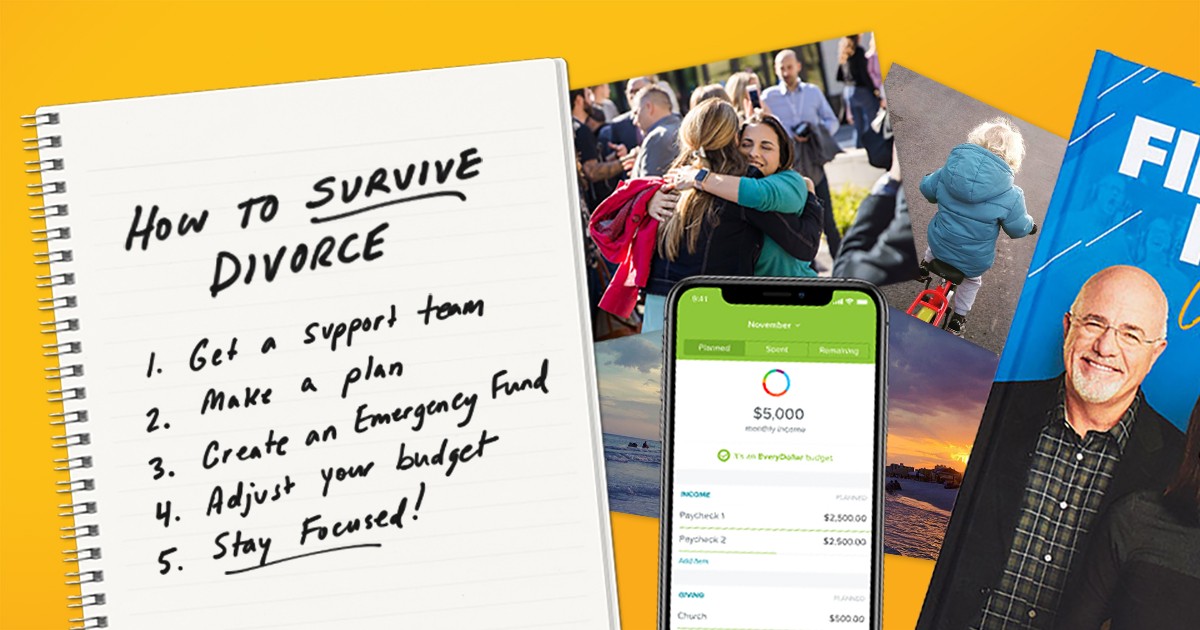

How to Survive Divorce: Protect Yourself and Your Finances

7 Min Read | Apr 21, 2025

Coming in right behind the death of a child or spouse as the most stressful life event a person can experience is divorce. And for those who have been through one, there’s no doubt it can feel like its own sort of death.

Whether the decision to divorce happens suddenly or gradually over time, one thing is pretty much guaranteed: Many things are about to change.

Know what else is guaranteed though? You will survive this. That’s right, there is a light at the end of the tunnel. And getting or keeping your finances in order during this time is one positive way you can protect yourself and your future as you move forward. So use these steps as a road map, and remember, you’ve got this.

Step 1: Get a Team Together

Repeat after us: I am not alone.

Divorce can feel like the loneliest place in the world. Some days (or weeks or months) you might feel like crawling under the covers and never coming out again. So having a team of people you can turn to for help is important.

Put pen to paper and write out who you want on your support team. Consider each area of your life as you make your list—because every part of your life is touched by divorce.

- Find a trusted family member or friend you can talk to for emotional support.

- Reach out to a work buddy and take walks together on your lunch break.

- Hire a divorce attorney who listens to you and can provide sound legal advice based on your situation.

- Check in with your certified public accountant (CPA) or financial planner and let them know what’s going on. They’ll have walked many clients through a divorce and can help you make solid decisions about your money during this time. A lot of things can change with your finances during times like these—things like finding a new job, paying alimony and child support, and filing taxes after divorce. If you don’t have a financial planner or tax pro, we can connect you with one of our vetted experts.

- Meet with your insurance broker and talk about different options for home, life, auto or any other policies you need moving forward.

- Schedule time with a counselor, social worker or minister to talk through the things you just can’t imagine talking about with anyone else in your life.

Step 2: Make a Plan

You know what chaos doesn’t love? A plan.

And while having a plan doesn’t mean everything will always go as planned, it’s a really helpful starting point.

Millions of people have gotten out of debt using our proven plan, and do you know how they did it? They started with a budget. A budget is a plan for your money. It lets you tell your money what to do so you don’t wonder where it went.

Now, it’s definitely not so cut-and-dry with a divorce. But like a budget, a plan for what needs to be done can change the impossible into the doable.

You’re going to need your team for this plan—because guess what? You’re not responsible for getting everything done yourself. (Unless you’re some magical unicorn that’s part-lawyer, part-CPA, part-insurance agent and part-therapist, in which case, we’d hate to see your student loan bills!)

Make a list of what needs to be done. Not everything needs to be done immediately, and you may find out from your team that some things don’t need to be done at all. Here are a few things you might want to add to your plan:

- Gather all the financial information you can, including tax returns, real estate paperwork, and retirement and other investment account statements.

- Check with your attorney first, but you may need to open new checking and savings accounts or remove your future ex-spouse from existing accounts.

- List all outstanding debt.

- Update insurance policies and change beneficiaries.

- Make or update your will, medical power of attorney, and durable financial power of attorney.This is especially important if you have children.

- Make a list of any irreplaceable items you want to keep, like antiques, heirlooms or photo albums.

- Map out your children’s schedules so you can plan for who needs to be where and when, plus who will be responsible for getting them there.

- Open a P.O. box if you need your mail to go to a more private location.

Step 3: Create an Emergency Fund

It’s safe to say a divorce is an emergency. One of the best ways you can protect yourself and your finances during this time is by getting an emergency fund in place.

The Dr. John Delony Show helps people through real-life marriage challenges. Listen now!

If you’re following the 7 Baby Steps, then you know Baby Step 1 is saving $1,000 for your starter emergency fund. Get that in place as fast as you can. (Here are some tips for how to save that first $1,000 ASAP.) The unexpected almost always happens during a divorce, and knowing you don’t have to swipe a credit card to take care of it brings so much relief.

Baby Step 2 is paying off all debt, except your home. If you’ve been working your debt snowball and attacking your debts smallest to largest, it’s time to press pause. It might feel like you’re taking a step backward, but you’re not.

Divorce isn’t cheap. Right now, you need all the extra income you can get. Continue making minimum payments on your outstanding debts while you stockpile cash. Once everything is finalized, you can return to debt snowball attack mode.

Step 4: Adjust Your Budget

Selling your house and stuff, alimony, lawyer fees and child support, not to mention moving from two incomes to one—these are just a few of the financial situations that usually come with a big, fat question mark during a divorce. So one of the smartest things you can do is map out a new budget, keeping in mind that it’s very likely to change month over month until the dust settles.

Create your monthly budget before the month begins, and tell every dollar where to go. We call this zero-based budgeting, meaning your income minus your expenses should equal zero.

Again, right now your focus is on stockpiling cash. So anywhere you can cut back or save more, do it.

Step 5: Take a Deep Breath and Stay Focused

Easier said than done, right?

It might be cliché, but don’t forget to put the oxygen mask on yourself first. In a divorce, it’s likely you’re going to suddenly have a lot of people looking to you for direction, answers and money. You’ll be able to make your best and clearest decisions about your life and money when you can take a moment each day to inhale, exhale, repeat.

Start small. (We do call them Baby Steps for a reason, after all!) Begin reorganizing your finances and prepping for the future using one (or all three) of these methods:

- Talk to a trustworthy financial coach. They won't judge. They will walk with you through this.

- Reach out to one of our SmartVestor Pros who can teach you how to best care for your current assets and investments.

- Take Financial Peace University to learn how to get your finances back on track in this new season.

Remember, you aren't alone, and everything you’re doing now is going to help you build a new future.