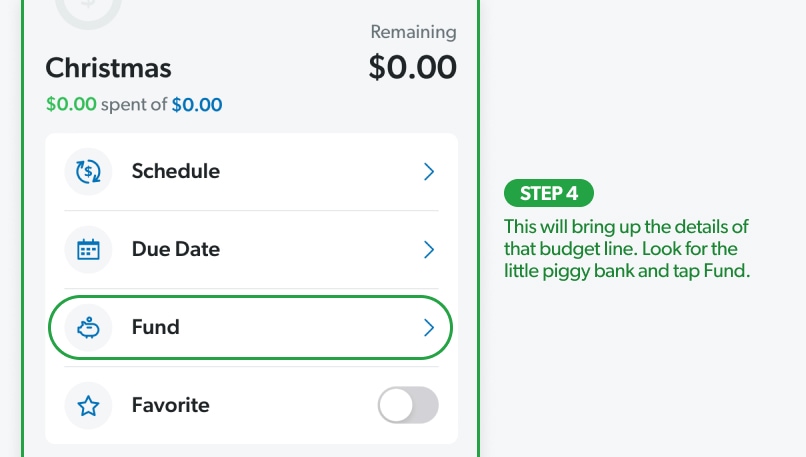

This will bring up the details of that budget line. Look for the little piggy bank and tap Fund.

This will bring up the details of that budget line. Look for the little piggy bank and tap Fund.

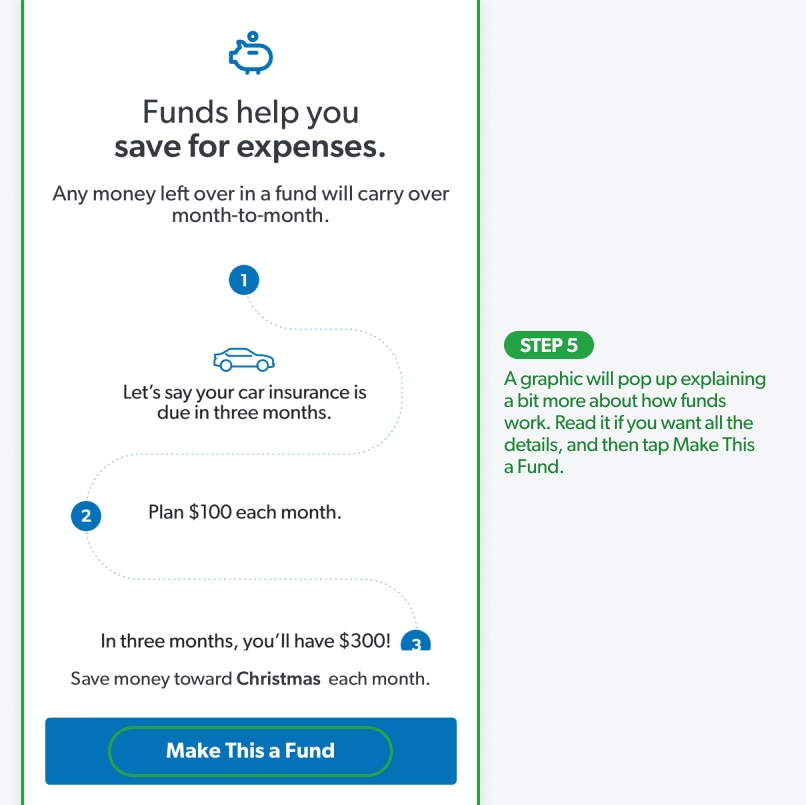

A graphic will pop up explaining a bit more about how funds work. Read it if you want all the details, and then tap Make This a Fund.

A graphic will pop up explaining a bit more about how funds work. Read it if you want all the details, and then tap Make This a Fund.

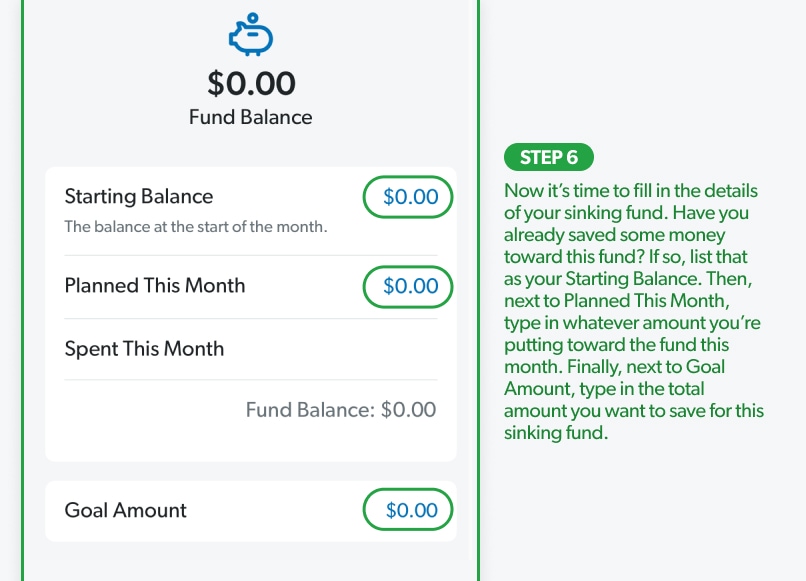

Now it’s time to fill in the details of your sinking fund. Have you already saved some money toward this fund? If so, list that as your Starting Balance. Then, next to Planned This Month, type in whatever amount you’re putting toward the fund this month. Finally, next to Goal Amount, type in the total amount you want to save for this sinking fund.

(Note, if you’re on the desktop version of EveryDollar, you’ll go through pretty much the same process, but everything will show up on the right side of the screen.)

Congrats! You’ve got your very own sinking fund.

Now you just need to make sure you transfer that amount to your savings account for the month and track it in your budget each time you add money to the fund. (You can even add a due date if you need a reminder each month.)

Stick with it, and you’ll be celebrating an all-cash Christmas this year—or whatever your goal is!

How Many Sinking Funds Should I Have?

Now that you know just how amazing sinking funds are, you may want to create one for everything. But in this case, there can actually be too much of a good thing.

If you’re trying to juggle a million sinking funds at once, you won’t see a lot of progress with any of them. There’s only so much money you can save each month, right? Depending on your current financial goals, it might be better for you to focus on saving for just a few things at a time.

Let me give you an example.

Here’s what it would look like to split $600 per month among six different sinking funds:

- $100 for vacation

- $300 for a new-to-you car

- $50 for a backyard makeover

- $50 for medical expenses

- $50 for car repairs

- $50 for home repairs

At the end of one year, your sinking fund totals would be:

- $1,200 for vacation

- $3,600 for a new-to-you car

- $600 for a backyard makeover

- $600 for medical expenses

- $600 for car repairs

- $600 for home repairs

Okay, now imagine you’ve decided it’s time to replace your car. You have two choices: Find a used car you can afford for $3,600, or use $600 to make repairs to your current car and continue to save until your car sinking fund grows some more.

But here’s the third option: If you skip the backyard makeover and the vacation this year, you’ll have $5,400 to spend on a new (to you) car. It’s all about what you choose to prioritize.

So, if there’s something you know you need to pay for soon or something you really want, do the math and decide if you can save for multiple things and still hit your savings goals. Just don’t spread yourself too thin!

Don’t Let a Big Purchase Sink You

See what a difference a little strategic saving can make? Instead of panicking, you can be prepared. Instead of going into debt, you can pay in full. Instead of playing catch-up, you can get ahead.

That’s the power of a sinking fund (and a good budget)!

We live in a culture where we buy now and pay later. We want stuff immediately. And Amazon has made anything longer than two-day shipping seem like a crime.

But if you have patience and a plan, you know what you won’t have? Worry.

Saving up ahead of time keeps you from being stressed and broke—so start creating some sinking funds today!

Save more. Spend better. Budget confidently.

Get EveryDollar: the free app that makes creating—and keeping—a budget simple. (Yes, please.)