The death of a loved one is devastating. Just dealing with the grief can feel overwhelming—and on top of that, there’s the job of figuring out what happens to their assets and estate.

That’s when probate comes in. Probate is a legal process that helps distribute assets and handle legal matters for anyone who has passed away. But how does probate work? Can you avoid it? And how can you make the whole probate process less stressful on you and your family?

What Is Probate?

Probate is the legal process that takes place after someone dies. It makes sure property and possessions are given to the correct people, and any taxes or debts owed are paid in full.

Save 10% on your will with the RAMSEY10 promo code.

But the court doesn’t do all this work alone. The probate judge needs someone to take the reins for this job—called a personal representative. There are several types of personal representative, but the ones you’re most likely to deal with (or even become) are the executor and the estate administrator. An executor is someone the deceased named in their will to carry out their wishes. An estate administrator is someone the courts appoint to carry out the probate process if the deceased died without a will.

When Is Probate Necessary and When Can I Avoid Probate?

Probate is necessary anytime someone dies, even if they had a valid will. So strictly speaking, you can never skip probate entirely. But if there is a will, this whole thing is a lot easier. In fact, a clearly laid out will (or living trust) can help speed probate way up and minimize its impact on your life.

The probate court judge just confirms that the will is genuine and authorizes the executor to carry out the deceased’s wishes. Then, they keep in touch with the executor to see that everything gets done.

If you die without a will, the probate process kicks up a notch. First the judge has to appoint an estate administrator. Then the court will be involved in valuing the estate, finding creditors and beneficiaries, and deciding a fair way to distribute the property to the deceased’s heirs.

We should also talk about the fact that any property the deceased owned jointly with another person doesn’t have to go through probate. Why not? Because the property would automatically pass to the surviving owner. For example, think of someone who dies and leaves behind a spouse. If they owned a house together, the survivor won’t need to bring the house through probate to be recognized as the new sole owner.

On the other hand, joint ownership is not always the best option in estate planning—especially for small household items. Do you really want to itemize a list with your spouse of every couch, toaster and book in your home and designate them all as jointly owned, just to avoid probate? That’s a pain nobody needs.

An easier route, and the one we recommend, is to let the probate process determine where household items should go. In almost every case, the obvious owner will wind up getting what they deserve.

Some people who don’t really know what probate is get scared about the process or think the courts are trying to take over control. But probate isn’t a bad thing—it has to happen. It’s more about organizing who’s in charge, who gets what and how much. So basically, probate is about guiding loved ones through a difficult situation and easing any confusion about what’s going to happen next.

What does not have to go through probate?

With a little preplanning, anyone can make sure the following items can avoid the probate process:

- Beneficiary-Named Items – A beneficiary-named item is anything that names a beneficiary in a document other than the will, like a life insurance policy or retirement account.

- Property Held Jointly With Survivor’s Rights – This is just a fancy way of saying that if someone else’s name is on a deed or title, they now own that property. For example, when a married couple owns a house jointly, the surviving spouse inherits the house.

- Payable-on-Death and Transferrable-on-Death Items – Using these notations on paperwork for vehicles, real estate (in some states—not every place allows this), bank accounts, stocks and retirement accounts helps these items bypass probate and go straight to the beneficiary.

- Items Placed in a Living Trust – Everything in a living trust is owned by the trust, not the person who’s died, so these items don’t need to go through probate court.

What does have to go through probate?

The short answer is, everything else. Here are the things that have to go through probate:

- Sole Ownership Property – Sole ownership property is just what it sounds like: Only the deceased person’s name is on the title or deed, and the property isn’t payable- or transferrable-on-death. For example, your loved one might have sole ownership of their house, land or car.

- Investment Property With a Partner – When people are in an investment partnership, they’re called “tenants in common.” Probate helps determine how the deceased’s portion of the investment should be handled if there aren’t specific instructions in a will or other legal document.

- Non-Titled Property – Any small stuff that doesn’t have paperwork saying it’s formally owned is called non-titled property. Furniture, appliances, clothing and household goods fall into this category.

- Inheritance When the Beneficiary Has Died – Let’s look at an example here. Joe passed away. His will leaves everything to his wife—but she died last year. Since his will can’t be carried out, the probate court will get involved to decide how to divide the estate among the remaining immediate family members. (The best way to avoid this extra stress is by updating your will after any life-changing events.)

Hopefully this helps you see why having a will is so important for making probate go smoothly. When these items are dealt with in your loved one’s will, everything’s simpler because they’ve written down exactly who will get what, and the executor can just make it happen.

But if there’s no will (or if the will is outdated or missing info), the probate court judge has to step in and help the estate administrator decide what should be done with the assets. And that means a lot of extra time and energy when you should be focused on grieving well.

Interested in learning more about estate planning?

Sign up to receive helpful guidance and tools.

How Does Probate Work?

The first few steps in the probate process can vary a bit depending on whether there’s a will. But after the will’s been found (or once you realize it doesn’t exist), things work pretty much the same. The personal representative should take the following steps:

1. Present the death certificate to the court.

The executor of the will, the estate’s lawyer or a close relative will need to tell the county court about the death and give them a copy of the death certificate to start the process.

2. Have the will validated in court.

The probate court will examine the will to make sure it was properly signed and dated. Once they confirm that it’s genuine, they’ll pronounce the will valid. (If there’s no will, you’ll skip straight to step three.)

3. Authorize someone to direct the probate process.

Next, the court gives the executor the authority to carry out the will or appoints an estate administrator to do the legwork of the probate process.

4. Post a bond.

The personal representative may be required to post a probate bond for the estate to ensure everything is distributed correctly according to the will or the court.

The bond is supposed to protect the beneficiaries against any error the personal representative might make during the probate process, whether on purpose or by accident. Think of it as an insurance policy to protect the property so the beneficiaries get what’s rightfully theirs.

The bond could cost a big chunk of change, but like any of the direct expenses during probate, the estate picks up the tab. And the good news is that in some states, the bond can be waived for various reasons—like if all of the adult heirs agree to sign a waiver or if the deceased person made a written request to do so in their will.

5. Inform beneficiaries and creditors.

The personal representative will need to find and alert any beneficiaries about the death. They’ll also need to contact creditors about any outstanding debts that need to be settled by the estate. Finding beneficiaries will be easier for the executor because they’ll be listed in the will. But both the executor and the estate administrator may have to do some legwork to find creditors. (Trust us—if you don’t find them, they’ll find you. And that’s a headache no one wants!)

6. Determine the value of the property and other items.

The personal representative will assess the value of everything owned at the time of death—and they may need to bring in a professional appraiser to help. The appraisal includes big ticket items like real estate and cars, but it should also include small things like personal and household items. Using this information, the personal representative will estimate the value of the entire estate.

7. Pay the necessary fees and debts.

Next, the personal representative will use the estate’s assets to pay for the funeral expenses, taxes owed, medical expenses and any other unpaid debts. They have to be careful, though, because if it’s not done correctly, creditors could follow up with the beneficiaries for any outstanding debts! (If you have questions, it’s a good idea to reach out to the probate court or even hire an estate lawyer to help you navigate this part of the process.)

8. Distribute the remaining assets.

The personal representative will have to transfer titles and deeds into the beneficiaries’ names. They’ll also need to arrange times for beneficiaries to pick up smaller items, like jewelry or housewares. Who gets what will be spelled out in the will. If there isn’t a will or if there’s information missing, the personal representative will need to follow the instructions provided by the probate judge.

How Long Does Probate Take?

If there’s a will and no one tries to contest it, the average probate process takes six to nine months. But if there isn’t a will, the process could be much longer. Depending on how complex the estate is, you could be looking at several years. Yep—years. That’s why having a will is so important: It will save your loved ones the stress of a long, drawn-out process.

Another thing to know during probate is that the personal representative needs to lock up any unused property to keep the assets safe until they can be distributed. And they’ll need to keep up with all utilities, mortgage payments and other bills as they come in—otherwise those unpaid bills could create huge problems for the beneficiaries down the line.

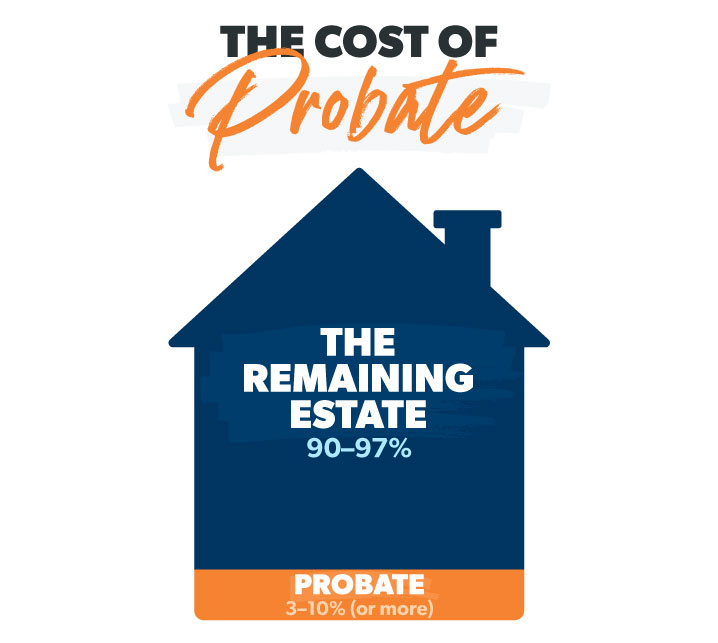

What’s Included in Probate Costs?

How much probate costs really depends on the estate size, the state you live in and how much legal work is needed during the probate process. But there are definitely a few items that come with a price tag:

- Personal Representative Compensation – Carrying out these duties is not a simple job. The personal representative will be paid from the estate for their services. Usually, each state has a certain percentage (like 5% of the estate value) as a minimum for compensation. In cases where the personal representative is also one of the heirs, they’ll often waive this compensation to keep things simple or speed up the probate process. (And keep in mind that compensation for acting as a personal representative is taxable income, so if you stand to inherit the money eventually anyway, waiving payment now would make sense.)

- Probate Bond (aka Executor Bond or Fiduciary Bond) – Some states require this expense unless the will specifically says not to get it. The bond company normally charges a percentage of the amount of the bond. For instance, if their premium was 0.5%, a bond of $500,000 would cost $2,500.

- Court Filing Fees – Each state (and county) has its own filing fee amount, so the exact amount will depend on where probate is filed.

- Attorney Fees – Some states say an attorney must handle the probate process, but most states don’t require that a lawyer step in. That said, having an attorney’s help could be worth the money if there’s anything complicated or wonky about the estate. (And yes, that’s the technical term.)

- Creditor Notice Fees – It’ll cost a bit to put up notices in local newspapers and other forms of communication to alert beneficiaries and creditors about the death.

Don't Know Where to Start With a Will?

Download our will worksheet to get started.

Getting Through the Probate Process

Probate shouldn’t complicate life—it should make everything easier at a hard time of life. If you’ve lost a loved one, probate is a steady hand during an unsteady time. It helps finalize and distribute someone’s estate—especially if they died without a will.

But that said, not having a will makes probate a whole heck of a lot harder than it needs to be. The best thing you can do for your family is to create your will sooner rather than later. We recommend RamseyTrusted provider Mama Bear Legal Forms. They’ll help you lay out your wishes clearly beforehand, setting up the probate process to run as smoothly and efficiently as possible. That means you can save your family from loads of stress and unwanted drama in the courtroom.

Instead, you’ll have a clear, easy-to-follow will that lets them know how much you love and care about them. And that’s a legacy worth leaving.