Key Takeaways

- On average, it takes about 10–20 years to pay off a student loan. But with the right strategy, you can pay off your loans way faster! (I’m about to blow your mind.)

- Exactly how long it will take you to pay off your student loans depends on your original loan balance, your repayment plan and how much you pay each month.

- You can pay off your loans faster by increasing your monthly payment, getting intense, and not letting student loan “relief” slow you down.

Sick and tired of your student loans? You’re not alone.

Pay off debt fast and save more money with Financial Peace University.

Student loan payments are the worst. Period. They’re annoying at best and totally defeating at worst, robbing you of your peace and your future. And most people feel stuck paying off their loans for literal decades . . . or worse, like they will never pay them off.

But take it from someone who had mountains of student loan debt and paid it off—there’s hope! You do not have to live with your student loans forever! So, let’s talk about how long it usually takes to pay off your student loans—and what you can do to pay them off faster.

How Long Does It Take to Pay Off Student Loans?

Even though the typical student loan is set up to be paid off in 10 years, it can take closer to 20 years or more for someone to pay off their student loans.1 In fact, a study done by Ramsey Solutions found that 40% of those who graduated before 2013 still have student loan debt.

Now, you may read that and immediately feel hopeless. But the fact is, how long it takes to pay off your student loans depends on several factors:

- Your original loan balance: The amount you originally borrowed when you took out the student loan is the biggest factor in determining how fast you’ll pay it off. A person who borrows $20,000 for an accounting degree will probably pay off their loans faster than someone who borrowed $100,000 for a law degree.

- Your repayment plan: Most borrowers are on a schedule to pay back their student loans within 10–20 years. But there are other repayment plans that drag out the length of a student loan even longer.

- How much you pay each month: You won’t make much progress, if any, if you only pay the minimum amount toward your student loans each month. As a matter of fact, some of you have even seen your balance increase! The truth is, you’ll need to increase your monthly payment if you want to pay off your loans faster.

I know just how heavy the weight of student loans can be. My husband Sam and I had around $280,000 of student loan debt, and it felt like a black hole. Like there was no hope. It felt like our only purpose was to work and earn money to pay those freaking loans. They sucked the life out of us. Everyone told us we’d have those loans for the rest of our lives and to just follow our repayment plan. Ha! If we’d listened to those folks we’d still be paying those jokers off! Luckily, we decided to flip the script by taking matters into our own hands.

Want to know how long it took us to pay off our student loans? Three years—and that was after knocking out $180,000 of other debt! So, when I tell you it’s possible, I mean it. And no, we weren’t doctors or lawyers with huge salaries. We were regular people who worked every angle possible to get our income up.

So, here’s the deal: How long it takes to pay off your student loans is ultimately up to you. And if you put in the work, you can beat the odds and avoid being another sad statistic.

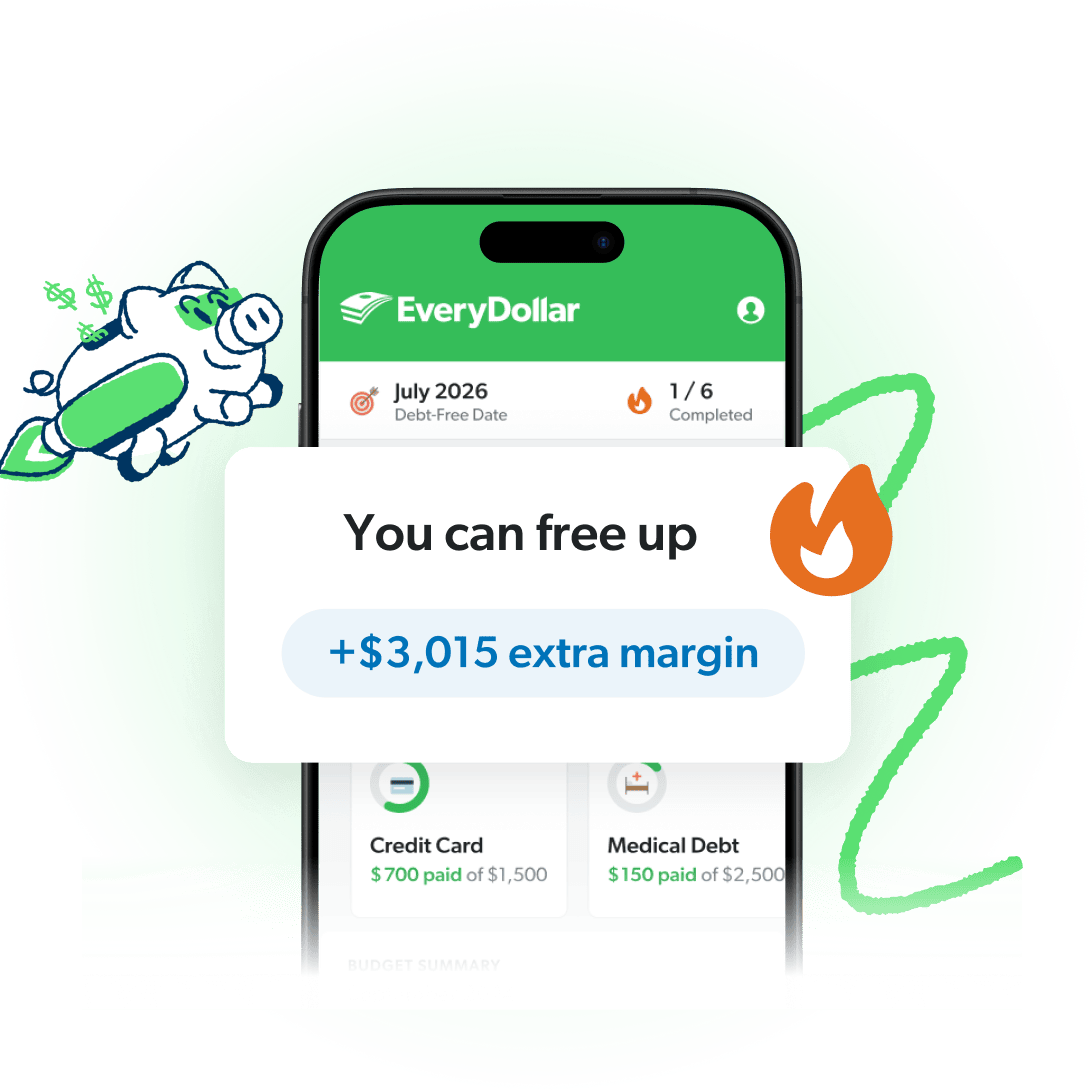

Find More Margin. Beat Debt Faster.

Paying off debt doesn’t have to take forever. With the EveryDollar budgeting app, you’ll find extra margin every month so you can pay off debt faster.

When Will I Pay Off My Student Loans?

Use the calculator below to find out when you’ll pay off your student loans. Just enter your student loan amounts (and any other debt you’ve got) to get your debt-free date.

Real talk, the date you see might upset you. But start playing around with the Extra Monthly Payment to get a feel for what magic can happen if you paid more each month. “But Jade, how am I supposed to find money for these extra payments?” Hey, cool out, we’re about to get to that!

How to Pay Off Your Student Loans Faster

So, now you know your debt-free date. (If not, go back and plug your numbers into the calculator. I'll wait.)

As you can see, the standard repayment plan is trash—especially if you’ve got six-digit student loan debt like we had. If you want to speed up your timeline, you need to change up your strategy.

Here are three ways to pay off your student loans faster:

Increase your monthly payment.

Listen, minimum payments equal minimum progress. And most of the time, your payment doesn’t even cover the interest! In fact, 21% of borrowers see their student loan balance increase in the first five years—because the interest causes their loan to grow faster than they can gain traction.2 That’s a crying shame!

But you can use the debt snowball method to boost your monthly payments and save yourself time (and interest). When you focus on paying off your debts from the smallest to the largest balance, you’ll be able to throw huge payments at your biggest debts. This is the method my husband and I used to pay off all of our debt, including our student loans. And let me tell you, the debt snowball works because it gives you the momentum and the motivation to keep going.

Just make sure you tell your student loan servicer that you want to apply any extra amounts toward the principal. And in many cases, if you have several smaller loans grouped into one payment, you have to be even more clear on which loan principal you want it applied to. Otherwise, they may try to spread it out over future months, or every individual loan, which only keeps you in debt longer. But don’t let them fool you—you’re the one in charge of your student loans!

Now, Sam and I had an outrageous amount of debt ($460,052 to be exact), plus we had a low starting income. So it took us seven years to pay off our debt. The good news is, the average person who uses the debt snowball usually pays off all their debt in two years or less. Come on, somebody!

Get intense.

Paying off debt isn’t for punks. Meaning, you best be ready to get after it! Trust me, that’s the only way Sam and I were able to pay off our loans. We had to get serious about attacking them. And yes, it requires some sacrifice, for sure. But it’s a trade-off. You’re trading a temporary sacrifice for long-term freedom. How fast you pay off your student loans depends on how willing you are to put in the work.

So, what does intense look like? It looks like making your meals at home instead of eating out and saying no to things you don’t need. It means finding ways to decrease your expenses and increase your income—so you can throw as much money as possible at your student loans. Remember, it’s only temporary until you get those loans out of your life!

Don’t let student loan “relief” slow you down.

Income-driven repayment plans, deferment, forbearance, student loan forgiveness. All of these relief options sound great, but they really just keep you from actually paying off your student loans.

First off, deferment and forbearance don’t make your student loans go away—they just put them on pause. And in most cases interest keeps accruing, which means you’ll end up with a bigger balance to pay off. I’ve fallen for it myself, and when I got my bill at the end of the term, seeing how much the balance increased made my head spin. So, unless you’re struggling to put food on the table or pay your bills, deferring or forbearing your loans isn’t an option. And to be clear, in no case should it ever be a long-term solution.

Also, while your loan servicer may tell you an income-driven repayment (IDR) plan is your best option, in reality it extends your loan for another 10–20 years! With some plans it could possibly be longer, depending on what you owe. The thing is: Lower payments equal a longer period in debt and a larger amount of interest paid. If you’re already enrolled in an IDR, take advantage of that lower payment to knock out your smaller debts. And then, like I said earlier, use all that freed up money from your previous payments to plow your way through your student loan!

And we’ve got to talk about student loan forgiveness (or should I say, the promise of forgiveness). The government’s track record of actually forgiving student loans . . . is terrible. And federal student loan forgiveness programs aren’t worth it either. In fact, the approval rate for Public Service Loan Forgiveness (PSLF) is less than 2%.3 Not worth it!

Instead of relying on student loan “relief” to get rid of your loans, what if you made forgiveness your job? Because the only person you can count on to pay off your student loans is you—not the government.

Don’t Just Make Payments—Make Progress

If you keep doing the same things you’ve always done, you’ll keep getting the same results you’ve been getting. It’s easy to sit back and tell yourself, “I’ll pay off my student loans later, but not right now.” Then, when later actually gets here, you’ll tell yourself the same thing.

Look, the time is going to pass regardless. You can look up in two years and be the same or worse. Or you can look up in two years and be debt-free! The choice is yours, and I say there’s no better time to pay off your student loans than right now. You just need to take it one step at a time—starting with a budget.

And our EveryDollar budgeting app can help.

EveryDollar shows you how to find thousands of dollars of hidden margin (no, really) and builds you a personalized, step-by-step plan to beat debt way faster! Plus, you’ll track your progress right in the app until every dollar of debt is history!

So, what are you waiting for? Start EveryDollar for free today!

Don’t believe what your loan servicer (or anyone else) says. You decide when you’ll be debt-free! And the sooner you pay off your student loans, the sooner you can start building the life you really want. I know you can do it!