9 Common Types of Fraud

16 Min Read | Mar 17, 2025

Fraud is a broad term. It covers everything from a guy in a suit selling bogus investments, to a faceless voice on the phone convincing an old lady to hand over her money because he claims he’s from the FBI. But it’s all got one thing in common: someone deceiving someone else and gaining from it.

The best way to protect yourself from fraud is to educate yourself—learn to smell the fishy smell. That way, when a bad guy (or girl, to be fair) tries to slip through your defenses, you’ll know something’s off.

So, let’s gear up our noses and learn about some common types of fraud.

Key Takeaways

- Common types of fraud include imposter fraud, debit and credit card fraud, mail fraud, job scams, bank account takeover fraud, stolen tax refund fraud, investment fraud, internet fraud, and elder fraud.

- Fraud can include scams, but if you willingly hand over your money to a scammer, banks and identity theft protection won’t reimburse you.

- Your best protection is being alert to the signs of fake websites and email addresses, researching companies and people, learning to recognize emotional manipulation, installing antivirus software, and getting an identity theft protection plan.

Common Types of Fraud

Sadly, fraud is all too common in our world today. From internet fraud to bank account fraud, Americans’ personal information is more vulnerable than ever.

People ages 30–39 report the most instances of fraud losses, with more than 130 loss reports per 100,000 people and a median loss of $479. But the older you get, the more expensive the losses get, with folks over 80 experiencing a median loss of $1,500.[1]

Here are nine types of fraud you need to watch out for:

Knowing the different types of fraud and following these tips to avoid being a victim can help you protect your identity and cash.

Scams vs. Fraud

Real quick before we move on—I want to clear something up. When talking about fraud, types of scams inevitably come up. But they’re not exactly the same thing. The government tends to lump scams and fraud together. Under fraud’s broadest definition (someone deceiving you for personal gain), scams are a type of fraud. But banks don’t see it that way, and that’s who you usually have to deal with in these situations.

Banks generally separate the two into these definitions:

- Fraud: the use of your personal sensitive info without permission

- Scam: a scheme to manipulate you into giving away your money or sensitive info

Scams (like fake sweepstakes entries) are used to gather your sensitive info and then that info is used to do things like open a new account (fraud) or take what’s in your account (theft).

If you fall for a scam and mail $50,000 in a shoe box to a Walgreens in another state, your bank won’t help you. And neither will identity theft protection (IDT) plans. If you mail someone your Social Security number on the other hand, a good IDT plan will help you sort that mess out.

My list of common types of fraud includes both scams and the stricter definition of fraud.

What's your risk of identity theft?

Take this quiz to assess your risk.

Imposter Scams

These stories sometimes make headlines. “Retired Woman Hands Over Life Savings to FBI Imposter.” Many people think they’d never fall for these types of scams, but with the emergence of AI voice cloning, you could get a fake call from your “son” telling you he’s in trouble and needs you to wire $10,000—and you might actually do it.

Try 30 days of identity theft protection free from our RamseyTrusted provider.

Losses from imposter scams in the first three quarters of 2024 topped $2.1 billion.[2]

Most often, imposters are posing as government agents from places like the FBI, CIA or IRS. Sometimes, they spend months grooming you to believe their fake identity before they actually ask you to give them something.

This is also the category where you find Nigerian princes, vehicle warranty department professionals, aid workers, tech support guys, package delivery companies and romantic partners that never materialize.

How to Protect Yourself From Imposter Scams

It’s important you’re vigilant about these because if you get duped and hand over money, not a lot can be done for you—the banks won’t help you, and IDT protection won’t help you. You’re on your own.

First off, be really skeptical. If someone on the phone, in an email, or in a text is claiming to be someone and you’re not 100% sure about them, double- or even triple-check. The government will never contact you out of the blue with wild requests. You can always look up the actual person or agent and call them with a number that you found from the official site.

It’s important to note that legit phone numbers can be spoofed, meaning the incoming call may look like the accurate number. So when in doubt, ask if you can call back, and use the legit phone number you find online. If they refuse to let you call back or get flustered, that’s a classic sign of a scam.

Also, talk to someone else! Run the request by a person you trust. Sometimes, two noses are better than one. Ask your bank—they’re experts at recognizing fishy transactions. Any legitimate request will never come with requirements to not tell anyone. But scammers often try to isolate you in the deception by telling you it’s vitally important you don’t tell anyone about it.

If someone you know is contacting you but something feels off, call them with a number you know to be theirs. Don’t give them anything until you’ve absolutely made sure it’s them and not a scammer. (And even then, you’re allowed to say no if you want. Boundaries are brave.)

Debit and Credit Card Fraud

When a thief gets access to your debit or credit card number, you don’t have to second-guess it—that’s fraudulent activity. And the banks will agree. This can happen when the card number or the physical card itself is stolen.

Sometimes, fraudsters don’t take the direct route. There’s a new scheme out there called refund phishing. A criminal steals your card number, but instead of going right for the money they can get off your card, they purposely make a purchase from a fraudulent website they’ve set up.

When you notice there’s a purchase you didn’t make, they hope you contact the fake company to dispute the purchase so they can trick you into sharing sensitive account details—which gives them more ways to steal from you than just the card.

How to Protect Yourself From Debit and Credit Card Fraud

I recommend monitoring your bank account on a weekly basis. That way, you’ll catch any unauthorized charges on your bank or credit card statements and can contact the card issuer right away so they can cancel the card and send you a new one. (If it’s a credit card, I’d recommend cancelling it and telling them they can shove the new one into a wood chipper. If you know, you know.)

Guard your cards carefully to make sure no one steals your numbers. Chip cards are more secure than those with only the magnetic strip.

You should also be cautious about using ATMs anywhere other than your bank. Hackers can sometimes tamper with these third-party ATMs with devices called skimmers that steal your information.

And remember: Never store your card numbers online. Instead, consider using a service like PayPal or Privacy.com to avoid putting in your actual debit card number when paying for things online.

Internet Fraud

Internet fraud is a blanket term—a blanket the size of Texas. It covers anything fraudulent done using the internet. So that’s going to be a lot of stuff. We’re talking stuff like:

- Phishing

- Smishing

- Data breaches

- Malware

- Online consumer fraud, like fake website scams

- Email account compromise

- Social media scams, like fake influencers and giveaways

There are other kinds of internet scams and fraud too. The FBI reported that online fraud likely led to losses of over $12.5 billion in 2023.[3]

How to Protect Yourself From Internet Fraud

You can help keep malware and other identity-stealing viruses at bay by staying up-to-date with your antivirus software on your computer and phone. When it comes to phishing and smishing scams, be on guard anytime you see an email or text asking you for personal information. And always read and reread links to make sure you’ve been directed to the official website and not a scam site.

Job Scams

One of the most common deceptions out there is fake job ads. When scammers post these, they’re often hoping to get your personal info so they can steal your identity. Or they take your money by requiring you to purchase equipment or training that doesn’t exist. Sometimes it’s worse, like they’re running a human trafficking ring.

Here are some common job scams:

- Pyramid scheme: Nobody’s making any money except a few people at the top.

- Online data entry: If someone tells you you can make six figures doing data entry at home, run.

- Personal assistant scams: After you’re hired, you get a check from your boss to cover some expenses—except the check is too big and you have to reimburse them for the extra . . . and the check bounces.

- Reshipping scams: How do criminals move their stolen goods? Convincing people to repackage and ship them from their homes. Payment never materializes.

How to Protect Yourself From Job Scams

These types of scams usually come with some telltale signs:

- Too good to be true

- Poor grammar and spelling

- Too urgent

- No request for work verification

- Generic email address

Respect your sixth sense when it comes to job offers. If something smells like sardines, it’s probably rottener than a cracked tin of tuna. You can always ask for more information, and if they don’t get any more concrete than vague promises of Prince Ali-level wealth, run. Finally, do your own research. AI is making it easier for criminals to create convincing websites, so this part is really important. If the email address looks off, check it out. Research the company online extensively. Scam companies usually don’t hold up under a magnifying glass.

Bank Account Takeover Fraud

One of the worst types of fraud to clean up is when a thief gets access to your bank account. This can happen pretty easily just by someone stealing a check out of your mailbox, getting ahold of your account info through an email scam, or (if you’re really unlucky) using malware to gain access to all of your personal information.

This type of fraud can completely drain your bank account if you don’t act quickly—and you might never get that money back. Be sure to monitor your account statements on a regular basis and keep an eye out for any transfers you didn’t authorize.

How to Protect Yourself From Bank Account Takeover Fraud

It should go without saying, but never log in to your bank account from unsecured Wi-Fi (checking your account balances while hanging out on JFK Airport’s Boingo Wi-Fi is a big no-no). And always check to make sure it’s actually your bank’s website you’re logging in to instead of a scam site built to look like the real thing.

Thankfully, this kind of fraud is covered by some IDT protection, like the one we recommend below. And if you go with the Elite plan, they also monitor your account for takeovers so you don’t have to.

Interested in learning more about identity theft?

Sign up to receive helpful guidance and tools.

Tax Refund Fraud

It might be hard to believe anyone would voluntarily go near taxes—but criminals do! They steal your Social Security number and then file for a giant tax refund on your behalf. You better believe it won’t be accurate, so not only will you not get your tax refund, but it’ll also look like you were the one committing fraud! You’ll catch it when you send in your real return and it’s rejected by the IRS because you’ve “already filed.”

During tax season, you’ll hear a lot about the importance of filing your taxes early. Why? Part of the reason is to avoid tax fraud! It sounds crazy, but this kind of identity theft happens more often than you’d think—in the 2023 tax season, the IRS identified over 2 million tax returns as potentially fraudulent.[4]

How to Protect Yourself From Tax Refund Fraud

So, what’s a law-abiding taxpayer to do? Be vigilant about who and where you give your personal information. Play it safe and use security software on your computer. And don’t ever carry around your Social Security card or anything with your Social Security number on it—including your W-2! Keep it all in a safe place.

Investment Fraud

After months of texts back and forth, the man of your dreams (who you haven’t actually met in person) suggests you invest in this stock. He wants to help you, after all.

Ding ding ding! Alarm bells. (Really, they should’ve gone off a long time ago when he refused to meet up.)

This is just one of many types of investment scams that are all based on someone trying to get you to invest in something that’s worthless—whether it’s stocks, a business, currency, real estate or even training on how to invest.

Here are some common types:

- High-yield investment programs: Fraudsters sell investors on stocks with promises of crazy high returns. If it sounds too good to be true, it is.

- Ponzi schemes: Scammers take money from one guy’s “investment” to pay out another—until they run out of new investors.

- Pump and dump: A scammer convinces a group of people to buy a worthless stock at a high price (because it’s going to be such a great investment, of course). Then, the scammer turns around and sells all their own stock for the inflated price. As soon as the scammer dumps all the stock, its value drops, and you’re left with worthless stock. This is a common trend in the crypto world lately.

- Unsuitable financial products: A financial advisor might actually sell you a legitimate investment—but it’s also legitimately sucky. It could be something that earns them more money than it does you, or maybe they earn tons from fees, while your investment isn’t even growing fast enough to keep up with inflation. I actually group any kind of permanent life insurance in with this type of scam.

How to Protect Yourself From Investment Fraud

This is another one that banks and IDT protection won’t help you with. If you get snookered by one of these scheming scammers, your money is gone, and there’s pretty much nothing you can do to get it back. So, what can you do?

Avoid anything that sounds too good to be true. This investment will consistently earn you big money? Walk away. This person magically knows your retirement and investing needs? Run. Someone says they’re the only ones who have access to this amazing investment opportunity but you have to sign right now? Slam the door in their face.

If you have any questions about the legitimacy of an investment, you can check up on the salesperson’s licensing. Scammers are often not registered to sell securities, or they’re trying to sell unregistered securities.

Mail Fraud

This is another one of those blanket terms. Mail fraud is any fraudulent activity that involves the use of postage mail. This could mean stealing and opening someone else’s mail, using chain letters to collect money or items, or sending a fake donation request letter for Bruce’s Abused Baboons Fund to try to scam money or personal info.

Basically, if snail mail is used at any point in the fraud process, it’s considered mail fraud.

How to Protect Yourself From Mail Fraud

The best way to guard against mail fraud is to make sure a letter is legitimate before responding to it. If there’s a phone number printed on what looks like a piece of official communication, verify it’s actually the phone number of the company involved and not a fake one.

A good rule of thumb when mailing a letter that includes personal information (such as your bank account number or Social Security number) is to take it directly to the post office so it can’t be stolen out of your mailbox.

And make sure you don’t leave mail out in your mailbox for too long! If you know you’ll be away for a while, try temporarily stopping your mail service or asking a neighbor to get it for you until you’re back in town.

Elder Fraud

While anyone can fall prey to any of the fraud types we’ve talked about, elderly people are targets for even more fraudulent activity specific to their age group. They’re generally known for being more trusting, good-natured and kindhearted people. And if they’re anything like my grandma, they jump at any opportunity for social interaction. (Also, friendly reminder—call your grandma.) But in general, this leaves them more exposed to types of fraud like phone scams or wire transfer fraud. Many scammers offer lottery winnings, sweepstake prizes or even health care services. These false promises help them gain access to financial and personal information.

I already mentioned it above, but elderly folks can be particularly vulnerable to imposter scams where fraudsters use AI voice tools to simulate a loved one asking for immediate payment for a lifesaving medical treatment or something similar.

How to Protect Yourself From Elder Fraud

Elderly people can also be less likely to keep an eye on their bank account information. So by the time they discover what happened to all their money, it’s too late. If you’re seeking peace of mind for the older loved ones in your life, consider getting them to sign up for an identity theft monitoring service like the one Zander Insurance offers. Zander will help them stay alert of any suspicious activity on their accounts.

Also, talk to your loved one about the new ways scammers can trick them using AI voice imitation (but you should probably cover this in person . . . so they know it’s not AI).

Don’t Be a Victim of Fraud!

Are you feeling a little world-weary now? I get it—there’s a lot of bad out there trying to get you. I’ve been gotten before, so it’s definitely a real threat. But you don’t have to rely only on your wits and ADHD vigilance with your accounts. You can rest easier if you know a good identity theft protection plan has your back.

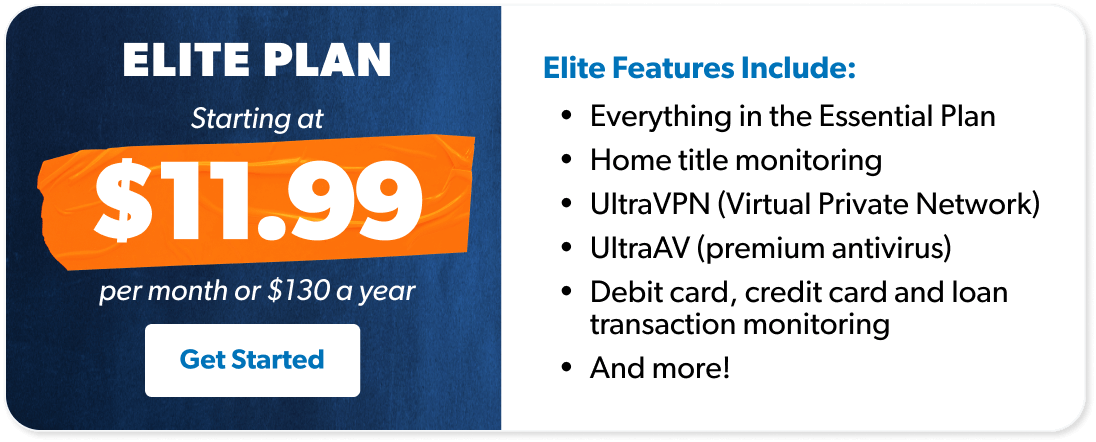

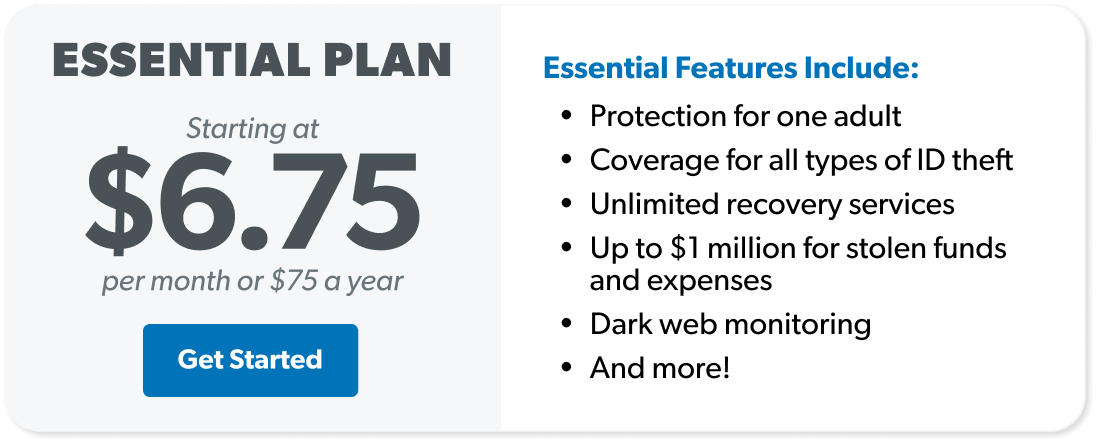

Set up a plan now to protect yourself from many common types of fraud through our RamseyTrusted® provider, Zander Insurance! They offer two plans, Essential and Elite, to give you peace of mind knowing your accounts and sensitive info are being monitored 24/7. Plus, if thieves manage to break into your account and take your cash, they’ll reimburse you up to $1 million.

Next Steps

- Learn how data breaches put you at risk.

- Read up on the best identity theft protection for you.

- Don’t leave your financial and identity safety up to chance. Get in touch with Zander to put a plan in place.