How to Create a Budget

If you’re already budgeting, you can skip to the next section. But if you aren’t, there’s never been a better time to start. Budgeting is the key to fighting inflation. That’s because your budget shows you where your money’s going—so you can start telling it where to go.

Your budget helps you take inventory of what’s really happening with your money and spot the expenses inflation is hitting the hardest. Your budget also allows you to make adjustments to your spending and income so money doesn’t feel so tight anymore.

But first: Before you start, open up your online bank account or pull out those hard copy bank statements for the past couple of months. Having these numbers in front of you will make the whole process way easier.

Step 1: List Your Income

Income is the money that will come in during the month.

Create a separate income budget line for each regular paycheck you (and your spouse, if you’re married) make—plus anything extra (like freelance work).

If you’ve got an irregular income, you can still budget! Look at what you’ve made the last few months and list the lowest amount as this month’s planned income. You’ll adjust this amount later in the month for how much you actually make, but you want to budget low. Check out our Irregular Income Planning form for more help here!

Step 2: List Your Expenses

Okay, you planned for the money coming in—now it’s time to plan for the money going out. Start listing your expenses!

If you’d like to write it all out first, print out our Quick Start Budget form and fill in budget lines you need in this order:

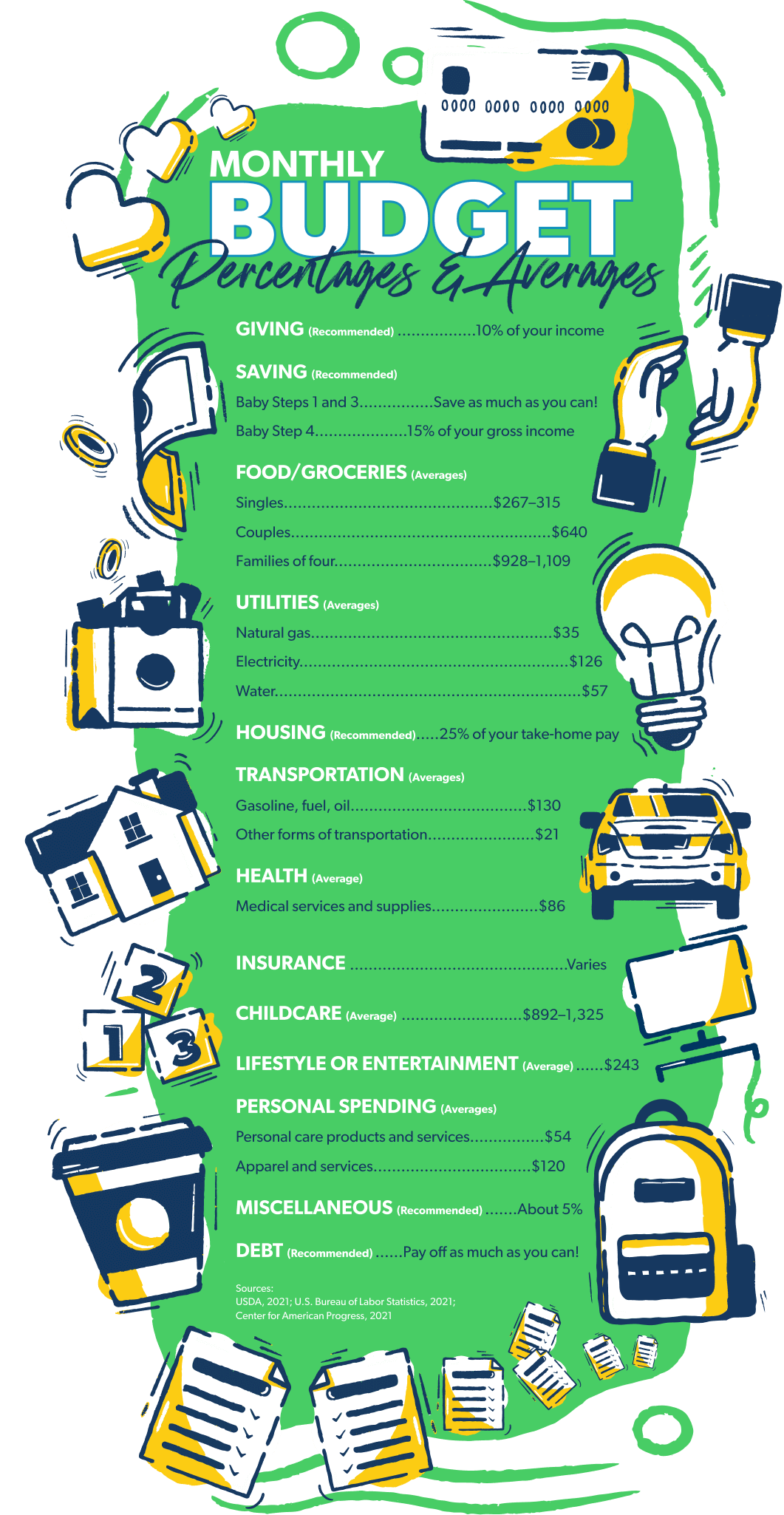

- Giving (10% of your income)

- Saving (depending on your Baby Step)

- Four Walls (food, utilities, shelter—aka housing—and transportation)

- Other essentials (insurance, debt, childcare, etc.)

- Extras (entertainment, restaurants, etc.)

As you go, write in what you plan to spend on each budget line. (That online bank account comes in super handy as you estimate your expenses.)

Step 3: Subtract Expenses From Income

Next, subtract all your expenses from your income. This number should equal zero, which is why we call this a zero-based budget.

Quick callout: A zero-based budget doesn’t mean you let your bank account reach zero. Leave a little buffer in there of about $100–300.

It also doesn’t mean you should spend all your money just to spend it and get to zero. The point of zero-based budgeting is to give every dollar a job to do—spending, giving, saving or paying off debt. Every. Single. Dollar.

Right now, you might not have a zero-based budget. If you’ve been spending more than you make each month because of inflation—or just because you haven’t been intentional with budgeting—don’t freak out. This guide will show you how to fix that! Just keep reading.

P.S. If the math is stressing you out, try EveryDollar. Our free budgeting app is made for this zero-based budgeting stuff.

Okay, so that’s it for setting up your budget. The next two steps are all about sticking with it.

Step 4: Track Your Expenses (All Month Long)

Tracking your transactions means you account for everything that happens with your money all month long. This is how you stay on top of your spending!

When you spend money somewhere, subtract it from the right budget line. When you make money, add it to your income lines. Don’t miss one single transaction, so you can stay aware and in charge!

Step 5: Make a New Budget Before the Month Begins

Your budget won’t change a ton each month, but no two months are exactly the same. That’s why you need to create a new budget every single month—before the month begins.

When you’re ready to make your next budget, go ahead and copy this month’s budget over. Then make tweaks for any month-specific expenses (like holidays or seasonal purchases).

Quick callout: Listen. It takes people about three months to really get the hang of budgeting, so give yourself some grace and keep working on it. The benefits of budgeting are worth it!

Complete Guide to Budgeting

That was a super quick flyover on how to create a budget. Check out the EveryDollar Complete Guide to Budgeting for a deeper dive.

Free EveryDollar App

We keep saying it, but keeping up with your budget is way easier with EveryDollar! You can get started with your free budget today.