When it comes to spending money, cash is king. But if you want to save that cash for later, you can put it into your bank account with what’s called a cash deposit.

Whether it’s money you earned from your side gig or a $100 bill your grandma gave you for your birthday, cash deposits are a great way to keep your money safe and secure, while still being accessible.

But before you rush off to the bank, there are a few things you should know about how cash deposits work.

Key Takeaways

- Cash deposits are money you transfer into your bank account.

- Cash deposits can include cash, checks and money transfers.

- You can do a cash deposit through a bank teller, at an ATM, or via mobile app.

- If you deposit $10,000 or more in cash, your bank will report the amount to the IRS.

What Is a Cash Deposit?

A cash deposit is an amount of money you transfer into your bank account, whether that’s a checking or savings account, or even a money market account. Even though cash is in the name, cash deposits can also include checks and money transfers—not just physical dollar bills.

How Much Cash Can You Deposit?

There’s usually no maximum deposit amount for checking and savings accounts, but there may be for some accounts, like a certificate of deposit (CD). Check with your bank to see if they have any limits around how much cash they’ll let you deposit monthly or daily.

Heads up, though: If you deposit $10,000 or more in cash at one time, your bank will report the transaction to the IRS (according to the Bank Secrecy Act). This is to prevent fraud and spot any illegal activities, like money laundering.

And before you get any ideas about trying to avoid this rule by making smaller deposits over time or into different accounts, that’s called structuring and it’s illegal. But as long as you report all your income to the IRS each year (aka file your taxes) and you’re not doing anything shady, you’ll be fine.

So, if you sell a car for cash or get paid for a job in cash, you shouldn’t have trouble depositing the money into your account. Just know the IRS will expect you to include that amount on your taxes—otherwise, you will have trouble (in the form of an audit).

How to Deposit Cash in a Bank Account

There are several ways to do a cash deposit, depending on your bank.

Local Bank or Credit Union

You can do a cash deposit in-person at your local bank or at any branch of your credit union. Depositing cash at a bank may seem intimidating, but it’s actually pretty simple!

Step 1: Go to the bank. You can either go inside the bank or use the drive-thru if you’re in a hurry (and who doesn’t love sending the canister up the tube?).

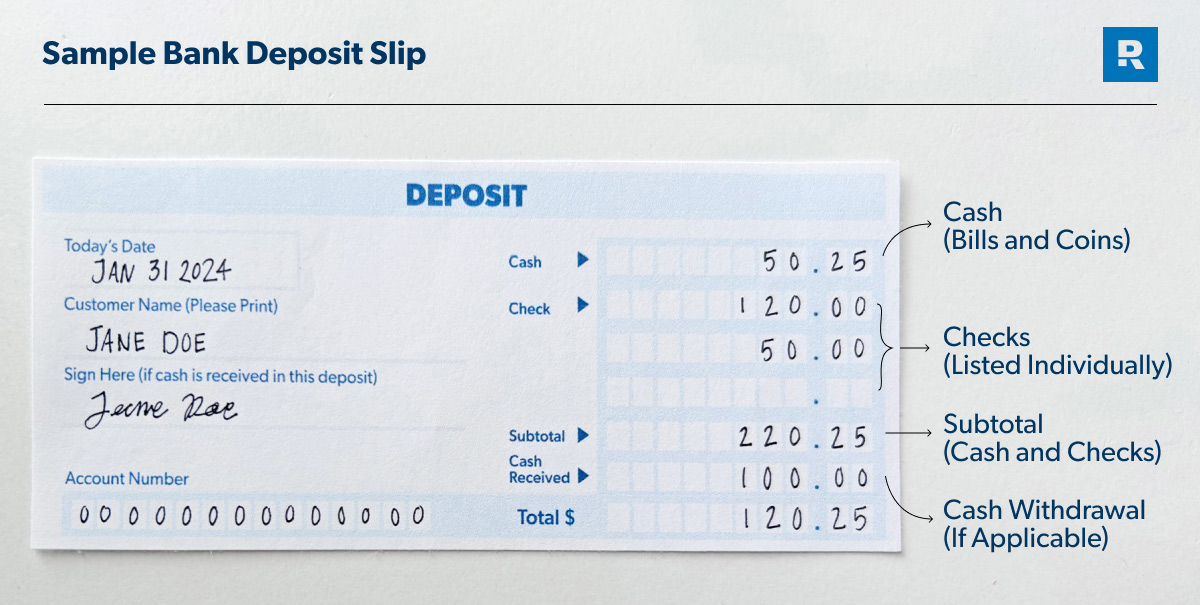

Step 2: Get a deposit slip. If you have a checking account that gives you actual checks, you might already have some deposit slips with your account number on it. If not, you can ask the bank teller for a deposit slip. Be sure to fill out the date, your name, the number of the account you want to deposit the money into, and the amount you’re depositing (whether it’s cash, checks or both).

Budget every dollar, every month. Get started with EveryDollar!

Step 3: Give the teller your cash and deposit slip. If you’re depositing a large amount of cash, the teller may ask for your ID. Don’t take it personally—they’re just doing their job.

Step 4: Take your receipt. You should receive a paper receipt that shows how much you deposited and other details of the transaction. At that point, (hooray!) you’ve successfully done a cash deposit.

ATM

Did you know you can do more than just withdraw cash at an ATM? Yep! You can do a cash deposit at an ATM if your bank is closed or if you just don’t feel like talking to a bank teller (no judgment).

While most third-party ATMs don’t have a deposit option, you should be able to deposit cash at an ATM linked to your specific bank.

Step 1: Insert your debit card and enter your PIN.

Step 2: Select the deposit option and which account you want to deposit to.

Step 3: Insert cash. Some ATMs may require a deposit slip. Others may ask you to put the cash in a provided envelope before feeding it into the machine.

Step 4: Take your receipt.

Here’s a tip: Always make sure the amount on your deposit receipt matches the amount you just deposited! If not, report the error to your bank immediately.

Online-Only Bank

If you have an account with an online-only bank, depositing cash is a little harder. You can do a mobile deposit for checks, but that won’t work for dollar bills. So, what do you do? Well, you’ve got several options.

Option 1: Find an ATM affiliated with your bank. Even if your bank doesn’t have a brick-and-mortar location, they may have in-network ATMs that accept deposits. Check your bank app to see if there’s an available ATM near you.

Option 2: Purchase a money order. A money order is basically a prepaid check that you can get at the post office or stores like Walmart. You have to pay a small fee, but it’s usually no more than a couple dollars. Then, you can either deposit the money order via mobile deposit or physically mail the money order to your bank. Whatever you do, though, don’t send actual cash in the mail!

Option 3: Have someone else deposit the cash for you. A last-ditch effort is to ask a family member or trusted friend to deposit the cash into their own account. Then, they can send you the amount via digital payment (like Venmo or Cash App) and you can transfer the funds from your mobile wallet into your bank account. But if you think you’ll be depositing cash again in the future, you’re better off just opening an account with a physical bank.

How Long Does It Take for Cash to Show Up in My Account?

Each bank has its own rules for how soon you can access a cash deposit. If you deposit cash with a bank teller, the amount is usually available in your bank account immediately. But if you deposit cash at an ATM, deposit a check, or deposit a large amount of cash, it may take several business days for the amount to show up in your account.

Just know that banks are legally allowed to hold funds for an extra day. So, if you need the money in your account ASAP, it’s best to do an in-person cash deposit with a bank teller.

Always Know Where Your Money Is Going

Whether you’re depositing cash into your bank account or keeping your bills organized with a cash envelope system, you should always know what’s happening with your money. And the best way to do that is with a budget.

A budget helps you stay on top of your spending and make progress toward your financial goals. And with the EveryDollar budgeting app, it’s super easy to make a plan for your money every single month.

Create your EveryDollar budget for free! Or upgrade to the premium version to connect your bank and have your expenses automatically stream to your budget. That way, no transaction (or cash deposit) gets left behind.

Save more. Spend better. Budget confidently.

Get EveryDollar: the free app that makes creating—and keeping—a budget simple. (Yes, please.)