When you’re drowning in debt, it can feel like the world is caving in around you. Your thoughts are swirling and just won’t stop. You’re not sleeping, and you’re worried your next paycheck won’t be enough to provide for your family. And then the questions fueled by endless worry begin: How will I make ends meet? How in the world will I cover my mortgage/rent this month? Will these debt collectors call my boss (how embarrassing)?

You’re not alone. In fact, 78% of Americans today are living paycheck to paycheck.1 That means you’re not the only person who’s ever been overwhelmed by debt. But there comes a point when you have to decide that enough is enough. You have to choose—right now—to start changing the way you handle money.

Did you know that personal finance is 80% behavior and only 20% head knowledge? That means with a plan—and a lot of hard work—you can be standing on solid ground in no time. And who knows? You could even become a Baby Steps millionaire.

Pay off debt fast and save more money with Financial Peace University.

Take a breath. You can do this. We believe in you!

What to Do if You’re Drowning in Debt

1. Get on a budget.

Making a budget is one of the most important steps you can take when you’re drowning in debt. It’ll show you where all your money is going and why you feel like you’re drowning. This is your first step toward taking control of your money—and never feeling like you’re in over your head in debt again.

When you’re making your budget (and we recommend making a zero-based budget), you might be tempted to cover all of your extra expenses first, like your debt payments. But really, you need to make sure your basic needs are met by budgeting for the Four Walls first:

- Food

- Utilities

- Shelter

- Transportation

Now, after you’ve budgeted for groceries, water, electricity, your rent or mortgage, and gas to get you to work (in that order), you can start assigning any leftover dollars to other important needs. Do you have student loans or a car payment? Are those hospital bills piling up? Or maybe your dad’s birthday is next month and you at least need to send a card. Whether it’s $50 or $500, all expenses have to go in the budget. Remember: In your zero-based budget, income minus expenses should equal zero!

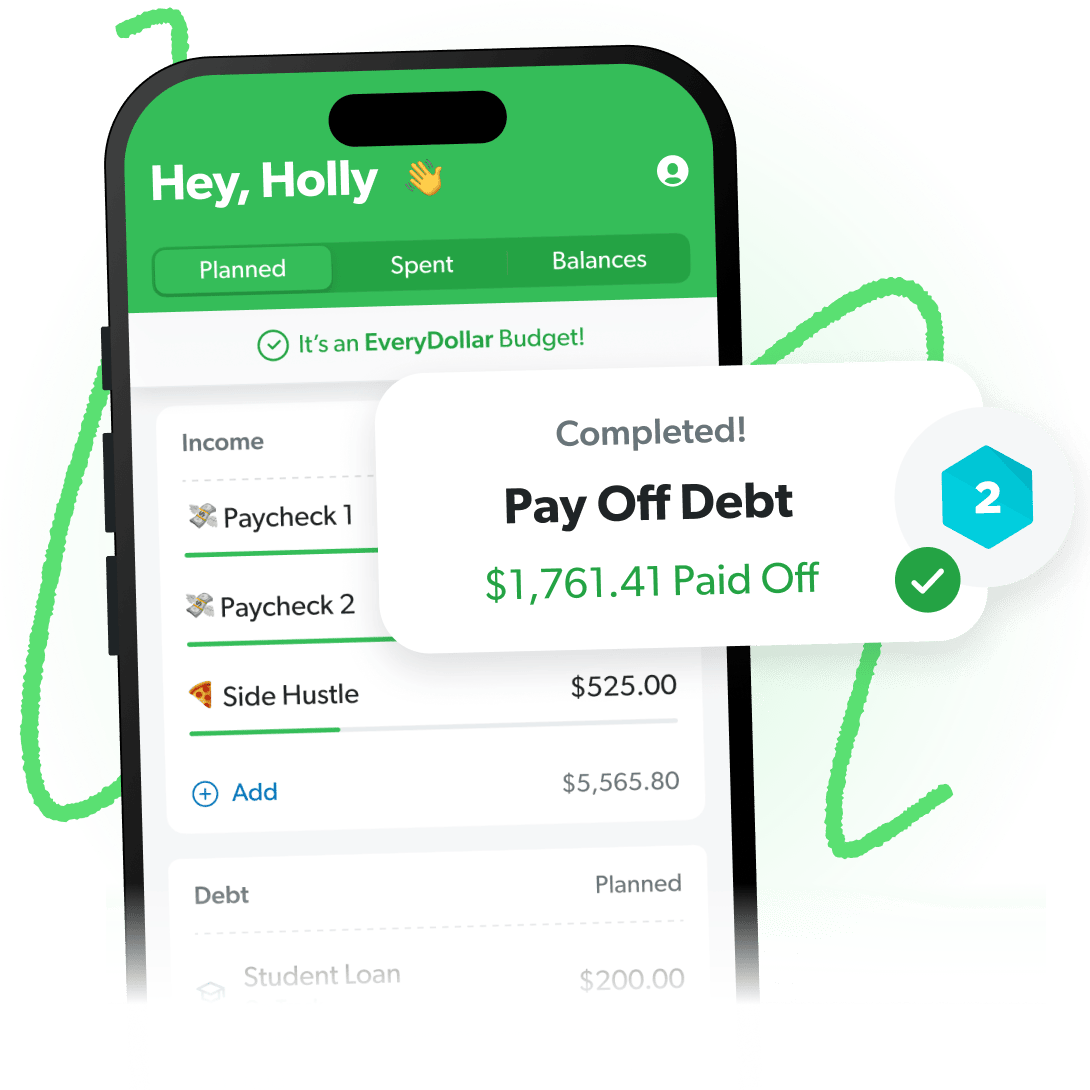

Find More Margin. Beat Debt Faster.

Paying off debt doesn’t have to take forever. With the EveryDollar budgeting app, you’ll find extra margin every month so you can pay off debt faster.

2. Cut back on the extras.

Now that every dollar has been given a job to do, it’s time to see where you can cut back.

Take inventory of any automatic payments that might be draining your bank account. Maybe you have a $7 subscription to the Clean Beard Club. We’re not knocking beards (especially clean beards), but these kinds of expenses add up quickly. Plus, that free gift they offered you when you signed up is probably long gone, leaving you with a subscription you keep forgetting to cancel every single month—and more beard oil than you know what to do with.

Don’t get us wrong. We love a good mail day as much as the next person. But if you’re drowning in student loan debt, credit card debt or just-plain-debt debt, you’ve got to make some pretty big changes. You guessed it. We’re talking about cutting back on nonessential items and getting your “want-itis” under control. Here are some tips:

- Make coffee at home (skip the $10 lattes until you’re not drowning in debt anymore).

- Cut back on your grocery bill by clipping coupons and going without the kids so you’re not tempted to overspend on Oreos (leftovers are your friend).

- Don’t even step foot in a restaurant (unless you’re working there).

- Sell everything that’s not nailed down (so much that the kids think they’re next).

3. Pause all investing.

Really? Yep. Saving for your future when you’re living paycheck to paycheck (or worse) isn’t the best idea. At least not yet. If you’re still trying to pay off credit cards, an upside-down car loan or a huge pile of student loan debt, it’s time to press pause on your future investments—temporarily. This frees up extra cash you can use to pay down your debt.

Here’s another idea: Instead of putting money in investments right now, you should also get $1,000 together as fast as you can for a starter emergency fund. It’s just a little more security as you dig yourself out of that hole of debt.

Don’t worry—you’ll get back to investing once you’re debt-free.

4. Don’t take on any new debt.

None. We know it’s hard (and maybe not what you’ve been used to), but trust us—taking on debt robs you and your family of a secure financial future. Your choices right now can and will impact future generations of your family tree. So don’t take on even another penny of debt.

To start with, it’s time to get out your favorite pair of scissors and do a plasectomy. Yup—we’re talking about cutting up those credit cards! The best part? No medical experience required.

You may feel your heart start to race and your hands begin to sweat. But hear us out: Having a credit card for emergencies seems like a good idea until your next “emergency” looks like your next afternoon coffee run. When you cut up those cards, you’re choosing to put an end to that awful cycle of debt for good.

5. Increase your income.

Now that you’re on a budget and you’ve decided to stop taking on any new debt altogether, it’s time to figure out how you can increase your income. Take a second job or pursue a side hustle that will give you the extra income you need (as quickly as possible) to throw at your debt. Whether that’s working at your local coffee shop, mowing lawns, or driving for Uber or Lyft, you’ve got to bring in more cash.

We get it. No one wants to work around the clock. But in order to see that mountain of debt turn into a valley, you’ve got to start doing something different. Remember: This isn’t forever. You won’t be skipping out on time with family and friends for the long haul. But to get yourself on the right track, you’ve got to start making sacrifices now.

6. Start working the debt snowball.

Now that you’ve got some extra money coming in each month, and you’ve got your $1,000 starter emergency fund standing between you and the unexpected, it’s time to start paying off your debt with the debt snowball method:

- List your debts from smallest to largest—no matter the interest rate. Keep making minimum payments on all of them except the one with the smallest balance.

- Attack your smallest debt with everything you have. Did you sell the couch? Great! Throw your earnings on this debt. Keep putting anything extra you make toward this debt until it’s gone.

- Once that debt is paid, take what you were paying on it and throw it at the next-largest debt while paying minimum payments on the rest.

- Keep this snowball rolling until you’re debt-free!

7. Stop the comparison trap.

Comparison is one of the worst things you could do while you’re getting out of debt, and social media is one of the biggest culprits. If you’re scrolling through your news feed and see your friend (who you haven’t talked to in years) on a European vacation with her mom, that doesn’t give you permission to plan a fancy vacation too. Nope. Europe will still be there when you’re completely debt-free.

When you’re in debt and going after your debt with gazelle intensity, it’s hard not to compare your financial situation to other people’s situations. But here’s the truth: You don’t actually know their financial situation. You don’t know if your friend put her fancy vacation on a credit card. But you do know that once you’re out of debt, you’ll be able to plan exciting (and paid-for) trips of your own. Listen: The Joneses are broke. If you’re falling into the comparison trap, it might be time to take a much-needed break from social media.

8. Start (or keep) working the Baby Steps.

Have you heard of the Baby Steps? These seven steps are the proven (and practical) way to help you change your life, pulling yourself out of the debt quicksand and on to more stable ground.

Baby Step 1: Save $1,000 for your starter emergency fund.

Baby Step 2: Pay off all debt (except the house) using the debt snowball.

Baby Step 3: Save three to six months of expenses in a fully funded emergency fund.

Baby Step 4: Invest 15% of your household income in retirement.

Baby Step 5: Save for your children's college fund.

Baby Step 6: Pay off your home early.

Baby Step 7: Build wealth and give.

It may feel like you’re drowning in debt right now. But like we said earlier, you can change that—starting today! Once you’ve had it with debt (and we hope you have), you can climb your way out of it. And remember: You’re not alone in this.

Take our free three-minute assessment to find out where you stand with debt. We’ll give you a customized list of next steps and resources to help you get started on your journey to financial peace. You can do this!