So, you just got a raise or a new job with a bigger paycheck. Good for you! But what happens to the extra cash now coming your way each month? If you aren’t careful, lifestyle creep can get you off track from getting ahead with your money. So, let’s talk about what it is and how you can avoid it.

What Is Lifestyle Creep?

Plain and simple, lifestyle creep is when your income goes up and your spending creeps right up to meet it. You don’t even notice the shift. It just happens. If you think about it, it’s the perfect name, right?

Lifestyle creep is sometimes called lifestyle inflation … or liflation. (Actually, liflation isn’t a word. I just made that up.)

Now, on one hand, things could be worse. You could be overspending. But lifestyle creep is still bad for your money. All those financial goals you’ve got? A raise could really help you get there way sooner! But not if you just start mindlessly spending it on impulse buys, eating out, coffee runs or well . . . anything!

Lifestyle creep can happen at any life stage. Raises, side hustles, promotions: Any time you up your income, you’ve got to be intentional with that money. Otherwise, your lifestyle will creep in and take over.

Signs of Lifestyle Creep

Okay, so how do you know if you’re experiencing lifestyle creep? Here are a few signs to tip you off:

Your money goals are at a standstill.

Most of us have money goals. What are yours? Building a huge emergency fund? Paying off your debt? Saving up for that dream vacation? Investing in retirement?

The good news is—you can do all of those things. The bad news is—you can’t if you’re spending everything you make. You’ve got to be intentional with your money. That’s how you make it do what you want it to do.

If your income goes up but you’re not seeing progress on your money goals, that’s one of the signs of lifestyle creep.

Your spending has gone up, but your savings hasn’t.

Listen, I’m a natural-born spender. It’s not on the level of a shopping addiction. I’m just geared toward spending money, and I love spending it.

But I know that about myself. So if my income goes up, I know I’ve got to be diligent about where that money goes.

So, if your spending is on the rise but your savings isn’t, that’s another clue you might be experiencing lifestyle creep.

Little luxuries have become common habits.

Remember when getting a fancy latte in the drive-thru on the way to work was treating yourself? And now you get one nearly every morning?

Okay, maybe it’s not coffees for you. Maybe it’s buying lunch every workday or getting pedicures each week or getting a $13 cocktail every time you go out for dinner.

Whatever it is, hear this: There’s nothing wrong with spending money on fun things, as long as it’s in the budget and not holding you back. But if all the things that were once treats now feel completely normal—and even necessary—it could be a sign of lifestyle creep.

Why Lifestyle Creep Is Harmful

I hope you can see that buying nice things isn’t the problem here. The problem is mindless spending. The problem is letting your money do whatever instead of telling it to do what you want.

Lifestyle creep is harmful to your financial health and your financial security. You’re trading the future for the present—but you aren’t even really aware you’re doing it!

Get Rachel Cruze's new book to learn why you handle money the way you do!

Listen, if you get a raise or start making extra money some other way—take a minute to celebrate it with friends and family. But then, start making a plan for what to do with that money. Or the next year will come and go without you even realizing what you spent it on.

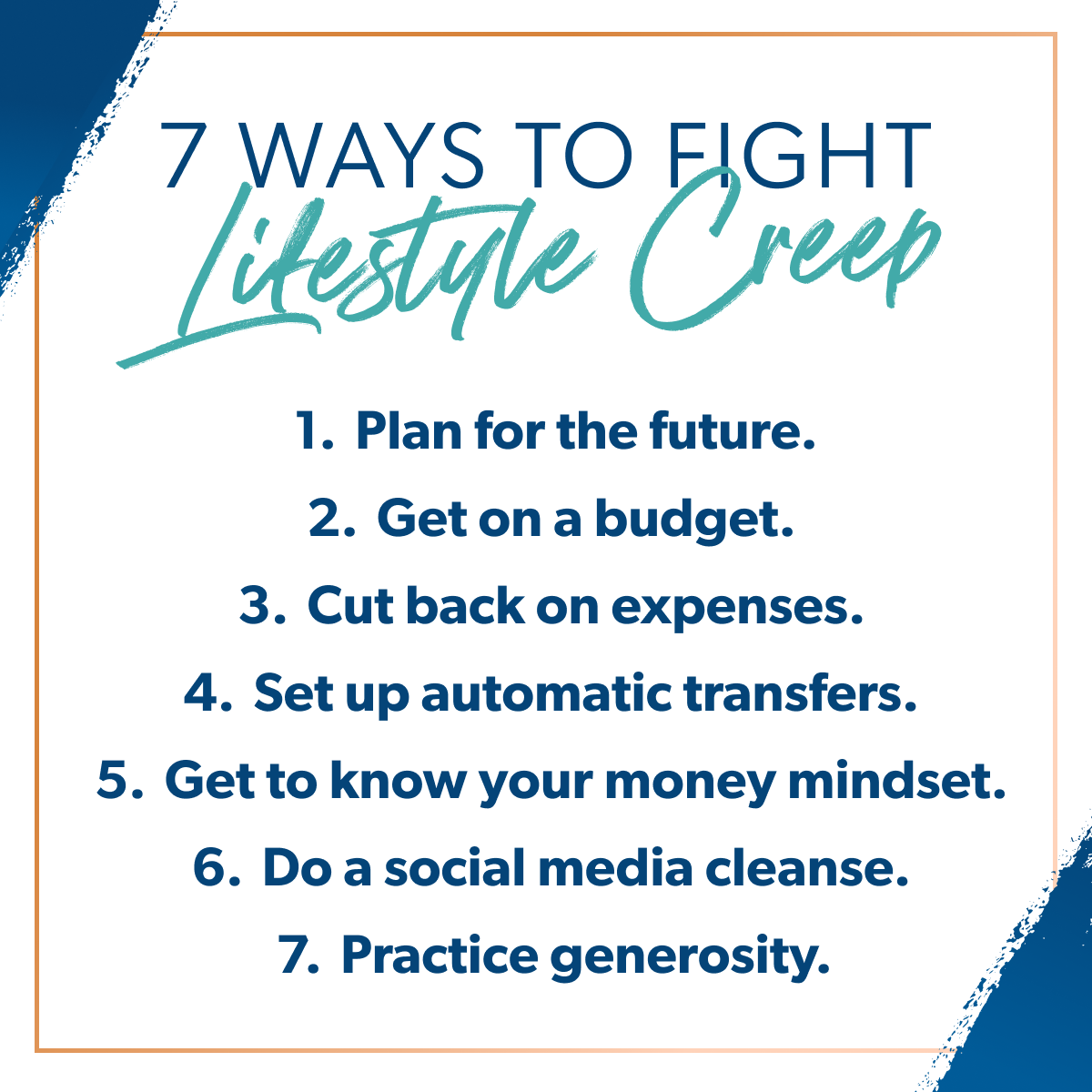

7 Ways to Fight Lifestyle Creep

Okay, guys. It’s time to do the exact thing I just said—start making a plan. This next part is all about being intentional with your increased income, because that’s how you’ll fight lifestyle creep. And win.

1. Plan for the future.

All of your money decisions will flow out of what’s important to you. Your career choices, purchases, investments, college selection for the kids—everything! So, let’s start there!

Take some time to think about your values. Then, write down your financial goals and put up pictures of those goals so you can be reminded of why you’re taking up the fight against lifestyle creep. You have to put in the work today to get the tomorrow you’re dreaming of. And trust me, it’s worth it.

2. Get on a budget.

Budgeting is the key to getting ahead with your money. A budget is just a plan for your money. And that’s exactly what you need right now.

Lifestyle creep happens when you have no plan for your extra income. You spend it—but not in a way that reflects your personal values and gets you closer to your dreams for the future.

Get on a budget and track every single transaction so you can see where your money’s going—and start telling it where to go. This is how you take control. This is how you get ahead.

3. Cut back on expenses.

In this pattern of lifestyle creep, you’ve gotten used to some expenses that you don’t really need. Look at that budget you made. Remember, you don’t have to drop everything. But I’m sure you’ll find some extras that sneaked into your spending habits.

What spending can you cut out or cut back on? Do it, and then budget that money toward what you really want it to do.

4. Set up automatic transfers.

Once you’ve made the budget and trimmed it, do yourself a favor and set up some automatic transfers to help you move forward with your goals.

For example, if you’re trying to build up that savings account, have some of your paycheck go straight into savings—or set up an automatic transfer that moves money from your checking to savings at least once a month.

Or, if you’re on Baby Step 4, set up 15% of your income to go straight into your retirement accounts.

Hey, you didn’t notice that raise when you were spending it here and there. This is a way to be in control—on the front end—of where your money goes.

5. Get to know your money mindset.

Your money mindset is your unique set of beliefs and your attitude about finances. It drives the decisions you make about saving, spending and handling money. A lot goes into what your money mindset is—including your past and your personality. If you can get a handle on your money mindset, you can get a handle on your life.

By the way, I do a deep dive on this in my Know Yourself, Know Your Money course.

6. Do a social media cleanse.

One way to fight lifestyle creep (and to stop comparing yourself to others) is to do a social media cleanse. Think about who you follow and delete accounts that make you feel discontent or that pressure you to buy things. Take breaks from going online. Period. That can be a week off, certain hours of the day off, or whatever is best for you.

All this will help you make real connections with other people—and help you stay true to those personal values you wrote down earlier in this process!

7. Practice generosity.

How can giving back help? Well, lifestyle creep naturally encourages us to think about ourselves. Generosity moves the focus off of us (our problems, our money, our wants) and on to others. It’s a great way to make a shift in your money mindset and help others at the same time.

You Can Beat Lifestyle Creep

Listen. If you’ve been caught in the lifestyle creep cycle, I know you’ve gotten into some spending habits you’ll have to break. But you can do this! And, in the process, you can stop being stressed over feeling like you’ve got nothing to show for all the extra money you’re making.

But you can’t make any of these changes if you don’t have a plan—aka your budget. And guess what? I’ve got just the budgeting tool for you. It’s called EveryDollar, and it’s what my husband, Winston, and I use every single month to make our budget and track our transactions. Oh. And it’s free!

Yup. So get started today. Beat lifestyle creep! And line up your money habits with your money goals, one EveryDollar budget at a time!