Mortgage Buydowns: What Are They and How Do They Work?

8 Min Read | Apr 17, 2025

As if the whole home-buying thing wasn’t complicated already, it’s gotten just a little more difficult over the last few years. House prices have gone up a ton, and mortgage interest rates have gone the way of Elon Musk’s rockets (and they’re slowly making their way back down to Earth).

So, to help buyers deal with those challenges, some mortgage lenders and sellers have gotten a little creative and started pushing something called a mortgage buydown. While buydowns aren’t new, they have gotten a little more popular lately.

If your lender, seller or builder is offering you a buydown, you probably have two questions on your mind: What exactly are mortgage buydowns? And are they a good idea?

Let’s break it all down! We’ll talk about what buydowns are all about, the types of buydowns that are out there, how much they cost, who pays for them, and—most importantly—whether they’re a good idea. That way, you’ll be able to make the best decision for you and your family when you buy a house.

What Is a Mortgage Buydown?

A mortgage buydown is a way for home buyers to reduce their interest rate in the first few years of their mortgage. In exchange for an up-front fee (paid in cash), a lender will lower the interest rate on your mortgage for up to the first three years.

Once those years are up, your mortgage will return to the standard interest rate you agreed on when the mortgage was finalized. If you use a fixed-rate loan (the only type of mortgage you should use, by the way), you’ll keep that interest rate until you pay off your house or refinance.

Types of Mortgage Buydowns

Understanding the differences between the types of buydowns is as easy as 1-2-3 . . . Or should we say 3-2-1? They all do the same thing—lower the interest rate, and in turn, the monthly payment. It all depends on how long the buyer wants the buydown to last.

- 3-2-1 buydown: lasts the first three years of your mortgage, with a 3 percentage point discount on the interest rate for the first year, a 2 percentage point discount for the second year, and a 1 percentage point discount for the third year

- 2-1 buydown: lasts the first two years, with 2 percentage points off the first year’s interest rate and 1 percentage point off the second year’s

- 1-0 buydown: lasts for one year, with (you guessed it) 1 percentage point off the interest rate during the first year only.

How Does a Buydown Work?

Let’s work through how a mortgage buydown plays out. For this example, we’ll say you’re buying a $450,000 house on a 15-year fixed-rate loan with a 20% down payment and a 6% interest rate.

If you got a 3-2-1 buydown on this mortgage, here’s what your monthly payments on your mortgage principal and interest would look like:

- Year 1: $2,486 (3% interest)

- Year 2: $2,663 (4% interest)

- Year 3: $2,847 (5% interest)

- Years 4–15: $3,038 (6% interest)

Get the right mortgage from a trusted lender.

Whether you’re buying or refinancing, you can trust Churchill Mortgage to help you choose the best mortgage with a locked-in rate.

How Much Does a Buydown Cost?

Lenders offer the lower interest rates you get with a buydown in exchange for a fee you pay in cash when you take out the loan.

Dave Ramsey recommends one mortgage company. This one!

How much is the fee? Well, it depends on how big your loan is. That’s because the fee a lender charges for a mortgage buydown will be almost the same as the amount of interest you’ll save during the time it’s in effect. So if a buydown would save you $10,000 over its lifetime, getting it would cost . . . $10,000 (give or take a few bucks).

Who Pays for a Buydown?

Pretty much anyone involved in the process of buying or selling a home can pay for a mortgage buydown—including the seller, the buyer or even a builder.

Sometimes, a seller will offer to pay for a buydown so their listing will have a little icing on the cake. After all, getting a one, two or three-year discount on payments is a pretty great perk! Builders will also sometimes pay for mortgage buydowns to entice buyers to purchase newly built homes in brand-new developments.

You can also pay for a buydown as a buyer when you take out a mortgage with certain lenders.

What’s the Difference Between a Buydown and Points?

Mortgage points are a type of buydown. Purchasing points does lower the interest rate on your loan—each point (which costs 1% of the loan amount) takes the rate down by 0.25%. But unlike the buydowns we’re talking about here, points last for the life of your mortgage (unless you refinance). And like the temporary mortgage buydowns, points are most often purchased by the buyer but are sometimes paid for by the lender or builder as an incentive.

Are Mortgage Buydowns a Good Idea?

Now you know exactly what buydowns are all about. But we need to discuss one more important question: Should you get one? Well, it depends on who’s paying.

If a seller or builder is paying for it, then a mortgage buydown is definitely a good idea. In that situation, you’d get a discount on your house payments for three years with no extra fees or strings attached. That’s free money! Aka a really good deal.

But if you have to foot the bill for the buydown, you’ll want to be far, far away from that!

Why? Because a mortgage buydown isn’t a very good deal if you’re the one paying for it. It’s not even a discount at that point—all you’re doing when you get a buydown is pre-paying for your mortgage.

Imagine giving a department store $20 so that, later, they’ll offer you a $20 discount on a shirt you want to buy. That would be silly, right? Well, that’s pretty much what’s happening when you pay for a buydown on your mortgage.

Plus, you’ll save a whole lot more if you put that extra cash toward your down payment instead of a buydown. When you do that, you’ll wind up with less total interest and the money will go toward your equity instead of . . . nothing.

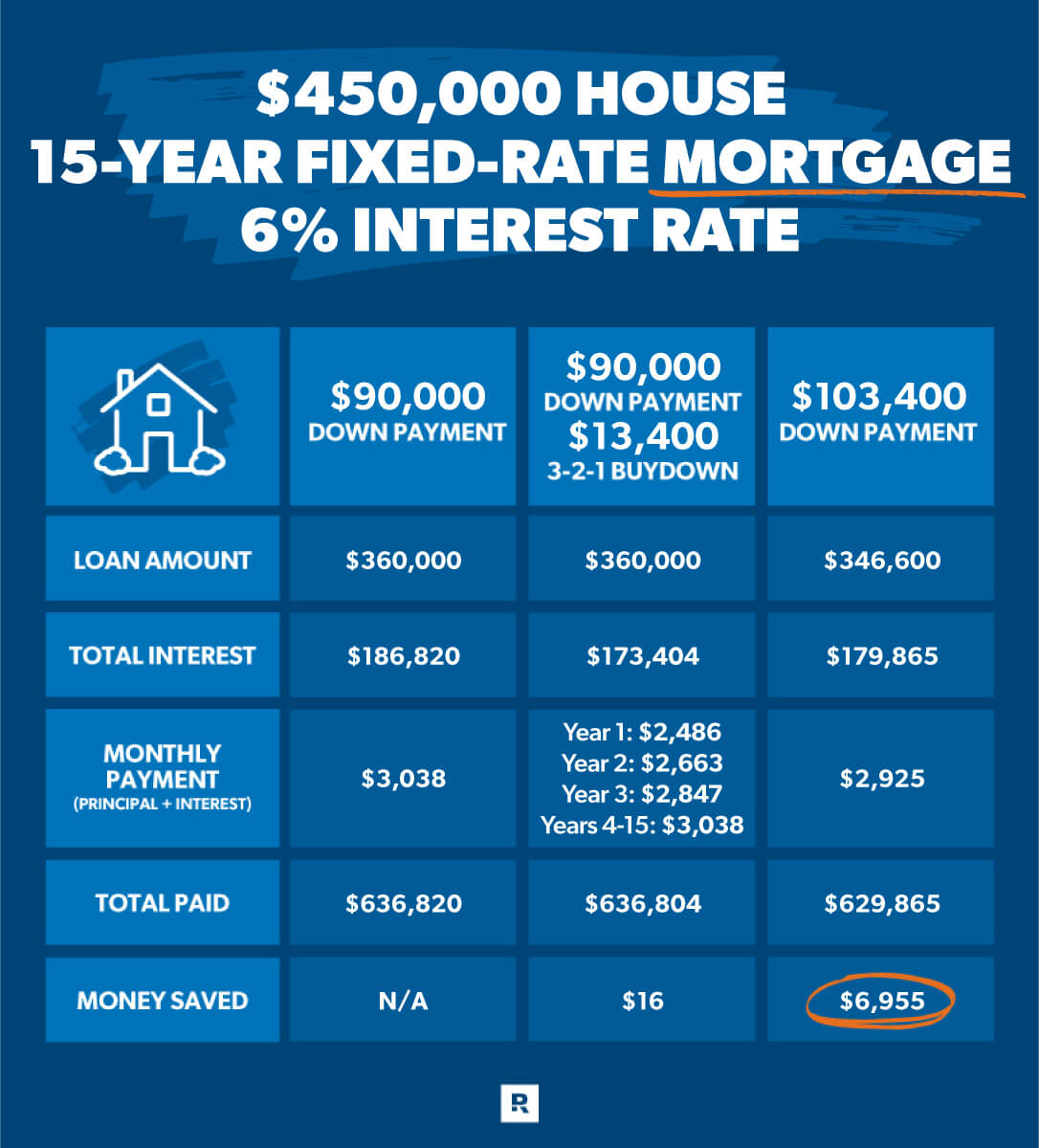

How much more? Let’s crunch some numbers. We’ll use the situation we looked at earlier: buying a $450,000 house using a 15-year fixed-rate mortgage with 6% interest and a 3-2-1 buydown.

While those three years of smaller payments with a 3-2-1 buydown look pretty nice, don’t forget that you’re paying for them in advance. Again, it’s just like a $20 discount you paid $20 to earn. And if you do go down that road, you’ll be missing out on saving thousands in the long run.

Myths About Mortgage Buydowns

As you’re going through the process of buying a house and getting a mortgage, you may run into a couple of myths about buydowns that could lead you to make a really bad decision.

Myth: “A buydown is a great way to get around high interest rates. Just pay for the buydown now, then refinance after three years when rates have gone back down.”

Truth: If interest rates are down in a few years and you want to refinance, you can do that whether you purchased a buydown or not. Plus, like we talked about earlier, those smaller payments you make over the first few years of a buydown aren’t a free gift. You pay for them! And you miss out on the savings you would’ve gotten by adding that extra cash to your down payment.

Want More Expert Real Estate Advice?

Sign up for our newsletter! It’s packed with practical tips to help you tackle the housing market and buy or sell your home with confidence—delivered straight to your inbox twice a month!

Myth: “A buydown is great for buyers expecting an income increase. It can help you afford a house until you start to earn more.”

Truth: Some lenders will try to convince you that buydowns are a good way for buyers anticipating an income increase down the road to get into a house they ordinarily couldn’t afford. It’s the reason why they offer so many buydown options—to “give you flexibility” based on your income and future earning power. But if the only way you can afford a home right now is with a buydown, what do you think will happen if that income increase you were planning on doesn’t happen because you get laid off or your new job falls through? Here’s the deal: If you can’t afford a house payment without a buydown (no matter who pays for the buydown), you can’t afford it period.

There’s a Better Way to Get a Mortgage

Don't fall into the trap of paying for a mortgage buydown or any other complicated financial product that promises to make homeownership easier. Buying a house the good ol’ fashioned way by saving up a down payment, getting a traditional mortgage that you can afford, and making the payments (or, even better, paying your mortgage off early) is still the best way to go. Remember: Only buy a house if you can afford the full payment—not just the discounted version—right now.

Have more questions? Need more info about the home-buying process? You can find all the answers, anytime, all in one place. We call it our Real Estate Home Base. You’ll have instant access to all our real estate calculators, how-to articles, guides, podcast and more—everything you need to prepare to buy or sell a home with confidence.

Next Steps

- Take a look around our Real Estate Home Base.

- Learn about how much house you can afford so you don’t have to get creative with your financing and end up house poor.

- Check out our free Mortgage Calculator to see what kind of monthly payment you can expect for different home prices and down payments.

- Once you’re ready to buy a house, connect with a RamseyTrusted® real estate agent in your area. Pros from our network are experts in their local areas, and they’ll serve you with excellence.

Did you find this article helpful? Share it!

We Hear You!

We’re considering adding the ability to save articles to your Ramsey account.