Study Summary

- 55% of employees say they worry about their personal finances daily.

- 45% of employees say that in the last year, they’ve been distracted at work due to financial problems.

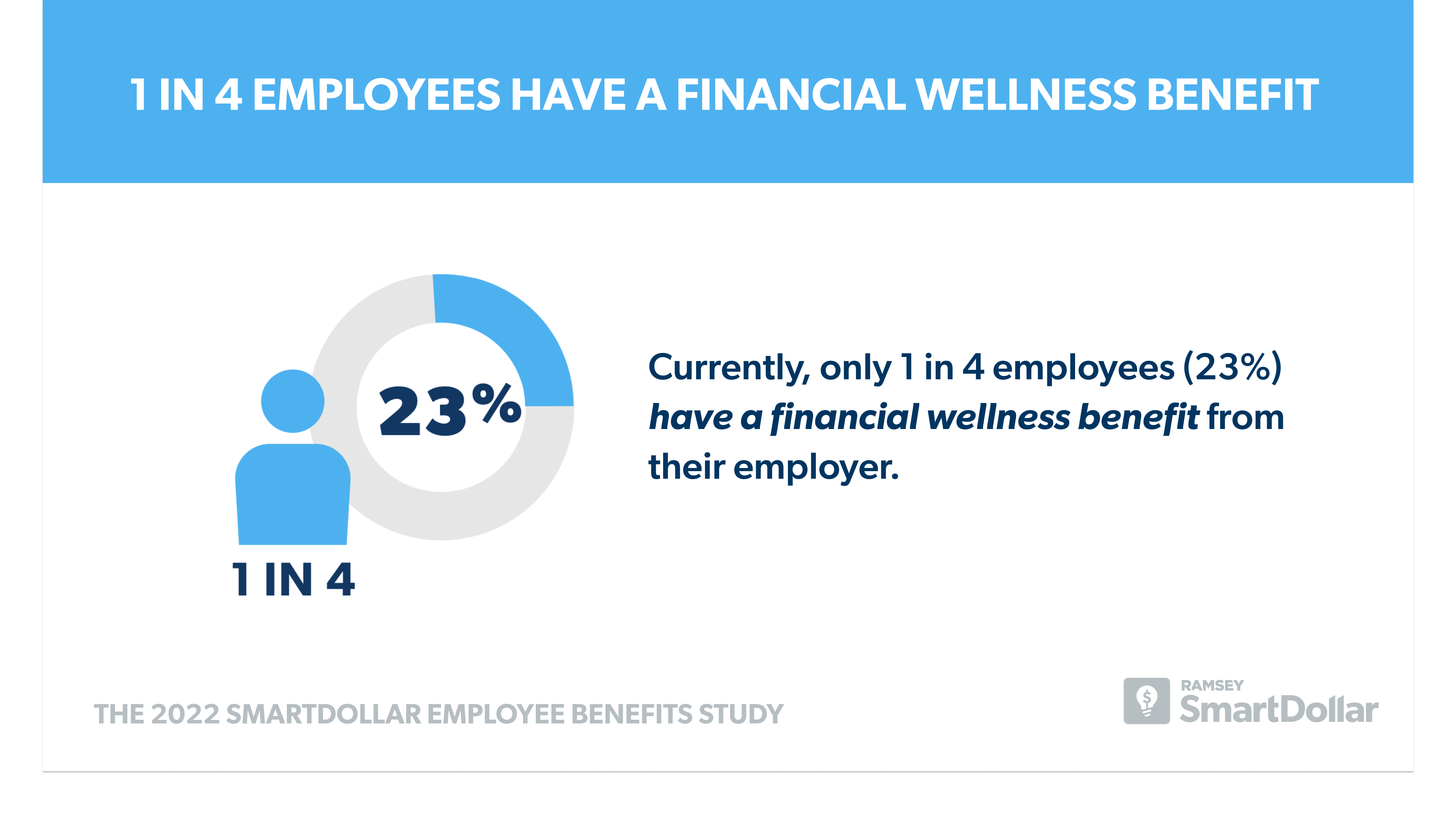

- 1 in 4 employees currently have access to a financial wellness benefit from their employer. But for those who don’t have access, it’s among the top benefits they wish they had.

- 38% of employees say having a financial wellness benefit has had a significant impact on their personal finances.

- 6 in 10 employees say they feel behind on their retirement goals.

- Nearly half of employees (46%) say that in the last year, their mental health has impacted their ability to do their job to the best of their ability.

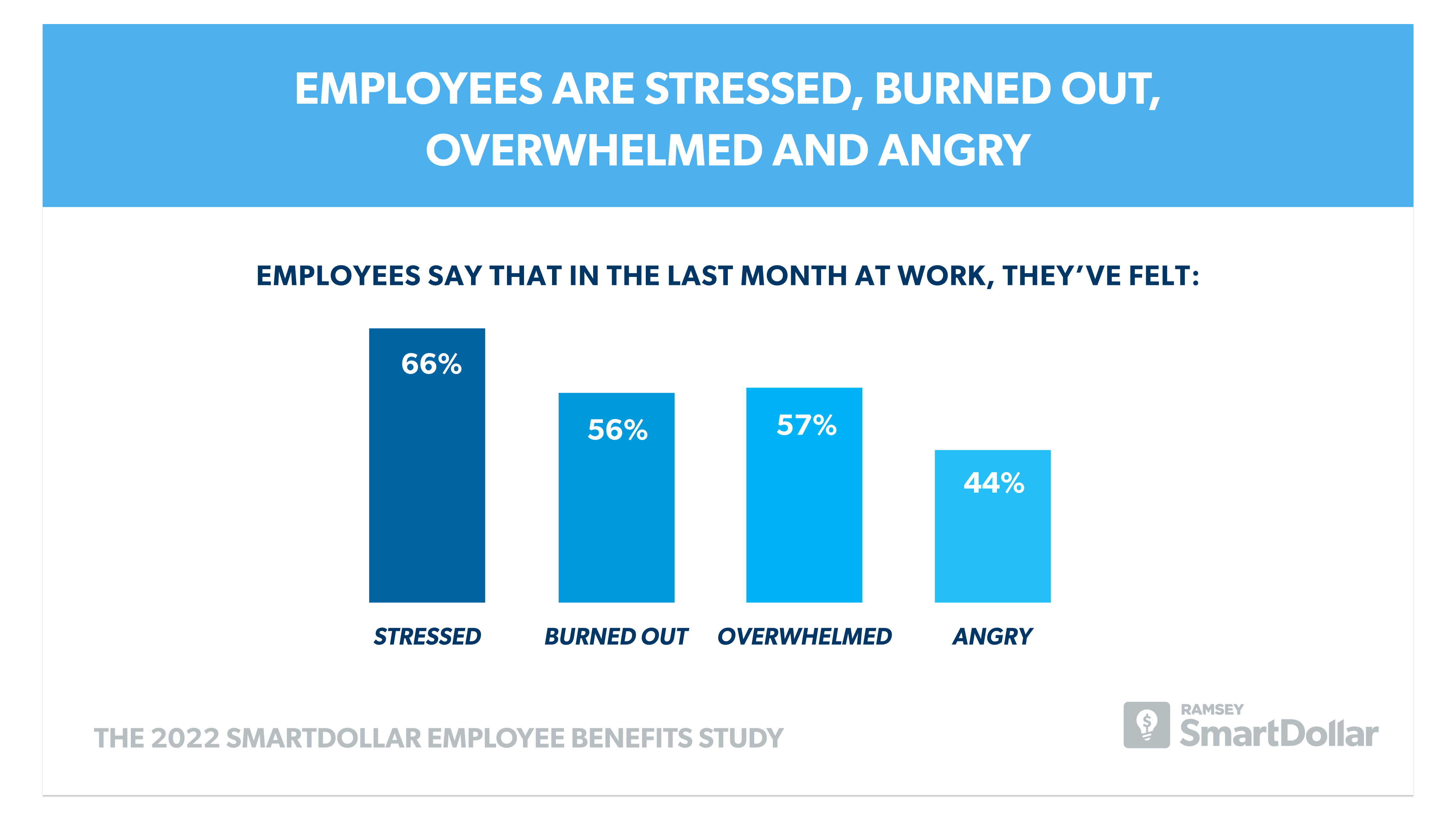

- Employees report that in the last month, they felt stressed (66%), burned out (56%), overwhelmed (57%) and angry (44%) at work.

The 2022 SmartDollar Employee Benefits Study from Ramsey Solutions reveals how employees feel about financial wellness benefits provided by their employers, the financial concerns they’re facing, and other workplace trends impacting today’s full-time workforce.

Downloads

- Research PDF

- Press Release

- Infographics

- Employees Worry About Finances Daily

- Distraction at Work Due to Financial Problems

- Employees Wish Employers Offered More Resources

- 1 in 4 Employees Have a Financial Wellness Benefit

- Majority Agree Financial Wellness Is an Important Benefit

- Employees Benefit From Financial Wellness

- Employees Are Stressed, Burned Out, Overwhelmed, and Angry

- Employees’ Mental Health Is Impacting Their Work

Have questions about this study? Email us or visit our newsroom for more information.

About the Study

Ramsey Solutions conducted a study of more than 3,000 full-time American employees working at organizations with 25 to 3,000 employees and who receive benefits through their employer. The study covered topics including employee benefits, perceptions of and engagement with financial wellness benefits, employee financial and mental health, and other trends impacting today’s workforce. The sample was fielded January 10, 2022, to January 25, 2022, using a third-party research panel.

For the purposes of this study, the following definitions of organization size were used:

Small Business: 25–199 employees

Medium Business: 200–999 employees

Large Business: 1,000–2,999 employees

American employees are burdened by money stress and worry.

Today’s employees are facing many challenges, from employee turnover to mental health to a lack of satisfaction. But their personal finances are a major cause of stress in their lives. One-quarter of full-time workers report that they’re struggling financially. Even more feel stuck—with 56% saying they feel like they can’t get ahead with their personal finances.

And those struggles translate to stress and worry. In fact, personal finances and money were the top issues creating “a significant amount of stress” in the last month for employees—more than their career, relationships and family. And more than half of employees (55%) say they worry about their personal finances daily.

Younger workers are even more likely to deal with money stress on a daily basis. Seventy-two percent of Gen Z employees and 65% of millennial employees say they worry daily about their personal finances, compared to 54% of Gen X employees and 28% of baby boomer employees.

Personal finance problems hurt employees’ ability to do their best work.

Personal finance problems don’t stay personal—employee money stress follows them into work as well. More than one-third of employees report that they’ve missed work due to a financial problem. This affected workers at small (37%) and medium (41%) organizations even more than those working at large organizations (30%).

Even more employees have had their personal finance problems interfere with their work. Nearly half of employees (45%) say that in the last year, they’ve been distracted at work due to financial problems.

Employees of small (44%) and medium (49%) organizations were even more likely to report being distracted at work due to personal finance problems than those working at large organizations (40%).

Most employees wish their employers offered more resources to help them manage their finances.

With these financial struggles, many employees are looking to their employer to step in with assistance. Nearly 3 in 4 employees (73%) say they wish their employer offered more resources to help them manage their finances.

Millennial workers especially are looking to their employer to step in with help. Eighty-four percent of millennials say they wish their employer offered more resources to help them manage their finances. In fact, financial wellness benefits are among the top benefits that employees who don’t already have one wish they had. Currently, only 1 in 4 employees (23%) have a financial wellness benefit from their employer.

That’s comparable to the percentage of employees who have other wellness programs, like mental health resources (25%) and career and professional development programs (22%). But it’s less than those who have a health and wellness program as a benefit through their employer (34%).

Of the different kinds of financial wellness benefits, large organizations were more likely to offer both financial planning resources and financial education resources to their employees as benefits. Only 12% of those working at small organizations currently have a financial planning benefit, compared to 15% of those working at medium organizations and 22% of those working at large organizations.

The discrepancy is even larger for financial education benefits. Only 7% of those working at small organizations have a financial education benefit, compared to 14% at medium organizations and 19% at large organizations.

Financial wellness benefits are among the top benefits employees are looking for from their employer, though few currently have access to one. Benefits related to their finances are what employees are looking for most after flexible and remote work options (14%). Among those who don’t currently have these benefits provided, employees wish they had access to perks programs for savings on purchases (14%), student loan repayment assistance (13%), financial hardship programs (12%), financial planning resources (12%) and financial education resources (12%).

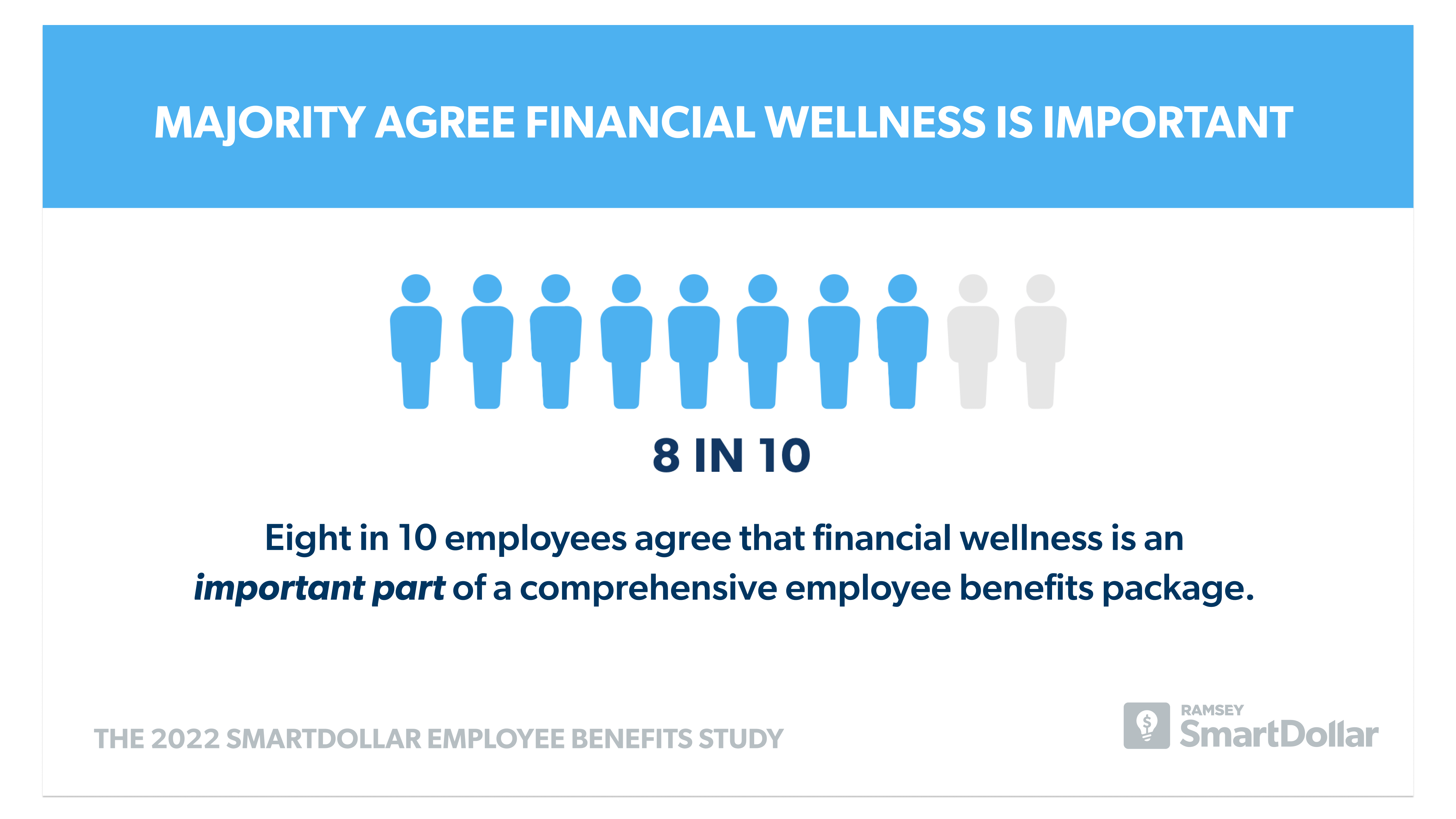

Even when they don’t have access to a financial wellness benefit, employees see the value one could offer. Eight in 10 employees agree that financial wellness is an important part of a comprehensive employee benefits package. And those who have a financial wellness benefit rate their overall benefits package much higher because of it.

One-third of employees (34%) say they’re extremely satisfied with their overall employee benefits package. But those with access to a financial wellness benefit provided by their employer (46%) are more than twice as likely to say they’re extremely satisfied with their current overall employee benefits package compared to those who don’t have access to one (21%).

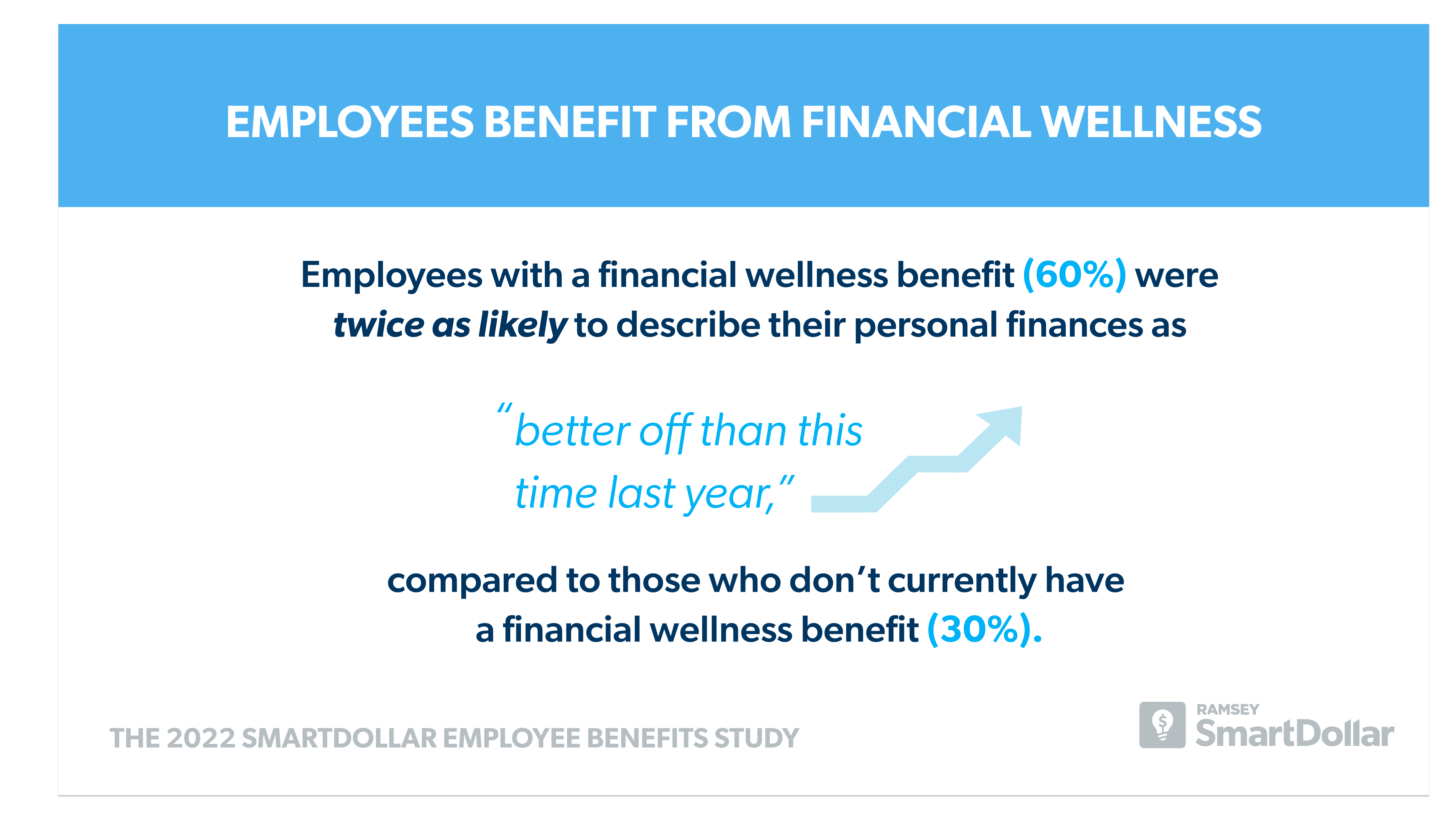

Employees with a financial wellness benefit made progress toward retirement savings and are less stressed about money.

Financial wellness benefits don’t just contribute to employee satisfaction. They also offer real value to employees and help them address their personal finance concerns and struggles. Nearly 4 in 10 employees with a financial wellness benefit (38%) say that having a financial wellness benefit has had a significant impact on their personal finances. Another 44% say it’s made a moderate impact. Additionally, those employees with a financial wellness benefit (60%) were twice as likely to describe their personal finances as “better off than this time last year,” compared to those who don’t currently have a financial wellness benefit (30%).

As a result of using their company’s financial wellness benefit, employees report both practical and emotional improvements in their personal finances. Both long- and short-term savings were top areas of concern that employees improved by using their financial wellness benefit.

By using their financial wellness benefit, 29% started saving for retirement and 25% built up their emergency fund. And not only did employees start saving for retirement, but one-quarter (24%) say they had more clarity around how much they should be saving for retirement.

Employees who used their employer-provided financial wellness benefit say it gave them peace of mind—27% say they experienced less stress about their personal finances.

Employees are concerned about retirement preparedness.

Preparing for retirement is a huge financial concern for employees. Starting to save for retirement is the top change employees are making as a result of their financial wellness benefit. And more than half of employees with a financial wellness benefit (53%) rank retirement planning as the most important feature.

Employees across generations view retirement planning as extremely important, no matter how far they are from retirement. Of those with a financial wellness benefit, 53% of millennials, 53% of Gen X and 55% of baby boomers rank retirement planning as an extremely important feature of their financial wellness benefit. Retirement planning is also the number one most-used feature for those who have access to a financial wellness benefit.

While employees feel strongly about retirement planning, the majority still don’t feel like they’re preparing for their retirement well. Six in 10 say they feel behind on their goals for retirement.

In this case, baby boomers are ahead of their younger coworkers. Only 39% of baby boomer employees say they feel behind on their goals for retirement. And not only do employees feel behind, but nearly half (48%) say they don’t have anyone they trust for advice about retirement. In fact, when employees have questions about their personal finances, they’re more likely to turn to their family (40%) or the internet (36%) for answers than to a professional financial advisor (33%).

Half of employees say money stress has negatively impacted their mental health.

The 2022 SmartDollar Employee Benefits Study not only measured employees’ attitudes and behaviors around their finances, but it also explored other influences impacting their work, including their mental health.

Half of employees suggest that their financial health and their mental health are connected, with 51% reporting that money stress has negatively impacted their mental health. And while 1 in 4 (26%) report financial stress as a top pain point, just as many report low motivation at work (26%), burnout (26%) and anxiety (29%) as their top pain points. These challenges have especially impacted employees of small businesses. They report that their top pain points are anxiety (31%), burnout (29%), financial stress (28%) and low motivation at work (25%).

Employees across generations are facing these challenges too. A significant number say that in the last month at work, they’ve felt stressed (66%), burned out (56%), overwhelmed (57%) and angry (44%).

And burnout is hitting younger workers at a higher rate. In the last month, 74% of Gen Z employees, 61% of millennial employees, 56% of Gen X employees, and 42% of baby boomer employees report feeling burned out. These feelings are evidence of a workforce that’s dealing not only with strain on their finances, but also with strain on their mental health. Overall, 4 in 10 employees rate their mental and emotional health as only okay, fair or poor.

And just like financial struggles, these mental health struggles can have an impact on how employees engage with their work. Nearly half of employees (46%) say that in the last year, their mental health has impacted their ability to do their job to the best of their ability.

Many employees are facing financial and mental health challenges that are limiting their capacity and leading to burnout. These employees are looking for resources from their employers to help address their concerns and set them up for success both now and in the future.

About SmartDollar

SmartDollar is an employer-provided financial wellness benefit from Ramsey Solutions that helps employees budget, get out of debt, save for the future, and retire with confidence using Dave Ramsey’s 7 Baby Steps.