So you want to go to college (or maybe continue on to grad school). But you feel like the only way to make it happen is by taking out student loans. Hold it right there! Let me speak to you real quick before you sign on the dotted line.

Hey, I’m all for getting an education. But I want you to leave college feeling free to start your career—not weighed down and stressed-out by the bondage of student loan debt. And while everyone says student loans are there to help you, what they don’t tell you is just how much they truly cost you (and I’m not just talking about money, honey).

Before you decide to sign for a loan (no matter the dollar amount), you need to know exactly how student loans work. And spoiler alert: Student loans are not the best way to pay for college. As a matter of fact, I want you to totally scratch student loans off your list of options! Keep reading to find out why.

How Do Student Loans Work?

Types of Student Loans

What Can Student Loans Be Used For?

How Does Student Loan Interest Work?

Student Loan Repayment Options

How Much Do Student Loans Cost?

What If You Can’t Afford Your Student Loan Payment?

How to Pay for College Without Student Loans

How Do Student Loans Work?

When you take out a student loan, you borrow money (either from the government or a private lender) to pay for college tuition and other education costs. The student loan has to be paid back, along with interest that builds up over time. And your repayment options and interest rate depend on the type of student loan you have.

So, that’s the short answer. But let’s break that down.

What Is a Student Loan?

A student loan is a type of financial aid you can use to cover the cost of college. But let’s be clear, student loans are different from scholarships or grants. Student loans are borrowed money that have to be paid back at some point. Scholarships and grants, on the other hand, don’t need to be paid back (yay for free money!). Student loans are also different from work-study programs, where students get paid to work on campus (which you should do if you can).

How Do You Get a Student Loan?

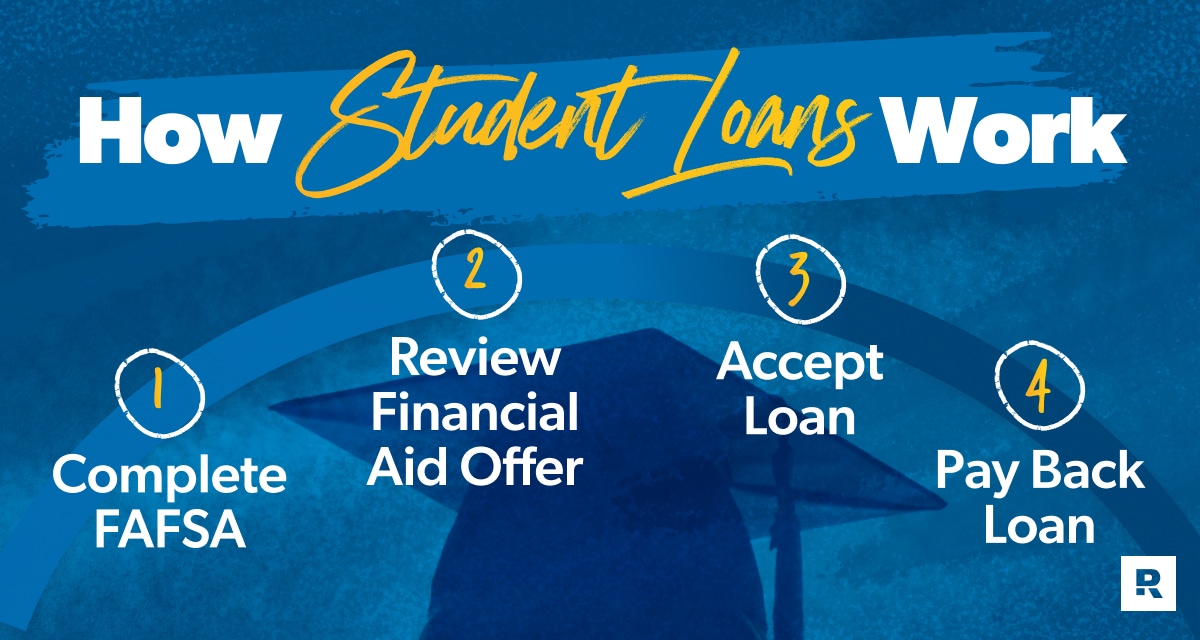

People can get federal student loans by filling out the Free Application for Federal Student Aid (FAFSA). Students share their financial information (or their parents’ if they’re a dependent) on the form, which is then sent to the student’s schools of choice.

The financial aid office at each school crunches some numbers to figure out how much (if any) aid the student qualifies for and then sends them an “award letter” with all the details about their financial aid offer. (Heads up: They love using “financial aid” as a blanket term so you forget that it’s actually debt. But don’t be fooled into thinking it’s free money—because it’s not! These are loans you have to pay back. Hard pass.)

The truth is financial aid could come in the form of student loans, or it could come in the form of scholarships and grants. And it’s important to understand the difference. That’s why I still recommend filling out the FAFSA—just make sure you only accept the free money (aka scholarships and grants) so you stay in the no-loan zone!

Ready to get rid of your student loans once and for all? Get our guide.

Students can apply for private student loans straight from the lender—usually after they’ve tapped out their federal financial aid. But for both federal loans and private loans, the student has to sign a promissory note (sounds scary, right?). That’s a legal document where the student promises to repay the loan plus interest, and it includes all the terms and conditions of the loan. Signing a promissory note is kind of like signing away your freedom. Think I’m kidding? Nope, not even a little bit.

Ditch student loans faster with EveryDollar.

Time to take charge of your money! Let’s make a game plan in a few simple steps.

Types of Student Loans

There are two main types of student loans: federal and private. Federal loans are issued by the government, while private loans can be issued through a bunch of different sources, like banks, schools, credit unions or state agencies.

Federal Student Loans

- Direct Subsidized Loans: Also called subsidized Stafford Loans, these are undergraduate loans for students who show financial need based on their FAFSA. The government pays the interest for you until it’s time to start paying the loan back. Once you leave school or you drop below a certain number of enrolled hours, there’s a six-month grace period before you have to start repaying the loan and interest begins to build up.

- Direct Unsubsidized Loans: Also called unsubsidized Stafford Loans, these are undergraduate or graduate loans not based on a student’s financial need. With unsubsidized loans, the government doesn’t cover the interest while you’re in school—meaning you’ll need to pay the interest or your loan balance will grow.

- Direct PLUS Loans: These are loans that graduate students can take out for themselves or that parents can take out for their dependent students (in that case, it’s called a Parent PLUS Loan). You usually have to fill out a separate application from the FAFSA and pass a credit check.

- Direct Consolidation Loans: If you already have student loans, a Direct Consolidation Loan lets you combine multiple federal student loans into one loan with one loan servicer. But while you might get a lower monthly payment, you’re also extending the length of your loan (which could keep you in debt longer!).

Private Student Loans

All you need to know about private student loans is that they’re usually more expensive and have higher interest rates than federal loans. Plus, you may have to start paying back your private loans while you’re still in school. It’s up to the lender to decide all of the terms and conditions of the loan—but they’re usually not good.

Also, since private loans are based on your credit score, most students need a cosigner for the loan—which is a terrible idea with a capital T. I cringe just telling you that my college boyfriend cosigned for one of my student loans. It was a stupid decision on both our parts, even though we’re married now. Never ever have someone cosign for your loan and never cosign for someone else’s loan!

What Can Student Loans Be Used For?

Student loans can be used to pay for anything education-related—which in this case, is pretty broad. In fact, you can use student loans to cover things like:

- College tuition and fees

- Room and board

- Books and supplies

- Computers and other needed technology

- Lab fees

- Parking fees

- Study abroad expenses

- Off-campus housing and utilities

- Groceries

- Childcare if you have a dependent child

- Car expenses

- Miscellaneous personal expenses (like bedding, a microwave, eating out, clothes, etc.)

But listen up: Just because you can take out student loans and use them for whatever you want, it doesn’t mean you should. Because the more you take out, the more you’ll have to pay back later. (Again, this isn’t free money!)

I’ll be real with you: My college tuition was fully paid for thanks to a full presidential scholarship and a full volleyball scholarship. But the folks in the financial aid office still talked me into taking out student loans to pay for “college life” (you know: clothes, groceries, fun). Talk about regret. If I could go back in time, I’d grab myself by the collar and tell younger Jade to run!

How Does Student Loan Interest Work?

Interest can be your friend—but only if it’s the good kind of interest that makes your investments grow from a couple hundred dollars to a mountain of cash. But student loan interest? Yeah, that’s the bad kind of interest. It makes a seemingly small pile of debt turn into a mountain of mayhem. Let me explain how it happens.

Your interest rate is a percentage of your student loan balance that you get charged for borrowing money. Federal student loan interest rates can vary per loan, but they’re usually fixed (meaning the interest rate stays the same every year). Private loans are typically based on your credit rating, so they can vary a lot. Private loan interest can be fixed or variable (meaning it can change).

Here are the interest rates for federal student loans for the 2023–2024 school year:1

- Direct subsidized and unsubsidized loans for undergraduates: 5.50%

- Direct unsubsidized loans for graduate and professional students: 7.05%

- Direct PLUS loans for graduate or professional students and their parents: 8.05%

When you make your student loan payment, the money is first applied to the interest. The rest gets applied to your principal (the base amount you owe for the loan). And sometimes the interest is capitalized—meaning any unpaid interest gets added to your principal. So, you could end up paying even more interest on a bigger balance. Shoot!

Depending on your interest rate and loan balance, you could get stuck mostly paying interest and barely touching the principal. And some of those sneaky repayment plans that promise to make your payment more manageable don’t even fully cover the interest. This is why so many borrowers can’t make progress on their student loans—because their balance grows faster than they can pay it off! It’s scary stuff.

Student Loan Repayment Options

Taking out student loans isn’t just a decision that impacts your college self, it also impacts your future self. Every. Single. Month. It usually takes about 10 years to pay off your student loans, but it can take up to 30 years in some cases.2 In fact, Ramsey Solutions research found that 40% of college students who graduated before 2013 are still paying on their loans! Do you really want to be in debt that long?

Here’s just a glimpse into what it looks like to pay back your student loans:

Repaying Federal Loans

- Standard Repayment Plan: The government or your lender provides a schedule with a set monthly payment amount. For federal loans, the plan is for 10 years.

- Graduated Repayment Plan: The payments start off lower, but they increase every couple of years or so. The plan is still to have everything paid off in 10 years.

- Extended Repayment Plan: These plans extend the payments beyond the normal 10-year window for borrowers who have more than $30,000 in outstanding loans. The payments could be fixed or graduated (meaning the payments increase little by little) and are designed to pay off the loan in 25 years.

- Income-Based Repayment Plan: This is a type of income-driven repayment plan that bases your payments on a percentage of your income. Usually, you’ll pay between 10–15% of your discretionary income (that’s the amount of income you have left after your set expenses are taken care of). The payments are recalculated every year and adjusted for things like the size of your family and your current earnings. Any remaining balance is supposed to be forgiven after a certain number of years of consistent payments (usually 20–25 years), but it’s not guaranteed.

- Income-Contingent Repayment Plan: This is similar to the income-based plan, but it’s based on 20% of your discretionary income. It’s also the only income-driven repayment plan for Parent PLUS Loans.

- Pay As You Earn (PAYE) Repayment Plan: Your monthly payment is 10% of your discretionary income, but you can only enroll if your monthly payment would be lower than the standard repayment plan.

- Saving on a Valuable Education (SAVE) Plan: This is the newest payment plan that increases the income exemption from 150% to 225% of the poverty line and can keep unpaid interest from building up. People who opt into this plan may have a much lower monthly payment than other plans. But just like any other income-driven repayment plan, it also drags out your debt for years (usually decades).

Repaying Private Loans

With private student loans, the lender makes the rules for payment. You’ll pay a set amount each month that’s a combo of a principal payment and interest, and the payments are usually set for a specific amount of time. Any changes in that plan—like a graduated payment schedule—would need to be negotiated with the lender (good luck with that).

How Much Do Student Loans Cost?

Your monthly student loan payment depends on how much you originally borrowed, your interest rate, and your repayment plan. The average student loan payment is around $393.3 But you can’t just look at how much student loans cost you monthly—you have to look at the bigger picture.

So, here’s the math (everyone’s favorite part): Let’s say you have a $35,000 principal and a 10-year loan repayment term with a fixed interest rate of 5%. With those numbers, your monthly student loan payment would be around $370, and the total amount of interest you’d pay during the loan term would be over $9,000. So, you might’ve started out by borrowing $35,000, but in the end, you’d really pay at least $44,000!

But student loans cost you much more than just interest. They steal your peace and your freedom! Instead of giving you a leg up like your guidance counselor promised, student loan debt sweeps your legs out from under you—and then kicks you while you’re down. And while getting a college degree can be a good thing, you don’t need to take out student loans to get one.

What If You Can’t Afford Your Student Loan Payment?

Student loans seem great . . . until it’s time to pay them back. And if you don’t, your loans can go into default—which has some serious consequences.

Now, you might’ve heard about some student loan relief options to help you out if you’re struggling to make your payment. But these options are only temporary, short-term fixes to long-term problems. And sometimes, they can end up costing you more in the long run.

- Forbearance: Your payment is put on hold, but the loan continues to accumulate interest. There are two types of forbearance: general (where the lender decides your level of need) and mandatory (where the lender has to grant forbearance based on your situation).

- Deferment: With deferment, you temporarily don’t have to make payments, and you may not be responsible for paying interest on your loan. Not everyone is eligible for deferment or forbearance, but you might qualify if you’re unemployed, serving in the military during wartime, or serving in the Peace Corps.

- Student Loan Forgiveness: I’m not talking about immediate forgiveness for everyone’s student loans like what Biden tried to do (we all know how that went). But there are some government programs that promise to forgive your loans if you work full time in a qualifying public service job or teach in a low-income school. The scary thing is, less than 2% of applications for Public Service Loan Forgiveness have actually been approved.4 So yeah, gambling your financial future for a 2% shot at forgiveness is not the move.

- Student Loan Refinancing: Refinancing can help you get that loan paid off quick. But it’s not a universal solution for everyone. Only refinance your student loans if it’ll get you a lower, fixed rate and if it’ll motivate you to pay off your loans faster.

How to Pay for College Without Student Loans

If you haven’t discovered by this point, student loans are the worst way to pay for college. Right now we’re in a student loan crisis of almost $1.6 trillion!5 And Ramsey Solutions research found that over half (51%) of borrowers regret taking out student loans.

You might be thinking: Okay, Jade, I get it. Student loans are bad. What’s the alternative? Now you’re asking the right question!

Believe it or not, you can pay for college without student loans (and not just tuition—your entire college experience). But you need to do your research and put in the work. Here are just a few examples of how you can cash flow college:

Find scholarships and grants.

You can find free money by filling out the FAFSA form, researching organizations in your field of interest that offer scholarships, and using online scholarship search tools. Yes, you’ll have to set aside time to write essays and apply—but it’s totally worth it if it keeps you out of debt!

Got some time before your kid heads to college? Work with a SmartVestor Pro and create a college savings plan that helps your child go to college debt-free!

Choose a school you can afford.

The best way to save money on college is by choosing the right school. I don’t mean to crush your dreams if you’ve got your heart set on a specific college. But maybe you need to start out at community college or go to a public, in-state school instead of a private university (there’s a huge difference in tuition costs). Or maybe your best path is a trade school or vocational school—and that’s totally okay. Remember, the only real “dream school” is the one you can afford to go to debt-free.

Work.

Yep, even when you’re in high school. A part-time job or side hustle won’t hurt your grades if you keep it to 20 hours per week or less, and it’ll help you save for college. Once you’re in college, try looking for an on-campus job or a work-study program, or apply to be a teaching assistant. Your future self will thank you for the extra work!

Be smart about your lifestyle.

Going to college doesn’t mean you have to live in a fancy dorm room with a $10,000 meal plan. Here are some ways to cut your college expenses:

- Live at home if you can.

- Stop eating out with your friends every weekend.

- Split groceries, rent and utilities with a roommate (or three).

- Use public transportation or walk whenever possible.

You don’t have to spend a ton of money to have a great college experience! So, get creative and find ways to lower costs where you can. And this part is crucial: Stick to a budget. That’ll make all the difference in helping you take control of your money. Plus, it sets you up for a much brighter financial future!

Budget for College—And Everything Else

EveryDollar will help you save up for your education and cash flow your entire college experience!

Create Your Free Budget