If your credit history is stopping you from getting a conventional mortgage, you may think a subprime mortgage is a good idea. But before you sign the dotted line, let’s look closer at subprime mortgages and see how they work.

What Is a Subprime Mortgage?

A subprime mortgage is a housing loan given to people with less-than-perfect credit. They were designed to bring the American Dream of homeownership within everyone’s reach—and when we say everyone, we mean, like, everyone: Whether you filed bankruptcy last year, have a low income, or have a long history of not paying your bills, you could qualify for a subprime mortgage—crazy, right?

How Do Subprime Mortgages Work?

You take out a subprime in the same way you’d take out a conventional mortgage—through a lender like a bank or mortgage company.

The biggest difference between a conventional and subprime mortgage is the interest rate. Because a subprime borrower poses a greater threat to the lender, the lender charges a higher interest rate per month. This means, in the long run, you’ll pay more for your house with a subprime loan than you would through a conventional.

What Is the Borrower Classification for a Subprime Mortgage?

Lenders have their own way of assessing borrowers for risk. Basically, they assign each potential borrower a "grade" that stands for the borrower’s level of risk. The highest grade is the "A-paper" and usually means the borrower has all of the following:

- A credit score of 680 or higher

- A debt-to-income ratio that isn’t above 35%

- A 20% down payment

- Documentation of income and assets

If you’re issued an A-paper, you won’t get a subprime mortgage. You’ll get a conventional mortgage, or a prime mortgage, with a fixed interest rate that’s much lower than the subprime loan’s rate.

If you don’t qualify for an A, you’ll get a lower grade—a B-, C- or D-paper. A B-paper is less risky than a C-paper, and a C-paper is less risky than a D. You get the idea. But all three are still considered subprime mortgages, and they’re issued to borrowers with these traits:

- A credit score below 660

- Trouble paying month-to-month living expenses

- Debt-to-income ratio of 50% or more

- Bankruptcy in the last five years

- Foreclosure in the last two years

What Are the Types of Subprime Mortgages?

Subprime mortgages come in several different forms, but these five are the most common.

1. Interest-Only Mortgages

Consider, for a moment, how a conventional mortgage works. Let’s say you take out a 15-year mortgage with a fixed interest rate. That means, for 15 years, you pay a fixed monthly payment that’s part loan balance and part interest. Simple, right?

An interest-only mortgage, however, requires you to pay only interest for a fixed amount of time, usually five, seven or 10 years. If you’re paying only interest, your monthly payments will be much lower than the payment on a conventional mortgage—but only lower until the interest-only time frame ends.

Once the time frame ends, you’ll have to pay interest plus your loan balance. And here’s the catch: You won’t get extra time to pay off your mortgage. So, if you took out a 15-year mortgage with a five-year interest-only time frame, you have 10 years to pay the entire loan balance plus interest!

2. Dignity Mortgages

Dignity mortgages are a new type of subprime mortgage loan. Like the original subprime mortgage, you pay a higher-than-normal interest rate. Then, after five years of paying your mortgage on time, your interest rate is reduced to the standard rate. And all that "extra" money you’ve paid in interest will go toward your loan balance. From that point on, your interest rate will be the same as a conventional mortgage.

3. Negative Amortization Loans

Positive amortization is the way a mortgage should work. You pay both the interest and a portion of the loan balance and slowly the amount you owe drops. Your loan is amortizing—it’s slowly dying out.

Dave Ramsey recommends one mortgage company. This one!

Negative amortization is the opposite. You can’t pay enough to cover the interest, which means every month that loan balance grows and grows and grows.

For example, let’s say you take out a $150,000 mortgage with a 7% interest rate. Every month, you’d pay $875 in interest (0.07/12 months x 150,000 = $875). Now, let’s also say your lender has agreed to let you pay only $500 a month, which means every month, you leave unpaid $375 in interest. What happens to that $375? Your lender adds it to your loan balance, raising it to $150,375. If this happened every month for a year, you’d have a loan balance of $154,500, and if this happened for five years, your loan balance would be $172,500!

When a lender gives you a negative amortization loan, you’ll have a time frame in which you pay a portion of the interest. But no lender wants your loan to grow forever! Eventually, they’ll raise your monthly payments, and you’ll have to pay all of the interest and a portion of the loan balance.

4. Balloon Loans

Think about how a balloon works. A balloon starts with a tiny width, expands slowly as you breathe air into it, then puff—it stretches to its full size.

That’s a balloon loan in a nutshell! When you take out a balloon loan, you make very small payments for a long time. Small payments, however, mean you owe more on your loan balance, and eventually you make one giant payment to repay the whole loan.

So, let’s say you take out a five-year balloon loan for a $250,000 house. Let’s also say that every month you pay $1,000 of the loan balance. After five years, you’ll have paid $60,000 of your loan, which means you still owe $190,000. Once your five-year loan period is up, you’ll make one small payment of $190,000. All. at. once.

5. Adjustable Rate Mortgages (ARMs)

With a conventional mortgage, your interest rate stays the same. Adjustable rate mortgages (ARMs), however, have interest rates that change, sometimes by a really large amount!

ARMs always start with a "grace" period with a fixed interest rate—what some lenders call the "teaser." You may have a teaser of two, five or 10 years, during which you pay the same interest rate, year after year. Then, when the teaser ends, your interest rate becomes subject to change. One year your interest rate could be very low, the next year, extremely high.

ARMs can pose a major threat to borrowers. Since borrowers can’t predict which way the interest rate will go—up or down—they could easily find themselves owing far more than they can afford. And if this happened on a large scale, if millions of borrowers found themselves unable to repay the mortgage, we could have a major economic crisis.

At least, that’s how the subprime mortgage crisis started.

Get the right mortgage from a trusted lender.

Whether you’re buying or refinancing, you can trust Churchill Mortgage to help you choose the best mortgage with a locked-in rate.

Wait, What Was the Subprime Mortgage Crisis?

Back in the early 2000s, people were getting subprime mortgages like candy on Halloween. Most of these subprime mortgages were ARMs, and because at that time interest rates were at a historic low, many broke people thought they could afford the loan.

On top of low interest rates, property values were soaring. Most subprime mortgage lenders didn’t even care if borrowers couldn’t pay off their loans. If they couldn’t repay, lenders would just take back the property, sell it for a higher price, and make some profit.

So lenders gave loans to everyone.

No income? No worries, take a loan!

No job? Take a Loan!

No assets? Loan!

Then, in 2006, the unexpected happened. For the first time in nearly a decade, home prices dropped and interest rates rose. And the ARMs, which had helped so many broke borrowers buy homes, started to kick in—suddenly, subprime mortgage borrowers found they couldn’t afford the higher interest rates. They had to default, which means they forfeited their houses to the banks.

In a good housing market, banks would have made a lot of profit. But by 2007, nobody wanted to buy houses and property values were plummeting. Banks had no choice but to sell the properties at a lower price. They lost money, became weak, and that’s when the banking world went under, triggering the Great Recession.

Are Subprime Mortgage Loans Bad?

Since 2007, the housing market has strengthened quite a bit. But did we learn our lesson? Well, not exactly. Lately, subprime mortgages have been making a comeback. Lenders give these resurrected subprime mortgage loans new names—like the dignity mortgage. Underneath the name change though, you’ll find the same old thing: a risky mortgage with a higher interest rate.

If you’re thinking about taking out a subprime mortgage, stop and ask yourself these three questions.

1. Are you truly ready to buy a home?

You may be mentally ready, sure. But unless you’re financially ready, you shouldn’t take out a mortgage, subprime loan or not. Remember: You want to own your home instead of your home owning you! If you need to go the mortgage route to purchase a home, make sure you have these basics covered:

- You’re completely debt-free

- You have three to six months of expenses saved in an emergency fund

- You’ve saved at least 10–20% of the down payment already (20% is ideal so you avoid private mortgage insurance (PMI) payments)

- Your mortgage payment is no more than 25% of your take-home pay

If you haven’t covered these basics, you’re not ready to buy a home. And though you could technically qualify for a subprime mortgage, you’re borrowing more than you can safely repay and are putting yourself in a dangerous position financially.

2. Do you want to take on the extra risk?

Be honest with yourself. If you haven’t paid back your debts well in the past, what makes you think you can do it now? Your lender won’t think twice before taking your house if you start missing payments. And if you thought you had trouble buying a home with bad credit, imagine trying to buy a home after you’ve defaulted!

There’s nothing wrong with renting, especially if you want to practice paying your monthly payments on time. You can save money for your down payment, build some confidence, and strengthen your history of making payments on time.

3. Do you really want to pay that much more for a house?

On the surface, a subprime mortgage looks like a humanitarian effort to help underprivileged people get homes.

But when you look closer, you’ll discover that you’re really paying more for a house. And by more we mean a lot more. You’re paying a higher interest rate, higher closing costs, and most of the time, you’re paying your loan over a longer period of time. Your lender is getting the great deal. And you? Not so much.

Want More Expert Real Estate Advice?

Sign up for our newsletter! It’s packed with practical tips to help you tackle the housing market and buy or sell your home with confidence—delivered straight to your inbox twice a month!

How Much More Is a Subprime Mortgage?

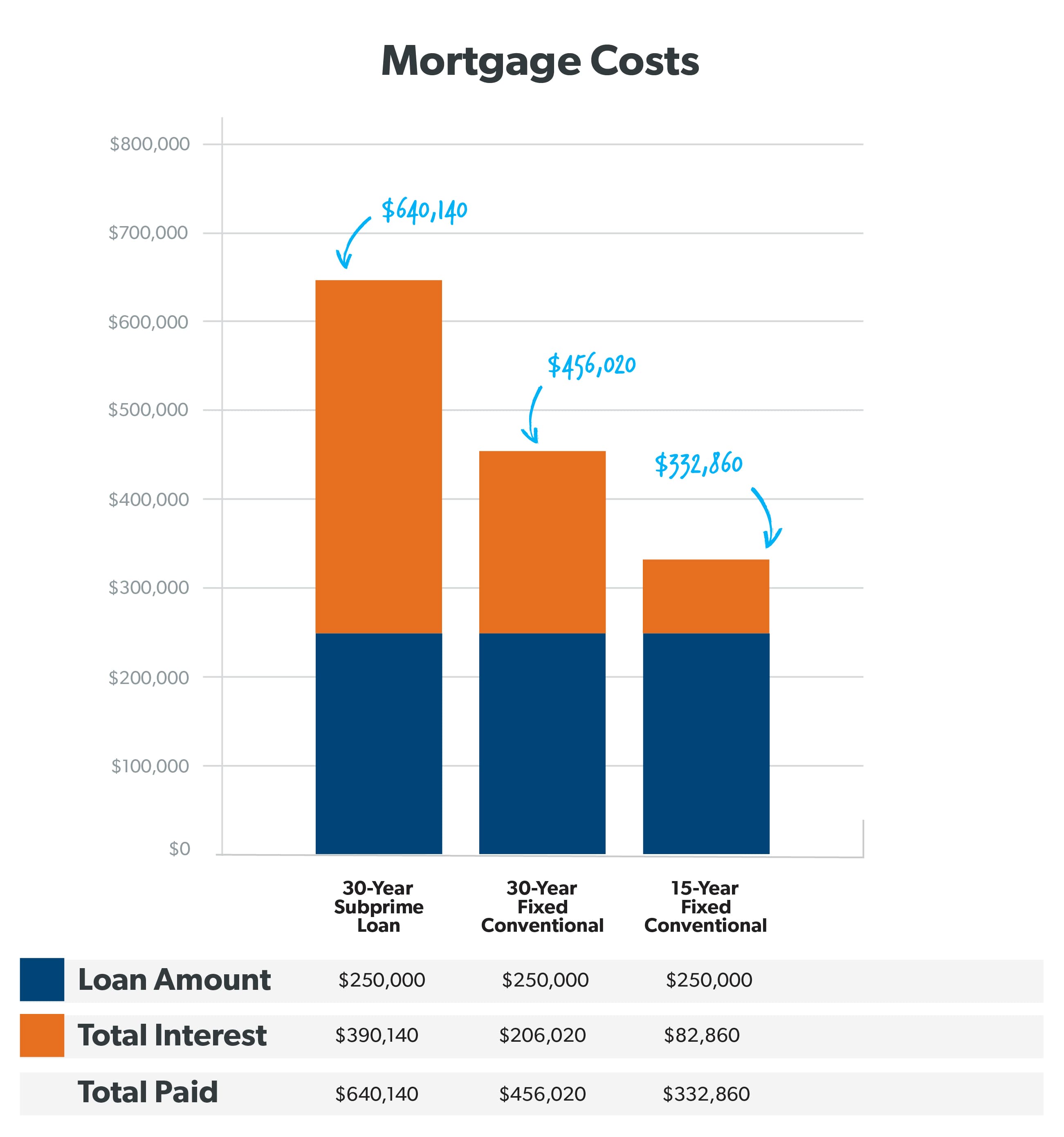

A subprime mortgage can cost hundreds of thousands of dollars more than a conventional loan. Here’s what that looks like compared to your more common loan options if you were to buy a home for $250,000.

Here’s how this graph breaks down:

Here’s how this graph breaks down:

30-Year Subprime Loan

Let’s say you buy a $250,000 home and take out a 30-year interest-only mortgage (a subprime loan) with a 7% interest rate. Use our mortgage calculator to figure out your final cost.

- Every month you would pay $1,458 in interest.

- The first 10 years, you pay only interest, which comes to $174,960.

- After 10 years, you must pay the loan balance, $250,000, over 20 years.

- Over that 20 years, you also pay $349,920 in additional interest.

- At the end of your 30-year mortgage, your total cost is $774,880. Yikes.

30-Year Fixed Conventional

Now, let’s say you buy the $250,000 home on a 30-year conventional mortgage with a fixed interest rate of 4.5%. What’s that total cost?

- The first month, you’d pay $938 in interest, and that amount will drop each month as you pay down your mortgage.

- After 30 years, you pay $206,020 in total interest.

- At the end of your 30-year mortgage, your total cost is $456,020.

In sum, you’d pay $184,120 more in interest on a subprime mortgage.

15-Year Fixed Conventional

Now, let’s say you take Ramsey’s advice and buy that same $250,000 home on a 15-year conventional mortgage with a 4% fixed interest rate. What do you pay?

- The first month, you’d pay $833 in interest, and that amount will drop each month as you pay down your mortgage.

- After 15 years, you pay $82,860 in total interest.

- At the end of the 15-year mortgage, your total cost is $332,860.

That means a 15-year fixed-rate conventional loan for the same $250,000 house is $123,160 less than a 30-year conventional mortgage and $307,280 less than a subprime mortgage!

Get a Mortgage the Right Way

If you’re financially ready to buy a house now, but your credit history is less than ideal, you don’t have to take a subprime mortgage. You just need to work with a lender like Churchill Mortgage that still does manual underwriting—a process where a lender reviews your loan application and determines if they can trust you to repay the loan.

If your credit score is scaring you into taking out a subprime mortgage, pay a visit to our RamseyTrusted provider Churchill Mortgage. The financial experts there have helped hundreds of thousands of people plan smarter and live better. Before you commit to a subprime mortgage, ask Churchill to help you find the right answers for your specific situation!

Did you find this article helpful? Share it!

We Hear You!

We’re considering adding the ability to save articles to your Ramsey account.