Key Takeaways

- The Dave app offers interest-free cash advances up to $500 with no interest, late fees or credit checks.

- Other features include a checking account with a debit card, a savings account, automatic “budgeting” and side hustle suggestions.

- While not as risky as traditional payday loans, the Dave app doesn’t solve the problem of living paycheck to paycheck.

You’ve just managed to pay your bills and put gas in the tank. But now you need to buy groceries for the week. Only problem is, your bank account is looking about as empty as your fridge . . . and you’ve still got days until your next paycheck.

Pay off debt fast and save more money with Financial Peace University.

As you’re doomscrolling Instagram, you see an ad for a money app called Dave, aiming to solve this problem by giving people cash advances to get them to their next payday and avoid paying overdraft fees. But while not as terrible as traditional payday loans, the Dave app won’t actually help you get ahead with your money.

What Is the Dave App?

Founded in 2017, Dave is a banking app mostly known for giving out pay advances through their ExtraCash feature. Basically, they offer short-term loans with no interest, no late fees and no credit checks to help people survive until their next paycheck.

Sure, that sounds nice. But don’t be fooled: These cash advances aren’t exactly free money.

The Dave app says their mission is “to build products that level the financial playing field.”1 But that really just means they make it easier for people to borrow money, which is a dangerous game to play.

And just so we’re clear, the Dave app has nothing to do with Dave Ramsey. One is a banking app with a bear mascot. The other is a financial expert with a southern accent (although to be fair, he does get a bit grizzly when talking about debt).

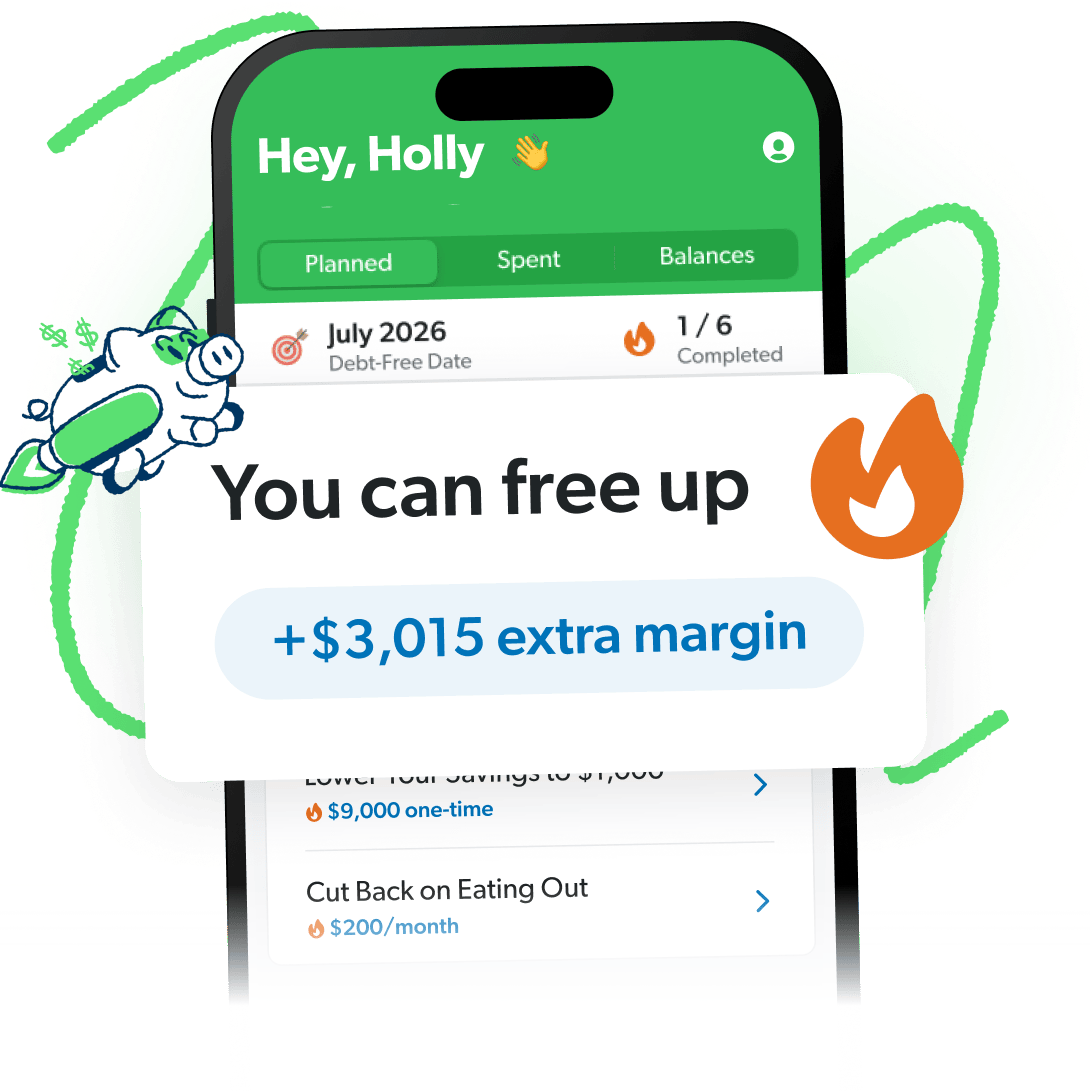

More Margin Means More Money in the Bank

In just minutes, the EveryDollar budgeting app helps you find margin you didn’t know you had—you’ll feel like you got an instant raise!

How the Dave App Works

ExtraCash is Dave’s most popular feature. But the app also comes with checking and savings accounts, automatic “budgeting” and side hustle suggestions. Let’s take a quick look at each.

ExtraCash Advance

Dave’s ExtraCash feature gives pay advances of up to $500. But it’s not as simple as just hitting a button and having cash flow into your bank account. Here’s how it works:

- Download the Dave app. The Dave app is free to download, but there’s a $1 monthly membership to use any of the features.

- Link an existing bank account. You’ll also need to open an ExtraCash account to access the advance, as well as a Dave Spending account (whether you plan on using it or not).

- See how much you’re approved for. Dave will let you know how much money you can borrow. But heads up: You may not be approved for the full $500, and you can only take out one advance at a time.

- Pay an express fee or tip (optional). It takes about three days to process the cash advance. Or you can pay an express fee ($3–25) to get it in under an hour.2 But most people who need a cash advance need it ASAP—so you’ll probably end up paying that fee. There’s also a tip option that’s automatically set to 15% (so if you don’t want to tip, you’ll have to manually lower the amount). P.S. You know tipping culture is out of control when even lenders are asking for a freakin’ tip.

- Transfer the money into your account. Once approved, Dave will transfer the money to either your Dave Spending account or an external checking account. At this point, your ExtraCash account will have a negative balance until you pay back the amount you borrowed.

- Settle the amount. Your repayment date is your next payday. Or if Dave can’t determine your payday, your repayment date is the next Friday. (You can request a 30-day extension, but it has to be approved). On your repayment date, Dave will automatically deduct the amount from your account to settle your balance.

Dave Spending Account

The Dave Spending account is a checking account that requires no minimum balance and doesn’t charge ATM, late or overdraft fees. It comes with a debit card that gives you cash-back rewards (but only for certain purchases).

You can also get your paycheck up to two days in advance (depending on your employer) and earn up to 4% in interest. But keep in mind, you have to actually keep a certain amount of money in your account to earn interest—which can be hard to do if you’re already struggling to make it through the month.

Goals Savings Account

In addition to the Dave Spending account, there’s also a Goals account you can use to save for a trip, a car or whatever else you want. But a Goals account with Dave isn’t the only way to save more money, you know. Plenty of banks and credit unions offer high-yield savings accounts with interest rates over 4%.

Automatic Budgeting

The Dave Spending account comes with an automatic “budgeting” feature (heavy on the air quotes). But it’s nothing to get excited about.

All the app does is show you how much you’ll have left to spend after you pay your recurring bills—which other budgeting apps do and do better. Plus, a budgeting app isn’t helpful unless it lets you make a detailed plan for your money before the month begins (which the Dave app doesn’t let you do).

Side Hustle Suggestions

The Dave app also gives ideas for how to make more money with paid surveys and their side hustle job board. And hey, I’m all for earning some extra cash! But save the $1 membership fee and take my free side hustle quiz instead to find out the best hustles for you.

How to Qualify for the Dave App’s ExtraCash Advance

Even though the Dave app doesn’t do credit checks, there are still requirements to be eligible for a cash advance. And, again, even if you’re approved, you’re not guaranteed to get the full $500.

To qualify for an ExtraCash advance, you need:3

- A bank account you’ve had for at least 60 days

- A positive balance in your bank account

- At least three recurring bank account deposits

- Monthly deposits that add up to at least $1,000

The Dave app looks at your income history and spending patterns to determine how much to loan you. But it’s about as consistent as a barista getting my name right on the cup—some days it’s Gorge, some days it’s Jorn. So don’t be surprised if the amount you’re approved for changes daily, especially if you’ve got an irregular income.

What Happens if You Don’t Have Enough to Pay Back Your Cash Advance?

If you don’t have enough money in your linked bank account when Dave comes to collect, they’ll take whatever is available and keep automatically withdrawing partial payments until the amount is settled.

For example, let’s say you got a cash advance of $250 from Dave. If you’ve got just $100 in your checking account on the repayment date, Dave will withdraw the $100 and keep withdrawing every day until they have the total $250. Like a mama bear protecting its cub, they’ll stop at nothing to get their money back.

So, while Dave may not make you immediately overdraft by taking more money than you have in your account, you risk overdrafting later if you don’t have enough to pay your bills or get though the month. Yikes.

And before you get any ideas of tricking the Dave app so you don’t have to pay back your advance, know this: If you don’t settle your balance by 120 days, Dave will pass you off to TrueAccord—a debt collections agency. And you don’t want that.

What’s the Catch With the Dave App?

Listen, I’m all for avoiding overdraft fees and calling out big banks and lenders for their predatory practices. But I also know how slippery a slope debt is.

Money-lending apps like Dave may spot you some cash when you’re in a pinch. But their short-term loans are just a short-term fix to a much bigger money problem.

Dave says they’ll get you “money that actually moves you forward.”4 But really, they just keep you trapped in a cycle of borrowing money. And trust me, borrowing money is not how you move forward. It’s how you stay broke.

Sure, you might be able to get a couple hundred dollars to tide you over. But once payday hits and they take that advance out of your account, you’re back at square one. The good news is, there’s a better way to get ahead with your money.

The Best Way to Get Ahead With Your Money

I know what it’s like to have too much month at the end of your money. And if you really want to break the paycheck-to-paycheck cycle, it starts with a budget.

A budget is the best way to take control of your finances. Why? Because when you have a plan for your money before the month begins, you can make sure you’ve got enough to cover your bills, groceries and other expenses—without accidently sliding into overdraft.

Budgeting is a game changer. And as Dave Ramsey (aka the OG Dave) says, "You have to be intentional with your money. Otherwise, it's going to leave."

The EveryDollar budgeting app does more than just help you track your spending and manage your money—it actually helps you find more margin every month!

Just download the app, answer a few questions, and we’ll build you a plan to free up thousands in margin to put toward your goals. Start EveryDollar for free right now!