Believe it or not, there was a time when people thought the safest place to put their money was in the freezer or under the ground. Maybe they took the phrase “cold hard cash” a little too seriously or thought money actually did grow on trees?

Nowadays, just about everyone keeps their money in a bank or credit union. And when you choose the right bank, not only is your money safer than in a hole in the ground, but depending on the type of bank account you open, you can also earn interest and grow your money a little more.

But what kind of accounts should you get? What’s the difference between a checking vs. a savings account? We’ll take you through all the basics right here.

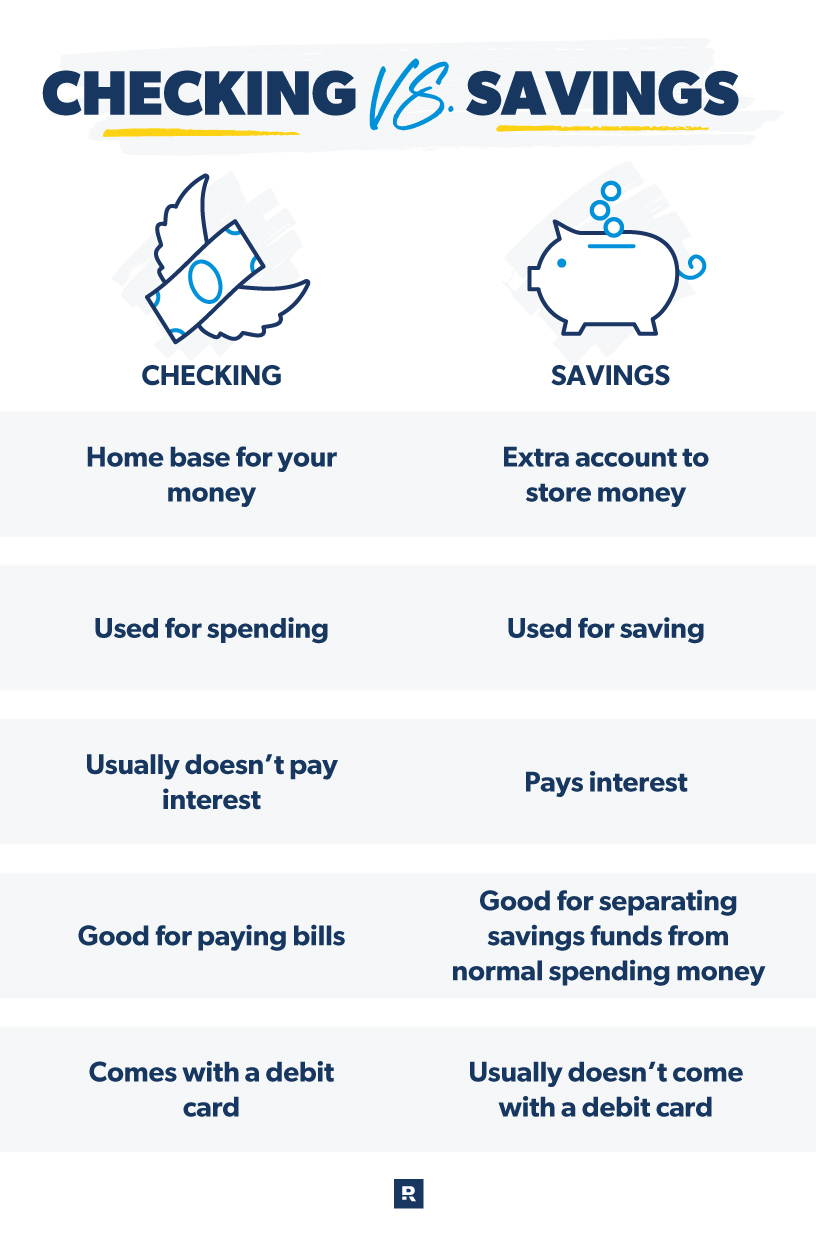

Checking vs. Savings Account

There are basically two types of bank accounts: checking accounts and savings accounts. The main difference between them is: one is an account for spending and the other is an account for saving. Simple, right? And they’re a winning combo when it comes to getting the most out of your money.

What Is a Checking Account?

Think of a checking account as a home base for your money. It’s where money goes whenever someone pays you, but more often than that, it’s where money goes out when you pay for stuff. Your checking account is a great tool for life’s everyday transactions.

Get expert money advice to reach your money goals faster!

Your checking account is also a great place to set up direct deposit for your paycheck and automatic bill pay. That way, your paycheck gets automatically deposited into your checking account (meaning you can get your money faster). And it eliminates the stress of trying to keep up with what bills are due when because you can set them up to be paid automatically from your account.

Once your checking account starts taking in and pushing out your money, you can use your account to start budgeting your money—keeping track of all your transactions to make sure you know where all your money goes. There are lots of budgeting apps out there that can link to your checking account and help you keep better tabs on your spending.

Checking Account Basics

- A checking account is simple to set up and easy to use.

- Checking accounts make budgeting and bill pay easier.

- It’s safer to keep your money in a checking account than to carry around a bunch of cash, and you can easily deposit cash into your checking account. Plus, if the bank you choose is insured by the Federal Deposit Insurance Corporation (FDIC), your money up to $250,000 is safe, even if your bank goes out of business.

- Checking accounts can come with hidden fees. Avoid any bank that charges a monthly maintenance fee or a fee for letting your balance go below a certain level.

- Say no if the bank offers overdraft protection. They put you in the fast lane for unnecessary fees and even debt! Instead, stick to a budget, watch your spending, and balance your checking account regularly.

What Is a Savings Account?

If a checking account is mostly about spending money, then a savings account is, you guessed it, all about saving money.

A savings account is a great place to keep money that you don’t need immediately but want to have access to when you do need it—say, for instance, your $1,000 starter emergency fund or a sinking fund set up to save for an upcoming expense.

Plus, with a savings account, you can earn interest just by letting your money sit there. Average interest rates for savings accounts are super small—like, less than one-tenth of a percent. So while you won’t get rich off the interest on your savings account, you can rest easy knowing it’s a pretty risk-free place to stash extra cash.

Savings Account Basics

- A savings account is a great place to keep money you don’t want to spend while also earning interest.

- There are different types of savings accounts—money market, high-yield, certificates of deposit (CD) and more. Some types are better than others (spoiler alert: CDs aren’t that great).

- Like a checking account, a savings account is insured by the FDIC.

- Savings accounts can also include fees if you’re not careful. Watch out for banks that charge a fee if your savings balance drops below a certain dollar amount.

- Until the FDIC lifted the rule, savings accounts were limited to six withdrawals per month. But that doesn’t mean your bank doesn’t have its own rules about how many times a month you can take money out of your savings account. Check with your bank to confirm its policy so you’re not on the hook for a fee if you go over the withdrawal limit.

Which Account Is Right for You?

The short answer is: Both! Peanut butter and jelly, Buzz and Woody, Bert and Ernie—when you pair them together, you get an awesome combination. The same goes for checking and savings accounts.

With both a checking account and a savings account in place, you’ve got a dynamic duo that can help you start crushing your money goals. A checking account is a safe, hassle-free alternative to cash that allows you to take care of all your basic transactions while staying on budget. And you can use your savings account to keep money you don’t want to spend separate from your everyday spending money.

These two types of accounts work so well together. You can easily (even automatically) transfer money from your checking to your savings to build toward your emergency fund, your next vacation or that set of tires you know you’re going to need. Plus, you’ll earn interest on your savings. And if you want to get really crazy, you can even open multiple savings accounts to put money away for different goals.

Keep Track of Your Money With EveryDollar

The best part about having checking and savings accounts? They make budgeting a breeze—especially if you have a budgeting app on your side. All your transactions are listed in your accounts (either online or on a printed statement), so it’s easy to keep track of everything.

And we mean everything. Your budget should tell every single one of your dollars where to go before the month begins. That’s called zero-based budgeting. And the premium version of our EveryDollar app makes it super easy to do zero-based budgeting by linking to both your checking and savings accounts. Every time money comes in or out during the month, you can say where it belongs in your budget.

Try out the free version of EveryDollar today! Or upgrade for the full premium experience (which includes linking to your bank accounts).