Something’s definitely wrong with the economy, right? Inflation is at a 40-year high. The stock market has dipped into bear market territory. And mortgage rates are higher than they’ve been in a decade.

Hey, we’re all feeling the pain of higher prices, and you’re probably wondering, Are we in a recession?

Well, the quick answer is no.

But listen up—we’ve had recessions before, and we’ll have them again. The number one rule for a recession is: Don’t panic. And for goodness’ sake, don’t buy up all the toilet paper!

Let’s take a look at who determines whether we’re in a recession and what economic signs are related to recessions.

Are We in a Recession?

A recession happens when the economy shrinks for more than a couple of months. You might hear economists say that a recession is two consecutive quarters of negative growth of gross domestic product (GDP). Clear as mud, right?

Get expert money advice to reach your money goals faster!

Let’s dig a little deeper. GDP is the sum of all goods and services produced in the economy. GDP normally goes up each quarter, so when it goes down, that means businesses are making less money and could be forced to shut down or lay off employees. So the big concern about recessions is that they increase unemployment.

Negative GDP also hurts the stock market, so a recession could cause a lot of heartburn about your retirement investments. But a drop in the stock market doesn’t always predict a recession.

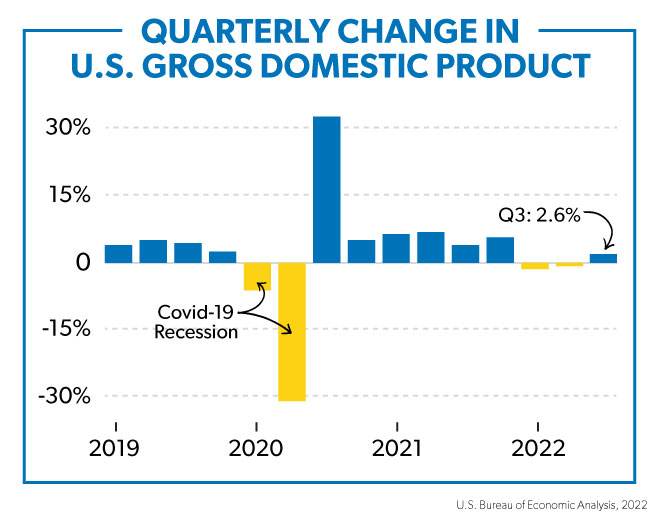

So, here’s the bad news: GDP was -1.6% in the first quarter of 2022 and -0.6% for the second quarter. That meant the American economy briefly entered recession territory, but it bounced back into positive territory with 2.6% GDP growth in the third quarter.1 2 This isn’t a crisis. The economy’s just slowing down.

Some economists think we’re currently in a rolling recession, which happens when parts of the economy take a downturn while others stay positive.

Who Decides if We're in a Recession?

Regardless of what politicians and economic experts say about the economy, declaring an official recession is the sole responsibility of the National Bureau of Economic Research (NBER). It monitors lots of data like personal income, employment, consumer spending, wholesale-retail sales and industrial production.

Even though GDP was down for two quarters, the NBER didn’t declare a recession. That’s not surprising, though, because the NBER usually beats around the bush when it comes to announcing recessions. So the economy could technically be in a recession for a few months before the NBER makes it official.

The silver lining of all this is that recessions are a normal part of the economy. The economy grows and shrinks over time, but overall, it’s got an upward trend. This rise and fall is just part of the business cycle.

What Are the Signs of a Recession?

You keep an alert on your phone for when GDP numbers are released, right? No?

Well, GDP isn’t the only thing to consider when it comes to recessions.

The unemployment rate is another sign of a recession to consider because people lose jobs during recessions. This is because when companies are struggling to make money, they have to pause hiring or even let people go.

Right now, though, unemployment is pretty low at 3.7%.3

On the other hand, the high inflation we’re all experiencing isn’t a sign of a recession. But high inflation is bad for everyone, so the Federal Reserve (the U.S. central bank) has started raising interest rates to fight inflation. Higher interest rates cause people and businesses to borrow less and spend less money, which can push the economy into a recession.

So, the Federal Reserve is walking a tightrope between lowering inflation and causing a recession. The goal is to have a “soft landing” for the economy—meaning inflation goes down without hurting economic growth too much.

How Long Will the Recession Last?

There’s no way to predict how long a recession will last (bummer, we know). But if you look back through history, the average length of the 13 recessions since World War II is about 10 months.4

Our most recent recession, brought on by coronavirus shutdowns, lasted just two months. This earned it the title of shortest recession in history. Yay!

Before that, the Great Recession of 2007–09 lasted 18 months. It was the longest recession since the Great Depression, and it caused unemployment to hit 10%.5 Boo!

Besides the length of a recession, the big thing to consider is the severity of it. The more severe a recession, the more the economy shrinks and the more people lose their jobs.

But even still, the lesson here is that recessions are normally short enough to measure in months instead of years. You could measure them in years if you wanted to, but you’d wind up having to work with fractions and decimal points—and no one wants to do that!

Listen, a recession is a short-term situation. Don’t let fear make you do things with your money that will have a long-term impact on your life. The best way to prepare for a recession is to get your financial house in order.

How to Handle Money in a Recession

Recession or not, the 7 Baby Steps are the proven way to take control of your money. Baby Step 1 is saving $1,000 for your starter emergency fund. Baby Step 2 is paying off all your debt (except your house) using the debt snowball. Doing those two steps will start you down the path of having financial peace during economic storms.

Want to learn more? Check out Financial Peace University. FPU is a nine-lesson course that teaches you the step-by-step plan—aka the Baby Steps—to pay off debt fast and save more money for your future.