Set a Down Payment Goal

Now that you know exactly how much house you can afford, you’ll be able to set a down payment goal with confidence.

When you've got a big number in front of you, it's easy to feel so overwhelmed that you never make any real progress. Hefty down payments don't happen by accident. You need a plan.

Shoot for a Smart Down Payment Savings Goal

As we mentioned in the previous chapter, your best bet is to aim for a down payment that’s at least 20% of your total house price. But again, we don’t get mad at first-time home buyers for putting down something smaller like 5–10%. Just remember, no matter how much you put down, never get duped into taking on a mortgage unless it’s that 15-year fixed-rate conventional loan we mentioned earlier. That’ll save you the most amount of money in the long run.

Once you have a percentage in mind, closing costs are the only other numbers you need to factor into your savings equation.

Consider Closing Costs

Closing costs are the fees charged by all the different folks who help finalize your home purchase. These costs usually include the home inspection bill, premium for home insurance, appraisal fee, credit report charges and attorney expenses. You’ll need to pay some of these fees (like earnest money and home inspection) before the actual closing day.

Why is it important to factor closing costs into your savings? Because they can add up to thousands of dollars! On average, you might pay 3–4% of your home’s purchase price in total closing fees.1 Yours could be more or less than that depending on where you live—so do research to get a better idea of what average closing costs are like near you.

For example, if your home costs $250,000, you could pay around $7,500–10,000 in closing costs. That’s a huge expense! Don’t let it catch you by surprise—or take away from the amount you’ve saved for your actual down payment.

Plan for Moving Costs

Unless you’re relocating for a job and your company covers moving expenses, you’ll also need to think ahead about moving costs. So, add at least another grand to your house-buying budget to be on the safe side.

Calculate Your Total Savings Goal and Monthly Savings Goal

Let's say you want to put 20% down on a $250,000 home with a $9,000 cushion for closing costs and $1,000 for other expenses like moving costs. That brings your savings goal to a grand total of $60,000. With your goal set, the only thing left to do is break it down into easy-to-tackle steps. If you want to buy a home in one year, divide that $60,000 total savings goal by 12 months to get a monthly savings goal of $5,000 per month. If that’s too steep, you might stretch it out into another year and make it $2,500 per month.

Or suppose you aim for a 10% down payment and save $8,500 for closing costs and moving expenses. To reach your new total savings goal of $33,500 by the end of the year, your monthly savings goal would be just under $2,800. And again, if you stretched that savings goal out into two years, you’d stash away $1,400 per month. Focus on that monthly goal, and you'll be amazed at how quickly your bank account grows!

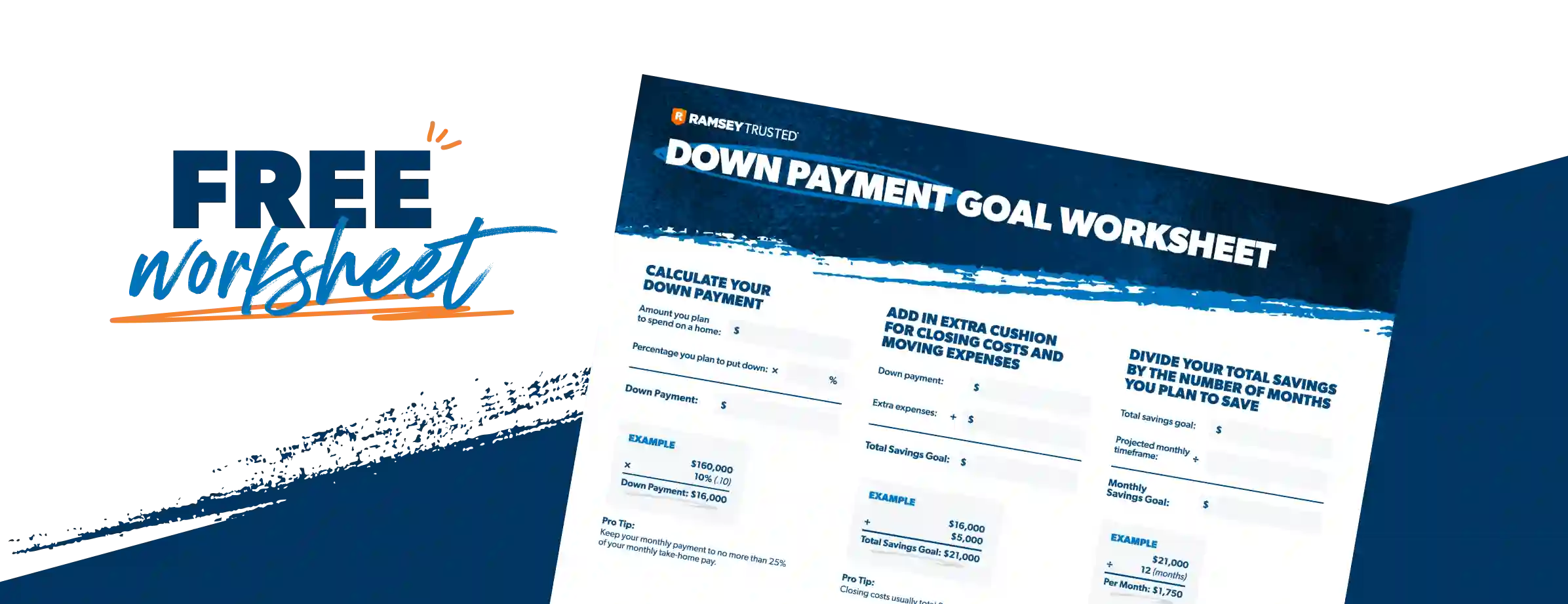

Set Your Savings Goal

To help you find your unique savings goal, use our free Down Payment Goal Worksheet. If your monthly savings goal looks a little intimidating, don't panic. In the next chapter, we’ll give you a simple plan to help you add $720 to your down payment savings every month.