How to Pay Off Your Student Loans

No one likes having student loans. It can feel like a struggle just to keep up with them—let alone get ahead.

But what if you were able to pay more than just the minimum payment each month? What if you didn’t have to worry about your student loans . . . because you didn’t have any? No, we’re not talking about waiting around for student loan forgiveness. We’re talking about taking matters into your own hands.

You have the power to get student loan debt off your back. How? We’re going to walk you through our proven plan to paying off student loans. For good.

Use the Debt Snowball Method

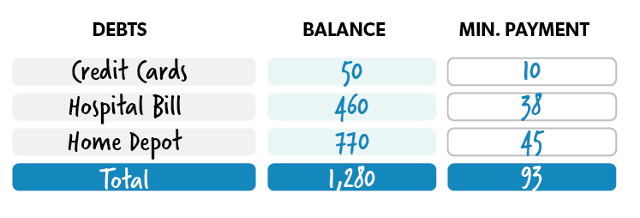

Step 1

First, list all your debts from the smallest balance to largest balance. If you’ve got more than just student loans (aka credit card debt, car loans, personal loans), include those too! Ignore the interest rates for now—we know that seems weird, but just trust us on this.

Step 2

Throw any extra money you can find toward paying off your smallest debt, while still paying the minimum payments on your other debts. The name of the game here is to attack that first debt with everything you’ve got!

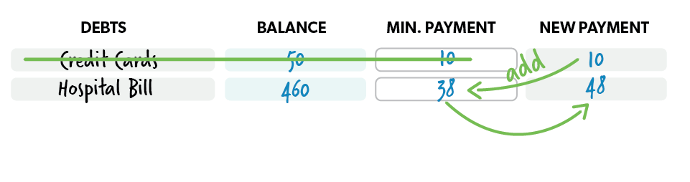

Step 3

Once you’ve paid off your smallest debt, move to the second-smallest debt. Take everything you were putting toward the first one and add it to the minimum payment of the second one. The more you pay off, the more money you free up to use as fuel—like a snowball rolling downhill.

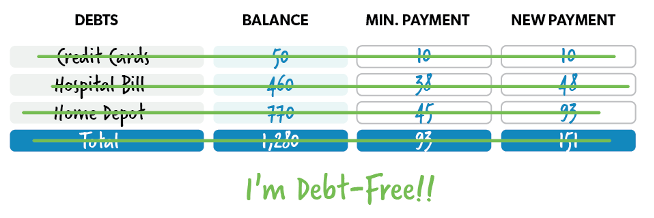

Step 4

Once that debt is paid off, move on to the next one and repeat the process until you’re finally out of debt! Boom.

Use our debt snowball calculator to help you get started!

You might be thinking, That’s going to take me forever! But hold up. Most people who follow this plan pay off their debt in 18 to 24 months. That’s not forever. And it’s definitely sooner than whatever student loan payment plan you’re currently on.

So, why does the debt snowball work so well? Because it’s all about momentum. Knocking out your smaller debts first gives you quick wins and helps you stay motivated to crush the bigger debts fast! Plus, winning with money is 80% behavior and only 20% head knowledge. The debt snowball forces you to build habits that help you get out of debt and stay out of debt.

Pro tip: Learn how to crush your student loans as fast as possible with Financial Peace University. This course will show you how to use the debt snowball to pay off your debt and manage your money so you build wealth that lasts.