Maybe you want to build your dream home. Maybe you’re looking for a place to run your small business. Maybe you want a vacation or investment property.

There are tons of reasons to buy land, and you’ve probably heard that land loans are the way to do it. But are land loans really a good idea? Heck no!

We’ll dig into what land loans are, how they work, and why they stink like a wet dog on a hot day. But don’t worry—we’ll talk about better ways you can buy land too. Let’s get started!

What Are Land Loans?

A land loan is money you borrow to buy land that doesn’t have a home or business on it yet. Land loan terms vary based on what type of land you want.

Raw Land

Raw land is all natural—no roads or utilities. Since it needs a lot of work, raw land loans typically require big down payments (at least 20%) and have high interest rates. You’ll probably even have to show the lender a detailed plan for how you’re going to develop the property. (That’s why raw land is a common target for real estate developers—that’s their strong suit.)

Unimproved Land

Unimproved land might have utility lines or a septic system, but they won’t be hooked up yet. Unimproved land loans are generally easier to get and cheaper to pay off than raw land loans, but again, you’ll need at least 20% down and a detailed plan for development.

Improved Land

Improved land has access to utilities and roads. Since it’s ready to build on, it’s also the most expensive. Lenders use that to their advantage: They offer lower down payments and interest rates so you think you’re getting a good deal, but since the loan amount is bigger, they actually make a huge profit off you. (Thanks for the “help,” lenders!)

Land Use

Before you buy any type of land, you’ll need to make sure you can actually use it how you want.

Find expert agents to help you buy your home.

For instance, if a property isn’t zoned for commercial use, you won’t be able to build your business there. And if you want a residential lot loan, you need to know the local zoning board’s plans for the neighborhood. They may be putting in a park or sewage treatment center nearby—which can change your property value in very different ways.

When buying raw or unimproved land, make sure you can get access to utilities and a public road. After all, it’s hard to build a house when you can’t put in lights or a driveway!

And last but not least, get surveyors to double-check the property boundaries. Otherwise, you could buy land because you like the creek nearby . . . only to find out the creek actually belongs to the neighbors.

How Do Land Loans Work?

Just like with any other loan, lenders want to make sure you can repay a land loan. Most lenders look at your credit score to see how much debt you have and how good you are at paying it back.

If you’re debt-free and don’t have a credit score, you rock! Your lender will do manual underwriting—where they look at your income, savings and overall finances. Manual underwriting is way better than getting a loan with a credit score because it looks at how much money you actually have in the bank. (A credit score is pretty much just an “I love debt” score—which is why they’re junk!)

Now, here’s where land loans are different: You have to tell the lender how you plan to use the land. So if you want a residential lot loan, you have to say whether you’ll build a house right away or improve the land first. You also have to tell the lender what you don’t know yet, like how the property is zoned, if there are any land-use restrictions, or if there’s utility access.

They’ll use that info to decide if they’ll lend you the money and to set the land loan terms. That includes the interest rate, how many years you have to repay the loan, and how much of a down payment you owe.

Generally, lenders consider land loans riskier than home loans. So land loan interest rates are usually about twice as high, and (like we mentioned) most lenders also ask for higher down payments—at least 20%.

Land Loans vs. Construction Loans

Okay, so we’ve covered how land loans work. But how are they really different from construction loans?

The main answer is time. Construction loans usually have a repayment term of one year. During that year, the buyer has to build a house and then switch to a regular mortgage that pays for the land and home.

Land loan terms last longer—anywhere from 2–25 years depending on which type of land loan you get.

Want More Expert Real Estate Advice?

Sign up for our newsletter! It’s packed with practical tips to help you tackle the housing market and buy or sell your home with confidence—delivered straight to your inbox twice a month!

Types of Land Loans

There are four main loans for land. They’re each a little different, and they vary by how many years you have to repay them. Let’s take a look:

- Lender land loans: Most small, local credit unions and banks give land loans with repayment terms of 2–5 years. They can assess land value easily since they know the area, and they might even know you. That makes them more willing to take the risk—whereas a big, national bank usually won’t give land loans.

- USDA land loans: USDA land loans are more like construction loans. Section 523 lets you borrow money to buy land and build your own house—which is great if you know how. If you want to hire a builder, you need a Section 524 loan. Both USDA loans have two-year repayment terms and usually have lower interest rates than lender land loans. The downside is that you’re dealing with a federal agency—meaning more hoops to jump through.

- SBA 504 loans: SBA stands for Small Business Administration. These loans let you buy land to use for your company—like if you want to store inventory or build a storefront. You put 10% down, an SBA-approved Certified Development Company lends you 40%, and a local lender pitches in the other 50%.1 These land loan terms last anywhere from 10–25 years.

- Seller financing: Seller financing, or a land contract, is when you and the current landowner make your own deal—without lenders or government agencies. Seller financing can be helpful because it’s so flexible. You and the seller set all the land loan terms, like the down payment, interest rate and loan length. A word to the wise: Hire an attorney to review the contract so the seller can’t pull any funny business.

Now, there is one more way to pay for a land loan—using a home equity loan to buy land. But that’s a rotten idea!

We won’t get into all the reasons home equity loans suck, but here’s the gist: You’re putting your home at risk. If you can’t pay the loan, you’ll lose the land and your house. That’s nuts—and it’s just too dangerous for you and your family.

How to Get a Land Loan

Getting a loan for land is harder than getting a regular home loan. Lenders will want you to have more money up front and be more qualified (which means having either a really high credit score or a big savings account). If you qualify, actually getting a land loan is similar to the home loan process.

Just like with any other loan, you’ll first want to narrow down your search criteria. What type of land are you looking for? What do you want to use it for? What’s your budget?

Once you decide these factors, you can apply to get preapproved for a land loan. That way you won’t waste time running back to the lender or finding out you can’t afford a property. When you’re preapproved, you’ll know exactly what you can afford and be able to quickly make an offer on the land you want.

That said, you may want to rethink getting approved for a land loan—because despite the name, they’re actually not the smartest way to buy land.

Should You Get a Land Loan?

No! Land loans may sound good, but all they really do is put you deeper in debt and further from your dreams. And even if you think your situation is different, the truth is that land loans are just a bad idea for everyone (including you).

Let’s look at some reasons people take out loans for land, why that’s a mistake, and what you can do instead.

Owning a Business

We get it—you’re sick of leasing a space, and you want to own property for your business. But running a company is stressful enough without throwing debt into the mix! You’ll sleep better, and your business will be safer, if you run it debt-free.

Think that’s impossible? Think again! Ramsey Solutions has always been a debt-free company. Our founder, Dave Ramsey, started by selling books out of the trunk of his car. Now we’ve got two beautiful—and huge—buildings we paid cash for. So, you can run a debt-free business.

Until you’re ready to buy a commercial property with cash, consider leasing a location with an option to buy later.

Buying Investment or Vacation Property

Using debt to invest in real estate is like building a house of cards. It’s just too easy to go broke. When we teach people how to invest in real estate, we always tell them to pay 100% cash for investment properties. If you can’t afford to do that, you’re not ready to invest and you need to focus on getting your financial house in order.

Being in Debt

Look, having any debt holds you back. So if you’ve got student loans, credit cards, medical bills, car notes or any other type of debt, you can’t afford land. You don’t even own the stuff that’s sitting in your house or your driveway. You’re broke!

Your job right now is to pay off your debt. Then you can save up to buy land later, without those monthly payments weighing you down.

And if you have a mortgage, the last thing you need is to juggle another monthly payment. Don’t put your home at risk! It’s smarter to pay off your mortgage and free up all that income. Then you can save up to invest in land or build your dream house.

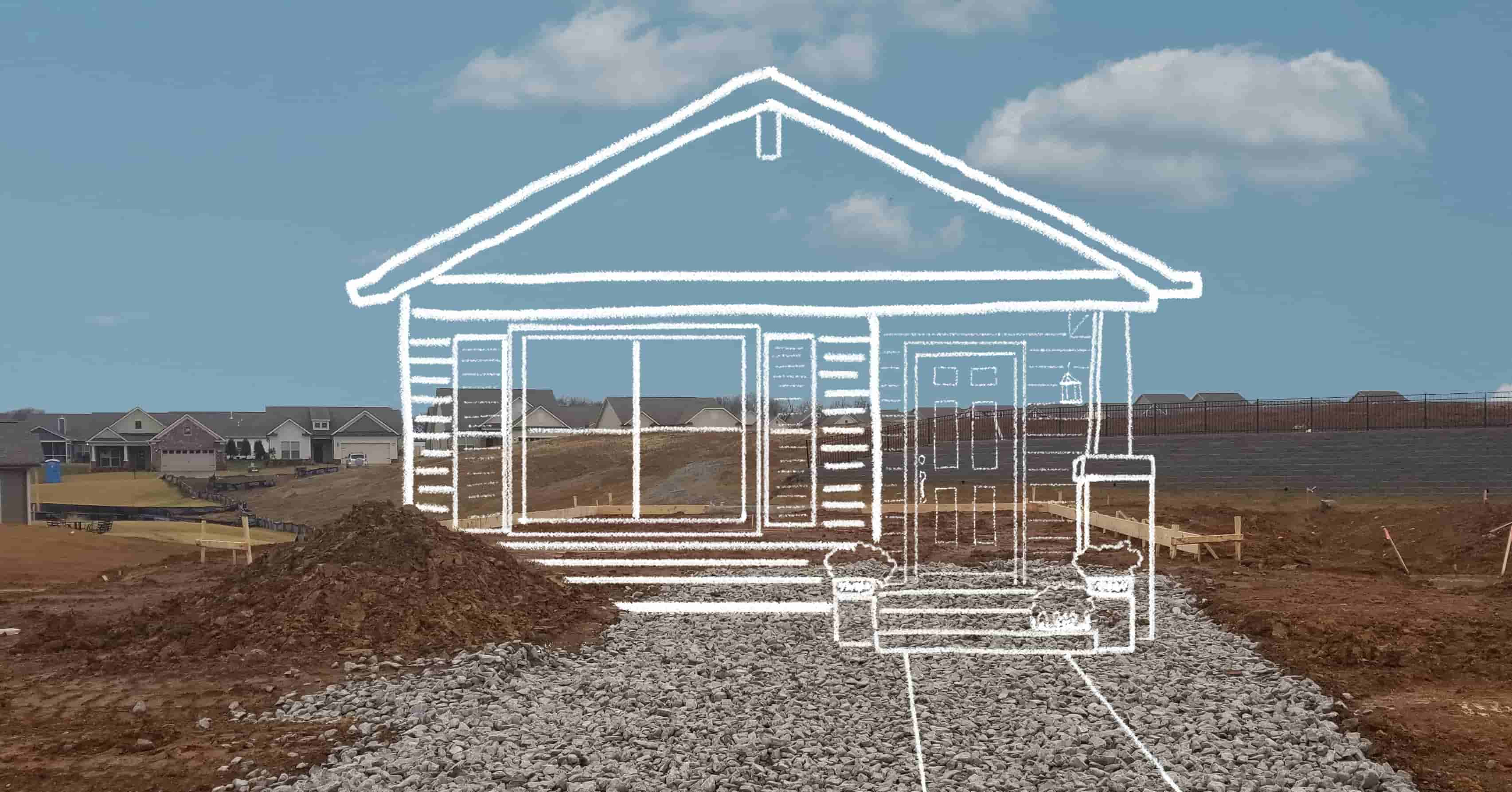

Wanting to Build a Home

Maybe you dream of building a home, and you’re not ready to pay 100% cash. We get it—building a house is expensive! But land loans aren’t the way to make that dream come true.

If you’re going to borrow money to build, it’s smarter (and faster) to get a construction loan. You can build the house, then switch to a 15-year fixed-rate mortgage that lets you pay for the land and the house at the same time. Just remember to keep your monthly payment to 25% or less of your take-home pay so you can actually afford it!

You should also wait until you’re really ready to buy land. So how do you know when that is? Here’s how:

- You’re debt-free.

- You can put at least 20% down.

- You have an emergency fund with 3–6 months of expenses saved up.

If all that’s true, then you’re financially prepared to buy land, build your home and then pay it all off quickly—because the grass just feels different when it’s yours!

Ready to Shop for Land?

When you’re looking for land, you need a good real estate agent on your side. They’ll help you navigate the whole process, and some will even help you select a builder too.

To find the best buyer’s agents around, try our RamseyTrusted® program. It helps you connect with top-performing real estate agents in your area for free. We trust these agents to serve you with excellence—so why wait? Work with the best.

Did you find this article helpful? Share it!

We Hear You!

We’re considering adding the ability to save articles to your Ramsey account.