So, you want to start budgeting, or you want to budget better than you ever have before. You don’t want random numbers on a spreadsheet—you want a plan for your spending that you can actually stick to so you can take control of your money for real.

First of all, bravo! That decision takes guts. We’re proud of you! Secondly, you can stick to your budget—it just takes some work to make a realistic, reasonable budget. Let’s talk about how you can make that happen.

Why It’s Important to Stick to a Budget

Listen. You’ve got big hopes and dreams—places to go and goals to crush. And you can do it all . . . but it all starts with a budget. And that budget will do you no good if you set it and forget it.

Your goals aren’t a slow cooker, and your budget isn’t either. You don’t dump in numbers, click a button, and walk away. You’ve got to keep at it and keep with it.

Budgeting is telling your money you're in charge. Sticking to the budget is showing your money you're in charge.

![]()

How to Stick to a Budget

There are tons of tips and tricks to sticking to your budget every month. But following “tons” of suggestions is hard. So, we narrowed it down to eight of the best.

1. Keep it real.

Have you ever made a goal that totally set you up for failure? Like saying you’ll read 10 books a month when you barely have any free time. Or promising to run 10 miles a day all year when you’ve never run a meter. If you want to succeed, you have to push yourself—but you also have to be realistic.

The same is true with your budget. Push yourself to spend better and save more—but be realistic when you set up every single budget line.

Saying you won’t buy any new clothes all year might not be realistic if your winter coat is falling apart. But you can challenge yourself to skip restaurants for a month and put the money you save toward your current money goal instead.

When you keep it real, you can really win.

2. Set up auto draft.

Set up automatic bank drafts so some of your bills and savings deposits are paid straight out of your paycheck. That way, you don’t even touch the money—and you won’t be tempted to put that $200 for your emergency fund toward a new pair of shoes you want but don’t need.

3. Plan your meals.

Beat drive-thru temptations that bust your restaurant budget, and keep the money-grabbing munchies at bay. How? By planning your meals: breakfast, lunch, dinner and snacks. Then make a grocery list—and stick to that list! Meal planning saves you from going overboard on your grocery and restaurant budget lines.

4. Think weekly.

You may want to break some of your budget lines into weekly portions to help you spread out your spending. For example: If you give yourself $300 for personal spending, think of it as $75 a week.

If you put $967 in your grocery budget (which is the average monthly spending for a family of four), that’s like spending about $242 a week.1 Sometimes thinking in these bite-sized amounts makes it easier to stick to your budget.

5. Check your social calendar.

Your BFF’s birthday is the same day every year. Budget for it. You’re hosting book club next month and need to make a charcuterie board. Budget for it. Family’s coming in from out of town. You get the idea.

Start budgeting with EveryDollar today!

Yes, emergencies and surprises pop up that can rock your budget. But a lot of what we call “surprises” are actually just poor planning. So, check your social calendar when you’re making each month’s budget so you can budget realistically for each month’s needs.

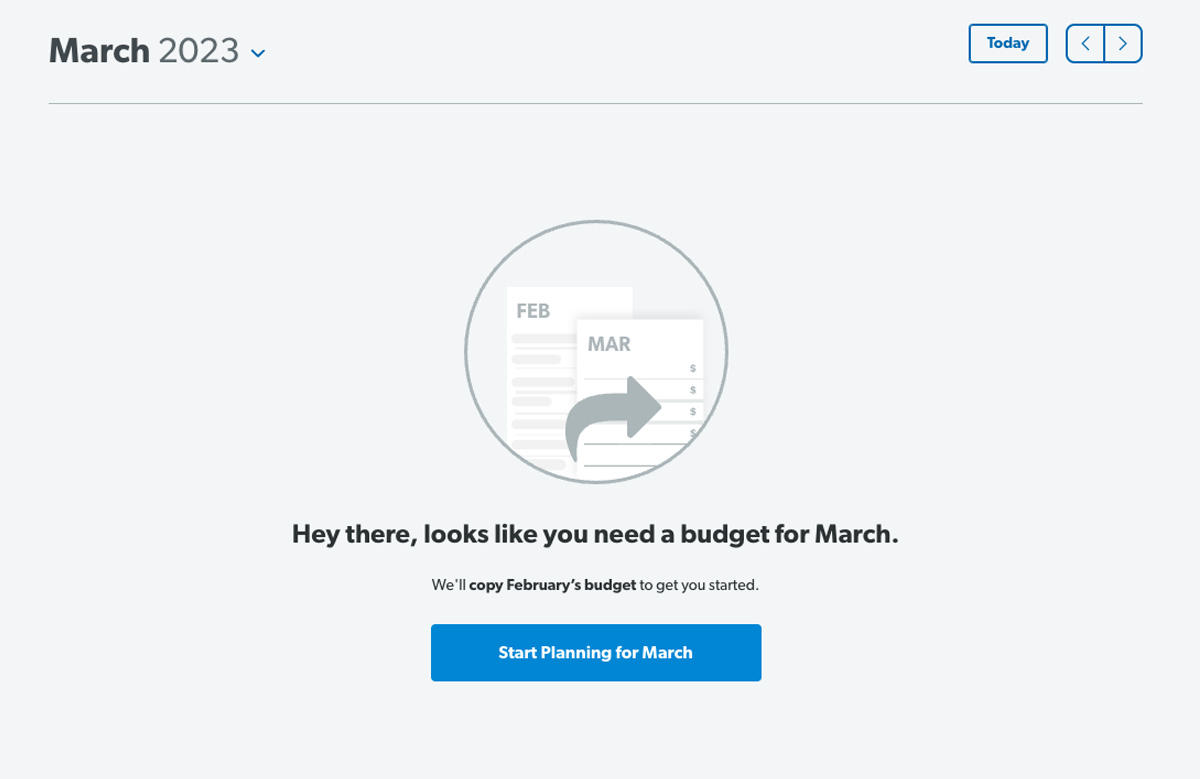

And don’t worry! You don’t have to build each budget from scratch. Go ahead and copy everything over from the previous month, then only make tweaks to the budget lines that will be affected by anything coming up.

6. Learn to say no (or not now).

If you want to buy something, a budget doesn’t always say, “No way.” But it often says, “Not today.” Instead of caving in to impulse buys, save up for bigger purchases, pay cash, and set financial goals for yourself.

And to be honest, sometimes you do have to say no. That’s part of being an adult. It’s like saying no to social events so you don’t drain your energy and time. The same goes for saying no to spending sometimes: You don’t spend so you won’t drain your bank account.

Don’t worry about what everyone on social media appears to have. Some are lying. Some are in debt up to their designer sunglasses. And a few really do have their lives together. But those people worked hard for it—and that’s what you’re going to do too.

Work hard defending your budget—saying no or not now when you need to—because being true to yourself, your budget and your money goals is more valuable than anything you could ever buy.

7. Ditch the credit card.

Listen carefully—you don’t actually need a credit card. In fact, it’s often a motivator to spend like crazy with the mindset that it’s tomorrow’s problem. Hey. Guess what? “Tomorrow’s problem” is a lame excuse, and you’re better than that!

If you want to stick to your budget, don’t use someone else’s money that comes with strings attached—like interest and fees. Pay off your debt and start using your real money—your cash or debit card. That’s how you stay away from “tomorrow’s problems” and start knocking out tomorrow’s goals.

8. Find an accountability partner.

Do yourself a huge budgeting favor and get an accountability partner. That’s someone who’s encouraging enough to cheer you on and bold enough to call you out. Got a spouse? Boom. You’ve got a built-in accountability partner.

Get with your accountability partner every month to check in and set up the next budget. If you’re married—do this together and in person at a monthly budget meeting.

If you’re working with a friend or family member, you’re welcome to make your budget alone, but never skip the check-in. Your partner can’t keep you accountable if they don’t know what’s going on!

If you aren’t sure how to have a good budget meeting with your accountability partner, check out our free budget meeting guide (the classic or the couples version).

Listen, there’s no shame in asking someone to help you keep your eye on the goal. Just the opposite. There’s incredible strength in working as a team. So, get yourself an accountability partner. Today!

![]()

How to Create a Budget You Can Stick To

Let’s start with the basics and talk about how you physically set up a budget in the first place.

How to Set Up Your Budget

Some people never start budgeting because they’re worried it’ll be super difficult. But it’s really just these five steps.

1. Add your income.

A budget starts with your income. All of it. That means your normal paychecks and any extra income that comes your way through a side hustle, garage sale, freelance work, etc.

2. List your expenses.

Next, list out your expenses. Start with essentials like giving, saving, food, utilities, housing, transportation, insurance and childcare. Then, add in the fun stuff like restaurants, date nights and entertainment. Because we all need a little money each month for things we can buy guilt-free.

Make sure you make budget lines for all of your monthly expenses, including the big expenses you're saving up for. And don’t forget the easily overlooked ones like haircuts, vitamins and pet care—take time to think through everything you spend money on every month.

3. Budget to zero.

This doesn’t mean you spend all your money and leave an empty bank account at the end of the month. (Keep a little buffer in there of $100–$300.)

It does mean you give all your money a job: giving, saving or spending. You make a spot in the budget for every single dollar you earn. It’s called zero-based budgeting, and this is how it works: List all your expenses, subtract them from your income, and if you still have money left over, chuck it at your current money goal! Boom.

If you don’t have enough to cover all your expenses, go back and trim your budget lines until your income minus your expenses equals zero.

4. Track your expenses.

This step is key. Track. Every. Expense. When you spend money, log that purchase in the correct budget line. This is how you’ll keep an eye on everything. Budgeting is how you plan. Tracking is how you keep up with the plan.

5. Budget every month before the month begins.

To get ahead, you need to think ahead. That’s solid life advice—and an excellent budgeting tip. You need a new budget each month. And you need to set that up before the month begins.

With EveryDollar, it’s easy. You can copy this month’s budget to the next and then adjust where you need to. Like we said before, you’ll think about the unique spending coming up (like your BFF’s birthday or that book club meeting) and move money around to make room for it.

![]()

And there you are! That’s how you stick to a budget—you budget with intention. You work to push yourself to make your goals come true while still living in the real world. Because you can do both: You can set realistic budgets that also get you from where you are today to where you want to be!

Start with an EveryDollar budget, add those guts we know you have—and get after it.