How Many Millionaires Are There in the U.S.? A Look at the Statistics

8 Min Read | Feb 2, 2024

If you know anything about Ramsey Solutions, you know we love busting the myth that millionaire status is out of reach for most Americans. That’s just not true! The truth is you already have everything you need to form a game plan that could make you a millionaire.

Don’t believe us? There are millions (that’s right—millions) of Americans out there who worked, saved and invested their way to becoming millionaires. Shoot, you might be living next door to a millionaire, and you don’t even know it!

We’re going to show you just how many people around you have already reached millionaire status—and how you can get there too.

How Many Millionaires Are in the U.S.?

Do you know how many millionaires there are across the country? According to a recent study, almost 24.5 million millionaires live in the U.S. today.1 To put that into perspective, that’s more people than the entire population of Florida!2 And that number is growing.

Here’s the thing: Millionaires probably don’t look the way you think they do. In 2017 and 2018, our team worked on the largest study of millionaires ever conducted and discovered that most of them didn’t inherit their wealth, drive fancy sports cars, or eat at five-star restaurants every night. In fact, most millionaires are just ordinary, everyday people who follow basic money practices.

If that sounds bizarre, wait until you hear what’s coming next: You can join them. That’s right—you could be the next millionaire!

What Is a Millionaire?

A millionaire is someone who has a net worth of a million dollars or more. Net worth is what you own minus what you owe. It’s a simple math formula—and nothing more!

For example, say you have a sizable emergency fund, a retirement account, and no debt besides a mortgage. Add up your emergency savings, the balance on your retirement account, and the value of your home. Then subtract the amount you owe on your mortgage, and you’ll know your net worth. It’s that easy! The majority of a millionaire’s net worth usually includes money invested in retirement accounts or real estate (like a paid-for home). Not only that, but they also tend to stay far, far away from debt (73% of millionaires never carried a credit card balance in their entire lives).3

If you want to dig deeper into your personal net worth, use our free tool—the Net Worth Calculator. It’s quick and simple, and it helps you with next steps to build your net worth based on where you are today.

Dave Ramsey's newest book talks about a special group of millionaires we call Baby Steps Millionaires. These are folks who used the 7 Baby Steps not only to get out debt, but also to build wealth and reach millionaire status over time. Order your copy today to learn more about the proven path that millions of Americans have taken to become millionaires—and how you can become one too!

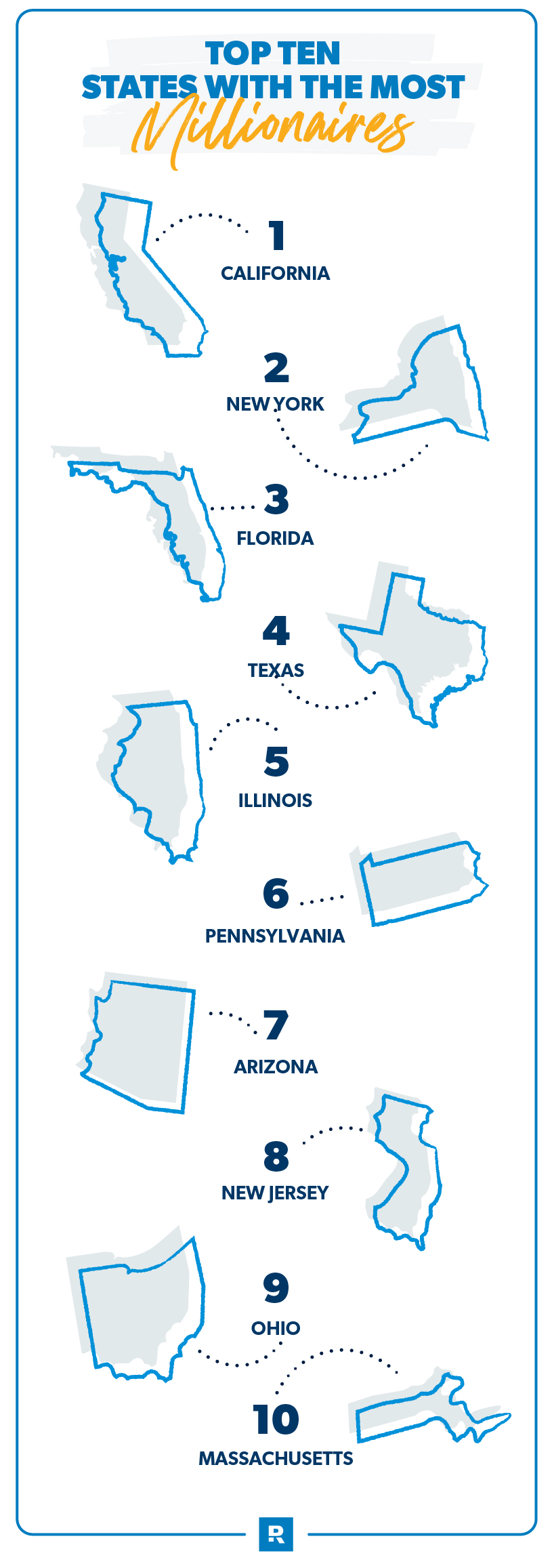

Which States Have the Most Millionaires?

If there are more than 22 million millionaires in the U.S., some of them must be in your state. Right? You’re about to find out!

We used the research from our study to break down the number of millionaire residents in each state. It’s no surprise that California and New York have the most millionaires. But if you don’t live anywhere close to those places, take a look to see if your state made the top 10.

Here are the states with the most millionaires:

- California

- New York

- Florida

- Texas

- Illinois

- Pennsylvania

- Arizona

- New Jersey

- Ohio

- Massachusetts

If your state doesn’t make the top 10 list for number of millionaires, don’t worry. Just because there are fewer millionaires in your state, it doesn’t mean you’re less likely to become one. Your state might just have a lower population than other states in general, which could be the reason why fewer millionaires live there.

Find out your net worth with this free calculator!

So, let’s look at this in a different way. Our team also collected data to find which U.S. cities have the most millionaires based on percentage of the population. Here are the top 10:

- New York, NY: 8.51%

- Los Angeles, CA: 5.34%

- Chicago, IL: 4.45%

- San Francisco, CA: 3.46%

- Washington, D.C.: 3.36%

- Philadelphia, PA: 3.26%

- Phoenix, AZ: 2.97%

- St. Louis, MO: 2.37%

- Tampa, FL: 1.88%

- Orlando, FL: 1.68%

Make an Investment Plan With a Pro

SmartVestor shows you up to five investing professionals in your area for free. No commitments, no hidden fees.

Ramsey Solutions is a paid, non-client promoter of participating pros.

Is a Millionaire Rich?

The simple answer is yes, but . . . it depends on what you mean by “millionaire.”

That word gets thrown around a lot as a stereotypical label for rich people in general. When you hear “millionaire” you might picture someone who lives it up in a big mansion and snacks on champagne and caviar. If you’re a millionaire, you’re doing great for sure. But you definitely don’t have a money bin full of cash like Scrooge McDuck.

There are a couple of reasons for that: First, a million dollars doesn’t have the buying power it did in the past. Thanks to inflation, a dollar is worth a lot less than it used to be.

Let’s say you had a million dollars back in 1955. According to the Bureau of Labor Statistics official CPI (consumer price index) inflation calculator, that million dollars has as much buying power as $11.4 million in today’s dollars.4 So if you had several million dollars back in the 1950s, you were basically among the super-rich.

Your rich status as a millionaire also depends on your location. In some big cities and states (like the ones we mentioned above), it takes a lot more money to lead a comfortable life. New York City is a lot more expensive than, say, Lewiston, Idaho. It’s why you see lots of people from big-cost states retiring to less expensive states—their dollar goes a lot further.

Like we’ve been saying, the lives of most millionaires are surprisingly normal. They just have bigger bank accounts than most people because they were intentional and made serious plans and goals earlier in life.

- More than 50% of millionaires live in a neighborhood where the average household income is below $75,000 a year.

- Nearly one-third of millionaires live in a zip code where home values are below the national median average.

- Six out of 10 millionaires live in a house valued under $500,000.

That means it’s likely there are millionaires in your neighborhood, and you don’t even know it! If you want to dive deeper into our research on millionaires and how they built their wealth, check out The National Study of Millionaires.

Expert Advice Delivered Straight to Your Inbox

Our weekly email newsletter is full of practical advice you can easily apply to your daily routine so you can win with your money, relationships and career.

How Long Does It Take to Become a Millionaire?

Okay, so how fast are our fellow Americans becoming millionaires? Well, these people didn’t magically wake up one day with a net worth of $1 million.

In fact, only 5% of the millionaires we surveyed got there in 10 years or less. It took most of them an average of 28 years to hit the million-dollar mark, and most of them reached that milestone at age 49.5

What about those Baby Steps Millionaires we talked about? Following the Baby Steps, it took them 20 years or less from the very beginning of their journey to reach the million-dollar mark!

Here’s how the timeline usually works: It takes most Baby Steppers two and a half to three years to get out of debt and build an emergency fund (Baby Steps 1–3). After that, it takes another 17 years or less of investing for retirement, saving for kids’ college, and paying off their home early (Baby Steps 4–7) before reaching millionaire status.

Here's the major takeaway: Becoming a millionaire takes time. There isn’t some magic bullet or get-rich-quick scheme that will get you there. It takes decades of working, saving and investing to become a millionaire. And thousands of Americans have proven that following the Baby Steps is the quickest right way to reach a million-dollar net worth!

How to Build Wealth and Become a Millionaire

Yes, you can join this growing group of Baby Steps Millionaires. How? It’s all about controlling your money! It’s that simple. It’s time for you to tell your money where to go instead of wondering where it went. That means having a written plan and getting intentional about it.

So what steps can you take to actually become a millionaire? Here are some ways you can get started today.

- Stay away from debt.

- Invest early and consistently.

- Make savings a priority.

- Increase your income.

- Cut unnecessary expenses.

- Keep your millionaire goal front and center.

- Work with an investment professional.

Next Steps

- Check out The National Study of Millionaires, which helps us gain an understanding of the behaviors and attitudes that factored into the financial success of thousands of millionaires.

- Dave Ramsey’s bestselling book Baby Steps Millionaires talks about people who used the Baby Steps to reach millionaire status over time.

- SmartVestor can connect you to a financial advisor who can help you make investing choices with your values and future in mind.

Frequently Asked Questions

-

What is a millionaire?

-

A millionaire is simply anyone with a net worth of $1 million or more. When what you own (your assets) minus what you owe (your liabilities) equals more than a million dollars, you’re a millionaire. Despite what culture might lead you to believe, being a millionaire is not about how much money you make in a year, how many rental properties you’re “leveraging,” or your crazy uncle’s opinion.

Sounds simple enough, right? But let’s clear up a few common myths about millionaires.

-

Don’t most millionaires live lavish lifestyles?

-

We’ll let you in on a little secret . . . just because someone looks like they’re a millionaire doesn’t mean they are. Sorry to burst your bubble, but most millionaires look more like your unassuming next-door neighbor than the celebrities and athletes you see on TV.

In fact, we found that the top three car brands millionaires drive aren’t even luxury brands. According to The National Study of Millionaires, the two most popular makes of cars among millionaires were Toyota and Honda, with nearly one third of them (31%) driving one of those brands.

Do millionaires spend their money on exclusive brands and dining out on steak and caviar? Nope. The millionaires in our study said they spend an average of $117 per month on clothes and less than $200 each month at restaurants.12 That’s some cheap caviar.

See, becoming a millionaire is all about how you behave with your money, not about keeping up with the Joneses. If you want to build wealth and become a Baby Steps Millionaire, stop caring about what other people think about your clothes, your car or your house. Keep your eyes on the prize. Live like no one else so that later you can live and give like no one else.

-

How do millionaires get rich quick?

-

It might be surprising, but most millionaires don’t get rich quick. In fact, folks who dive into single stocks, crypto, or their friend’s latest rental property flipping scheme looking for a quick and easy way to make bank usually only end up with more heartbreak and less money in their pocket.

So how do millionaires build their net worth? The answer is actually quite boring, but with consistency and patience, it works! The number one contributing factor to millionaires’ high net worth was investing consistently in their retirement plans over a long period of time.11 That’s right! Most millionaires used their 401(k) and IRA to build their wealth.

It’s not flashy or fancy, but it’s tried and true—if you invest 15% of your gross income into tax-advantaged accounts over 25, 30 or 40 years, you will become a millionaire!

This article provides general guidelines about investing topics. Your situation may be unique. To discuss a plan for your situation, connect with a SmartVestor Pro. Ramsey Solutions is a paid, non-client promoter of participating Pros.