Picture a guy who wants to be smarter with his money. Naturally he looks for ways to invest. Then one day in line for coffee, he sees a beautiful woman dressed like a winner and she tells him if he puts money in fair-trade bespoke wooden drinking straws, he’ll get rich. “It’s what all the wealthy people do,” she says.

You already know where this is going. After falling for her pitch, he makes no money or (worse yet) it disappears. We usually call this kind of thing a scam . . . but in the insurance world, it’s called cash value life insurance.

Think we’re going too far? Stick around, friends. We’re going to dive deep into cash value life insurance, and it doesn’t look anything like Scrooge McDuck diving into his vault of gold.

Key Takeaways

- Cash value life insurance is any kind of life insurance that takes part of your premiums and puts them in a savings or investment account.

- Common types of cash value life insurance include whole life, universal life, variable universal life, and indexed universal life insurance.

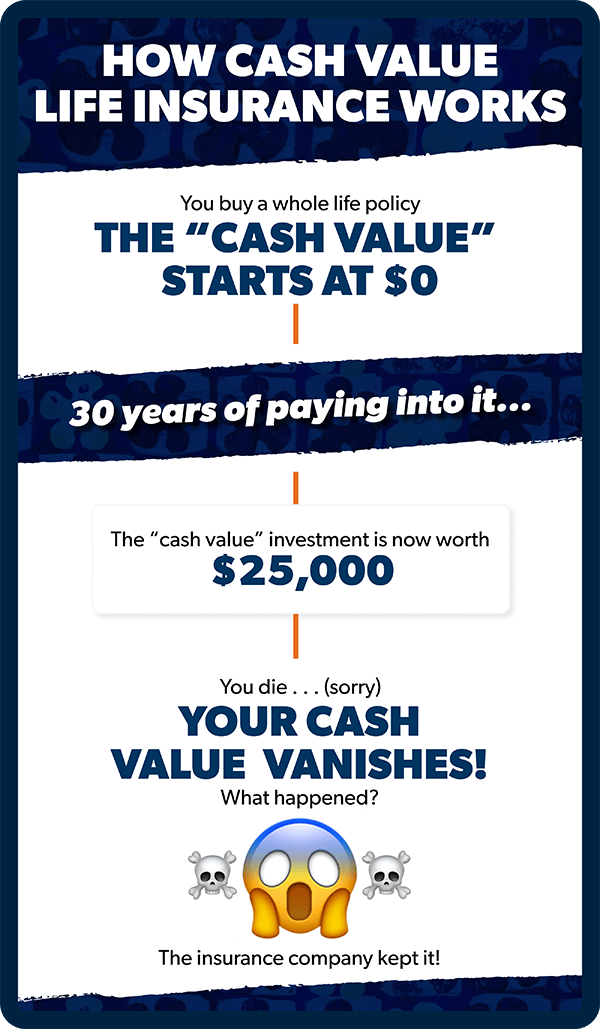

- Insurance companies like to sell these kinds of policies because they make the most money off them. One reason is if you die, your cash value goes to the insurance company, not your beneficiary.

- Since the insurance company is investing it for you (and they’re not good at investing) and they charge a ton of fees, returns on cash value life insurance are low.

What Is Cash Value Life Insurance?

Cash value life insurance is a type of life insurance policy that’s in place for your whole life and comes with a sort of savings account built into it.

Compare Term Life Insurance Quotes

So, you’re paying for two things here—the life insurance part (the bit that covers your family if you die) and the cash value part (the savings account that supposedly grows your money over time). How much it grows really depends on the type of cash value policy you buy, and what its returns are.

Types of Cash Value Life Insurance

Each of these policies works a little differently—and there’s a lot of fine print to wade through. Here’s a breakdown of each type of cash value life insurance.

Whole Life Insurance

Whole life insurance is the least flexible of the three choices we’re going to cover. Once the insurer decides on your premium, that amount gets permanently specified in your policy. You’re stuck paying that premium amount every year (or month) for, well, your whole life. A slice of that premium will go into the cash value part of your policy, and that can’t change either. You can expect your rate of return to hover around 2%—so it’ll basically just keep up with inflation. The longer your policy lasts, the more cash value you’ll build up.

Variable Life Insurance

Variable life insurance serves up an extra helping of complication because rather than giving you a guaranteed rate of return, variable life allows you to decide how your cash value is invested. This could be in stocks or bonds, for example. So, you’d be making the call, and it’s a risky one if you’re not always keeping an eye on your investments. Oh, and variable life insurance comes with crazy high fees, so don’t expect to see much cash value in the first three years! One thing they do have is fixed premiums and guaranteed minimum death benefits.

Universal Life Insurance

Universal life insurance is different (and more complicated) because it comes with “flexible” premiums and payouts. This means you have some control over how much you pay in premiums. If you’re feeling flush, you could “overpay” your monthly premium and have the difference go into the cash value side of your policy. And if you’ve built up enough of that cash value over time, this could be used to reduce your premiums (more on this later).

How much your money grows over time all depends on the type of universal life insurance you have (remember when we said it was complicated?). These types are: variable universal life, guaranteed universal life, and indexed universal life.

Indexed Universal Life Insurance

With this kind, your investment or cash value account is tied to an index fund. The percentage of your premiums going to insurance versus investment is the same as the others. If the market does well, your cash value will go up, but if it goes down, your cash value won’t go anywhere. Whatever happens, your returns will always be at best slightly below the index performance because the insurance companies love their big fat fees.

Variable Universal Life Insurance

What do you get when you take part of one bad thing and combine it with parts from another bad thing? A really bad thing. (Is this obvious to anyone?) With variable universal life insurance, you get all the risk of deciding how your cash value is invested and no guaranteed rate of return. You also get no fixed premiums or guaranteed minimum death benefit. A real winner.

Here's A Tip

Just because we don’t like cash value life insurance doesn’t mean we don’t like life insurance! If you have folks that depend on your income, you need some. We recommend a term life policy worth 10–12 times your annual income.

How Does Cash Value Life Insurance Work?

The annoying thing about life insurance is we’re paying premiums in case something awful happens—and the only way you see any of that money again is if something awful happens! Cash value life insurance plays on that feeling by suggesting you can get some of those premiums back, with interest.

(The truth is you are getting a return on that money even if you never get the insurance payout. You’re getting your family’s financial safety if you do die.)

Cash value works like this: Say you’re paying $300 a month for your cash value life insurance policy. A portion of that $300 covers the cost of actually insuring your life. The rest is put into investments by the insurance company.

The breakdown of how much they invest versus how much they put toward your policy varies over the years. In the earlier years, they put a larger percentage of your premiums toward the cash value, while in the later years, they send more of your premiums toward your policy since the cost of insurance increases as you age.

These investments are meant to build and make you money over time. As we said earlier, the rates of return on your cash value investment depend on what type of cash value life insurance you’re buying. (But they tend to suck.)

Insurance companies will point to the cash value as a positive thing. You pay your premium, part of it gets invested, and eventually you get a pile of cash . . . just as long as you’re still alive.

Wait, what?

Yep. Most of the time, if you don’t use the cash value while you’re alive, it goes back to the insurance company when you die.

And here’s a fun tidbit: If you try to get your hands on some cash from your cash value life insurance after a year, guess how much you’ll have? A big fat zero. After three years? Still zero.

During those first few years, you’ll see no cash value because of all the fees, expenses, commissions and costs you’re paying to the insurance company just to have a policy in the first place!

How Do I Access the Cash in Cash Value Life Insurance?

First off, are you willing to wait 10–15 years for some decent cash value? Because that’s how long it’ll take.

Let’s say you can wait 10–15 years to build up your cash value. How can you take it out? Well, here are your choices, depending on whether you’ve got whole life or universal/variable life insurance . . .

1. You can take out a loan against the cash value.

- With whole life: Taking out a loan against the cash value is the worst thing you can do. Why? First up, you’re going into debt, which is never a good idea. Second, you’ll have to pay interest on the loan, and if you don’t pay all of it back, your death benefit will decrease. Think about how crazy this is—you’re paying interest on a loan made up of your own money.

- With universal or variable: The same applies as with whole life insurance. Your death benefit will reduce if you take out a loan against your universal/variable cash value. And you’ll pay interest on the loan you’ve just taken out too.

2. You can make a partial withdrawal.

This is the closest you’ll actually get to taking out cash. But if you withdraw money and don’t put it back into your policy, guess what happens? Your death benefit (you know, the money that’s paid out when you die) will decrease.

- With whole life: Although you may be able to cash out a portion of the dividend paid by the insurance company, you cannot use the cash value you’ve accumulated like an ATM without surrendering the policy. That’s crazy, considering it’s your invested money. But it’s so hard to get your hands on it!

- With universal or variable: A partial withdrawal is like getting a chunk of the death benefit early. So, the amount you withdraw is subtracted from the death benefit payout at the end. You won’t get taxed on your withdrawal—so long as it’s for an amount that adds up to less than what you’ve paid in premiums.

3. You can surrender the policy.

- With whole life: This means you tell your insurance company you want to give up the policy and get the entire cash value you’ve built up in one lump sum. Sounds easy enough, right? But you’ll have to pay a fee to the insurance company, and you’ll be taxed on the amount you receive if it’s more than what you’ve paid in premiums over the years!

- With universal or variable: Surrendering your policy has the same results as with whole life. Giving up the policy and cashing in your cash value comes with fees. Oh, and don’t forget—because you’ve surrendered the policy, you’ve also ended your life insurance coverage.

4. You can sell your policy for a life insurance settlement.

- With whole life: Instead of surrendering your policy, you could sell it for a cash settlement. Cash sounds good, right? Especially if your premium is high or your kids have left the nest. But there’s a catch! (There’s always a catch.) The broker who sets you up with the company buying your policy will get a cut from your settlement amount. And when it comes to the settlement, it’ll be less than your death benefit amount. The company buying your policy (usually some sort of investment company) will try to swing this by saying that while you’re getting less money than your death benefit, you’re receiving more than whatever cash value you have. That doesn’t mean a lot since it’s your money in the first place! Keep in mind too, if your settlement is more than the total you’ve paid over the years in premiums, you’ll pay capital gains and income tax on this profit.

- With universal or variable: Selling your policy comes with similar issues to whole life. And you’ll pay taxes on the amount you’ve made in cash value if it totals more than what you’ve paid in premiums over the years.

5. You can pay your life insurance premium with the cash value.

- Whether you have whole life or universal/variable:Some folks use their cash value to pay for the monthly or annual premium itself. That’s if they’ve built up a big pile of cash, of course! But this doesn’t really fall in line with how cash value life insurance is marketed. Insurance companies push the cash value account as a way to save for retirement. But really all you’re doing is saving up money to pay them later. If this was the only option, then insurance would just suck but you’d be stuck with it. But it’s not (ahem, term life). So this is not smart financial planning.

Notice how all these ways of accessing the cash value come with a catch? You’ll either slash your death benefit, face a heavy tax, or pay a fee. Getting hold of the cash value without any consequences to you isn’t in the insurance company’s interests. It’s how they make their money, and yet another reason to stay away from cash value life insurance.

Get Term Life Insurance Rates from Zander Today!

RamseyTrusted partner Zander Insurance will get you rates from top life insurance companies and pair you with the one that fits you best.

Is Cash Value Life Insurance a Good Way to Boost My Retirement Income?

This one’s easy: No! One of the worst things you can do is buy cash value life insurance with the hopes of it helping you in retirement. The returns will barely keep up with inflation, and you’ll get hit with tons of fees and commissions.

You’d be much better off buying a term life policy and investing 15% of your household income into good growth stock mutual funds through a Roth IRA and/or 401(k).

What Happens to the Cash Value When You Die?

By now you’ve probably gotten the hint—cash value life insurance is a total waste of money. But we haven’t even hit the worst part! As a cash value policy is normally set up, the only payment your family will get is the death benefit amount. If you haven’t taken extra steps to make sure the cash value goes to your family, any cash value you’ve built up will go back to the insurance company.

Just let that sink in.

You faithfully invested your whole life only to leave all that money to the insurance company. Doesn’t sound right, does it? But that’s how insurance companies make the most money, and that’s why they’re so quick to sell you cash value life insurance.

The Difference Between Cash Value and Term Life Insurance

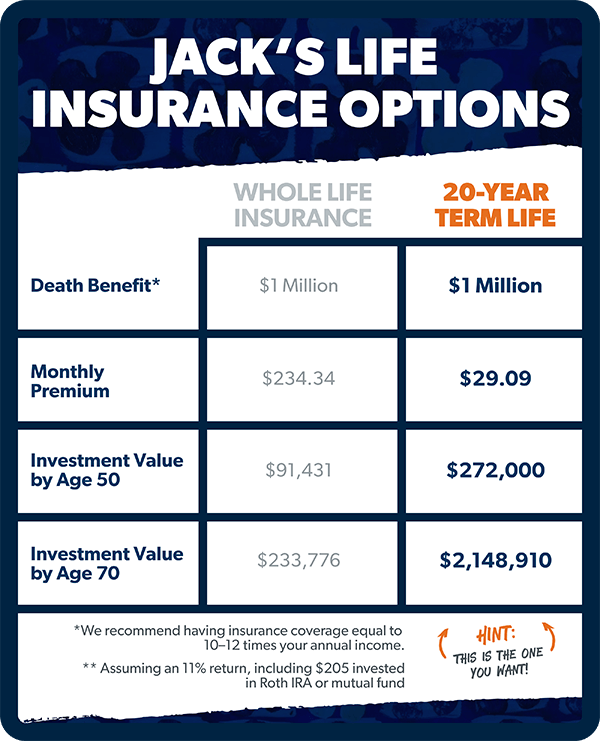

Let’s talk about Jack. He’s 25 years old, doesn’t smoke, is pretty healthy, and wants life insurance. But he’s really confused with all the options out there. (Aren’t we all, Jack?)

He heard that a term life insurance policy is different because it only lasts for a certain amount of time (we recommend 15–20 years). He knows a term life insurance policy is just life insurance and no cash value, so that makes it cheaper. Jack ain’t no sucker! But he wants to make the most of what he does have. So what are his options?

When it comes to Jack’s death benefit, term life offers almost four times as much coverage. But he’s only paying $29 a month for it! If he follows our advice when it comes to investing and paying off his debts, he would be self-insured by the time he reaches retirement.

The biggest difference between a term life insurance policy and a cash value policy is the price he would pay every month. Even though he’s putting some of the $234 of his cash value premium into investments, it’s not going to make him as much in the long run compared to investing outside of his life insurance policy.

Monthly Estimate

0 - 0

What Life Insurance Does Ramsey Recommend?

We always say not to buy life insurance as an investment! That’s not what it’s for—and it’s a lousy way to invest.

In recent years, more people have been buying cash value policies, so it’s even more important for us to say this loud and clear: With cash value life insurance, you’re throwing away more of your cash while you’re still alive when you could be saving and investing it somewhere else for much more return.

If you’re in debt and think cash value life insurance will help you down the line, it won’t. You (and your family) will be better off getting a term life policy and putting 15% of your household income into a Roth IRA or 401(k) that offers good mutual funds instead. It’s the smart way to make your cash work for you!

If you’re like, Heck yeah—get me some of that now! but don’t know where to find it, we recommend Zander Insurance. They’ve been serving Ramsey folks like Ryan B. for 20 years. They found him a policy for $19 less than the other guys.

“Seeing how Zander got me about 30 quotes in 30 seconds, and I got to choose the best one, I’ll roll with Zander,” Ryan said on the Ramsey Baby Steps Community Facebook group.

Next Steps

- Learn more about how cash value life insurance stacks up against a better option, term life insurance.

- Learn more about what life insurance should really do for you.

- Calculate how much term life insurance you need.

- Get in touch with a RamseyTrusted insurance expert from Zander Insurance and get a free quote today.

Learn the Smarter Way to Do Life Insurance

Life insurance can feel freakin’ confusing. Sign up to get Ramsey’s no-nonsense advice, including free access to Dave’s video from Financial Peace University (normally $80), plus guides and resources sent right to your inbox.