How to Read Your Credit Card Statement

Opening your credit card statement can be a drag, but ignore it and you could be paying hundreds in interest. Find out how to understand the fine print!

Sick and tired of credit card debt? Find out exactly how long it will take you to pay off your credit cards—and how to do it faster.

*Not sure how to use the credit card calculator?

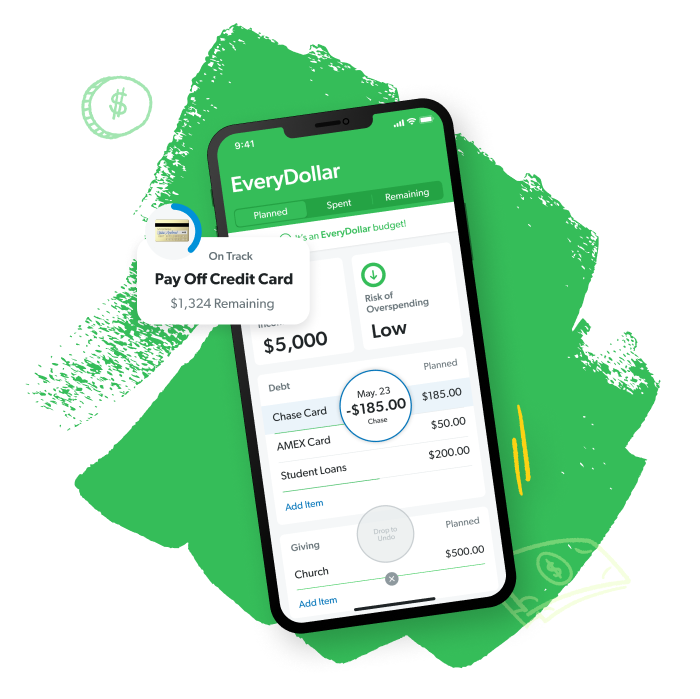

It all starts with a budget. The EveryDollar budgeting app helps you make a plan for your money every month—so you can confidently cover your expenses and free up more money to throw at your credit card debt!

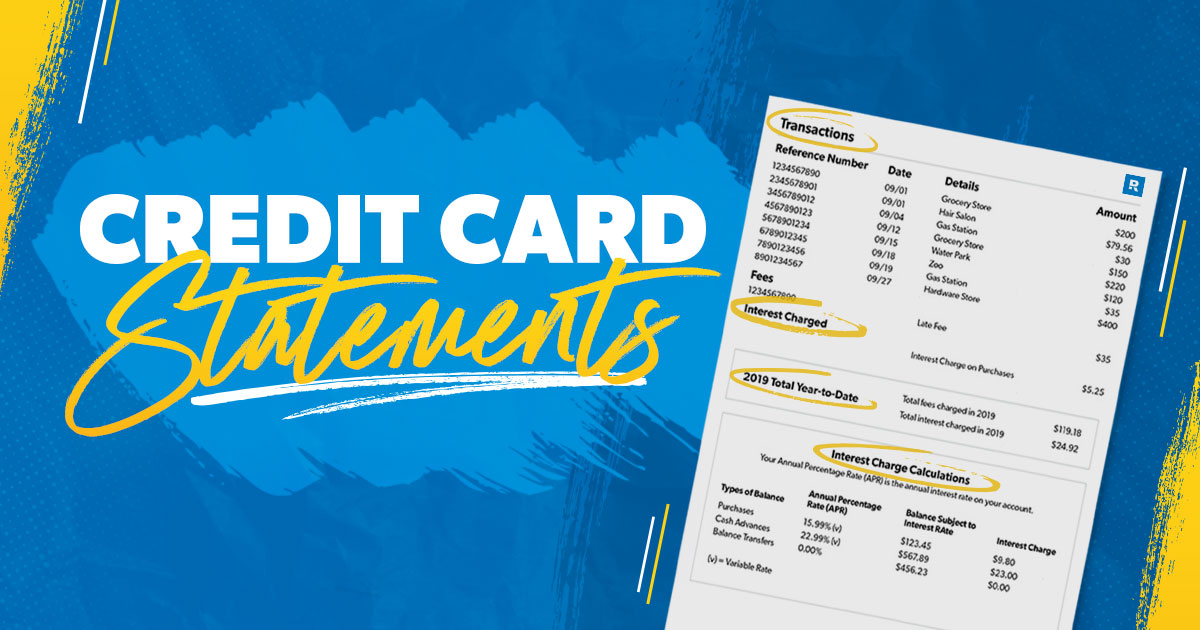

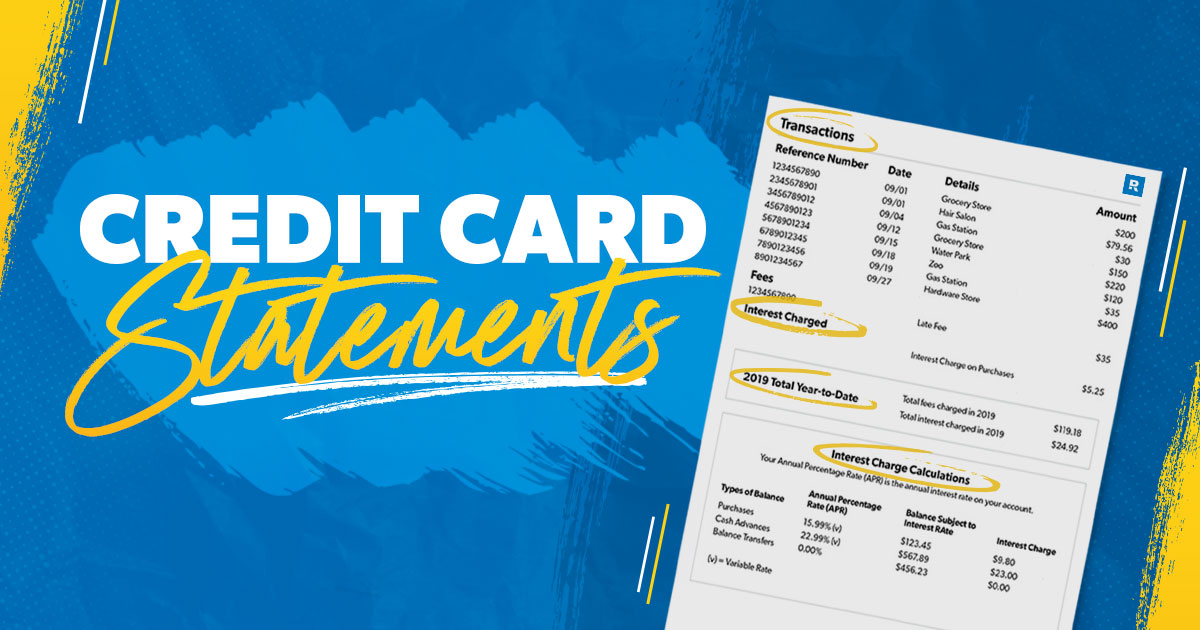

Credit card terminology can be confusing and overly complicated (lucky for the credit card companies—but not for you). Let’s break down what some of the common credit card terms actually mean.

This is the amount you owe on your credit card. You can find your current balance by reading your most recent credit card statement or logging in to your credit card account online.

This is the amount the credit card company charges if you don’t pay off your balance by the due date. Your interest depends on the credit card’s APR (annual percentage rate) and is usually charged as a percentage of your unpaid balance.

This is the lowest amount you are required to pay each month to stay in good standing with the credit card company. But keep in mind, if you only pay the minimum payment and don’t pay off your entire balance in full, you’ll get charged interest.

Don’t let credit card debt get you down! Here’s how to pay off your credit card debt fast:

Credit card interest depends on the card’s APR. But even though it’s called an annual percentage rate, it’s calculated daily. To figure out how much you’ll pay in interest, multiply your average daily interest rate by your average daily balance (oh, and don’t forget the compound interest).

Credit card consolidation is the process of paying off your existing credit card debt with either a new credit card or a personal loan. The goal with credit consolidation is to trade multiple credit card payments for one single payment with better terms. But there’s no guarantee you’ll get a lower interest rate when you consolidate. Instead of combining your debts, you’ll be better off knocking them out one by one with the debt snowball.

A balance transfer is a type of credit consolidation where you take the balance from one credit card and transfer it to another card, usually one with a lower interest rate. That may sound nice, but balance transfers don’t help you get rid of your debt—they just move it around. Plus, you have to pay a balance transfer fee.

Watch out for credit cards that promote 0% APR! Most of the time, the 0% interest is only an introductory rate that lasts for a couple of months before switching to a variable rate that can jump sky-high. It’s a sure way to make your credit card debt problem an even bigger problem. So, steer clear.

Carrying a credit card balance from month to month can cause your credit score to go down. And while paying off your credit card debt can boost your score, the credit game is a never-ending, exhausting cycle. The truth is, you don’t need a credit score to live your life or reach your goals—actually, it’s a lot easier without credit slowing you down.

Opening your credit card statement can be a drag, but ignore it and you could be paying hundreds in interest. Find out how to understand the fine print!

Even a single credit card can do some serious damage to your finances. But carrying multiple credit cards is just asking for trouble. Find out what happens when you open too many credit card accounts.

Credit card debt is at an all-time high! Learn the truth about how credit cards work (and the hidden costs) so you can avoid the trap.

Financial Peace University (FPU) is the money class that’s helped millions of people get rid of their debt—and stay out of debt.