We. Love. Budgeting. And we will never stop shouting its greatness from the rooftops. Why?

A budget is a plan for your money—plain and simple. It’s you telling your money where to go so you stop wondering where it went. It’s the first step to making any money goal a reality. It’s how you truly take control of your finances.

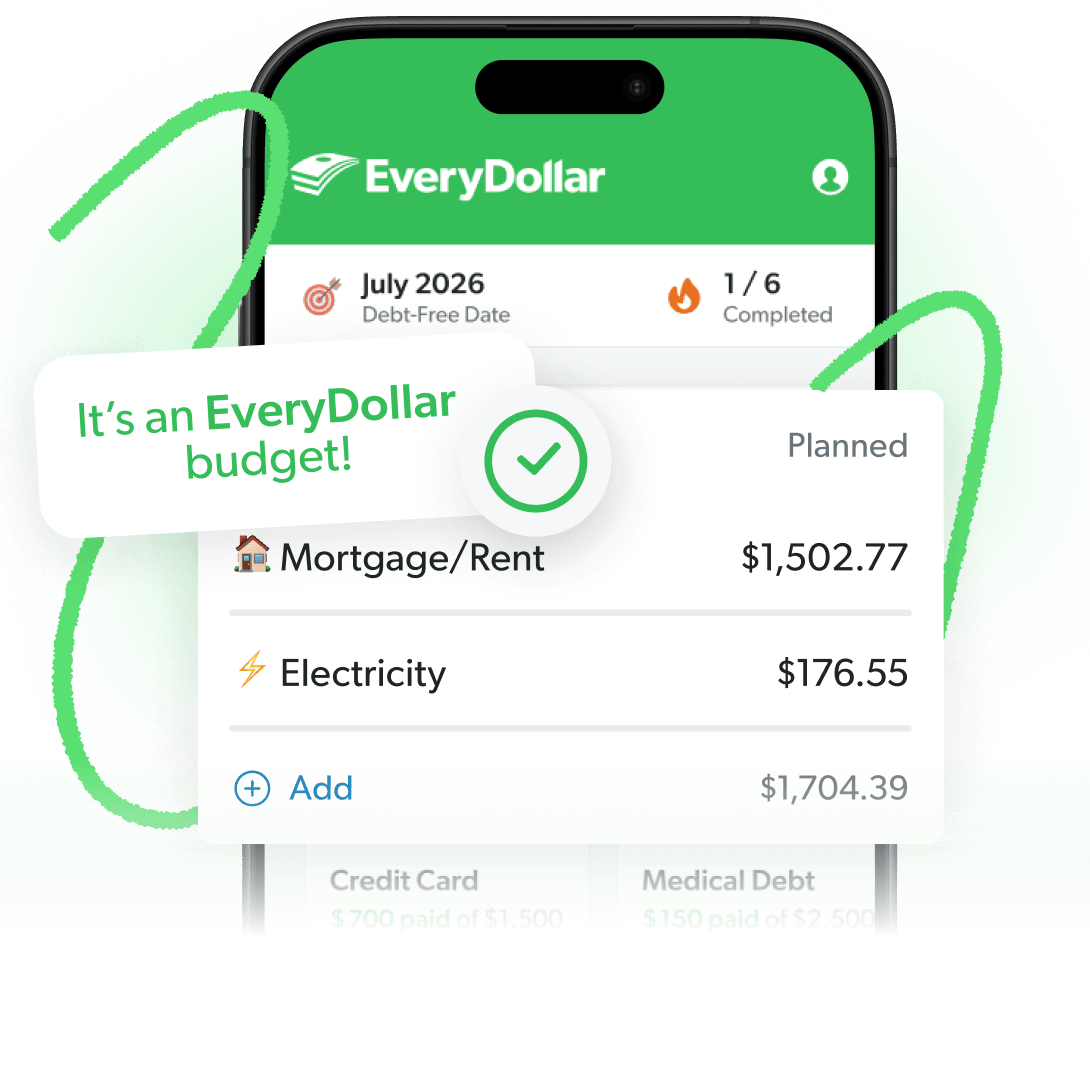

But if you’re just getting started (or might be thinking of trying something new) you might not be sure what method is best: build-it-yourself budget spreadsheets or a built-for-you budgeting app. Let’s look at some of the benefits of both—specifically spreadsheets vs. EveryDollar.

Key Takeaways

- Budget spreadsheets and EveryDollar both offer customizable budgets, stability for budgeters, and free budgeting options.

- Spreadsheet users often say they enjoy how well this method supports their complicated budgets.

- EveryDollar offers easy budgeting and tracking, accountability, and lots of features, all in a mobile app.

Budget Spreadsheets Benefits

Super Customizable

The possibilities for customizing your spreadsheet budget feel nearly endless. A spot for every budget category and line you could ever dream up? Splendid. You just create a new cell to hold it.

Get expert money advice to reach your money goals faster!

You can also make the budget spreadsheet work how you like—as long as you’ve got a solid understanding of the inner workings, of course.

Useful for Complicated Budgets

Often, die-hard spreadsheeters will say they’ve got super complicated budgets. They love how well a spreadsheet steps up to the task, working like a budget calculator and then some. Graphs. Charts. Formulas. If you know how to work the Excel magic, you can unlock a whole new budgeting world.

Timeless

Unlike your second-grade crush, spreadsheets probably won’t leave you for some kid in a Big Bird T-shirt. This technology has been around for a long time, and your budget history will stand the test of time if you use spreadsheets. That sense of security is huge for budgeters, especially after Mint announced they’re closing their budgeting app in January 2024.

Free

As you’re learning how to make a budget spreadsheet, you can buy spreadsheet templates or programs to give you a starting point. (That’s how the YNAB budgeting app started out, as a spreadsheet for purchase!)

But you can also just create your own 100% free version. And free is a beautiful thing when you’re trying to save money (which is something budgeters do best).

EveryDollar Budgeting App Benefits

Simplicity of Budgeting

Yes, spreadsheets have their budget benefits—if you know how to work all the formulas and set up the math systems correctly.

But if you’re new to budgeting, or you aren’t an Excel wizard, the EveryDollar budgeting app makes it simple to create your first budget and keep up with every monthly budget after that.

Also, if you are super tech savvy but married to someone who isn’t, EveryDollar helps you both budget together so one person isn’t carrying the load or making all the financial decisions. Because there’s no “I” in budget, after all. (You can spell-check us on that one.)

Ease of Tracking Your Spending

We know the secret to budgeting really really well. And we refuse to keep it to ourselves. You ready? Track all your expenses. And good news, a budgeting app makes it easy to track expenses anywhere, any time.

You can track receipts in the grocery store parking lot or right after clicking “purchase” online. Tracking helps you see how much is left to spend so you don’t overspend.

P.S. With EveryDollar, you can do this manually in the free version or upgrade to the premium version and have transactions automatically stream into your budget. All you have to do is drag and drop them to the right spot. Either way, put this secret tip into action. Pronto.

Instant Accountability

With your budget in your back pocket, you’ve got accountability walking around with you. This isn’t restricting. It’s empowering! You’ve got money goals of all sizes to reach—and remember, the budget is how you get there.

This accountability works when married couples use the same EveryDollar budget. It works when you track every expense so you never hide spending from yourself. It's like having a personal trainer for your money, minus the sweat and the guilt of skipping leg day.

Find Margin You Didn’t Know You Had With EveryDollar

The EveryDollar budgeting app helps you find extra money every month so you can beat debt, build wealth, and make progress. Every. Day.

Features Aplenty

EveryDollar has the features you need to truly level up your budgeting—right in the palm of your hand. What features? We’re glad you asked:

Free Budget Features

- Create monthly budgets

- Access your budget on your computer, phone or tablet

- Customize budget categories and lines for all your monthly expenses (yep, it’s customizable too!)

- Create unlimited budget categories and lines

- Set up sinking funds and track savings goals

- Split transactions

- Set due dates for bills

- Talk to a live human being for customer support

Premium Budget Features

Includes all the free features, plus:

- Connect to multiple financial accounts in one app

- See custom budget reports

- Export transaction data

- Join live Q&A sessions with professional financial coaches

- Automatically stream your transactions into your budget

- Get tracking recommendations for your transactions

- Set due date reminders for your bills

- Calculate your current and projected net worth

- Plan your spending based on when you get paid and when things are due with paycheck planning

- Set big-picture goals and see a timeline of when you’ll hit them with financial roadmap

All those features were designed with you in mind—to help you create custom monthly budgets that reflect your life, your priorities, your goals. They’ll help you build the habits you need to make your money dreams a reality.

Because it always comes back to the habits. And the on-the-go nature of budgeting with EveryDollar makes building a budgeting habit so much easier.

Free to Use

We mentioned it earlier, but EveryDollar has a paid version and a completely free version! And just look at all those awesome free features up there.

Stability

EveryDollar was created by Ramsey Solutions, a company built on the principle that budgeting is foundational to personal finance. No matter where you’re starting your financial journey, you need to budget—and EveryDollar’s all about helping you do that. It’s part of the DNA of this place. We aren’t going to sell our app to another business or shut our doors. We aren’t going anywhere!

Which Should You Pick?

If you’re on the fence about which option to pick, slide on over to the EveryDollar side. If you’ve been working with spreadsheets but feel stuck or frustrated, we’re ready for you too!

You’re the hero here, and you’re the one who’ll put in the work and build the habits to crush those goals. But we’d love to be the Robin to your Batman—here as your sidekick every step of the way, making it easier to save the day with your money in big and small ways. (This feels like a time to shout, “Holy budgeting app, Batman!” But we’ll hold back. This time.)

EveryDollar does more than just help you track your spending and manage your money—it actually helps you find more margin every month! Just download the app, answer a few questions, and we’ll build you a plan to free up thousands in margin to put toward your goals.