Elder Fraud: How to Protect Seniors From Scams

12 Min Read | Nov 11, 2024

Okay guys, picture this: Your parents have worked hard their whole lives and have a nice little nest egg set aside to enjoy their retirement years.

Then one day, someone calls or emails them from the IRS or somewhere else super official-sounding, and your parents share private financial info with the mystery person on the other end of the line. And before you know it, a scammer has drained their bank account.

It sounds like something that would never happen to your family, right? Well, sadly, things like this happen every single day to thousands of older Americans. Elder fraud is big business for cyber criminals. People over 60 lost $1.7 billion—or more than $18,000 per victim—to internet scams in 2021 alone.1 Yes, billion. That’s terrible, you guys!

Here’s the thing, folks like your aging parents and grandparents are at a much higher risk for being scammed or defrauded out of their money because they might not be as tech saavy as young people.

But you can help protect your older loved ones from elder fraud and marketing ploys meant to steal their money. Now, talking to your family about their money isn’t always easy, but it really is an act of love when you do. So I’m going to walk you through the most common scams on the elderly so everybody’s on the same page.

What's your risk of identity theft?

Take this quiz to assess your risk.

10 Most Common Elder Fraud Scams

There’s straight-up fraud (like someone stealing your grandma’s bank account information from her mailbox), and there’s also just gross marketing strategies aimed at seniors to get them to buy things they don’t need (like prepaid funerals). We’re going to cover it all so you can help your older loved ones avoid these traps.

1. Tech Support Fraud

This one’s a biggie right now. Scammers impersonate tech companies and then email or call saying you need to pay to fix a phony tech issue or sign up for a subscription for a fake security service. They also might impersonate a customer service rep for a utility company, a government agency or a bank and tell you there’s a problem with your account and they need personal info to fix it.

Try 30 days of identity theft protection free from our RamseyTrusted provider.

These scammers will try any means possible: email, phone, text, social media, snail mail, you name it.

But remember, no government agency, including the IRS, will ask for personal information over the phone. And in general, one of the best ways your older loved ones can protect themselves is to never give their personal information to anyone unless they know exactly who the person is and why they need it.

2. Stolen Tax Refunds

Tax identity theft is one of the top scams the IRS deals with each year. Scammers steal someone’s Social Security number, file taxes using the stolen identity, and then steal the tax refund. Yuck. These people are lower than low. They’ll happily steal your parents’ refund but certainly won’t be stepping in to help if they owe money!

One of the very best ways to prevent tax identity theft is to file your taxes as early as possible. Encourage—or even help—your older loved ones to file as soon as they can. The sooner they file and get their refund, the sooner they’re not a target.

3. Mail, Email and Phone Fraud

Part of the reason the elderly are a target for scammers is because they can be easier to reach. While younger generations head off to work each day or are tied up with other commitments on nights and weekends, older folks just tend to have a little more time on their hands.

That means they might be home in the middle of the day to answer a robocall or chat with a smooth-talking phone scammer. And these phone scammers are good. They sound official and often use fear (“It’s not safe to go without our medical coverage”) and urgency (“We won’t offer coverage at this rate ever again”) to get older folks to give out personal or financial information.

The same goes for email and mail fraud. Fraudsters are banking on older folks not being as tech savvy and will use email as a way to get access to sensitive information. Or scammers will send “official” paperwork in the mail that looks legit but isn’t at all.

A good rule of thumb here (and it might sound like a no-brainer by now) is: Don’t give anyone personal information over the phone, over email, in a mail-in envelope—nothing—if you don’t know what company they’re with and why they’re requesting this information. It’s that simple. And if a request is actually for real, then they should have no problem with you calling customer service or your personal account representative to confirm their request.

4. Health Care Fraud

It makes sense that as people age, their health care needs go up. This makes the elderly a prime target for health care fraud.

Think about it like this: If you’re young and healthy, you’re probably not interacting that much with doctors, your health insurance company, or other health care-related services. But if you’re older or have a lot of health challenges, your personal, financial and medical information is getting passed around a lot. And unfortunately, that means an increased chance of your older loved ones’ information falling into the wrong hands.

Keep a close eye on statements, insurance claims and medical bills. See a service you know mom or dad didn’t get? Call their provider and health insurance company ASAP to report the issue.

Interested in learning more about identity theft?

Sign up to receive helpful guidance and tools.

5. Reverse Mortgages

Some people are out to steal identities so they can nab your older loved ones’ money. But more often than that, there are just a ton of sleazy businesses out there that aren’t technically doing anything illegal, but they’re more than happy to con your loved ones out of cash. And reverse mortgage lenders are the perfect example.

Okay, first of all, when it comes to reverse mortgages, the name says it all. You’re going in reverse! And hello, don’t we want to be going forward? Yes! So, reverse mortgages are a big, fat N-O.

With a reverse mortgage, you’re getting a loan that uses your home equity to provide the money for the loan itself. Reverse mortgages are only available to people 62 and older. (Right out of the gate, this is a setup for seniors.) It’s like this: Instead of making payments on a home loan like you would with a traditional mortgage, you’re taking payments out of the equity you’ve built. The bank is lending you back the money you’ve already put into your home and charging you interest. See? Big, fat N-O.

Not only are reverse mortgages a black hole of fees, but your older loved ones could also end up owing more on their home than it’s worth, or worse, losing their home altogether.

6. Gold and Silver Scams

These gold and silver sales pitches you see every 10 seconds on TV are designed to prey on fear that the economy will crash, and you’ll need gold to survive. Or they’ll say gold is the sure-fire way to make a fortune.

The people hawking commodities are bottom feeders. Many will tell you they bought gold or silver for you that they’ll store in a safe place until you need it. But really, they’re just taking your money.2

But even if you find a reputable precious metals dealer, there’s no reason—zero—to buy gold or silver. It’s a horrible investment.

Okay, say a zombie apocalypse happens and the economy goes belly up. Of course zombies don’t carry cash, so wouldn’t we all be bartering for shelter and food, not trading in little gold bars? I mean, that’s what I would be doing! Help your older loved ones by encouraging them to invest their money in mutual funds instead.

7. Accidental Death Insurance

Here’s some quick real talk. You only die once. That’s right, it’s crazy but true. Anyone trying to sell your older loved ones on accidental death insurance is basically trying to convince you of double-death. Sorry, that’s not a thing.

You don’t need accidental death insurance, which pays if you die in an accident. How you die doesn’t change your family’s financial needs. A great term life policy will meet their needs. Your loved ones are wasting money for double coverage if they buy accidental death insurance.

8. Prepaid Funerals

Yes, preparing for future expenses is always a good idea. But preparing and prepaying are totally different things.

It’s normal to think more about death (and the expenses that come with it) as you get older. So it’s not totally crazy if your parents or grandparents are thinking about prepaying for their funeral. But prepaying for funerals is actually a waste of a good investment opportunity.

Help your older loved ones skip the prepaid funeral. (It’s a sales gimmick for people in the funeral biz to get cash on hand now.) Then set them up with a qualified investment professional who will teach them how to invest and grow their money. When the time comes for a funeral, there will be more than enough for the funeral and then some.

9. Cancer Insurance

Disease-specific coverage just isn’t a thing your loved ones need. Again, it’s a way for businesses to cash in on fear, selling your family something you probably already have coverage for somewhere else. Think about it—do you have heart attack insurance? Stroke insurance? Broken arm insurance? No. Because most insurance policies already cover those types of events. And it’s the same with cancer.

If your older loved one’s insurance policy doesn’t cover cancer care, I still don’t recommend getting cancer insurance. Instead, get with one of our health insurance experts who can help your loved ones pick the best policy for their needs. Don’t go buying specialty coverage though!

10. Other Family Members

Let’s face it, just about every family’s got a wild card (or two, or three). Maybe mom and dad turn a blind eye to your 40-year-old brother’s can’t-keep-a-job antics and still pay his rent for him. Or grandma and grandpa have been bankrolling your Aunt Sally for decades. It’s really tough when it comes to family to keep a clear head.

But it’s also really important that your family’s wild card doesn’t derail mom or grandma’s lifetime of working and saving. There needs to be at least one person in the family keeping a close eye on things and helping your older loved ones make important financial decisions with their head instead of their heart.

Help your older loved ones name a financial power of attorney. This is usually done when people are creating a will, but you can do it at any time. A financial power of attorney is a document that allows someone to make money decisions on your loved ones’ behalf in the event they can’t make those decisions for themselves.

Say grandma’s been in a car accident and is in a coma. Her financial power of attorney is legally able to take care of her money matters, like paying the mortgage and hospital bills when she can’t. It’s not a comfortable conversation to have, I know. But when push comes to shove, you want a reliable person in that position.

How Can You Tell if You’re Being Scammed?

New elder scams pop up all the time, but most have some things in common. So, alarm bells should go off if you or your loved one encounters some of these scammy traits:

- An email that appears to be from a real organization, but has a fishy email address

- A notification that you won a contest you didn’t enter

- A call or email from the IRS that requires personal info

- A call or email that asks you to pay a fee or fine with a gift card or wire transfer

- A caller who pressures you to make a payment or give them personal info

What Do You Do if You’ve Been Scammed?

If you or a loved one has been a victim of fraud, contact your bank immediately to report any suspicious transactions. It’s also a good idea to call the National Elder Fraud Hotline (1-833-FRAUD-11) to report the crime.

What Are the Emotional Effects of Elder Fraud?

Getting scammed can make your loved one feel embarrassed, sad and anxious. Don’t let them beat themselves up for getting tricked. Walk with them through their emotions, and try your best to help them see the light at the end of the tunnel.

The Best Way to Protect Older Loved Ones From Elder Fraud

Talking about elder fraud and scams with your loved ones is so important. Is it fun? No, usually not. Is it a way to show them how much you care? Yes, 100%.

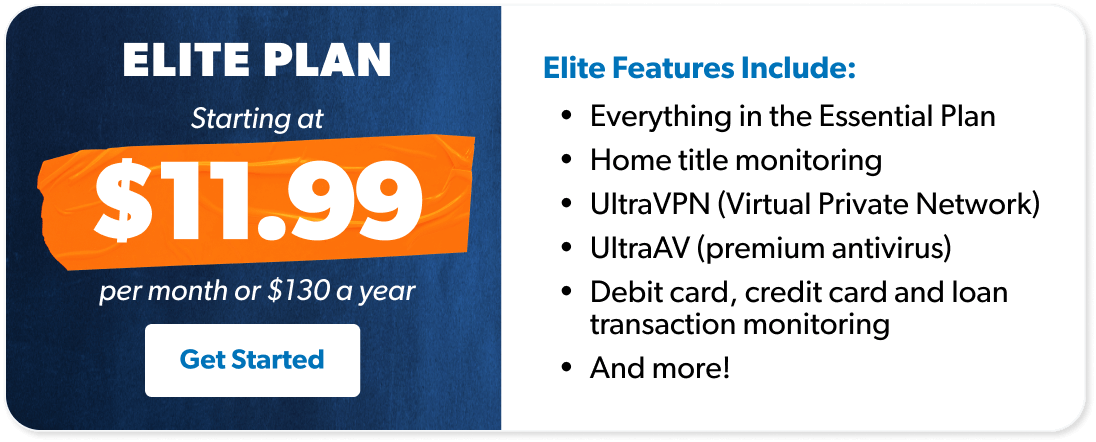

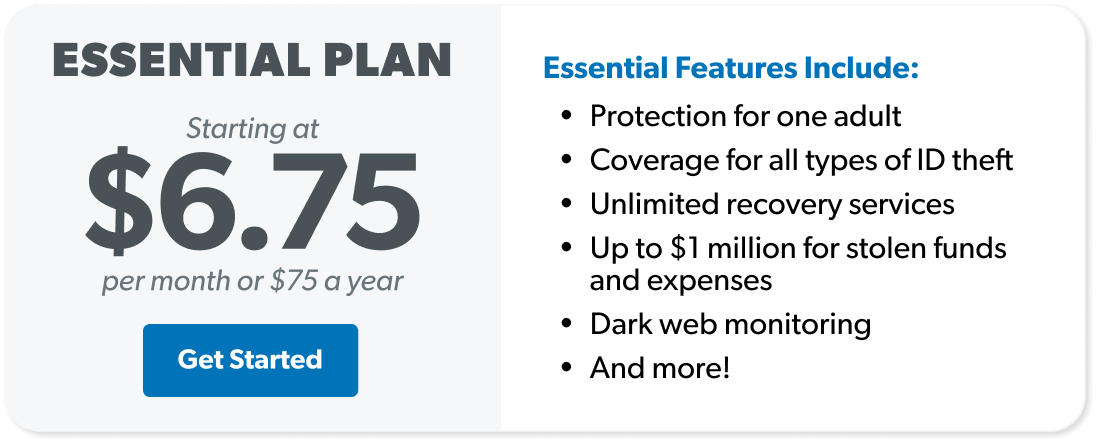

One of the most important steps you can take to protect your parents or grandparents from different kinds of elder fraud is to set them up with identity theft protection. I recommend working with RamseyTrusted provider Zander Insurance. With identity theft protection in place they can focus on what they’ve spent a lifetime working to enjoy—retirement, vacations, time with grandkids and so much more. You can help them get and stay protected today!

Frequently Asked Questions

-

How do you identify elder fraud?

-

It’s not always easy to know if your loved one has been a victim of elder fraud. And honestly, scammers sometimes get the best of us. So, having identity theft protection is key.

But you might spot some other signs that something is amiss—like if grandma suddenly doesn’t have money to pay her bills because her bank account is short. Don’t be afraid to ask your loved ones questions about their finances or go over their budget with them. You could find out they’ve been victimized.

-

How common is elder fraud?

-

In 2021, more than 92,000 people over the age of 60 were victims of online scams. This was a 74% increase from 2020.3 This doesn’t even include the thousands of fraud cases that go unreported each year.

-

What kind of fraud is the fastest-growing form of elder abuse?

-

Tech support fraud was the most common type of fraud among victims over age 60 in 2021. This type of fraud, which usually has victims pay for nonexistent tech or security services, resulted in $238 million in losses.4