How a Young Couple Faced the Music and Paid Off $56K

4 Min Read | Sep 24, 2021

When Lane and Tomi got married, they were young, starry-eyed and flat-out broke.

"We had no money," Lane says.

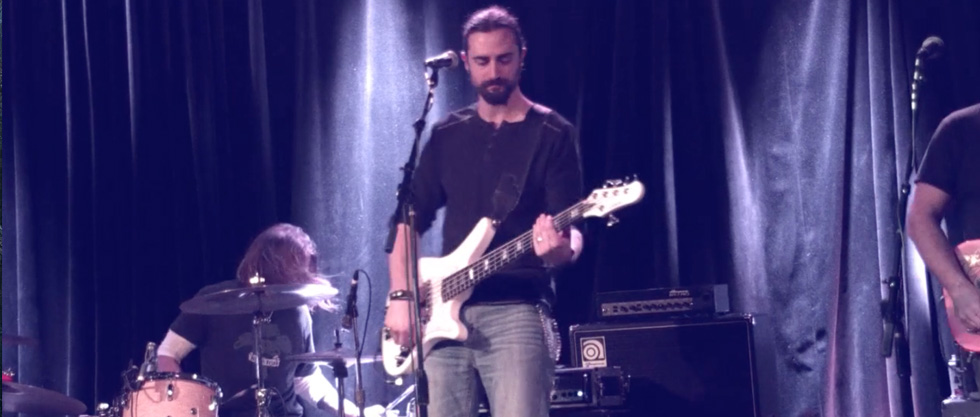

Things got better for a brief period during the summer of 2011. A musician in Nashville, Lane was playing in a cover band pretty regularly at that time, so he was doing well.

"I always had cash in my pocket," he says. "We went into that summer and everything was fine, but I didn’t watch how I spent my money so it just slipped through my fingers like water."

When winter came around, the music gigs slowed down—and that’s when Lane and Tomi realized they were in trouble. "It was December, and I realized I didn’t have any money to pay for rent in January."

Communication was an issue as well. "We both had separate bank accounts, so I didn’t know what he was bringing in. I didn’t know how much we made. I had no clue," Tomi says.

"I don’t think the stress he was feeling even registered to me," she adds. "Because every time things were tight he would find work. So it didn’t click to me that we had problems."

"She didn’t know because we weren’t talking about it," Lane responds.

After he realized the reality of their situation, Lane says he got down on his knees, "ugly cried," and poured his heart out in prayer. "I realized we needed to do better and we can do better. I didn’t know what that looked like, but I was open to learning."

"I hadn’t felt the weight and pain of the debt until that December," he says. Lane reached out to a friend and asked him for help with taxes. His friend, David, happened to be starting a Financial Peace University class at that time and invited Lane and Tomi to attend.

After that, things changed quickly. "I started meal planning, couponing, and making laundry soap. It was so much fun, and it was exciting to know that we could work together at a common goal," Tomi says.

"We started with $56,000 in debt," Lane says. "After a year and a half, we had paid off $25,000 and were living in a three-bedroom rental house my parents owned. One day, we found out my dad’s job was in jeopardy and they needed to sell the house."

"I wanted to buy it," Tomi says. "We had made it our home, so it was heartbreaking to leave."

"On the other hand," Lane adds, "we were still $30,000 in debt. So we moved into a much smaller apartment. Reality started setting in. This was what it looked like to be living within our means."

"We realized we were very spoiled," Tomi says.

Despite the reality check, the couple stayed the course. Just two years later, Lane and Tomi were completely out of debt and traveled to Ramsey Solutions’ headquarters to do their debt-free scream.

They told Dave their secret to getting out of debt was simply communication.

"When we attended FPU, we realized the importance of sitting down and doing a weekly budget," Lane says. "We started watching every penny."

Tomi says they’ve started to make "budget day" a fun routine. "Thursdays are our day off. We get up, make coffee, cook a big breakfast, play cards, and then we’ll sit down and get to business," she says. "That became one of the sweetest times of the week," Lane says.

Because of their recent success, Lane says the couple will be able to take a long-delayed trip. "I never got a chance to take her on a honeymoon, so we’re going to save up and go," he says.

Pay off debt fast and save more money with Financial Peace University.

Looking back, the couple says all the difficulties and sacrifices had a huge effect on where they are today. "I’m grateful for the experience," Lane says. Tomi adds, "It was a temporary pain."

"It hasn’t always been easy, and there were many dissonant moments where we felt discouraged and defeated," says Lane. "But those times were essential to creating a deeper appreciation for just how sweet and meaningful this verse of our lives has been. Can’t wait to start the next."

For more inspiring stories from The Dave Ramsey Show, click here.