Owning a home can be a joy and a great springboard for building your family’s wealth. You may have visions of a white picket fence and a front-yard tree perfect for a tire swing. But it’s also a big responsibility. Because you’re the owner, everything is on you. That means you have to take care of all the expenses associated with homeownership—keeping that fence bright white and pruning the tree that tire swing hangs on. And those things come with price tags.

So how much does it actually cost to own a house? Let’s pull back the curtain (or blinds) and find out.

Key Takeaways

- Owning a home means you’re responsible for all the expenses associated with keeping it in tip-top shape.

- A typical homeowner in the U.S. might expect to shell out about $45,400 a year for home expenses.

- The costs to consider before owning a home include things like a mortgage, HOA fees, increased utilities, lawn care, and home maintenance and repairs.

- Rather than budgeting for homeownership based on averages, it’s better to come up with a plan that’s suited to your specific situation.

How Much Does It Cost to Own a Home?

Here’s the short answer: Based on average costs associated with homeownership, a typical homeowner in the U.S. might expect to shell out about $45,400 a year for home expenses.

Find expert agents to help you buy your home.

Now here’s the long answer: It’s much more complicated than that. $45,400 is a very broad ballpark estimate based on national averages. You shouldn’t base your ability to afford a home on just an average, let alone one for the whole country. There are all kinds of other factors that determine just how much it will cost to own your home.

Want to see what those are and how to actually prepare in the best way possible? We thought you’d never ask. Read on!

What Are the Costs of Owning a Home?

First, let’s build a foundational understanding of the cost of homeownership by stacking up a few of the most important expenses to consider—one at a time.

Mortgage

Most people think of the word mortgage as just a lump of money you give the bank to pay off your house. But it’s more than a lump. When you pay your monthly mortgage, that money actually goes toward five separate payments.

What are those five payments? We’re glad you asked this mortgage question, because we planned to tell you.

- Principal: The principal is the amount you borrowed to buy your house. So when you pay on the principal of your home, the amount you owe on the house goes down. Your goal is to get the principal down to zero—meaning you own your home 100%, mortgage-free. And the grass sure does feel different when it’s all yours!

- Interest: The interest is the money the lender is making. Paying this doesn’t lower the amount you borrowed, but it is the cost of borrowing.

- Property tax: Most mortgages include your property tax in the monthly payment. The lender will set aside a portion of your payment in a separate escrow account and pay those taxes for you when they’re due.

- Insurance: The monthly mortgage payment can also include your homeowners insurance. Just like with the property taxes, the lender handles that payment for you.

- Private mortgage insurance (PMI): In the event of a foreclosure, the bank can often get around 80% of the home’s value. So if you don’t give them the other 20% up front as your down payment, they add on PMI to protect themselves.

If it’s a number you’re looking for, the average mortgage payment in the U.S. as of April 2024 is about $2,200, or $26,400 a year.1

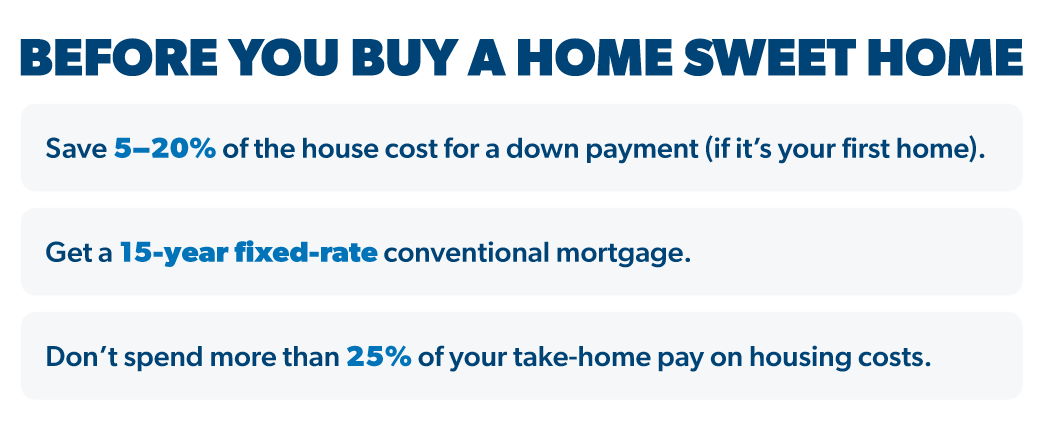

Something to remember: All five of those things together shouldn’t be more than 25% of your take-home pay. When you start spending more than 25% here, you become house poor—meaning your house might be awesome, but the rest of your life suffers financially. Who wants to live in a three-story house with no furniture or a have a gourmet kitchen with no money to buy groceries? And a lot of first-time buyers slip into that trap without realizing it, so make sure you know the most common home-buying mistakes young buyers make.

Those may seem like extreme examples, but being house poor can put you at extreme risk later on. So as you look at those pieces of the mortgage-payment puzzle, remember these main takeaways:

HOA Fees

Some neighborhoods or complexes have homeowners associations (HOAs). Those associations generally have monthly fees (though they’re sometimes collected quarterly), and the average monthly HOA fee in the U.S. is $300, which adds up to $3,600 a year.2

The good of HOAs is that they’re in charge of maintaining and improving the shared properties. Maybe your HOA fee covers your use of awesome amenities like a pool, playground, pet spa, landscaped walking trail or the like. The bad part about HOAs is that some are poorly managed.

But someone’s got to take care of those things, and someone’s got to pay for it. Everyone in the neighborhood splits the costs with HOA fees. Make sure you know this cost before you buy.

Want More Expert Real Estate Advice?

Sign up for our newsletter! It’s packed with practical tips to help you tackle the housing market and buy or sell your home with confidence—delivered straight to your inbox twice a month!

Utilities

Natural gas, electricity, water, trash collection, internet, phone and television streaming services—these are some of the most common utilities.

Of course, not all of those are necessities, but have them in mind as you budget. You might already be paying for these as you’re renting, but sometimes your rent includes some utilities.

Also remember that if you’re upsizing, several of those bills will increase. It costs more to heat and cool a three-bedroom, two-bath bungalow than it does a studio apartment, for example. The average monthly total for home utilities in the U.S. is $583, or $6,996 per year.3

Lawn Maintenance

If you’re moving somewhere with a lawn, you’ll need a maintenance plan. Are you going to mow, clip, prune and bag it yourself or hire a crew? Will your obsession with coral-colored roses be a constant temptation to spend half your paycheck on a garden the Queen of Hearts herself would envy?

While the roses can wait, you don’t want to make enemies of the neighborhood (and/or the HOA) by growing your grass miles high. Plan on a reasonable amount of money going toward lawn care. The average American homeowner spends about $300 on lawn care a year—but that can go up and down a lot depending on how much lawn you have and if you’re hiring someone.4 And that probably doesn’t include purchasing equipment like a lawn mower when you’re first starting out, which can run you about $500.5

Home Maintenance and Repairs

When you own rather than rent, one of the biggest adjustments is home maintenance and repairs. No more ringing up the landlord when a family of skunks moves under your deck or when your HVAC goes kaput on a sweltering summer day.

You get to call pest control or that local air company who got past copyright issues and named their company Mr. Freeze. And you get to pay the bill. From gutters to garage doors, roofs to refrigerators, toilets to termites, your housing budget will look different when you make the move to homeownership.

As far as average maintenance costs go, there’s an old rule out there in the housing industry that says you should set aside 1–4% of your home’s purchase price toward home maintenance expenses. Since the average cost of a home in America today is about $403,000, homeownership could potentially cost you anywhere from $4,030 to $16,120 a year.6 For the sake of our example, we went with 2%, or $8,060.

How to Budget for Homeownership

We’ve looked at some of the possible expenses you could pay owning a home. And yes, we included some really rough estimates of prices based on national averages. But again, basing your budget on averages isn’t the way to go. It’s just a jumping-off point.

Here’s the real deal: You need a plan to pay for home expenses that exist in reality. That means doing a little homework, creating a custom plan for your life, and taking the necessary steps before you buy the house to make sure your dream home doesn’t become a nightmare.

Let’s look at how you can start an actual plan that suits your personal homeowning journey to a T.

Take a good, honest look at your potential home.

This might seem like a weird place to start, but it’s true. A home’s physical condition will have a big impact on your costs from the moment you’re handed the keys. It will give you an idea of what to expect and how to budget for it. Don’t forget to ask the right questions for your home-buying journey.

- Size: How big is the house? The bigger the house, the more it costs to heat, cool, and keep the lights on and the water running. A bigger home also means more to repair and maintain.

- Location: Is the home in an area that gets humid during the summer or icy in the winter—or both? The environment takes a toll on a house’s physical integrity, which means money for upkeep, weatherproofing and damage repairs. And a home’s location will also bring with it higher or lower property taxes and insurance premiums.

- Age: How old is the house? An older house will need extra TLC sooner than a newer build. This could look like having to replace old appliances, fixtures, roofs, electrical systems and more.

- Wear and tear: How you and your family treat a home can also influence the cost. Do your kids run though the hallways and mark up the walls? Does your grandma prefer a balmy 75 degrees inside the house all winter long? All that use and abuse puts mileage on your home and appliances.

Get or stay out of debt.

If you have any kind of consumer debt, it’s best to take care of that before even thinking about buying a home. The last thing you want is to face all those added expenses with a giant pile of debt on your back. Start your homeownership with a clean slate.

Have budget lines for your monthly home expenses.

For all the steady monthly expenses—like your mortgage payment, water bill, electricity, natural gas and such—you need to set up separate lines in your budget. If you’re doing this for the first time, look back at your bank statements to see the average bill for each (that is, your actual average and not a national average), and put those amounts in as the planned costs.

Budgeting for each of these expenses keeps you from spending your light-bill money on laser tag by accident. Once you’ve got your Four Walls covered—food, utilities, shelter and transportation—then you can spend what’s extra on money goals and fun.

Keep an emergency fund for surprises.

If you don’t already have one, you need an emergency fund. That means enough money to cover 3–6 months of expenses.

The thing with surprises is that you don’t know when they’ll happen. But you do know surprises will happen. This is especially important when it comes to owning a home because broken water heaters and busted HVAC systems need to be addressed ASAP. That’s what your emergency fund is all about: being ready to meet those surprises—with cash.

Create a sinking fund for semiannual expenses or repairs.

Here’s the thing: Some of those repairs and home maintenance issues mentioned earlier really aren’t surprises. When you own a home, you need to regularly inspect appliances and major systems so you can know what will need some financial attention soon. And that’s why you should have a sinking fund—a separate account to squirrel away cash for those larger known expenses.

For the repairs and replacements you see coming, as well as the semiannual expenses (like a quarterly bill for pest control), you can easily set up a sinking fund in your household budget in the EveryDollar budgeting app. Calculate how much money you need by when, divide it by the months until that time, and start stashing cash in the fund to prepare.

Get a Pro on Your Side

Now you’ve got the knowledge you need to be financially ready to buy a home. If you think you’re ready to own a home (and take on all the responsibility that involves), you need someone in your corner to help you make the best choices along the way. And that someone is a real estate agent.

But how do you find a trustworthy agent you can count on to keep your best interests at heart? Get a RamseyTrusted® agent. They’re experts in the field—the best of the best in your area—and we’ve checked them through and through so you don’t have to.

You can focus on the fence, tire swing—oh, and that awesome down payment. Your RamseyTrusted real estate agent will focus on getting you the best deal on your new home!

Next Steps

- Check out the How Much House Can I Afford Calculator to get a clearer picture of the kind of house you can get that won’t leave you house poor.

- Use the EveryDollar budgeting app to create a real-world home budget for your life.

- Get with a RamseyTrusted real estate agent who will answer all your questions, find you a home that won’t overwhelm you, and serve you with excellence.

Did you find this article helpful? Share it!

We Hear You!

We’re considering adding the ability to save articles to your Ramsey account.