How to Pay Off Student Loans Fast

You don’t have to live with student loan debt forever. Find out how to ditch your student loans fast!

Find out how long it will take to pay off your student loans—and how you can save yourself

time (and interest) by boosting your monthly payment.

Got more debts than just student loans? Use our debt snowball calculator.

Watch our student loan livestream replay and find out what to do now that student loan payments are back.

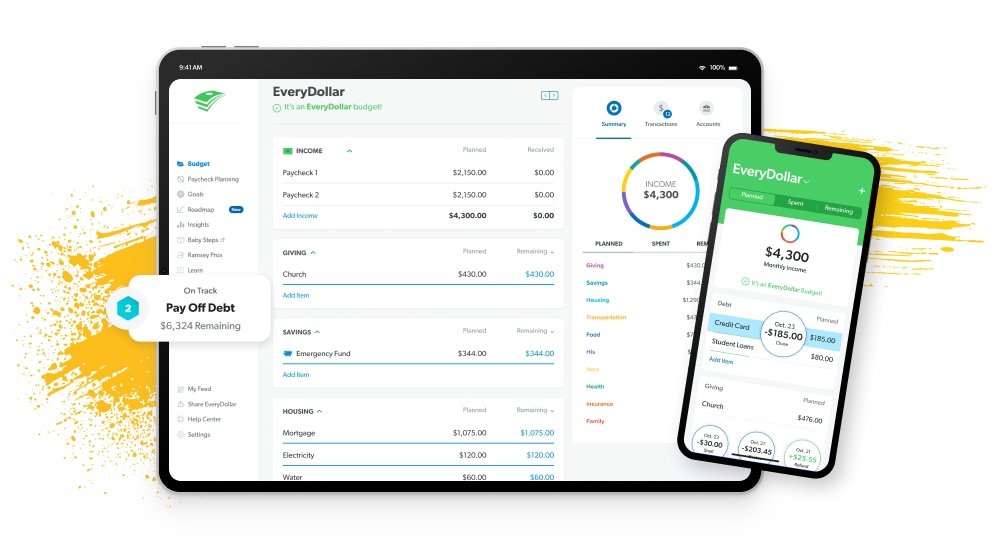

Confidently cover your payment and pay off your loans faster with EveryDollar.

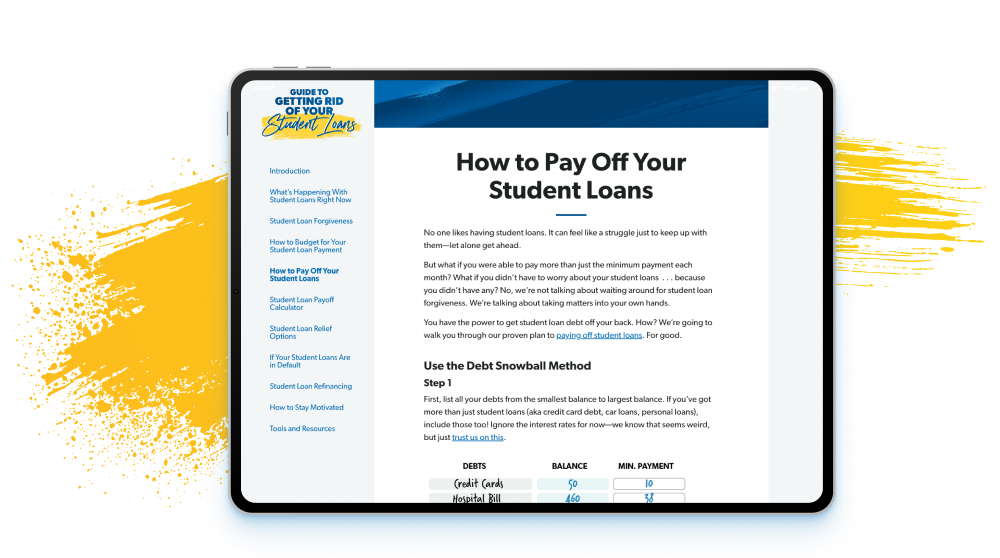

Learn how to ditch your student loans once and for all with this in-depth guide.

No sweat—we know keeping track of your student loans can be confusing. If you have federal student loans, you can log into your studentaid.gov account to see who your loan servicer is, your current loan balance, your interest rate and more. If you have private student loans, you’ll need to contact your specific lender(s) to get your loan information. If you don’t know what private student loans you have, you can request a free credit report to find out.

Kudos for asking this question! The fastest way to pay off your student loans (and any other debt you may have) is with the debt snowball. Here’s how it works:

Step 1: List all your debts (including your student loans) from smallest to largest, regardless of interest rate.

Step 2: Make minimum payments on all your debts except the smallest.

Step 3: Throw as much money as you can on your smallest debt (that means paying more than the minimum payment).

Step 4: Repeat until each debt is paid in full and you’re debt-free!

When you pay more than your minimum monthly payment, be sure to let your student loan servicer know that you want the extra payment to go toward the principal. Otherwise, they may just put it toward the next month’s interest. (It’s their sneaky way of trying to keep you in debt longer.)

There are lots of ways to make extra payments on your student loans—like taking on side hustles, cutting back your spending, and saving money in other areas. Just get creative and use the time and talents you already have.

Yeah, it’s going to take some sacrifice. But it’s only temporary while you work to get those student loans out of your life! Just imagine how amazing it will feel to never have another student loan payment stealing money from your bank account ever again. Totally worth it!

Don’t let the all the lingo keep you from making progress. Here are some of the student loan terms you’ll come across and what they mean.

This is the base amount you owe for the loan, not including interest.

Your loan balance is the amount you have left to pay on your student loans. Let’s say you took out a loan for $35,000, and you’ve paid $5,000 toward the principal since you graduated. Then your remaining loan balance would be $30,000.

This is the ongoing amount you pay for taking out a student loan, on top of the principle. Your interest rate is typically represented as an annual percentage of your remaining loan balance. This is also the reason your student loans may be growing faster than you can pay them off.

Your minimum payment represents the total amount you must pay each month toward your student loans (principal and interest). But remember, the bigger your monthly payment, the faster you can get rid of your student loans!

Making extra payments toward your principal balance on your student loans can help you save money on interest and pay off your loan faster. If you want to make extra payments, budget extra money each month to put toward your principal balance.

This is how long you have to pay off your student loan. But trust us, you’re better off speeding up that timeline by making extra payments. You’ll end up saving so much money in the long run!

This is just a fancy word for the process of paying off your loans with a planned, incremental repayment schedule. An amortization table can help you estimate how long you'll be paying on your student loans, how much you'll pay toward the principal, and how much you'll pay just in interest. But you can always pay more than the scheduled amount—and you should!

You don’t have to live with student loan debt forever. Find out how to ditch your student loans fast!

You don’t have to live with your student loans forever! Find out when you’ll pay off your student loans—and how to get rid of them faster.

If you’re looking to make progress with your student loans, you have plenty of options. And refinancing can help. The ultimate point, though, is you just need to get rid of your student loans for good!